By Soile Kilpi, director, and Kathren Kneer, principal, Pöyry Management Consulting

Growth and omnichannel

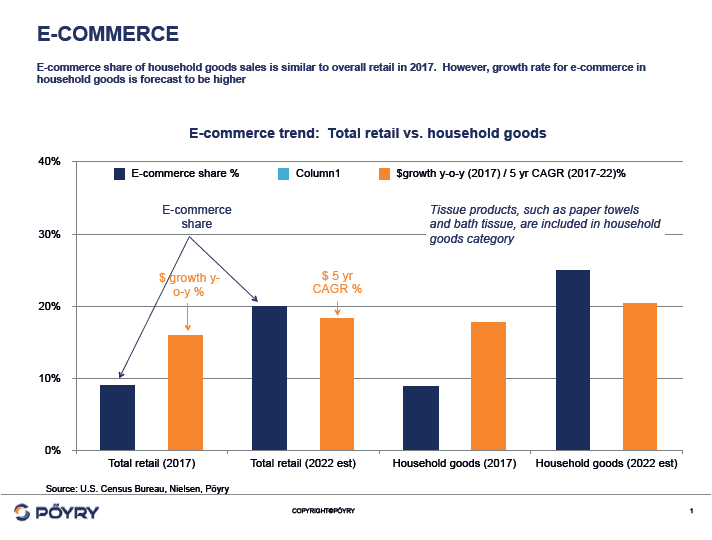

The continued growth of e-commerce has made it a crucial part of the sale and marketing equation for household care brands, including paper products such as paper towels and toilet paper. According to a Nielson Report, online sales in the household care category grew by ~35% over three years, while growth of in-store sales was almost flat, at less than 1%. This growth is being driven by several factors. One of the keys is the move by grocery and mass market retailers to expand omni-channel capabilities with orders placed online and either delivered to the customers’ doors or picked up at stores by the customer. Household care products are the most popular category for this type of ordering, and within household products, toilet paper is one of the top five purchases in both of these categories, while paper towels is a top five for in-store pick-up.

On auto-reorder

As customers realise the convenience of ordering online, automated reordering becomes a natural occurrence for these products, especially as they are bought on a regular, recurring basis and typically don’t require much thought or research after the initial purchase. Once a customer finds a home care product that works for them, they usually stick to that product, and don’t often switch, or explore new products. In fact, according to Global Data consumer research, toilet paper and kitchen paper are the 3rd and 4th highest categories most apt to be purchased “on auto-reorder”.

Household care products are also one of the top three most popular for online ordering in the FMCG category, and continue to experience strong growth online as well, and, as was already mentioned, growth in online sales was ~35% over three years.

The growth in this category is being driven by Amazon, retailers such as Walmart and Costco, and Consumer Packaged Goods (CPG’s), themselves. Estimates are that Amazon accounts for ~85-90% of Household Essentials purchases, but their growth is slowing, while growth for other retailers is increasing, as they improve their service offerings in e-commerce.

Money to be made

With such a high share of the e-commerce pie, Amazon is in a category by itself and has a strong understanding of what is required to make money in e-commerce. The fact that it has increasingly been embracing the sale of household paper products, e.g., toilet paper and paper towels, means that there is money to be made by selling these products through e-commerce.

In fact, according to the Wall Street Journal, Amazon is tired of selling products they refer to as CRaP, which is short for “Can’t Realize a Profit”. It has taken them a while, but Amazon now understands how to make a profit on paper goods.

Large vs. small packs

Toilet paper and paper towels aren’t heavy, but they are bulky, which makes them expensive to ship. To improve profits, the best strategy is to sell high-value items with low shipping costs. With the paper products, profits were improved by selling large volumes or packs, thereby providing higher revenue to the seller, offering value (discounts) to the buyer, and minimising the cost of shipping and handling. It is cheaper to ship one order of 20 rolls of towels or toilet paper than it is to ship five separate orders of four packs of these items.

This is because the “outbound shipping” cost can be spread across a higher average selling price. So there is money to be made on these large packs, whereas it could all be eaten up by shipping costs on the smaller packs, requiring multiple shipments.

The good news is that online sales seem to be predisposed to larger pack sizes, e.g., selling “club” sizes rather than “grocery store (smaller multiples/single packs)” sizes. After all, online shoppers don’t have to carry the bulky or heavy loads home, they just have to find the space to store all of the items. Not all shoppers have the space, but many do, and appreciate the opportunity to “stock up”, at a lower per unit price. It’s a win-win, as Amazon, and even the CPG, gets more bang for its buck with these larger pack sizes.

For the shoppers who don’t have the space, they will continue to pay a higher per-unit cost for their preferred pack size, and it is up to the retailer to understand what that cost needs to be in order for them to still make a profit. Or, they drop the smaller size and shoppers will go elsewhere to get the smaller size they want.

No more hassle

Consumer Packaged Goods companies have also played a part in increasing the sales of household paper products through e-commerce. One good example is a first of its kind campaign by Georgia-Pacific (GP), e.g., the Quilted Northern brand, which worked with Amazon to encourage shoppers to subscribe to Amazon’s Subscribe & Save replenishment service by scheduling periodic deliveries of packaged goods staple items, such as paper towels and toilet paper.

GP was touting the elimination of the hassle of lugging a bulky package of toilet paper around a store, and they and Amazon provided discounts, as well as free shipping, for those who signed up for the replenishment service. This programme drove two months’ worth of sales volume in a single day, and was considered a success. The subscription service also eliminated one of the key issues for shoppers with on-line sales: waiting up to five days for delivery. The product delivered on an agreed upon time during the month, so that the shopper knew when it would be delivered.

From here to 2025

All of this activity from CPG’s, retailers, Amazon, and consumers has led to strong growth in each of the household care paper segments via e-commerce. Continued growth is expected, with some of the key numbers below:

According to Edge by Ascential, paper towel sales on Amazon reached an estimated $160M in 2018, up almost 20% from 2017; Online sales made up 90% of the growth in the CPG industry in 2018; 49% of US consumers now shop for consumer packaged goods online, an enormous increase from just a few years ago; Projections that online grocery sales will make up 20% of all grocery sales by 2025.

Private Labels Play a Big Role

Another indication that there is strong opportunity in the paper segment of

household care is the fact that Amazon is aggressively expanding the number of private label goods it sells in this category.

Amazon generally decides which products to offer as private labels by monitoring sales of third-party brands on its marketplace. For those that have strong sales, it will review customer comments and ordering patterns and then, potentially, develop its own private label.

If the product gains traction, Amazon will increase production and heighten visibility of the products by advertising on its website. In addition to its own private labels, Amazon offers exclusive brands that are owned by third parties.

Introduced in 2017/2018, Amazon’s private label paper towels and toilet papers (Presto!, Solimo, 365 Everyday Value) have seen large increases in market share. According to Edge by Ascential, its Presto! brand of paper towels was the #5 bestselling paper towel on Amazon, and the other two Amazon private labels were in the top 10. Amazon is playing a large role in the increased sales of private label household care paper goods in e-commerce.

Wrap up

As consumers have embraced on-line and auto-reorders for toilet paper and paper towels, along with larger packages of both, the sustainability of these products has improved, a bit. Larger rolls, e.g., giant, huge, XLarge, etc., have led to fewer cores used as well as less plastic wrapping used in fewer large packages vs. many small packages.

Most of the major producers focus on the recyclability of the wraps and cores, and reduction in packaging, in general.

Although all of the major brands, including major private label brands, continue to use plastic over-wraps for their toilet paper and paper towels, there are several smaller, more environmentally conscious brands which utilise paper overwraps, or a combination of paper and film, in addition to other alternatives. The trend toward improved sustainability is continuing in the retail tissue sector, even if it seems that progress is slow, at times. Overall, we expect the key trends to continue:

• growth in tissue paper product demand and online ordering;

• expansion of omni-channel capabilities;

• increased demand for private label tissue products;

• continued emphasis on sustainability efforts.