Against a background where grocery prices have risen by 26% and consumers are spending the highest share of their income on food for 30 years, AFRY Management Consulting’s Sanna Sosa, Senior Prinacipal, and Soile Kilpi, Director, discuss the forces shaping the tissue sector in 2024 and beyond, from decarbonisation to industry re-structuring and raw material challenges.

Across North America, tissue products demand growth has stabilised from the pandemic panic buying years and is settling back on its pre-pandemic tracks. After the Covid-driven surge in demand in 2020 and 2021, At-Home tissue demand has settled in 2022 and 2023 close to 7.1m short ton, which is 4.5% above pre-covid demand level. Increased working from home (WFH) and attention to cleanliness and hygiene are bolstering the At-Home tissue demand to above pre-pandemic levels.

Consumers are monitoring their grocery bills in an environment where food prices have shot up by 26%, according to the Bureau of Labor Statistics, and American consumers are spending the highest share of their income on food for 30 years. The high inflation market environment has been beneficial for lower cost private label products.

Private label tissue is estimated to have reached 36% market share of North American retail tissue demand – impressively up from 30% in 2016 or growth of 0.5m short tons of annual demand. However, Americans’ shopping behaviour remains far from Europeans’ love and appreciation for private label products. Private label tissue products are estimated to have close to 70% of the market share in Western Europe.

AfH tissue demand recovery has continued steady from the Covid lows in 2020, when non-essential businesses, travel, and events ground to an abrupt halt, at around 2.8m short tons, reaching 3.2m short tons in 2023 and showing 3% growth from the year before. However, AfH tissue demand remains close to 160,000 short tons below pre-Covid level. Although WFH and hybrid work models are here to stay, AFRY expects AfH tissue demand to surpass pre-Covid levels by 2025, driven by growing population and mobility.

On the supply side, the market turmoil of recent years has seen a high number of tissue machine and mill closures. Tissue assets worth over 500,000 short tons of annual manufacturing capacity have closed since 2020. Most of the closed assets were small, aging, and focused on the AfH tissue markets.

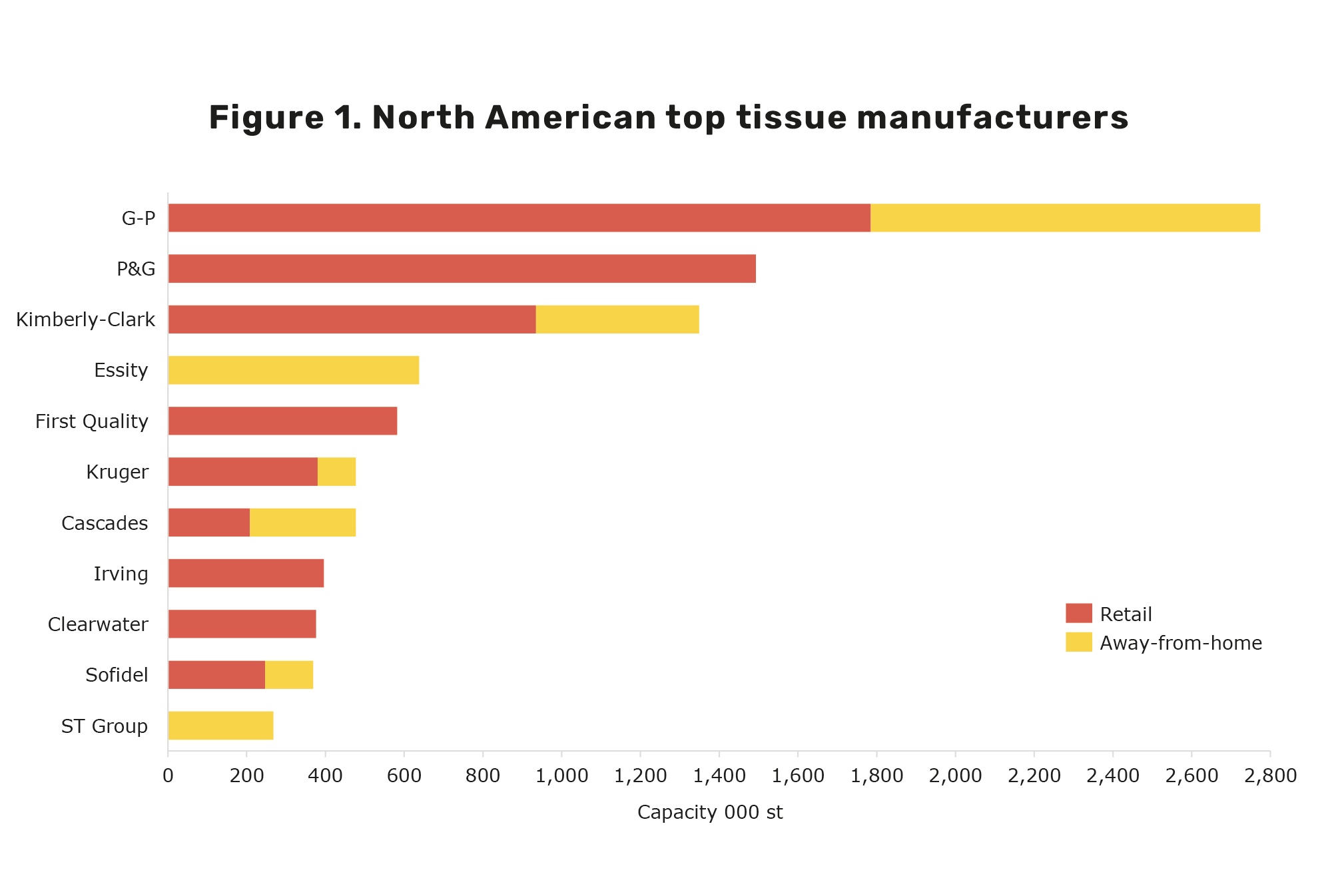

However, the capacity rationalisation did not significantly impact the overall tissue industry structure. Georgia-Pacific, Procter & Gamble, and Kimberly-Clark continue to be the clear industry leaders and hold about 60% of North America’s tissue capacity.

The midsize producers have been adding – and continue adding – new capacity and betting on private label tissue market growth. The market share of “mid-size” players has grown from 27% in 2007 to current 33%. First Quality, Kruger, Sofidel, and Irving have all been adding capacity over the past four years. In addition to continued new tissue machine investments by Kruger and Sofidel in 2024/25, Georgia-Pacific and Procter & Gamble are following suit with new projects expected to come online this year.

But, in addition to organic capacity growth and capacity rationalization, merger and acquisition (M&A) activity is again emerging as an element in the North American tissue sector. First, in early 2024, Sofidel – which has and continues to build new capacity, after their initial North American market entry acquisition of Cellynne in 2012 – acquired ST Tissue’s newly build tissue operation in Duluth, Minnesota. The M&A news was followed by Clearwater’s statement during their 2023 fourth quarter analyst call that they are currently evaluating strategic options for their tissue business, while investing in their cartonboard business.

M&A certainly makes sense in the North American tissue market setting where demand growth is steady but slow (at typical 1-2%/a) and the competitive landscape consists of a few large-scale players and many medium to small size challengers. Typically, in industries with similar fundamentals, the market leaders drive growth by acquiring competition and market share, or the medium size players consolidate to become one of the industry leaders.

Clearwater Tissue combined with another mid-size, private label focused player would consolidate the private label supply landscape and potentially create a new private label market leader to captain the segment. A large-scale private label supplier with strong nationwide footprint could further drive market adoption, as well as steer positive EBITDA development.

Up-stream challenges

Pulp price volatility and parent roll costs are major drivers for tissue company bottom lines, as pulp represents close to 70% of parent roll manufacturing cost and base paper typically represents two thirds of converted bath tissue manufacturing cost. Additionally, AfH focused tissue mills (which includes 30% of North American market) and independent tissue converters (which supply 10% of North American tissue demand) often focusing on the AfH segment and have been facing their own set of up-stream challenges with reduced availability of high-quality recovered fibre and open market parent rolls.

Availability of domestic open market parent rolls has shrunk in the past four years, with closures of mills that supplied parent rolls to the independent converter market. Cascades rationalised its St. Helens, Oregon, and Ransom, Pennsylvania, mills, which were both supplying market parent rolls. Sofidel’s Duluth mill acquisition from ST Tissue is likely to further shrink the domestic parent roll availability. In addition, the traditionally open market focused ST Tissue has been forward integrating in their operations, following the still prevailing paradigm of the value of integration between base paper production and converting of tissue end-use products.

What has kept the independent tissue converting market humming? Partly imports, but the parent roll market is increasingly tight. Tissue parent roll imports to North America have been growing. Tissue parent roll imports close to doubled from 230,000 short tons in 2015 to over 400,000 short tons on peak year of 2020, but then crashed to just 215,000 short tons in 2021/22, driven by high logistics costs and supply chain issues. Parent roll imports bounced back up to 330,000 short tons in 2023 reflecting recovering AfH market and tightening domestic market parent roll availability.

Over the next five-10 years, the AfH tissue sector has a fibre raw material dilemma to solve, as availability of high-quality recovered fibre material such as sorted office papers continues to decline due to less and less consumption of printing and writing papers and high export market prices drawing supply.

Tissue mills in North America as well as Europe have started to investigate alternative fibre options to traditional high grade recycled papers. Other fibre options, aside from moving to higher cost virgin market pulp, include; old corrugated containers (OCC), when brown colour is not an issue, or sourcing of still underutilised recycled liquid packaging or food service board materials, which can be a source of strong and white fibres. However, use of recycled liquid packaging and food service boards represents not only mill technical and operational challenges, but also challenges in fibre sourcing and management of complicated side-streams.

In addition to different types of recycled fibres, tissue mills can consider inclusion of alternative non-wood fibres such as bamboo, bagasse, straw, and others, in their products. Use of non-wood fibres in tissue products is rather prevalent in Asia, and some bamboo containing tissue products have started to find their way into the increasingly eco-conscious North American market. However, in the North American context, large scale and cost-effective sources of non-wood fibre pulps have so far been hard to find. Therefore, tissue companies with sustainability and ESG related ambitions to increase use of “environmentally preferred fibres” have had to keep pivoting to FSC-certified recycled and virgin wood fibres.

Sustainability challenges

To combat the looming threat of climate change, the US, Canada, and countries around the world have pledged to significantly curb carbon emissions, cut emissions in half by 2030, and achieve net-zero carbon emissions by 2050. Therefore, jurisdictions are setting carbon taxes that emitters must pay for each ton of CO2 they emit, and companies including tissue manufacturers and tissue manufacturers’ customers from major retailers to food service operators are setting targets for decarbonisation.

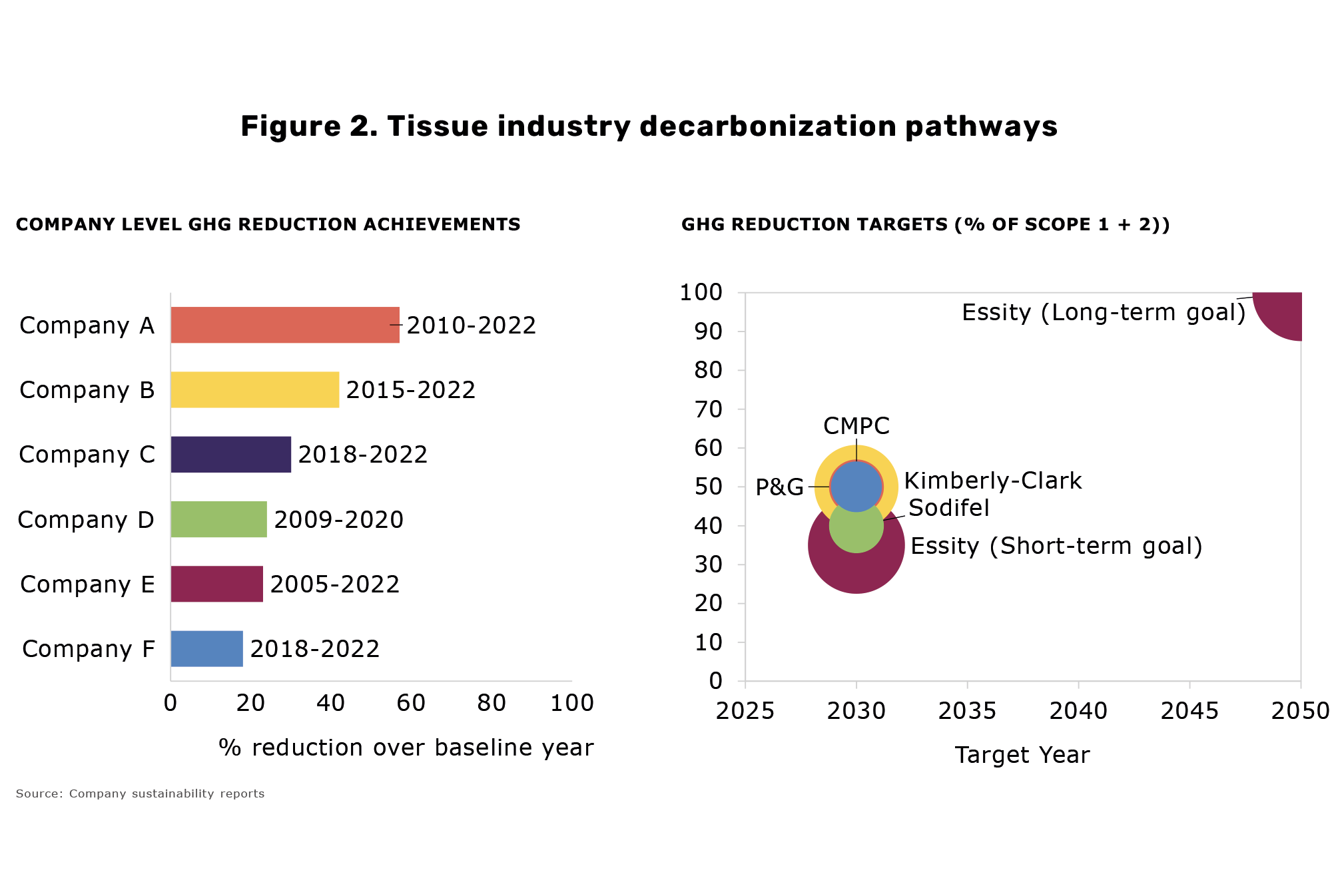

The tissue industry has a large carbon footprint. Tissue production is a carbon-intense process due to the energy requirement for the drying process, and the still high use of fossil fuels and purchased electricity. However, good progress has been made over the past 20 or so years in terms of tissue industry greenhouse gas (GHG) level reductions.

Based on publicly available information, tissue companies have been reporting 20-60% reductions from baseline years. But the challenges and journey continues for the tissue industry to further reduce GHG emissions. Leading North American and global tissue companies have announced aggressive short term GHG emission reduction targets ranging from 30-50% by 2030, while Essity has already published its long-term commitment to get to net zero by 2050.

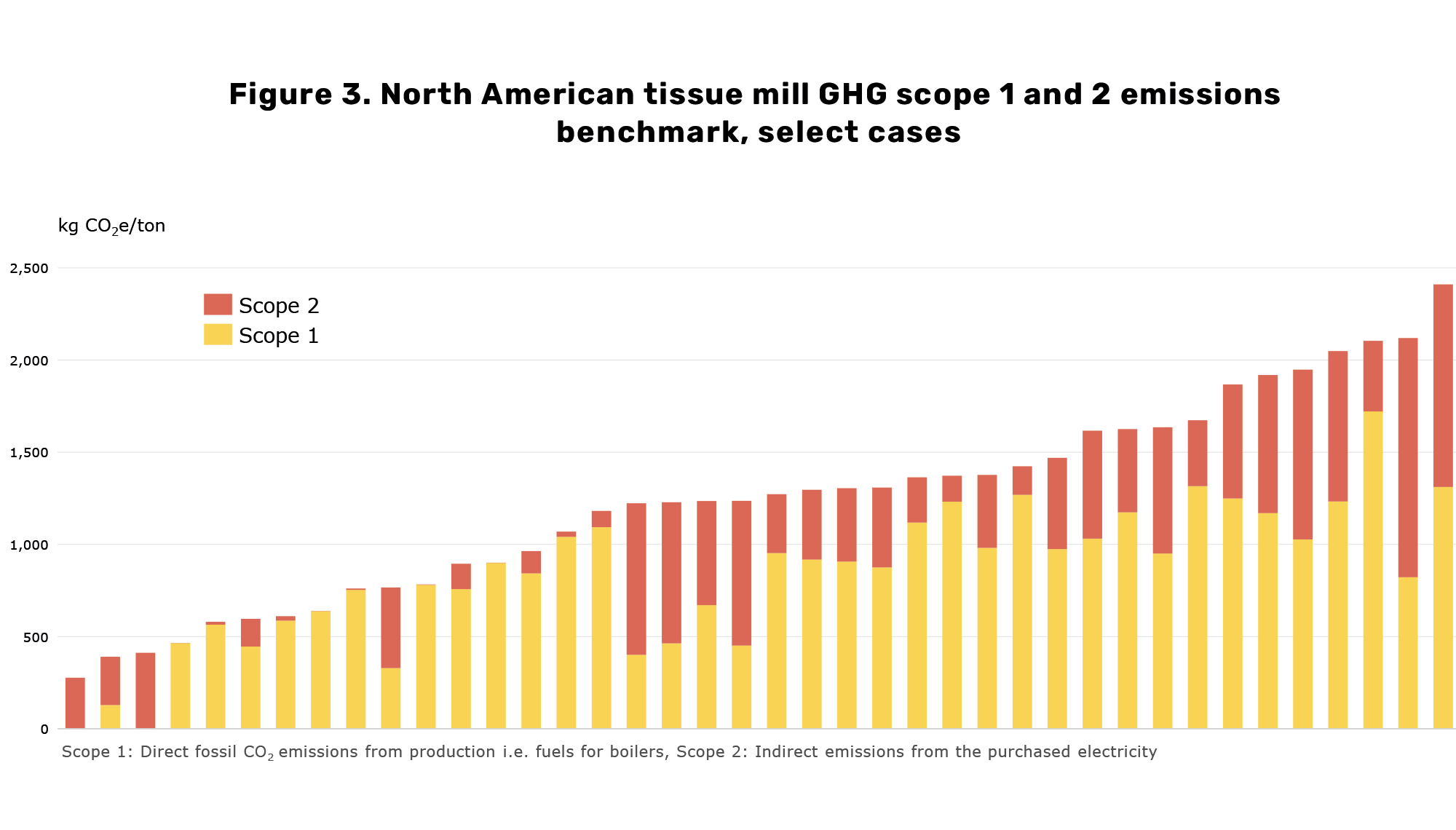

North American tissue manufacturing sites have a wide range of GHG emissions ranging from <500 kg CO2e/ton to close to 2,500 CO2e/ton. The low emitting tissue mills typically have high levels of energy self-sufficiency and they may use up to 100% biomass or renewable gas, and if they buy electricity, it is from renewable sources. These types of tissue mills are typically either integrated to pulp or have highly energy efficient new processes.

At the other end of the spectrum, the high GHG emitting mills (those >2000 CO2e/ton) depend on fossil fuels such as coal and fuel oil, and they purchase electricity from high GHG emission grid and often run older and smaller scale tissue manufacturing assets.

Tissue industry decarbonisation

The main levers for tissue mill operation decarbonisation are renewable energy, energy efficiency, carbon markets, and emerging carbon capture. The biggest impact on tissue operations’ carbon footprint can be made by energy decarbonisation, meaning a transition to renewable energy and energy self-sufficiency. Tissue mill energy decarbonisation paths can include investment in biomass plant, cogeneration, waste or e-boilers. Transition from natural gas consumption to use of bio-gas, renewable gas (syn-gas), geothermal energy, or hydrogen, has a high positive impact on GHG emissions in addition to moving to renewable electricity purchases.

Energy efficiency programmes continue to be core to incremental gains in GHG reduction. Energy efficiency gains can come through technology innovation and modernising energy intensive systems such as investing in Steel Yankees or new drying and forming technologies. Carbon offset purchases are an option when other options have been exhausted. And carbon capture, and sequestration, is an opportunity available but not yet fully matured. Tissue companies can use a variety of methods to reduce GHG emissions. Having a clear decarbonisation plan is essential to keep ahead of customer needs, meeting long term global carbon reduction targets and avoid penalties and cost related to GHG emissions.