Tissue producers are in a solid position, but the example of retailers expanding their private label offering shows genuine interest to incorporate margins currently generated in the upstream business. By AFRY Management Consulting’s Hampus Mörner, Manager, Christoph Euringer, Principal, and Tino Mäkelä, Analyst.

Ask any Chief Executive or salesperson about their competitive advantage and you will hear very different accounts on why their company is the best, the superior, or at least the one with the best outlook going forward. Citing most value-add products, most efficient production, best service level best assets, etc. And within their individual sector, they might even be the leading company. But at the end of the day, there is a limited amount of money available in any value chain – and finally only the distribution of profits should be the litmus test of who is performing best.

We had a look at the tissue value chain, its key suppliers of fibre and machinery, and their main clientele – the big retailers and discounters. In short, the tissue industry has performed well, although the gap of value creation between the lower and higher end of company groups is notable. And yet the key question for the tissue industry’s future is – how can it further improve its situation?

The simplified consumer tissue value chain holds four main company groups to enable the finished goods to end up at a consumer: pulp manufacturers, tissue paper producers, retailers, and machinery suppliers (including converting, pulp and paper and machinery equipment). Each group can be further divided and described in detail. For instance, the stage consisting of tissue paper production can be divided into integrated paper producers (with converting capabilities) and independent converters (sourcing the base paper externally). Physical stores and traditional retailers may as well be replaced by e-commerce platforms. Moving forward, we will stay on the simplified level of breakdown.

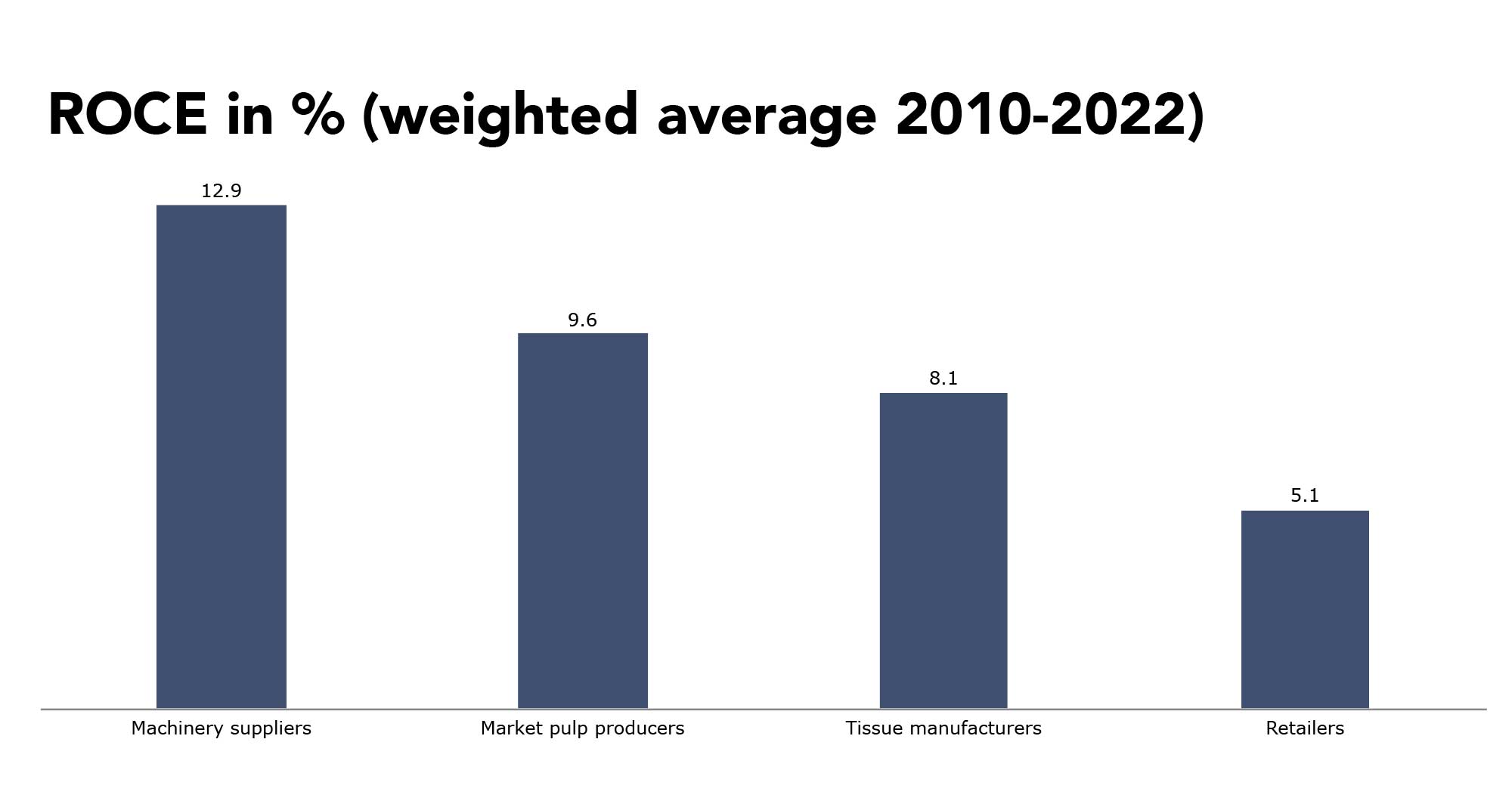

Figure 1 shows the average of ROCE between 2010 – 2022 as weighted average (by turnover) for the selected steps in the value chain. Numbers are taken from the highest ‘legal entity’ level of the respective companies and basically also cover non- tissue businesses. Paper machine producers also sell packaging paper machines, tissue producers might have a non-woven business, and retailers have a very wide assortment. Still, on this helicopter level it provides a robust picture for the assessment of companies which are able to generate the highest profits.

Reading from the comparison in figure 1, the gap between the highest (machinery) and lowest level (retail) of value creation is notable. From the tissue industry perspective, the challenge comes more from the suppliers – they can achieve higher profitability levels – while retailers instead face stiff competition among themselves, and within this comparison find themselves in the least comfortable situation.

What are the challenges within each of these groups?

Machinery suppliers: In Europe, this is a group of companies that have experienced a trend of growing consolidation historically, and where technology development has been led by few companies. Many of the global top-tier players within this sector originate from Europe, which are leading in innovation and provide the highest technology level.

There have been numerous interesting acquisitions during the past few years, not only amongst the paper machinery and converting machinery suppliers, but also recently across these two sub-groups. Next to consolidation, the most recent acquisitions have also set a direction towards more complete end-to-end offerings where fewer parties are involved to fulfill an order for a complete line from stock preparation to packaging line. Technologies and solutions simply come under the control of fewer players.

Another aspect is the high thresholds to enter as a new machinery supplier. The business is capital intensive and being at the forefront of technology development and intellectual property is a decisive factor. Lastly, maintenance, trainings, diagnostics, and any other services which the incumbents can supply next to pure machinery purchases are raising the entry bar further. Machinery suppliers have been successful in meeting the high demand for quality, energy efficiency, and strict environmental policies in Europe through their high – and specialised machinery know-how. This also carries a premium price.

Pulp suppliers: As the structural decline in graphic papers continues, tissue paper has become the single most important end-use segment for the market pulp sector. Essentially, this means that growth opportunities for pulp producers are more connected to the success of tissue paper when compared to the past.

Just as with the machinery suppliers, a positive aspect within the pulp sector is the increased consolidation witnessed in the last decades. Most global production assets are now under the control of a few leading corporations. Additionally, currently known capacity expansions are led by the top producers. Customers are facing fewer sourcing options and less bargaining power when buying pulp. Still, this consolidation and its impact on pricing power should not be overemphasised. It’s worth remembering that pulp remains a cyclical business and prices were not kept from falling in the previous cycle.

Other supportive factors that have led to a superior value creation, is an efficient resource management through land ownership enabling access to competitively priced fibre, which is then converted to pulp in new mega sites. Fewer and fewer white spots on the global map show how the development of new pulp mills is becoming more difficult. The needed access to land and massive CAPEX required for new modern “mega-mills” increases the thresholds. But it also drives producers to maximise economies of scale on the existing plots – and successful value creation.

Retailers: Reading from the comparison in Figure 1, this has been the company group creating the least value historically. Retail and grocery stores typically require high priced real estate plots in close surroundings to consumers. Much of the store area is required for traffic of consumers rather than shelves generating revenue. The number of goods that major retailers carry and handle can easily be counted in thousands, each requiring different space, shelf time and indirect cost to finally generate value.

Tissue articles make up a fraction of the total number of articles and are not necessarily in the largest focus. On the other hand, tissue products are bulky and demand substantial shelf space. But as they are an everyday necessity, tissue paper products can, among other consumer goods, be a determining factor to drive traffic and ultimately consumers to stores.

Consequently, tissue is not only a product that claims much attention in stores but also a product any retailer is expected to offer. Given the importance for such an important item, where the cost of producing is much tied to the fluctuations in fibre and energy, and thus price volatility, retailers have for many years been tough negotiators to protect the value created from these vital articles.

They have also pushed for more private label (PL) products on their shelves. The growth of private label has been distinct in the last decade and reading from consumer panels from last year and onwards, there has been a growing trend in the form of more attention on “affordable” or “discount oriented” brands on the costs of tissue producer’s premium brands. It is fair assumption that the tissue industry might expect more pressure and push for PL as retailers seek to improve its value creation.

Tissue manufacturers: The group of tissue manufacturers comes out as the second lowest in the above comparison. Still, it is well within the range and at a level that can be considered as acceptable. On the other hand, it is also at notable levels below machinery and pulp.

Unlike machinery and pulp, the European tissue sector has been the subject of fragmentation instead of consolidation during the last decade. Resilient, stable demand and bulky products make local presence key and have been supportive factors for investments by numerous stakeholders of varying scale. The total manufacturing footprint of the producers spans between domestic to global players. Additionally, a prolonged period of low interest rates has lowered the thresholds to enter until recently. Essentially, competition is up, which in combination with an increased presence of sizeable discounters in the retail sector seeking higher value creation, has made it more challenging to sustain long-term value creation.

Tissue producers are in a solid position but the example of retailers expanding their private label offering does shows their genuine interest to incorporate margins currently generated in the upstream business. And as the suppliers are further improving their position, one of the key questions for the years to come is if we are also going to see higher levels of consolidation in the tissue industry, and what that means for the whole supply chain.