As 2021 draws to a close, TWM asks leading figures across tissue’s global supply chain for their retrospectives on 2021… and predictions for 2022

“We do think the pandemic has caused structural changes”

Mathieu Wener, Economist, Numera Analytics, USA

This year, we’ve been surprised by the extent of the de-stocking in mature markets. On a global basis, we expect demand to end 2021 up just 1%, which would make 2021 the weakest year going back to at least 1990. This suggests that most of the above-trend growth we saw last year (+4.5% globally) was due to inventories rather than increased consumption of higher basis weight At-Home tissue. Still, we do think the pandemic has caused structural changes.

Compared with our pre-pandemic projections, our latest global forecast shows an upward step change of roughly half a million metric tonnes in the long-run. This reflects increased usage of towelling in both At-Home and AfH markets due to hygiene concerns, and the new working arrangements.

In terms of challenges, we have seen tissue demand decline in all mature markets this year (North America, Europe, Japan, South Korea and Australia). In our view, this is mainly due to last year’s pantry stocking, but it’s also clear that supply-chain disruptions have accentuated the inventory adjustment. Global trade volumes of parent rolls and converted products combined are down 10% through nine months.

Pulp prices have also had an impact on producer profitability. Looking at financial statements from nine publicly traded tissue producers, we find that low pulp prices and strong At-Home volumes boosted overall industry margins by 2-3%, on average, last year. In Q2-2021, margins fell about 1% below the 2019 average due to the combined drag of higher fibre and energy prices, downstream destocking and supply-chain issues. In Q3, margins were back to the 2019 level, thanks to higher AfH volumes and cost increases being successfully passed on to buyers. With peak destocking likely behind us, continued improvement in AfH sales should contribute to higher margins next year.

Technology will continue to play a large role in the ‘new normal’

The increasing prevalence of remote and hybrid working arrangements will play a large role in the ‘new normal’ where AH tissue has gained market share at the expense of AfH. In the AfH market, the extent and direction of structural changes will vary considerably by end-use and by type of product. For instance, offices are the AfH end-use with the lowest likelihood of making a full recovery. If you look at mobility data, they show that traffic through workplaces is stable at roughly 15-20% below the pre-pandemic level. Hotels will also continue to demand less tissue as long as international travel restrictions remain in place. On the other hand, spending in restaurants has fully recovered, and hygiene concerns are a plus for the usage of towelling.

We expect demand growth to accelerate to 3.0% next year, mainly driven by a continued recovery in AfH volumes. Yet we believe AfH growth in 2022 will be very uneven. Geographically, immunisation rates by region will play an important role. The emergence of the Omicron variant at the end of 2021 is also adding uncertainty with regards to the recovery in the AfH sector.

Looking at it by segment, towelling should continue to benefit from hygiene concerns, for both surface cleaning purposes and as a substitute for hand dryers. Producers will likely face more challenges selling to AfH users who mainly buy toilet grades, for which demand will depend on developments on the epidemiological front.

We expect a consolidation of the costs issues by 2022 Q2 onwards

Klaus Blechinger, Vice President Tissue, Andritz, Austria

We have seen no real impact on Andritz as a business in general. In the previous years, we have established a global set-up which over the past 20 months has served us well, giving us high flexibility to source, manufacture and sell in different regions of the world. All our machine deliveries could be commissioned and started up successfully despite the pandemic, and partly even with remote support and optimisation. Here to stay will definitely be the trend to an increased hygiene behaviour, the accelerated trend to digitalisation and an enhanced demand to provide environmentally-friendly and sustainable solutions.

The main challenges for us as a tissue machine supplier have been the significant increases of prices for steel and other components. Additionally, the availability of items such as electronic components became increasingly limited, with impact on the time needed for procurement of certain parts and components. And finally, the increase of transportation costs, caused by higher fuel and energy prices as well as lack of container availability in certain areas of the world turned out to be a major impact on project costs and on-time delivery.

NBSK and BEK pulps have reached peaks again during mid 2021 after really high price levels during the whole of 2018. NBSK even reached its all-time high since 2010.

All the latter has put tremendous pressure on tissue producers. However, we are currently seeing pulp prices drop towards the end of the year 2021 with an expected stabilisation on a lower level through 2022. For 2022 we expect a consolidation of all those issues and even an improvement vs. the actual situation. When this could take place nobody can really predict, but we expect it from Q2 onwards.

In any case, communication with our customer, partners and sub-supplier has changed to certain degrees to online communication vs. regular traveling. And as a consequence of the recent developments, digitalisation has received a strong boost. Metris is the Andritz digital platform which unifies the two worlds of Operational Technology (OT) and IT. The classical OT such as the DCS System of a plant is now seamlessly integrated together with Applications and Tools for Production Optimisation, Artificial Intelligence and Cyber Security, with permanent access to Data Scientists and Andritz Domain Experts out of one platform. Plant optimisation, remote start-up, on-line monitoring and support, etc. are possible with this digitalisation tools and are becoming more common in our industry.

Further focus will be on sustainable tissue production in all kind of tissue technologies, dry-crepe, intermediate and premium. We have launched the “CircleToZero” initiative with the goal of achieving zero emissions and zero waste, as well as a target for our “CO2 footprint reductions” at tissue mills, comprising four corner pillars: Reduction of energy consumption, fibre savings and use of alternative fibres and nanocellulose, reduction of fresh water consumption, emissions, recover and recycle rejects in other industries and use of bio-chemicals. All of this will be supported by a higher degree of digitalisation.

As for trends going into 2022, we see trends for higher product qualities in regions such as China and Southeast Asia. However, the limitations given for energy consumption and emissions are getting more stringent, so intermediate technologies will be of interest for these markets. On the other hand, TAD will still have its strong presence in North America, and we are developing solutions to significantly reduce the energy consumption of TAD technology, while still maintaining the product quality.

In drying technology, the focus will remain to be on fossil-free resources, which we already have experience with and which we will further develop and optimise, e.g. use of biomass, syngas, electrical heating and others. Depending on the resource availability and local regulations at a certain location, the right energy concept is the key to strengthen the future of a tissue mill.

Digital development has taken off in a manner and pace that was difficult to anticipate

Jenny Lahti Samuelsson, Vice President Tissue Global Technology, PAP Tissue Mills Business Unit, Valmet, Sweden

For Valmet, the largest impact of the past year has been the fact that our personnel haven’t been able to travel as needed. In many cases, they have been quarantined for weeks before being admitted to enter the community and mills sites globally. As a direct result, the digital development has taken off in a manner and pace that was difficult to anticipate; we have rapidly managed to take full benefit of our digital tools and developed our way to operate in order to serve and support our customers remotely. A concrete example of this is that we have carried out machine check-out and start-up at customer sites with our experts supporting remotely. This change is persistent and will be a good complement to on site services in the future.

The pandemic has of course impacted tissue consumption. When the world shut down it was the AfH market that took the hit, naturally increasing the consumption on the consumer side. We also see a persistent increase in towel demand. This can be explained by new hygiene behaviours due to Covid-19. With the improving health awareness we have even seen, we also expect to see the continued replacement of hand dryer machines with tissue and towel products. How the industry will continue to cope with cost increases – not only for pulp, but also for energy in all forms, specially electricity and natural gas in the EU – will be key for 2022. Also, on the logistics side, there are issues not only about raising costs, but also about the lead time for transports which has been extended. At the end of the day, this increases the risks in the supply chain for all parties. Valmet has been putting a lot of effort minimising the risks and has coped to ensure that deliveries are on time and within our own manufacturing as well at customer sites.The challenges have forced us to focus even more on developing our technologies and deliveries in order to optimise the use of raw material and energy, as well as the efficiency of our tissue machines and process.

The market of raw material, energy and logistics is volatile at the moment and very difficult to predict, and is mainly dependent on the evolution of the pandemic. Sustainability is, as we all know, in every company’s interest and strategy. To become more energy efficient and in the end of the day, achieve a fossil free operation is essential both for us and for our customers. Valmet’s climate neutrality programme

The AfH market has been in bad shape… but I think this industry will hugely rebound in 2022

Sumit Khanna, Chief Executive, Beeta Tissues, India

The past 20 months have had a negative impact on the domestic tissue market as sales have gone down – and export prices have gone up due to high increase in logistic costs! I think inflation is here to stay for the long-term, which will have a negative impact on India’s tissue and towel markets. The Afh market has been in bad shape with restaurants and hotels and offices being shut down. However, I think this industry will rebound in 2022. Even now we are starting to see this; the last two months have seen restaurants approaching full capacity. Generally, I don’t see private label increasing because of the pandemic. However, one big change I would like to share is the sudden surge in new supermarkets, chemists and mom-and-pop store sin India after the outbreak. We have also seen a continuous rise in pulp prices in 2021. We forecast that, hopefully, that may stabilise by the middle of 2022.

The rise in fuel and logistical costs has led to this increase, and we as a tissue mill have had to absorb the prices for the first two months, and finally been forced to pass them on to the consumer. While we as a business have no expansion plans for the year 2020 and 2021, environmental issues remain key for us and the market. We have released another range of products made from 100% recycled tissues and we are seeing increased popularity for these products in India. With the current business environment, the consumption of kitchen rolls and facial tissues has definitely increased. People are prioritising hygiene now, and I think that’s a trend that will stay. I believe that the increase in tissue products consumption will continue to have a major impact on the global tissue paper industry.

The main challenges I see for 2022 and beyond is that there are now many more companies diversifying into the tissue market or coming into the tissue market for the very first time. We are definitely seeing more tissue players, and that means a lot more competition for our products, raw materials and resources. The main opportunity remains that, with an increase in awareness for hygiene and sanitation, there will be more consumption from consumers for our products. I believe that trend is here to stay.

A huge opportunity for us will be our range of eco-friendly products … hosting COP 26 in the UK has heightened consumer awareness

Oday Abbosh, Founder and Chief Executive of Better All Round and Chairman of Consuma Paper Products, UK

2021 has, without doubt, been a challenging year on many levels. Covid has continued to have a significant impact on most businesses, and it’s also clear that Brexit ramifications are beginning to filter through. It is no secret that the labour market in general has been more challenging than any time in recent history, whether that’s specifically for HGV drivers or more general labour supply. Similarly raw material availability has seen its own set of challenges, as pretty much anything related to fibre has had unprecedented demand, restricted availability and increasing prices. To top it all, energy prices have seen huge spikes this year as well, with no end in sight quite yet.

Against this backdrop, we have continued to drive our investment programme across all aspects of our business to ensure we are able to serve all our customers as expected. We have increased our capacity and capability significantly over the past year and are optimistic about the future even if we know the coming months will continue to be difficult. Importantly, the changes seen in the past couple of years around increased hygiene, increased ecommerce and new ways of working are all here to stay and we continue to ensure we are well positioned to serve all our customers in future.

In addition to these broader market challenges, we have witnessed significant increases in the cost of pulp from the start of the year and the outlook remains uncertain given the energy crisis affecting all paper mills. Demand for fibre-based raw materials will keep rising given the transition underway for everyone to replace fossil fuel-based packaging with more sustainable alternatives. The continued rise in e-commerce is also creating further demand and all this at a time when supply of recycled raw material is in decline owing in part to new ways of working.

As an industry, we continue to make great strides in finding more sustainable solutions to how we manufacture and bring the products to market. At Consuma, we have switched to 100% renewable energy, and we’re excited to be embracing a more circular approach to some of our products. For example, with our Ora Household Towels, the pulp bases are now made from our factory waste and generally we continue to reduce the amount of plastic packaging across the site having invested in machinery capable of wrapping all our rolled products in paper.

As with all companies, we have had to adapt to new ways of working with increased remote working and implementing new processes to protect all from Covid transmission has become critical. For example, we now have temperature monitors as you enter our building and factory; we have new diagnostic kit on a number of our machines; and as a smaller player, we have been able to be nimble and flexible, whilst meeting the needs of our customers with their changing requirements. Customer meetings on zoom and commissioning of new lines, with input and training from machine manufacturers across the globe have become the norm, meaning our workforce has had to be more flexible in their working hours and be willing to learn in very different ways.

I believe some of 2021’s challenges will continue in to 2022 – labour shortages and the knock on effect of inflation impacting wages. But there are some exciting innovations in alternative, more sustainable and environmentally-friendly fibres that we should be keeping an eye on. A huge opportunity for us will be in relation to the breadth of eco-friendly products we manufacture and the range of new and emerging technologies and partnerships that will allow our business to grow across the paper spectrum. Hosting COP26 in the UK has heightened consumers’ awareness more than ever, so we fully anticipate consumers and retailers to continue to demand products with a reduced carbon footprint. Innovations in machinery and production process will be key to this. And, not only will the switch in the raw materials deliver opportunities, but an ability to source locally will be increasingly important too.

2022 could be good for our segment as we have presidential elections when money is normally injected into the economy

Pedro Vilas Boas, Director, Anguti Estatística, Brazil

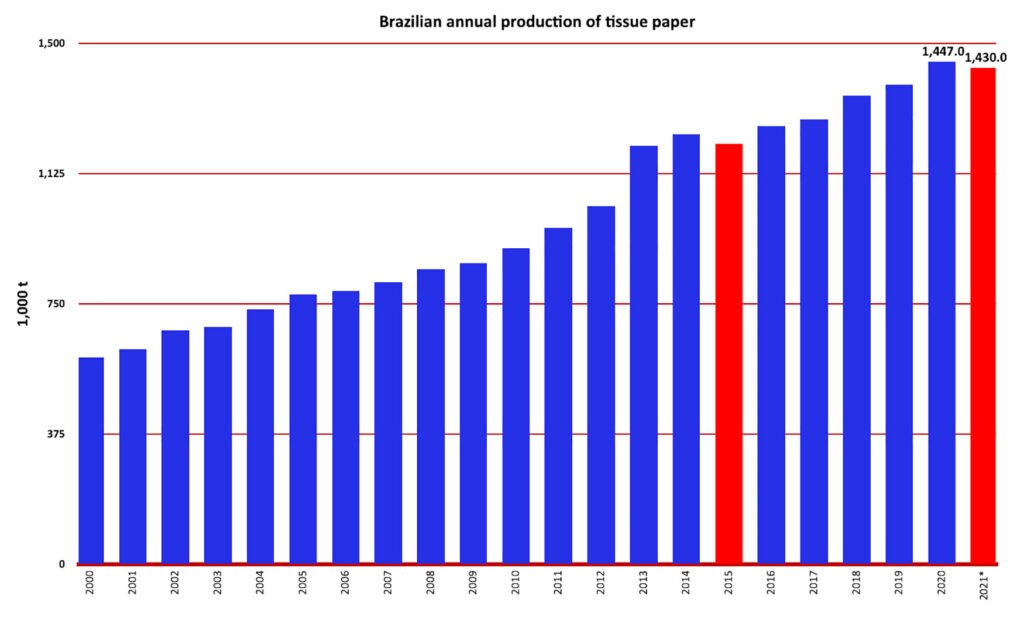

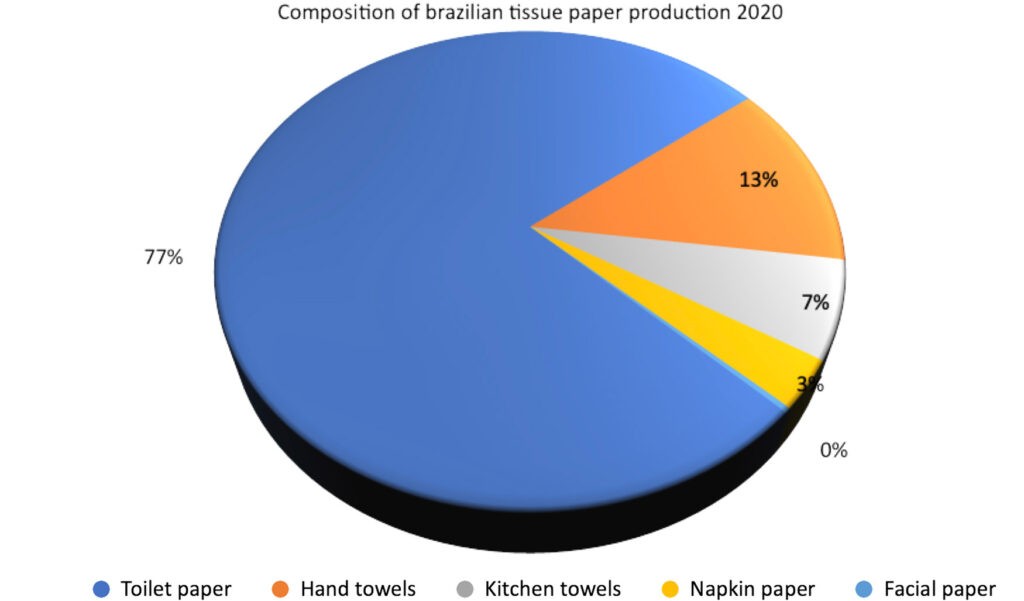

2021 has been a difficult year for the Brazilian tissue paper industry, mainly due to the strong evolution in production costs, which harmed the profitability of companies, and this was further aggravated by the low demand seen in the year. It has led us to estimate a drop of 2% in production this year compared to 2020, which is unusual in Brazil. Since 2000, only in 2015 have we recorded another unfavourable result. Across the tissue market, some negative results were expected with a drop in the performance of the AfH segment following the closing of shopping centres, offices and restaurants for the lockdown, and this brought down the consumption of the third most important product in the sector, the hand towel. However, the strong increase in toilet paper consumption which was observed in 2020 at the beginning of the pandemic offset the losses in the institutional segment, which did not repeat this year even with an even stronger second wave of the disease.

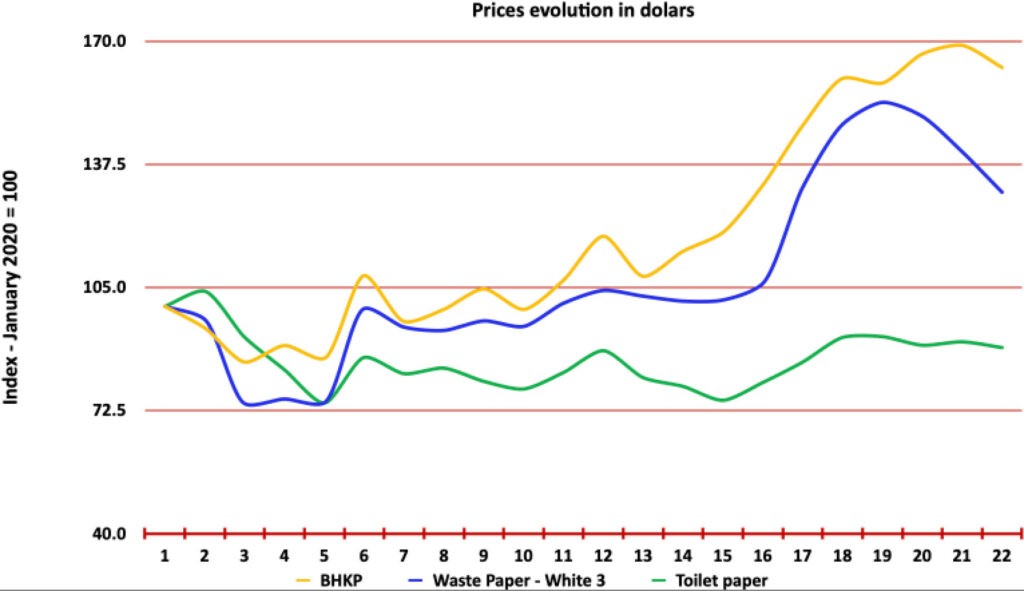

Undoubtedly, the biggest problem has been the mismatch between the increase in raw material costs and the prices of paper, that, with weak demand, has not been getting readjustments by supermarkets, which are the largest distributors of toilet paper in Brazil. If we consider prices converted into dollars, while eucalyptus pulp was readjusted by 63% and white waste paper by 30%, multi-ply toilet paper recorded an 11% reduction in its average price on supermarket shelves, that is even more serious if we consider that our currency has appreciated by 31% in the period. The consequence was the shutdown of machines and, worse, of smaller factories. However, if we don’t have more problems with the pandemic and if we can go back to operating without any big surprises, then 2022 could be good for the segment. This is mainly likely because we will have presidential elections when money is normally injected into the economy, and this is already happening with the new emergency aid programme that was readjusted recently and could mean an increase in consumption by the neediest Brazilians. Another fact that is impacting the market and that will change the sector in the coming years is that we are seeing a concentration of companies, especially with Softys announcing the purchase of Carta Fabril shortly after acquiring Sepac. With this acquisition, the Chilean company is approaching a 30% share of the Brazilian market. In addition, if we consider the recent purchase of Santher by the Japanese association Daio/Marubeni and, already traditional in our market, the American Kimberly-Clark, foreign capital companies are close to holding a 50% share of the Brazilian tissue market.