Today tissue products are part of normal daily life in the vast majority of Chinese households. But major developments are having profound consequences – the trade war, price increases, and the early stage of the coronavirus outbreak in a crucial manufacturing region for the whole world. Esko Uutela, principal, tissue, Fastmarkets RISI, looks at the economy pre-coronavirus.

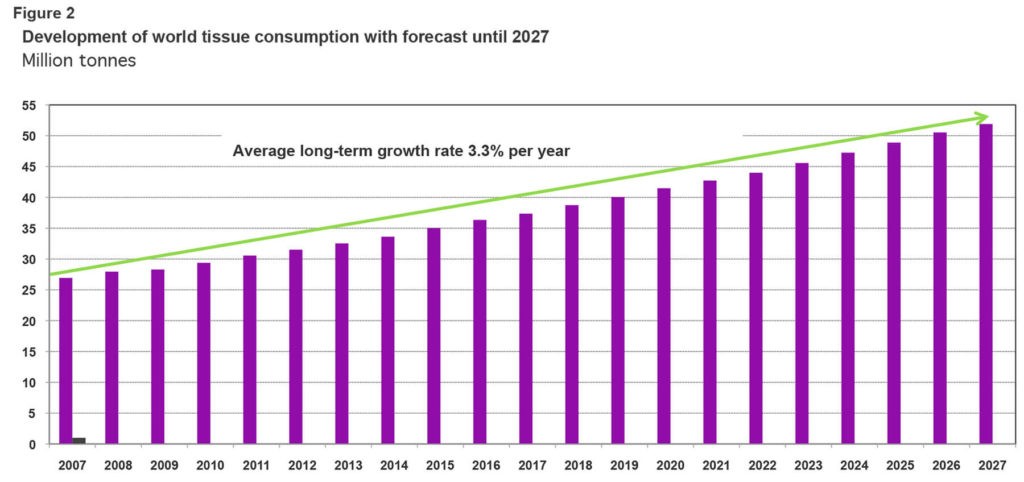

For the past 20 years, China has been the main driving force of global tissue growth. In 2008-2018, more than 40% of the volume growth in global tissue consumption took place in China and the country showed very strong growth rates, which in some years even exceeded 10%.The average relative growth rate in 2008- 2018 was 8.0% per year, up slightly from the 7.6% per year average recorded in 1998-2008 An essential change in the growth is that 20 years ago the geographic focus of expansion was the eastern coastal strip and the Beijing metropolitan area, but more recently the fastest expansion has taken place in the Chinese hinterland, including both central China and parts of northern China; tissue products have had a lot of untapped consumption potential in both regions. Urbanisation has been a major driver for tissue consumption for a very simple reason: when you move from rural living conditions to urban areas, you need to change your hygienic habits as well. Today, tissue products are part of normal daily life in the vast majority of Chinese households and the AfH tissue business has also started to develop rapidly. The rapid expansion of the Chinese tissue market is closely related to the overall improvement in the welfare of the population, and the past strong economic growth substantially contributed to the steady and robust growth in tissue consumption. But recently, the Chinese economy has shown signs of weakening for several reasons, of which the trade war with the USA is certainly one of the most important. In China, the escalation in prices of daily necessities has also negatively affected the attitudes of consumers, and growth in the retail business has slowed substantially.

These developments have also influenced sales of tissue products. It was a major surprise to me and certainly also for many industry spectators when the China National Household Paper Industry Association (CNHPIA) published its figures for 2018 last spring. In particular, tissue parent roll production was clearly lower than anticipated and domestic sales were also below all expectations. Based on the apparent consumption calculation method we use for tissue consumption (production plus imports minus exports), growth in Chinese tissue consumption in 2018 was no more than 4.0%, only half of the 8.0% growth recorded in 2017.However, the weakness of apparent consumption is that it does not take into account any stock changes, so it is possible that because a lot of tissue capacity came on stream in 2017 (peak year), and because market pulp prices were so high, that companies reduced their production of parent rolls and used their parent roll stocks for converting instead. Even so, this would explain at most only one percentage point of actual consumption growth. So, the Chinese tissue business definitely slowed in 2018, a fact which all the indicators in the 2018 CNHPIA annual report confirm.

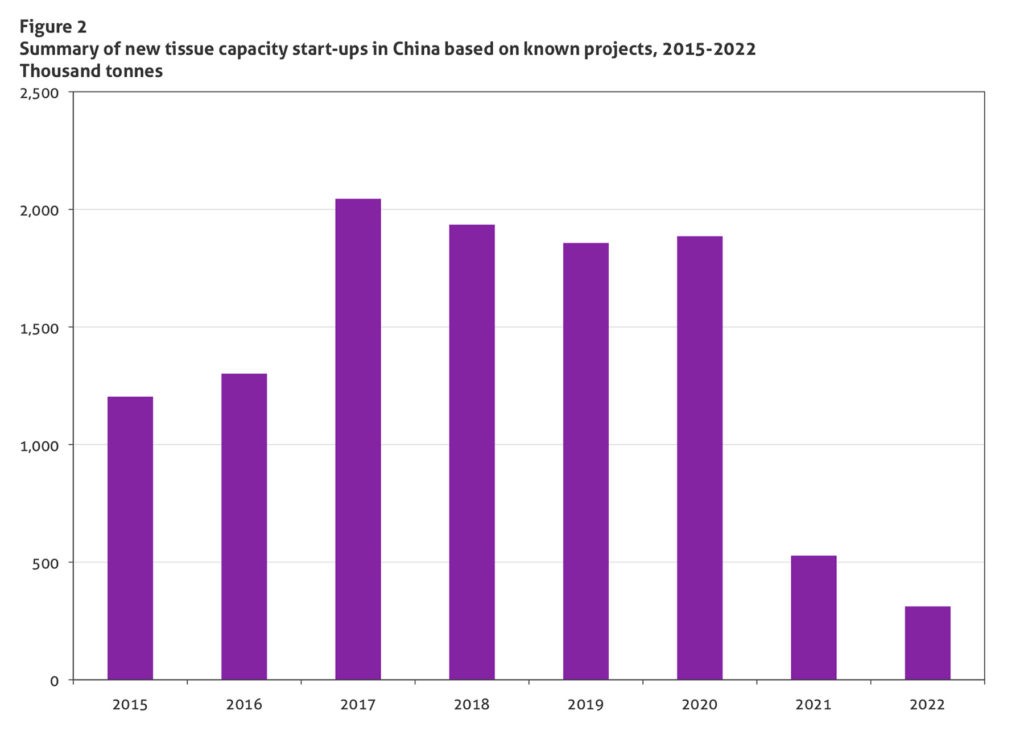

However, on the supply side, there are almost no signs that investment activity is calming down. The number of new investment projects has exploded in recent years; 2017 was the most recent peak year with more than 2 million tonnes of new tissue capacity starting up. In 2018-2020, our project list shows about 1.9 million tonnes of new PMs each year. Some PMs have already been ordered for 2021 and 2022 and more will certainly be announced later on. This means that in 2015-2022, the known or announced projects will add about 11 million tonnes of new tissue capacity, of which more than 8 million tonnes has already been started up. The Chinese tissue industry is experiencing major restructuring, with new, modern PMs being constructed and older capacity closed. Tissue PM closures also peaked in 2017, when about 1.3 million tonnes of old PMs were closed. In 2015-2019, about 3 million tonnes of tissue capacity was idled and dismantled. Some of the closures were caused by mandatory shutdowns because of environmental reasons and high energy needs; for example, in Baoding, Hebei, the main hub of the Chinese tissue industry, coal-burning boilers were forbidden and tissue mills were required to invest in gas-burning boilers and, where applicable, gas-fired hoods and new machines. This was a major impetus behind the investment wave in 2017. But as the Chinese tissue market is extremely competitive, closures have also occurred for financial reasons, such as the recent closure of the large Ningxia Zijinghua mill and the bankruptcy of the Shandong Tranlin group, both of which used straw pulp as their main raw material. But will these heavy investments, which clearly exceed the organic market growth, continue? Tissue exports have expanded and have eased the overcapacity situation in China somewhat, but now the trade war (at the time of writing) with the USA will likely result in no export growth in 2019.

The organic growth of the Chinese tissue market cannot absorb all the new capacity and average tissue capacity utilisation will continue to fall. The CNHPIA reported capacity utilisation of 73% in 2018, which is reasonable if not accounting for learning curves for new PMs. One item of note about the industry expansion is that more and more Chinese companies, including the large players, have begun to conduct trials with smaller PMs made by domestic tissue PM manufacturers instead of large world-class machines imported from Europe. Additionally, the number of Chinese tissue PM suppliers has grown and new entrants are gaining ground in the market. There is a major difference in tissue PM prices between domestic and imported PMs, which has certainly been a major factor for selecting the supplier. A second fact is that the average quality of Chinese tissue PMs has rapidly improved and their capacity has risen above 20,000 tonnes to as much as 30,000 tonnes per year. Our project list for the coming years does not show any small PMs with capacity below 10,000 tonnes per year at all, and also no narrow PMs (trim below 2m). However, the competitive situation is likely to slow down investments, which will become riskier in China in the next few years. The bare truth is that serious overcapacity in the tissue market is prevailing in China and there seems to be no end for this development. It is very likely that there will be more bankruptcies of tissue mills and companies and several will exit the business. The competition is keen and only the best performers will be winners in this game.

Esko Uutela, principal, tissue, is the author of Fastmarket RISI’s Outlook for World Tissue Business study, the World Tissue Business Monitor and the US Tissue Monthly Data. He works outof Fastmarkets RISI’s EU Consultingoffice near Munich, Germany, and can be reached at: Tel:+49.8151.29193 or Email: [email protected]. To learn moreabout the global tissue market, visit www.risi.com/tissue.