Understanding the complex drivers behind consumer choices has become indispensable. Report by Jorge Araya, Santiago-based Consultant Tissue & Hygiene, Euromonitor International.

In recent years, countries across Latin America have been immersed in a complex economic scenario that has proven challenging to navigate. The low economic growth in the region’s key markets has led to a contraction in the consumption of various categories, directly impacting several industries in the fast-moving consumer goods sector, including consumer tissue. Without intending to see the glass as half empty, the projections for 2024 are modest to moderate, posing a challenge to overcome in the new consumer reality.

The inflationary factor – and the rollercoaster of rising prices

Undoubtedly, inflation, as reflected in the prices of consumer goods, has had a significant impact on the performance of the industry. In 2022, it reached 15% in Latin America, with Argentina, Chile, and Colombia being the markets with the highest recorded rates during that period.

Currently, although inflation tends to decrease, it persists above pre-pandemic levels and central banks’ targets. Additionally, the sluggish growth of major economies and interest rates, directly impacting companies’ investment capacity and available working capital crucial for job creation, further compounds concerns.

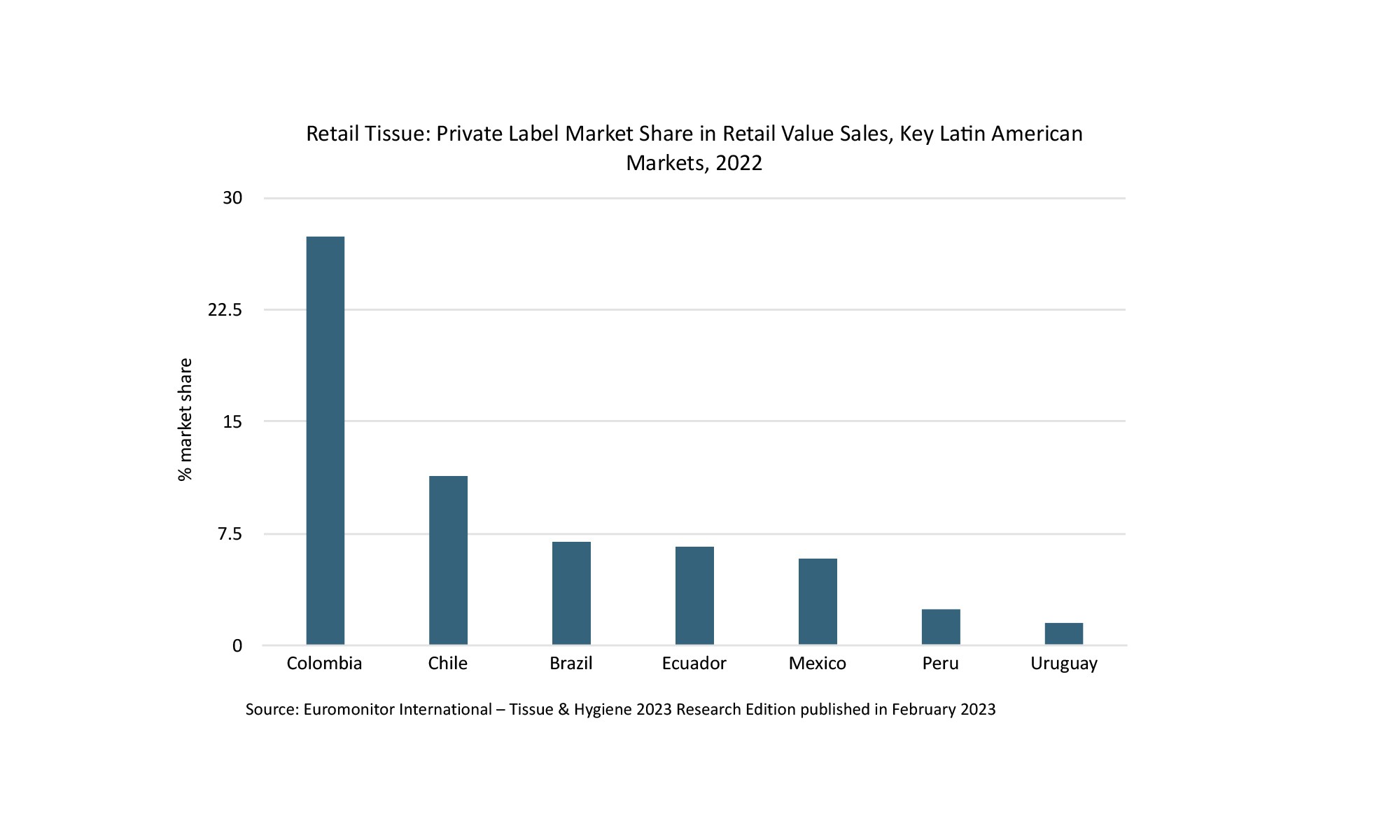

The current cost-of-living crisis has brought about a change in purchasing priorities, forcing increasing numbers of consumers to prioritise quality and value over attributes such as sustainability. This scenario amplifies consumers’ sensitivity to any price changes and encourages them to contemplate switching to private label brands in pursuit of more cost-effective alternatives.

The Euromonitor Consumer Lifestyles Survey 2023 reveals a significant shift in the behaviour of young Latin American individuals aged 18 to 29. This demographic shows a notable inclination towards prioritising private labels over established brands in the next 12 months. Surprisingly, this preference is not directly linked to income levels, as individuals with medium to high incomes within this age group display a greater openness to considering private label alternatives. This trend reflects a nuanced change in consumer values, indicating that factors beyond financial constraints influence preferences toward quality and value rather than solely relying on well-known brands. As consumer choices evolve, the connection between age, mindset, and purchasing decisions becomes increasingly apparent, reshaping market dynamics.

The Latin American consumers

Understanding the intricate characteristics and consumption patterns of Latin American consumers is indispensable for formulating effective strategies to enhance the penetration and sales of tissue products. The significant prevalence of small households, constituting 62% of the region’s households, and the escalating trend of single-person households as the fastest-growing category, emphasize the necessity for tailored approaches. Furthermore, the dominance of the Z and millennial generations, accounting for 48% of consumers, not only shapes market dynamics but also influences channel distribution and the digitalisation of the purchase journey.

Adding to the complexity, the unique spending pattern across the region is noteworthy, with an anticipated annual expenditure of $493 per household on personal care products in 2023. This amount is significantly lower than observed in Western Europe (half) and North America (one-fifth). This economic distinction presents a clear opportunity for crafting targeted, country-specific strategies. Recognising and capitalising on this diversity empowers the development of initiatives aligned with the specific needs and preferences of the Latin American consumer base. By doing so, tissue (and hygiene) products can effectively convey their added value, resonating with the intended target audience in this dynamic and evolving market landscape.

Retail tissue volume consumption softens amid inflation pressure, yet unmet potential remains.

In 2022, despite the widespread resumption of daily routines and the adoption of hybrid work models, which contributed to the consistent expansion of the retail tissue sector in Latin America, the industry encountered notable challenges. The emergence of high inflation, escalating unit prices, and strained supply chains proved to be substantial hurdles. As consumers grappled with elevated prices, they responded by shifting to more economical brands, opting for smaller package sizes, or implementing cutbacks to navigate these economic challenges.

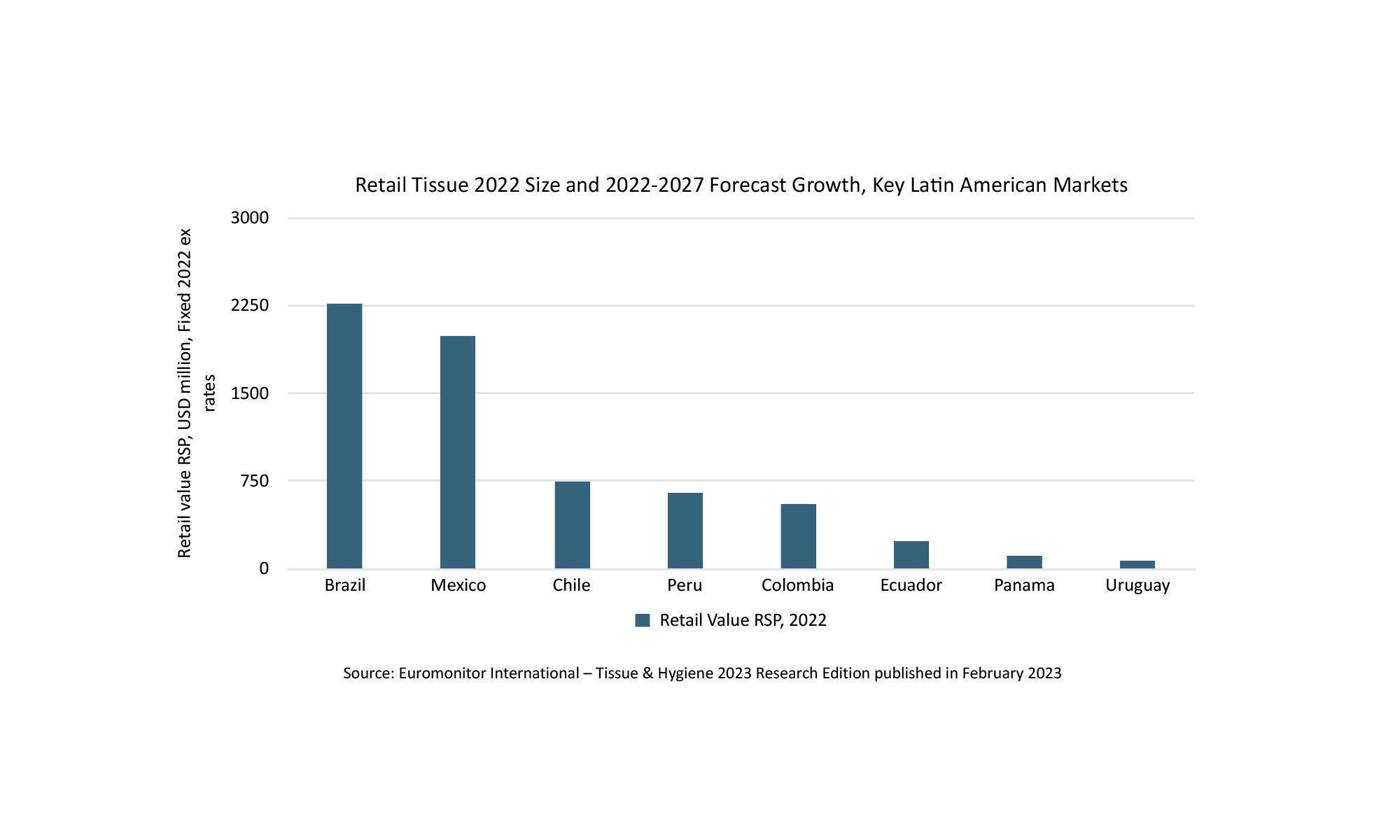

In this context, retail tissue value sales have surged by 15% in 2022 (accounting for inflation effects), while volume growth has tapered to a modest 1.5% during the same period. Moving forward, the regional market is predicted to grow at 6.2% CAGR over 2022 to 2027. This growth will be primarily driven by the toilet paper category, constituting 79.6% of the market in 2022 and expected to maintain a robust 6.5% CAGR in value terms throughout the forecast period.

Looking at it from a different angle, the per capita sales volume of key tissue retail categories in Latin America notably trails behind that of regions with more developed markets. A striking illustration of this discrepancy is evident in the per capita consumption of toilet paper, where, in 2022, Latin America registered 4.1 kilograms compared to North America’s 8.4 kilograms.

What measures are required to boost per capita consumption in these categories? Should they be limited solely to brand positioning strategies and availability in distribution channels? This challenge presents a complexity that goes beyond simple solutions, involving essential governmental initiatives. These strategic actions encompass the enhancement of sanitary infrastructure in rural areas within key markets, addressing both infrastructure gaps and improving overall hygiene conditions, as noted in slide 1.

AfH tissue shaped by work practice normalisation and distinct AfH dynamics

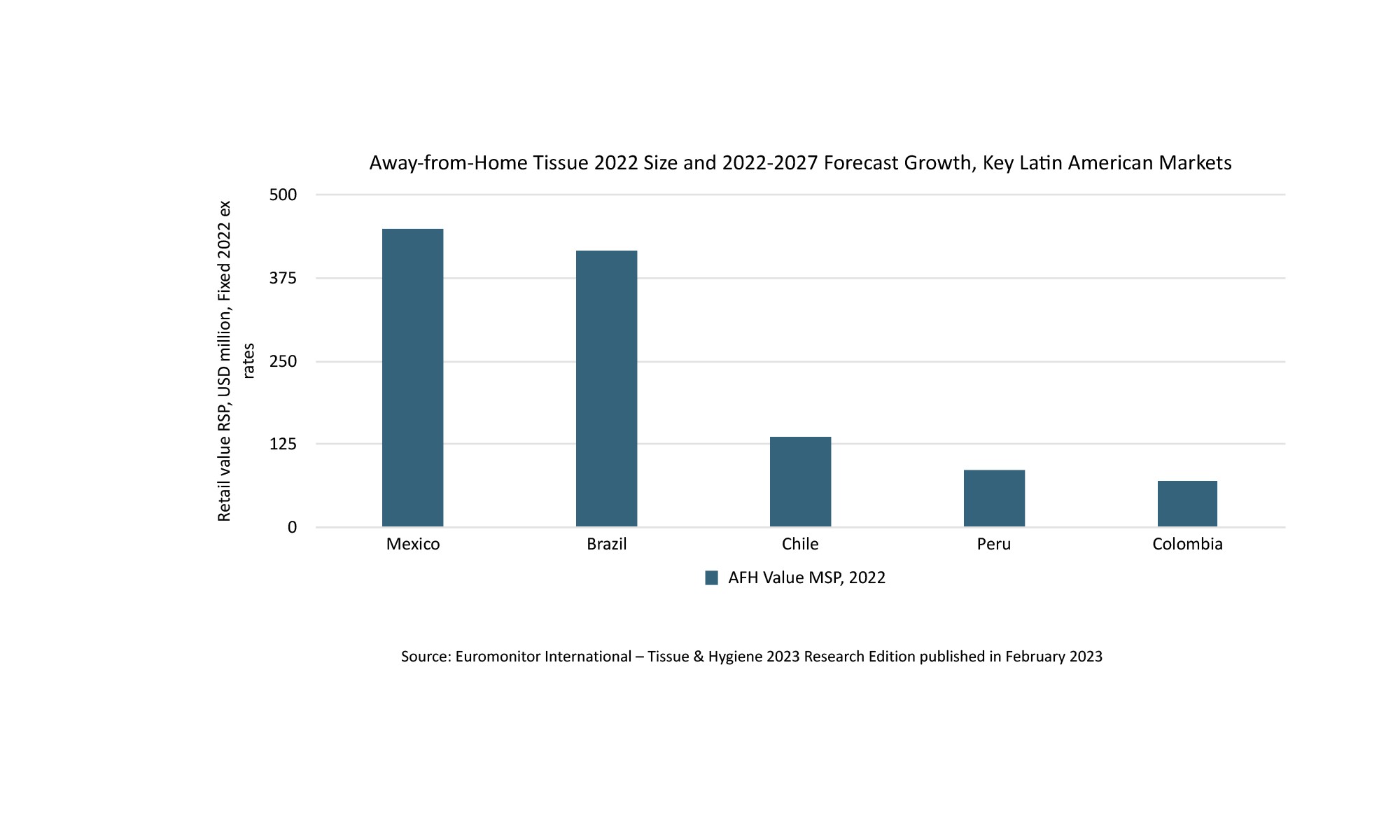

Amidst the resurgence of out-of-home activities, the sales of these products are experiencing an upward trajectory, accompanied by distinct challenges arising from the evolving trends and characteristics of the primary target channels.

Although remote work has persisted as a consequence of the pandemic, this modality shows a year-on-year trend toward reduction. This is reflected in Consumer Lifestyles Survey, where 30% of respondents plan to maintain the work from home on a weekly basis in 2023, compared to 35% the previous year.

Although there are certain myths surrounding the hotel market and tourists’ accommodation preferences in the region, the latest Euromonitor Travel & Tourism research figures indicate that only 7% of total lodging in Latin America are short-term rentals.

Meanwhile, 82% of Consumer Foodservice sales in the region come from independent establishments, presenting a significant challenge for the sales force of products intended for AfH activities.

Affordable sustainability remains is key to incentivise green purchases

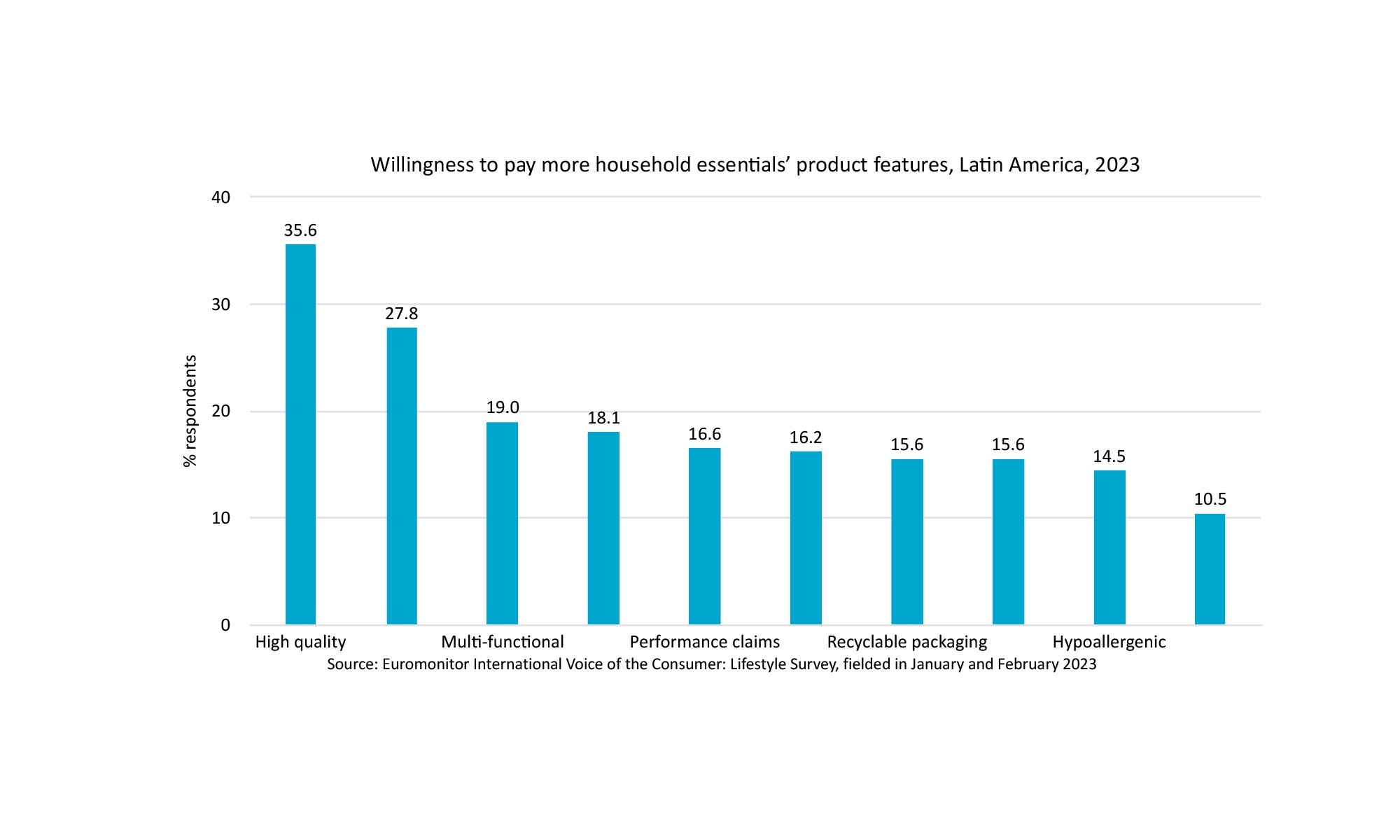

Is sustainability a pivotal factor influencing consumer choices in the realm of tissue products? The evidence suggests that it plays a crucial role, particularly in the context of packaging and its potential for recyclability. However, not at any cost.

According to the findings from Euromonitor’s Voice of the Consumer survey, “Recyclable packaging” emerges as the foremost sustainability-related aspect influencing consumers’ willingness to pay more for essential products in Latin America in 2023. It holds the seventh position, following attributes such as effectiveness, price-to-quality ratio, multifunctionality, and a strong/well-known brand. Yet the challenge lies in preventing recyclability from becoming an exclusive factor for a niche market willing to pay a premium.

Considering this challenge and with a dedicated focus on making sustainability economically feasible, the concept of the circular economy takes on paramount importance. Striving for efficiency improvements across the design and production phases of tissue products not only benefits manufacturers but also resonates positively with end consumers. This strategic pursuit of circularity ensures tangible advantages that extend beyond the realm of production, aligning with the broader goal of making sustainability accessible without imposing a burden on consumers.