To encourage consumers to choose sustainable products at a premium price, tissue companies must prioritise improving product performance and providing well-defined sustainability metrics and information. Report for TWM by North Carolina State University’s Keren A. Vivas, Ramon E. Vera, Naycari Forfora, Ronalds Gonzalez, and Georgetown University’s Sudipta Dasmohapatra.

If you haven’t visited the hygiene tissue product aisle of a supermarket recently, we recommend doing so. You’ll notice that the offerings are evolving, being notable in products featuring new colours, messages, and various types of fibres (wood, recycled, and non-wood). Interestingly, most of those features aim at promoting sustainability. This transformation is just the beginning; the hygiene tissue industry is preparing to embark on one of its most challenging journeys. Some products may remain unaffected, while others will require complete reinvention. To navigate and embrace these changes successfully, it’s crucial to stay attuned to global megatrends.

In the face of new challenges, researchers from the Tissue Pack Innovation Lab at North Carolina State University undertook an extensive analysis to identify key global megatrends shaping the hygiene tissue industry. Their objective was to grasp the industry’s evolving landscape, predict its future, and explore potential strategies to adapt to disruptions. Through their research, these researchers identified digitalisation, shifts in social behaviour, and sustainability as the primary global mega-forces propelling transformative changes.

One disruptive situation is related to the shift from using printing and writing paper to going paperless, which is part of the broader trend of digitalisation. This is having a significant impact on the global tissue paper industry relying on recycled fibres. Only in the United States one-third of hygiene tissue is made from recovered paper (such as recycled printing and writing paper). Digitalisation is leading to a substantial reduction in the production of these traditionally used recycled fibres, resulting in a shortage of these essential raw materials.

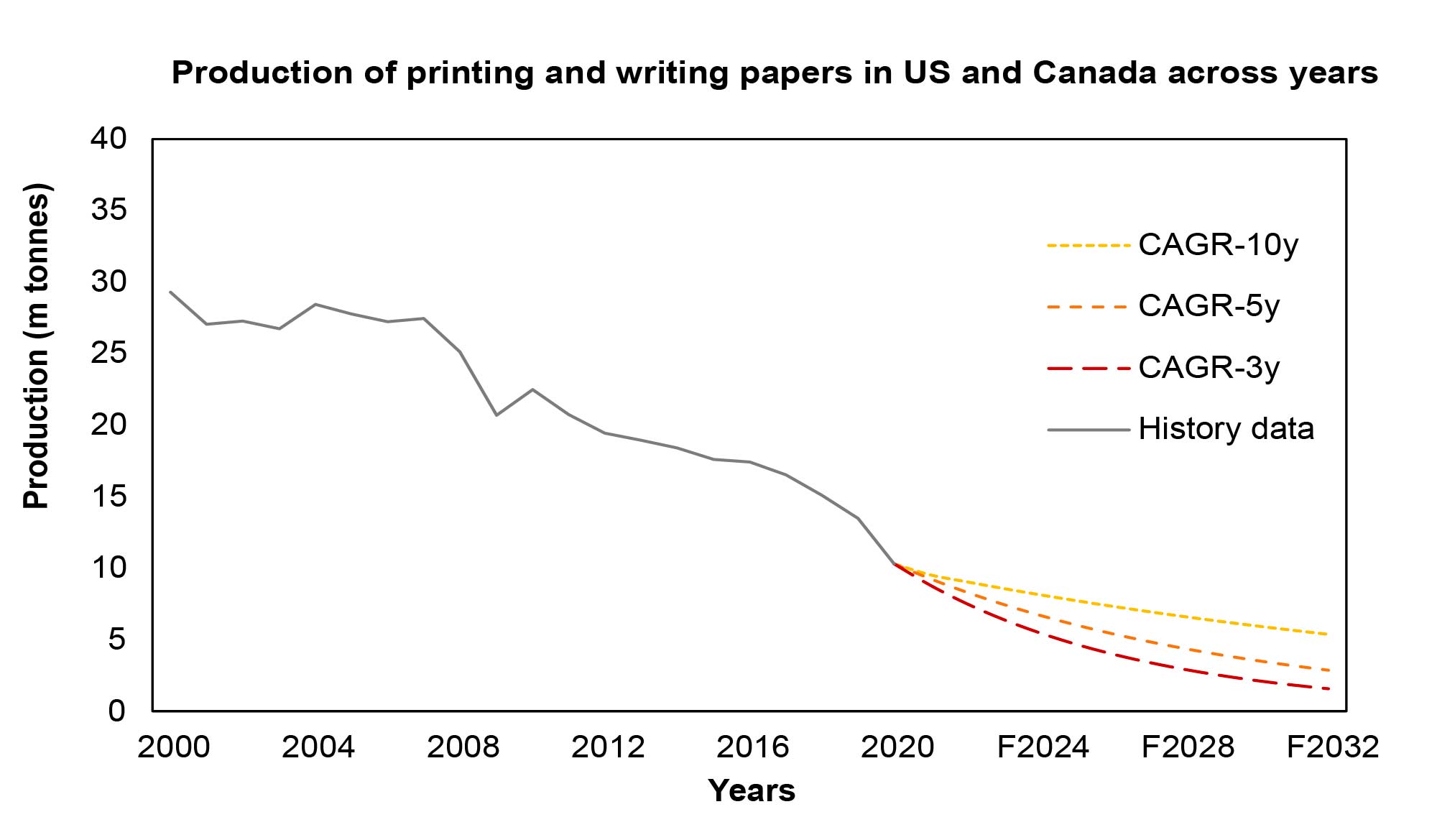

Between 2000 and 2018, printing and writing paper production in the US decreased by half, from approximately 30m tons to 15m tons (Figure 1). Covid-19 further accelerated this trend, reducing an additional 5m tons within two years. It resulted in several facilities transitioning from producing printing and writing paper to manufacturing paperboard for boxes.

Correspondingly, the future availability of recycled fibres is expected to face further disruptions. To predict future trends, a forecast for the period from 2022 to 2032 was created. This forecast is based on factors like compound growth rates from different time frames, such as 2010-2020 (CAGR-10y), 2015-2020 (CAGR-5y), and 2017-2020 (CAGR-3y) (see Figure 1). These projections help to understand how digitisation will impact the availability of recycled printing and writing paper by 2032. These estimations suggest that over the next decade, production and availability of printing and writing paper may decrease by 50-75% compared to 2020 levels. This will lead to increased costs and lower quality materials in certain areas. In light of this analysis, it’s crucial to urgently explore alternative options for replacing recycled printing and writing paper. Potential solutions include alternative non-wood fibres or finding different sources for recycled paper fibre.

Digitalisation is also reshaping consumer behaviour, particularly in the realm of shopping, with online transactions experiencing significant growth, a trend that has been ongoing for years and accelerated by the Covid-19 pandemic. The shift towards online shopping, along with the conversion of multiple printing and writing paper facilities to produce containerboard and an increased focus on eco-friendly paper-based packaging, has resulted in a substantial increase in secondary packaging production.

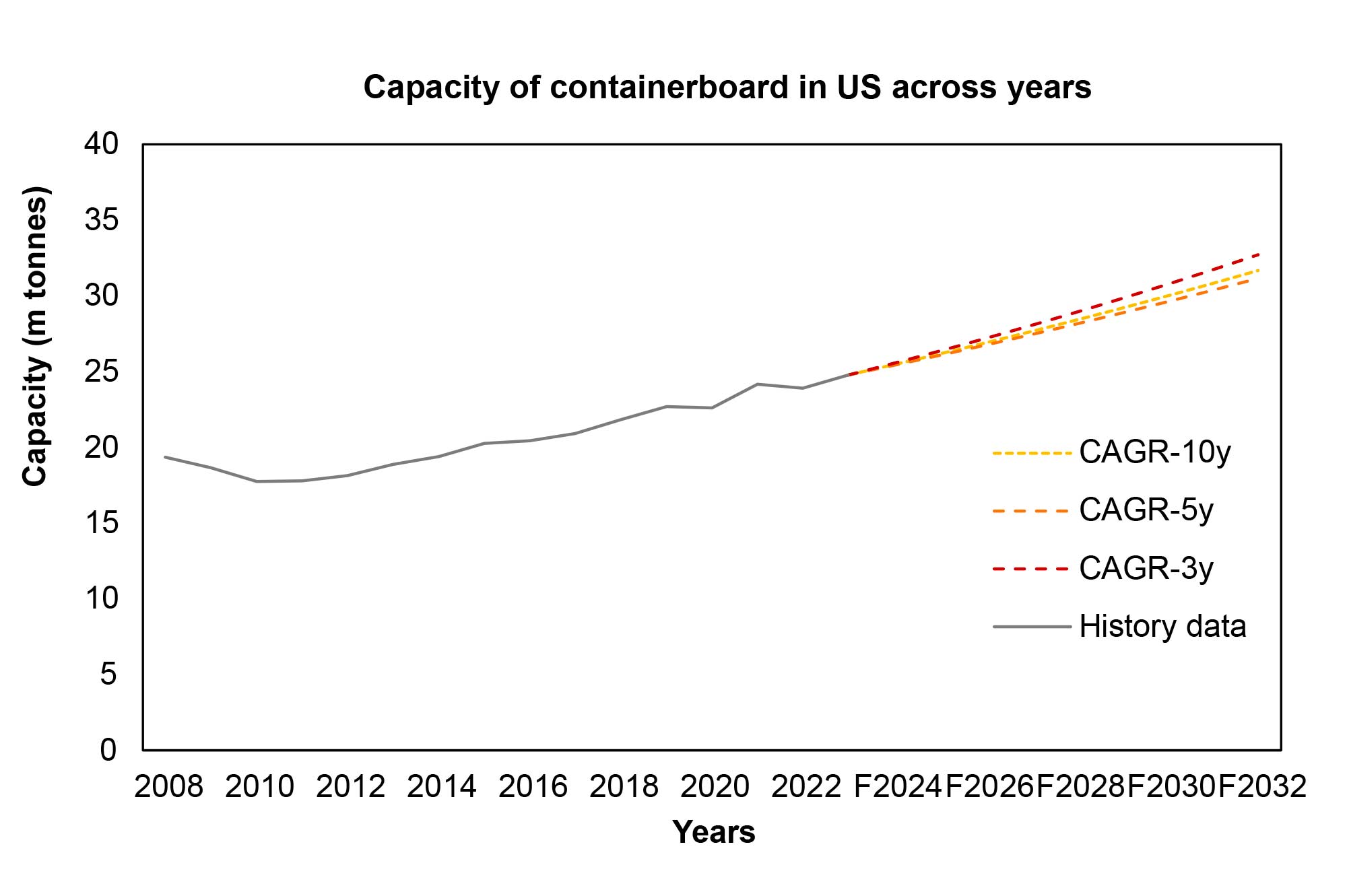

From 2008 to 2022, containerboard production has grown by 32% or approximately 6m tons (Figure 2). Forecasts for 2023-2032 (based on various periods of CAGRs) predict an ongoing capacity expansion of 15-30% by 2032. Old Corrugated Containers (OCC), sourced from industrial and consumer packaging, are being considered as a potential replacement for recycled paper in hygiene tissue production due to their high production volume and recyclability. However, challenges arise from the brown colour and reduced softness of fibres found in OCC. In response to the colour challenge, some hygiene tissue companies are introducing products featuring natural colour fibres, such as mocha. Nevertheless, consumer preference for white tissue products remains high. This necessitates the exploration of environmentally friendly bleaching processes aligned with the sustainability megatrend.

One significant and rapidly evolving trend reshaping social behaviour is the increasing environmental consciousness and the heightened concerns surrounding climate change. This behaviour shift has prompted individuals to leverage their purchasing power to address societal issues and minimise their environmental footprint. These shifts in consumer behaviour are observable across all generations, united by a shared environmental awareness. However, each generation exhibits unique priorities, behaviours, preferences, and spending habits. In the United States, as of 2022 the proportion of older and younger generations is nearly balanced. Nonetheless, demographic projections indicate a forthcoming transformation, with younger generations expected to constitute 64% of the population by 2030. Given this substantial change in generational composition and the influence of global mega-trends, it is essential to examine consumer behaviours and perceptions of sustainability across generational groups.

Older generations tend to display strong brand loyalty and a preference for traditional in-person shopping experiences. They value personal interactions and the ability to physically interact with products before making a purchase. Conversely, younger generations gravitate toward digital technologies for product research, price comparisons, and purchases. They prioritise convenience, accessibility, and a diverse online product range at competitive prices. When making purchasing decisions, they heavily rely on recommendations from friends, influencers, and online reviews. They also want more value for their money, which explains the rise of private labels.

Despite variations in the perception of sustainability among generational groups, defining sustainability remains a challenging task. The concept of sustainability with hygiene tissue market experts was explored by developing a Delphi study (this technique is a systematic process of forecasting using the collective opinion of panel members). The findings underscore the intricate nature of defining sustainability, which can be seen as either an ambiguous ‘trend similar to climate change’ or as a precise metric, such as comparing carbon footprints between products.

Sustainability presents challenges to the manufacturing of products while also opening opportunities for differentiation and additional revenues, as some consumers are willing to pay a premium for environmentally responsible products and services. Hygiene tissue companies have been progressively incorporating sustainable options into their product portfolios. The Tissue Pack Innovation Lab at NC State University has tracked the offering of self-labelled sustainable hygiene products in the US from 2017 to 2022, noting a 30% increase in bath tissue and a 25% increase in kitchen towel during this period. The category of self-labelled sustainable hygiene tissue products encompasses products displaying various sustainability attributes, including the use of alternative fibres, recycled fibres, or responsibly sourced fibres from managed forests. Moreover, features like recyclability of the product packaging and eco-friendly manufacturing processes are highly utilised.

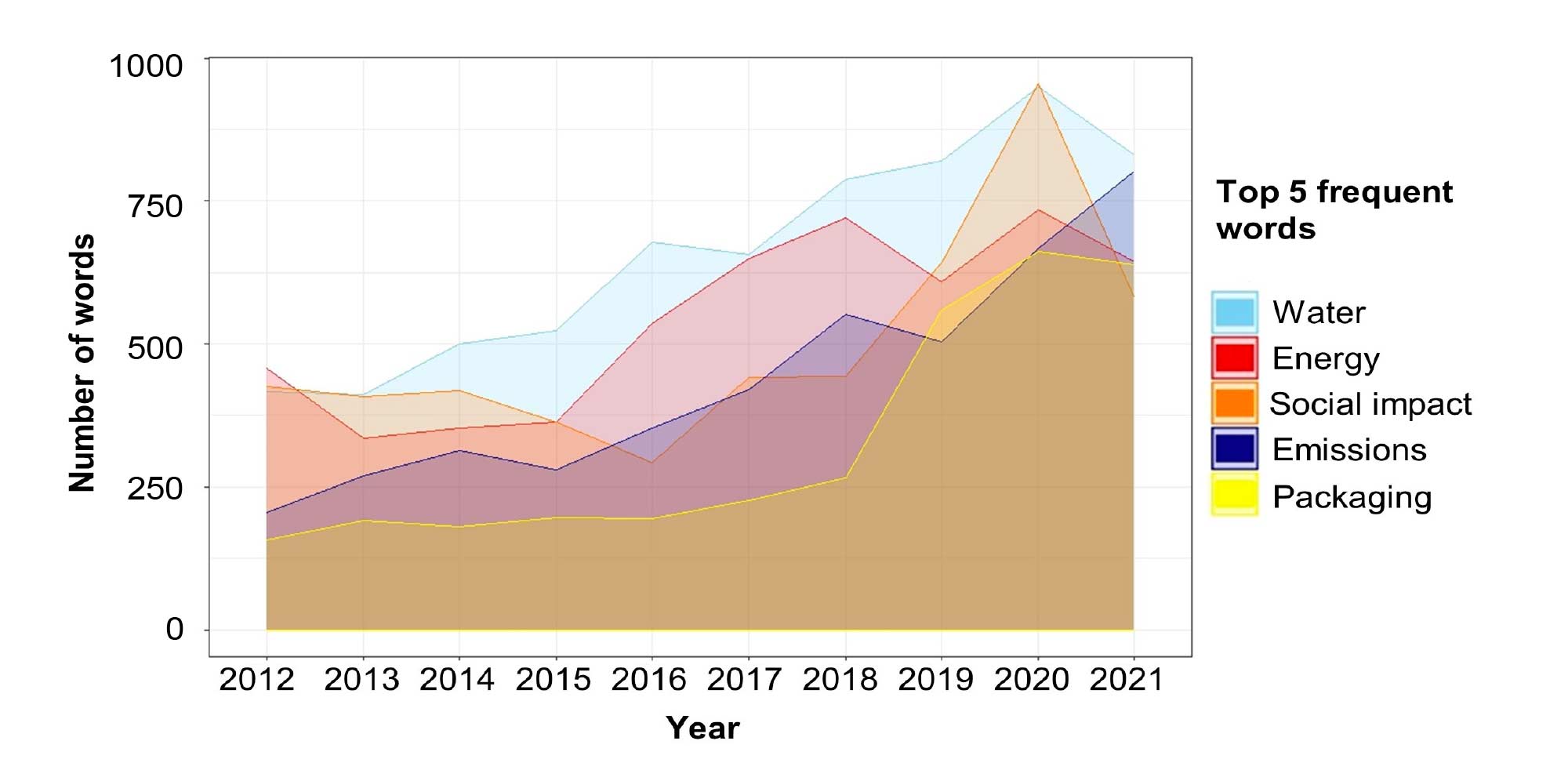

To examine the past and current perspectives on sustainability within the hygiene tissue industry, an LDA topic modelling was conducted on sustainability reports from the top sixteen hygiene tissue companies in the US (2012-2021). Insights from the topic modelling and relevant literature review suggests that the current sustainability landscape in the hygiene tissue industry can be outlined through these aspects:

- Responsible forest management and certifications

- Recycled fibres

- Alternative fibres

- Environmentally friendly production processes

- After-use disposal implications

- Social aspect

In the Delphi study, which sought insights from experts in marketing hygiene tissue products, several barriers hindering the adoption of sustainable hygiene tissue products were identified. These obstacles encompass premium pricing, insufficient information about sustainability and certifications, brand loyalty, lack of consumer confidence, and perceived low performance. The barriers were ranked in terms of how impactful they are to make consumers hesitate to buy sustainable options when purchasing hygiene tissue products. The ranking indicates an equal impact from premium pricing and insufficient information about sustainability. This may suggest that once a sustainable product is recognized, the price may not be a significant barrier. While consumers may assume a positive correlation between premium price and superior performance, research challenges this assumption. A particular example exists for kitchen towels, where higher prices do not necessarily guarantee better water absorbency. Furthermore, experts unanimously expressed the view that one of the key sustainability-related attributes for the next decade will be product performance. To encourage consumers to choose sustainable products at a premium price, tissue companies must prioritise improving product performance and providing well-defined sustainability metrics and information.

Examining the frequency of sustainability-related words mentioned in sustainability reports over the years (Figure 3), a noticeable upward trend is evident, especially concerning carbon emissions reduction, packaging materials, and after-use implications. Providing transparent and reliable sustainability information enables companies to address consumer hesitations, including concerns related to insufficient information or fear of greenwashing, thereby promoting the adoption of sustainable hygiene tissue products.

Concluding remarks:

Digitalisation megatrend will continue triggering a shortage in the supply of recycled writing and printing paper with additional drop between 50-75% (with respect to 2020), which will force the penetration of other recycled fibres like OCC and alternative fibres (e.g. wheat straw).

Using brownish fibres from OCC enhances environmental appeal for sustainability-oriented consumers, but developing low-carbon footprint bleaching processes is crucial for diverse consumer preferences.

To meet the sustainability demands of the younger generation, hygiene tissue companies must provide clear metrics and data on raw materials and packaging implications.

Providing hard data about sustainability (carbon footprint) will enable consumers to confidently identify, compare, and adopt sustainable hygiene tissue products.

Companies are shifting towards key indicators like “emissions” in sustainability reports and packaging. In the future, companies are expected to list carbon footprint data, instilling greater confidence in consumers.

This article was written for TWM by: North Carolina State University’s Keren A. Vivas, Ramon E. Vera, Naycari Forfora (Research Assistants and PhD students at the Department of Forest Biomaterials); Ronalds Gonzalez, PhD (Associate Professor, Consultant & Thought Leader in Sustainable Fibre-Based Consumer Goods at the Department of Forest Biomaterials); and Georgetown University McDonough School of Business’s Sudipta Dasmohapatra, PhD (Senior Associate Dean of MBA Programmes | Professor of the Practice in Business Analytics and Marketing).

Name of the scientific article: Predicting the Impact of Global Megatrends on the Hygiene Tissue Industry in the Next Ten Years: An Analytical Study Utilising Delphi Study and Topic Modelling.

Websites: SAFI consortium (https://research.cnr.ncsu.edu/safi/safi-consortium/), Tissue Pack Innovation Lab (https://research.cnr.ncsu.edu/tissuelab/) both at North Carolina State University.