The pandemic caused a four-year economic slowdown and hit consumer confidence – but an impressive projected five-year CAGR is now “inevitable,” says Euromonitor International Consultant Jason Tjiptadi.

The Indonesia retail tissue market is poised to experience double digit CAGR growth in the next five years, the second highest in the Asia Pacific region. The growth will be fuelled by the increasing disposable income within young middle-income households, improved consumer awareness, favourable demographic trends, enhanced digital engagement and business-led product diversification and innovations.

Economic uncertainties compromised short-term growth

Over the past decade, the tissue market in Indonesia has seen remarkable growth, buoyed by the country’s robust economic expansion which has fuelled urbanisation and the rise of middle-income households. Manufacturers have also actively raised awareness through endorsements and live campaigns, effectively reaching new consumers and increasing per capita consumption.

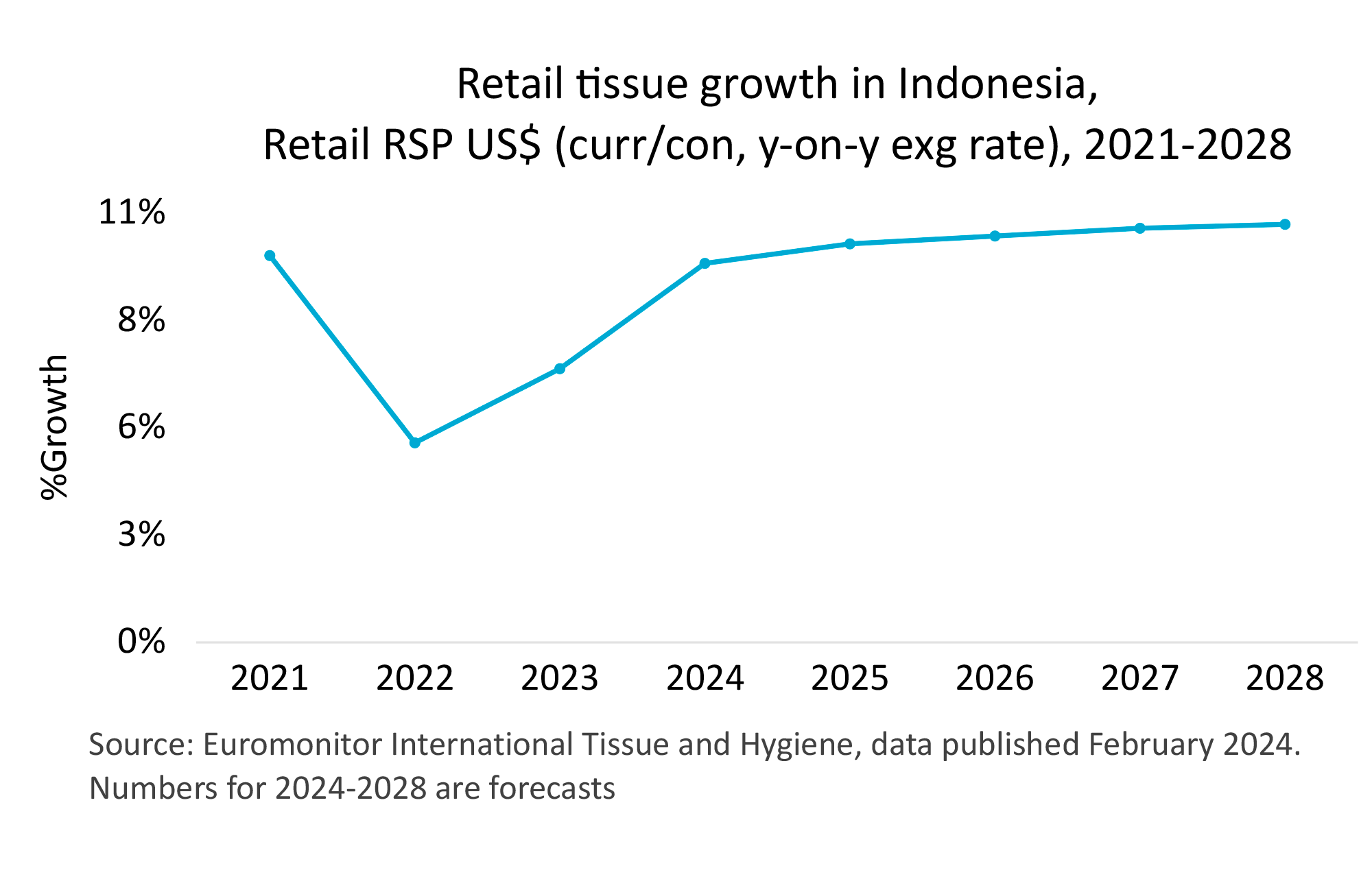

However, this promising growth trajectory faced challenges during the pandemic in 2020, as well as periods of high inflation and federal interest rates in 2022 and 2023, leading to reduced consumer confidence. Manufacturers struggle with escalating costs of raw materials and production, necessitating price hikes. Consequently, consumers have become more cautious, cutting back on usage to manage expenses, resulting in significantly weaker growth for retail tissue compared to pre-pandemic projections.

Simultaneously, consumers are cutting back on leisure spending and dining out. The consumer foodservice market in 2023 continues to lag, with a 20% decline in output value sales compared to pre-pandemic levels. Additionally, inbound travel numbers in 2023 remain below those of the pre-pandemic era, leading to slower growth of AfH tissue value (curr/con) in 2023.

Despite recent challenges of rising inflation and interest rates, there’s a noticeable uptick in product and hygiene awareness, with middle to higher income households demonstrating increased spending on innovative, higher-quality tissue products. This trend is amplified by the power of social media platforms, particularly TikTok and Instagram, which effectively reach consumers from diverse backgrounds. Influencers and users sharing their tissue usage experiences online contribute significantly to public awareness regarding the importance of tissues in various settings, including the kitchen, living room, and bedrooms. Manufacturers are also doubling down on innovation, introducing new products equipped with features like antibacterial properties and extra softness. These advancements are pivotal in laying the groundwork for the future growth of retail tissue.

Fast-paced economic growth and favourable demography translates to long-term growth

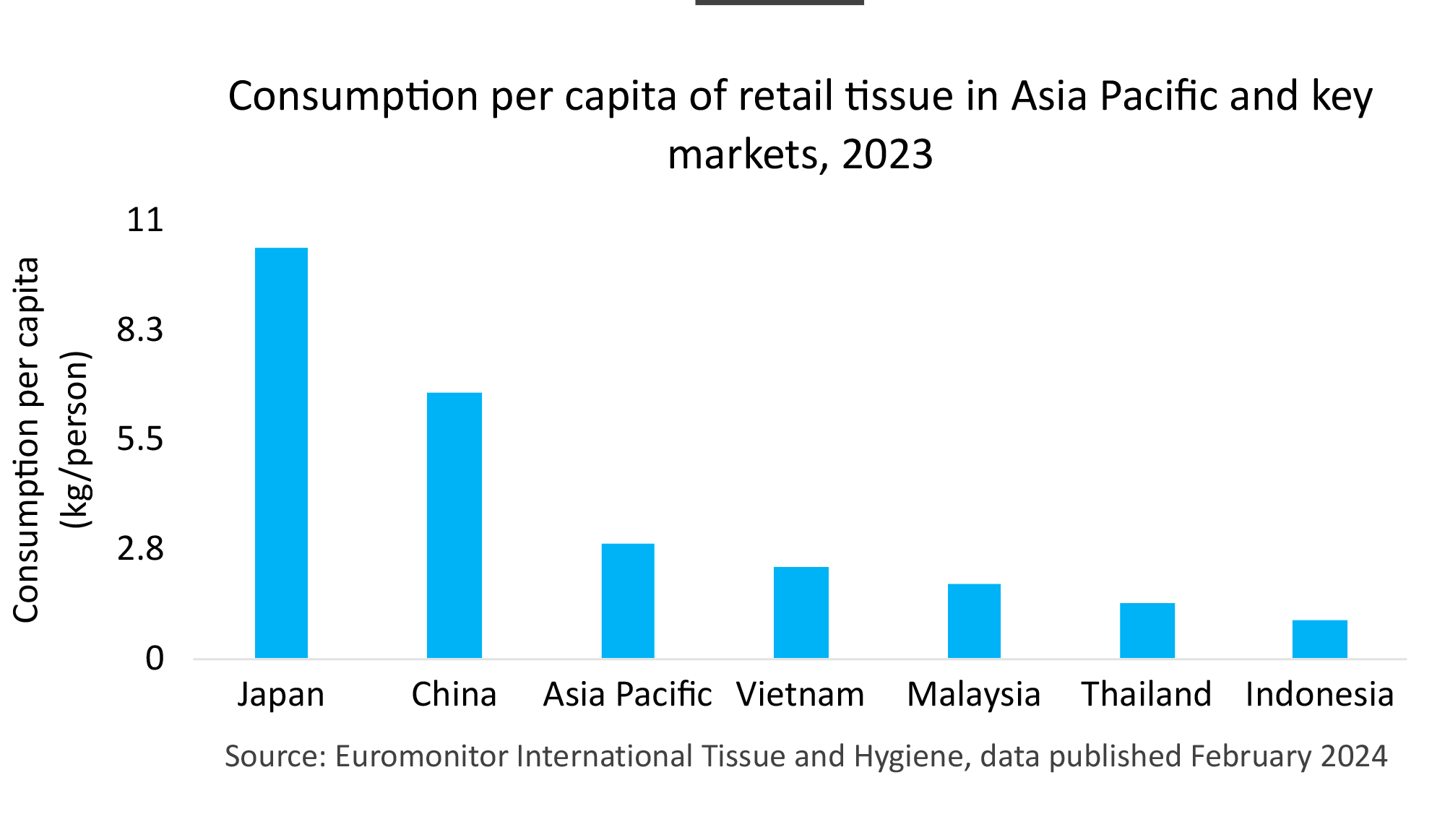

While the Indonesia economy and consumer confidence has been compromised the past four years, it is inevitable that the country will be back on a fast-growth track. Indonesia is expected to experience 5.2% GDP growth in 2024. The country has a median age of 30.9, in which around 70% of the population will be in working age at least for the next 20 years. At the same time, Indonesia just received upper middle-income status from World Bank in 2022, showing a significant growth of gross national income per capita every year. All these statistics are important to know for tissue manufacturers as it shows that the demography is on their side to have double-digit forecast CAGR in the next five years. The double-digit is also made possible by the low current consumption per capita as compared to countries in the region. Manufacturers will be able to capture first time buyers while continuing to increase penetration among existing users.

The rapid expansion of the economy is also leading to the construction of more public facilities such as hospitals, malls, and offices, which will also benefit the market for AfH tissue products. Additionally, the revitalisation of domestic and inbound tourism will contribute to increased sales within the HORECA industry, the largest channel for AfH tissue consumption in Indonesia.

In the next five years, retail tissue in Indonesia is expected to grow 7% CAGR in volume terms and 10.3% CAGR in retail value US$ (curr/con, y-on-y exg), while AfH tissue in Indonesia is forecasted to grow 8% CAGR in volume terms and 10% CAGR in AfH value US$ (curr/con. Y-on-y exg).

The robust growth outlook and a large influx of first-time buyers present an opportunity for new manufacturers to enter the market and secure significant market share. This trend aligns with consumer behaviour across various industries in Indonesia, where brand loyalty tends to be low, and consumers prioritise perceived value, even from products with little established presence in the country. For example, newer local brands such as Yukinawa and Montiss gained significant sales growth in recent years – especially in e-commerce platforms – by offering lower unit price.

Presently, the Indonesia tissue market is largely dominated by two manufacturers, Asia Pulp & Paper (APP) and Graha Kerindo Utama, commanding nearly 80% of the market share. Their popularity stems from effective product segmentation, innovation, and adept utilisation of online platforms, all of which will remain pivotal growth drivers in the coming five years.

Product and price segmentation to cater TO a wide range of audience as a key competitive pivot

The key for growth lays in the understanding that there is no “one-size-fits-all” product and innovation for a population of over 270 million. This means that manufacturers have to offer diversified brand portfolio to cater to different market segments.

For instance, APP has three distinct brands: Paseo for the premium segment, Nice for the mid segment, and Jolly for the economical segment. Volume growth in the next five years will be mainly driven by the mid and economical segment as Indonesia’s middle-income households still have the reputation of being price sensitive. According to Euromonitor’s lifestyle survey 2023, 57% of Indonesian respondents’ future spending habits involves putting more money aside for savings, higher than the global average of 44%.

Simultaneously, most of the value growth is expected to be generated from the premium segment, where affluent consumers prioritise high quality and innovative products.

Therefore, introducing new products with attributes such as anti-bacterial properties, extra softness, and eco-friendliness remains paramount to cater to the increasing numbers of health-conscious and environmentally-aware consumers. Paseo’s recent launch of Paseo Aroma Relief, which infused with soothing aromas from Eucalyptus and Lavender essential oils, exemplifies this trend. Additionally, its triple softness, dermatological testing, and halal certification are features highly valued by Indonesian consumers.

Social media and e-commerce as enduring key sales drivers

Sustaining the trajectory of recent years, the significant influence of both social media and e-commerce will continue to drive sales. By 2028, approximately a quarter of all retail tissue sales are projected to come from e-commerce channels, driven by consumers seeking cost-effective bulk purchases. E-commerce platforms serve as crucial avenues for Indonesian consumers to discover new products, given their prolonged engagement with these platforms.

Concurrently, leveraging influencers on platforms like TikTok and Instagram will be essential for market expansion and competitive positioning, as influencer endorsements can significantly impact consumer choices regarding products and brands.

Conclusion

Indonesia’s favourable demographic profile, characterised by a young population and expanding middle-income households, coupled with rapid economic growth, is poised to propel the tissue market to a double-digit CAGR over the next five years. Increased disposable income and heightened awareness of products and brands are pivotal factors driving this expansion. To capitalise on these opportunities, manufacturers must prioritise fostering social media engagement and introducing innovative products to maintain consumer interest and satisfaction.