AfH is largely back to pre-pandemic levels. AH is seeing structural changes in buying habits, pressure on spending power, a rise in private label, and the return of the frugal consumer. US market survey by AFRY’s Sanna Sosa, Senior Principal, and Sivashankari Bharathi, Consultant. A TWM report.

AFRY Management Consulting

North American tissue demand has been on a rollercoaster ride since the first days of the Covid pandemic in early 2020, characterised by double digit ups and downs in market demand. 2022 year-end market indicators show another slump in At-Home tissue demand during the second half of the year, coinciding with consumers’ struggles with spending power. The AfH tissue market was in recovery mode through 2022, driven by increased mobility and return to service sector patronage.

To gain insights on what to expect in 2023, AFRY surveyed over 300 American consumers to take a pulse on people’s mobility and spending habits. Will the tissue market volatility continue? How are consumers translating pressures on their wallets into tissue paper purchases?

Are people back at pre-pandemic levels of service sector consumption? Has there been a structural shift in mobility impacting AfH tissue demand long term?

AfH tissue market in recovery

The pandemic has been an especially tumultuous time for the AfH tissue sector and producers. Before the pandemic, American AfH tissue demand was steadily growing close to the rate of GDP, at about +2% per year, until Covid-19 shut down parts of the AfH market due to stay-at-home orders. People cocooned in their homes and shifted spending from services and experiences to goods. AfH tissue consumption hit a decade low in 2020 at 2.6m tons after a close 15% drop in demand. However, since then the AfH tissue segment has been in recovery as people have been returning to service sector consumption.

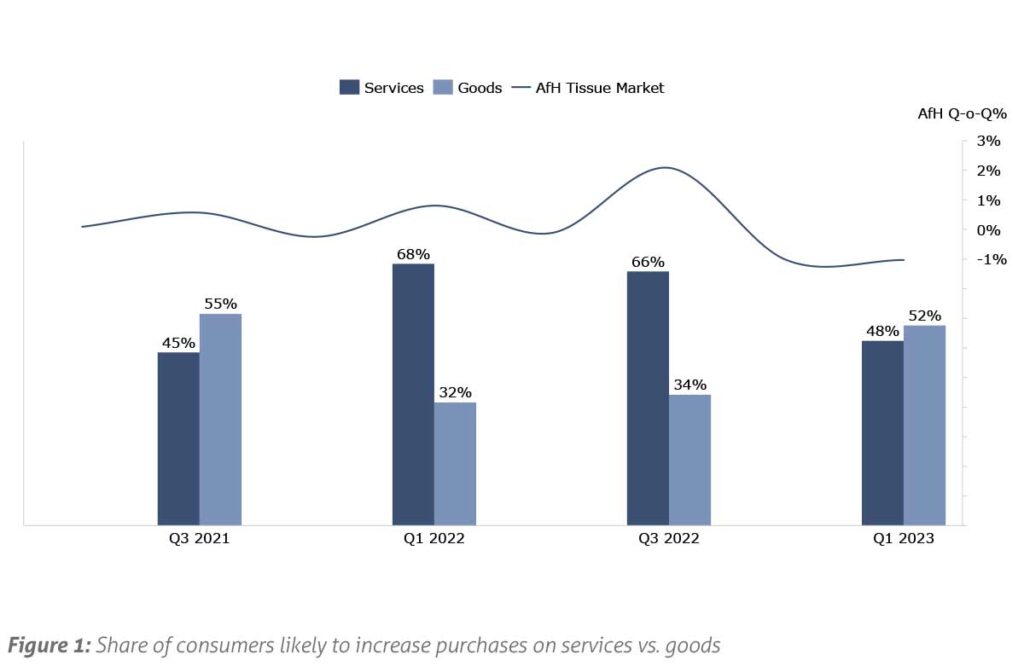

Results from AFRY’s consumer surveys – which have been conducted every six months since 2021 – illustrate how, by the beginning of 2022, people had increased spending on services rather than goods (Figure 1), which coincides with the recovery of the AfH tissue sector. However, AFRY’s latest consumer survey conducted in January 2023 shows the smallest difference in consumers increasing spending on services vs. goods. If 2022 was a strong recovery year for service sectors, including the AfH tissue sector, the growth in 2023 is likely to moderate as most of the pent-up service sector demand may already have been released and the concerns over inflation, economy and spending power weigh on consumers’ wallets.

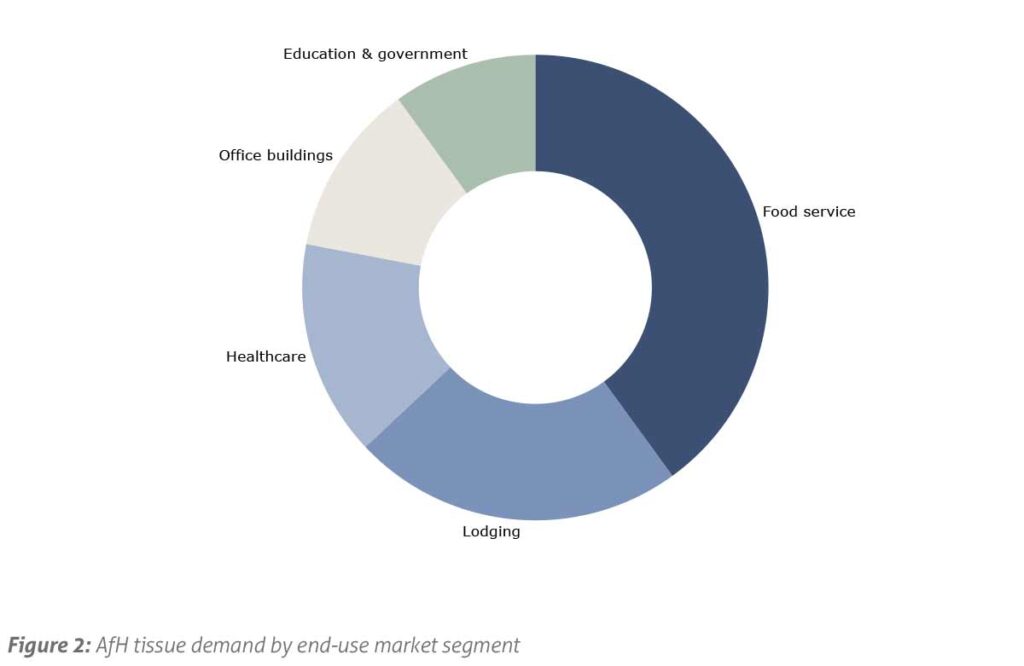

The AfH tissue market consists of five main end-use service sectors, as shown in Figure 2. Over 40% of North American AfH tissue consumption is estimated to take place in food service settings or in take-out. The travel industry represents about a quarter of AfH tissue demand, followed by healthcare, office buildings and education and government sectors, which are estimated to represent less than 15% of AfH tissue demand each.

The pandemic drove the biggest hits (or even a temporary halt) on the travel industry, as cruise ships stopped sailing and air travel and hotel stays declined by an estimated 50-60% in 2020, based on data from International Air Transport Association and leading airlines and hotel chains. In-person education also swiftly moved on-line, leaving schools and university campuses temporarily empty. Virtual visits in the healthcare sector increased significantly as people avoided hospitals and doctors’ offices in fear of being exposed to the Covid virus. Food service saw the smallest disruption overall, thanks to the boom in food delivery services. Where are American consumers currently in terms of returning back to these key sectors of AfH tissue consumption?

Service sectors already at pre-pandemic levels

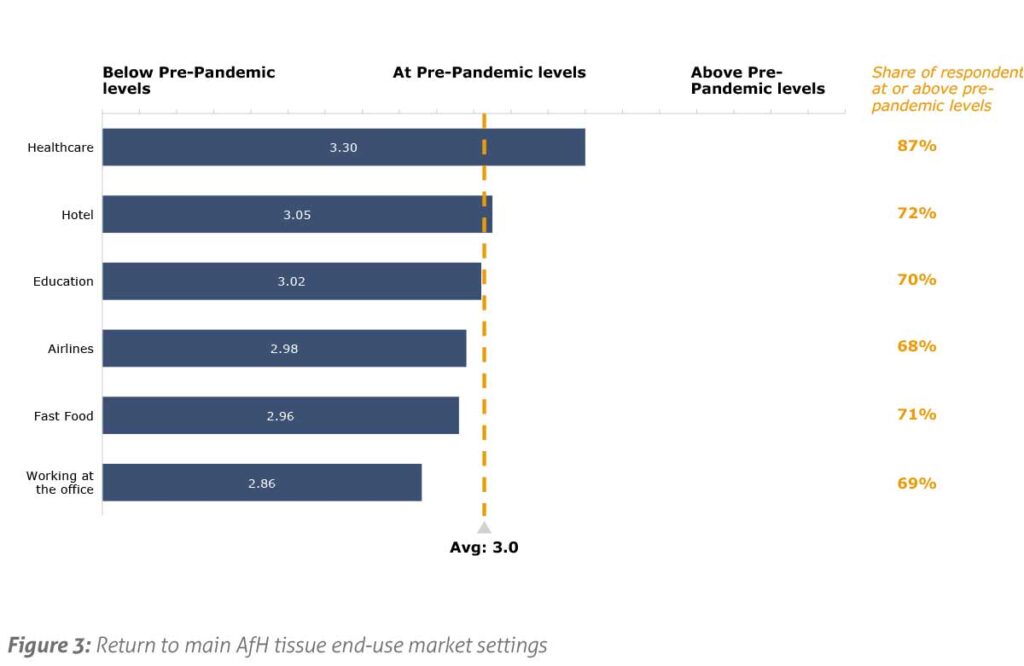

The most recent AFRY consumer survey of over 300 American consumers, conducted in January 2023, shows that people have already largely returned to pre-pandemic levels of key AfH tissue end-use service sector patronage (Figure 3). Especially, 87% of the respondents are already back at using healthcare sector services at or above pre-pandemic levels. We asked the consumers to rate their level of activity on a scale from one = well below pre-pandemic level, three = at pre-pandemic level, five = well above pre-pandemic level. Accordingly, consumption of healthcare sector services received the highest average rating, which indicates that people are using healthcare services above the pre-pandemic levels potentially due to amplified interest in health and wellbeing combined with the backlog of pushed back visits in the middle of the pandemic.

Hotel stays and return to school campuses (and student social life) had the second and third highest level of return to pre-pandemic behaviours. Working in-person in the office, and potentially related to reduced number of in-person work meetings, airline travel had the lowest return rates to pre-pandemic level of use. Notably, respondents from the Northeast and the West Coast had the lowest return rates back to working in office environments, especially in the West Coast with all the various tech companies.

Structural shift impacting office buildings

AfH tissue consumption in office buildings is experiencing a structural shift, as people continue to work in hybrid work models.

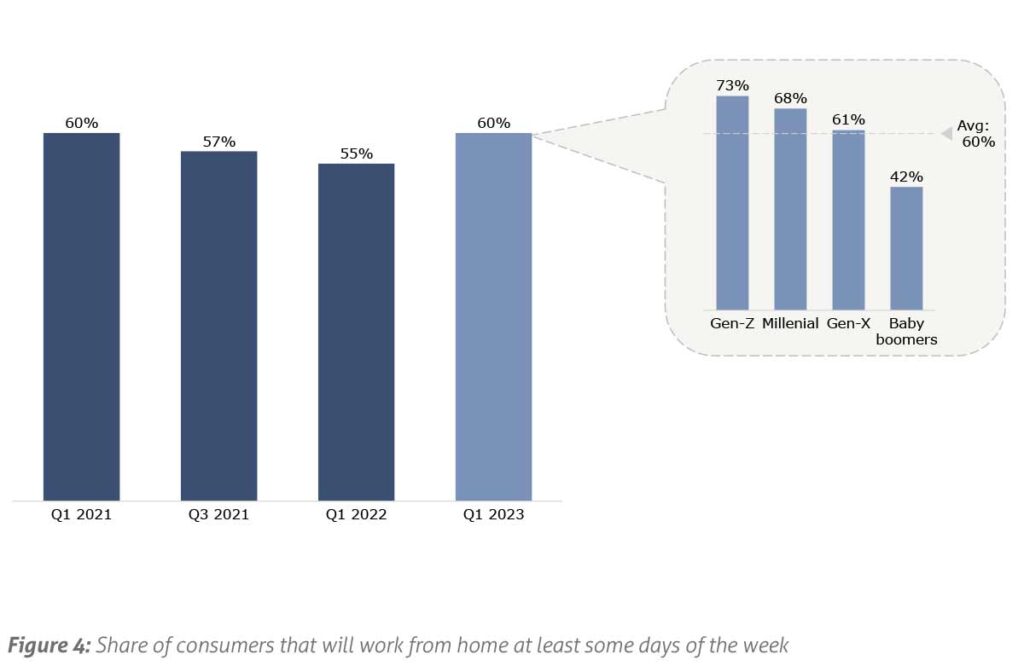

The latest AFRY consumer survey reports that 60% of the respondents work from home at least some days of the week (Figure 4). This is an uptick after steady decline in the number of respondents reporting to continue to work from home or in hybrid models through 2021 and 2022, as companies and people started the partial return to offices. The uptick may indicate that employees and employers are still calibrating the new balance between in-office and remote work modes.

One trend seems to be clear; the hybrid work model is here to stay. Firstly, consistently 55-60% of the respondents in our survey samples can work from home at least some days of the week. Secondly, we can see a clear correlation with younger generations working more in the hybrid model. Some 73% of Generation Z respondents (born after 1997) are working from home at least some days of the week versus only 42% of baby boomers (born 1946-1964). A dramatic generational difference.

Steady but more moderate growth outlook for the AfH tissue sector in 2023

The pandemic, combined with Generation Z entering the workforce, brought along a structural shift to working more from home and jumping more often on video conference calls than on flights to attend a meeting in person. The lower volume of daily commuters should help traffic congestion, but also reduce the foot traffic in downtown coffee shops and lunch spots, negatively impacting AfH tissue product demand. Therefore, the AfH tissue market size may not have reached its pre-pandemic level, yet.

However, American consumers are back at service sector consumption and back out visiting doctors’ offices, getting their hair cut in salons and traveling again. The Biden administration is planning to end the Covid-19 emergency declarations on 11 May, 2023, which seems to fit the people’s mood and mobility. Hence, AfH tissue demand recovery should continue in 2023, although at steadier and more moderate rate than over the past two years.

AH tissue sector: the return of the frugal consumer

Consumers have been coping with record high inflation. Although inflation is expected to moderate in the US in 2023, it remains above historical average. Therefore, we at AFRY wanted to investigate how are consumers’ economic concerns impacting AH or retail tissue purchases. Are consumers buying less bulk and therefore having less rolls in inventory? Are consumers shifting towards lower cost products, such as smaller packaging sizes and private labels, to save money?

As we well know, consumers stockpiled on tissue products during the early months of the Covid-19 pandemic and at onsets of new Covid-19 variants. The hoarding and buying in bulk, and then consecutively drawing product from built up inventories in closets and storerooms, has caused significant volatility in retail tissue purchases since the beginning of the pandemic. To get clues for what is in store for AH tissue demand in 2023, we surveyed our respondents regarding the packaging size of tissue product purchases.

Some 30% of the survey respondents indicated that they are currently buying smaller pack sizes than before. At the same time 36% of respondents have increased tissue products purchasing frequency. This means that close to a third of consumers are shifting and adjusting their tissue purchasing habits away from larger packaging sizes, most likely to save money.

Private label market is up

Also, on the trend of cost-conscious consumers, private label tissue consumption has been growing in the US over the past decade. We estimate that private label tissue products have grown to about a third of the American retail tissue market volume.

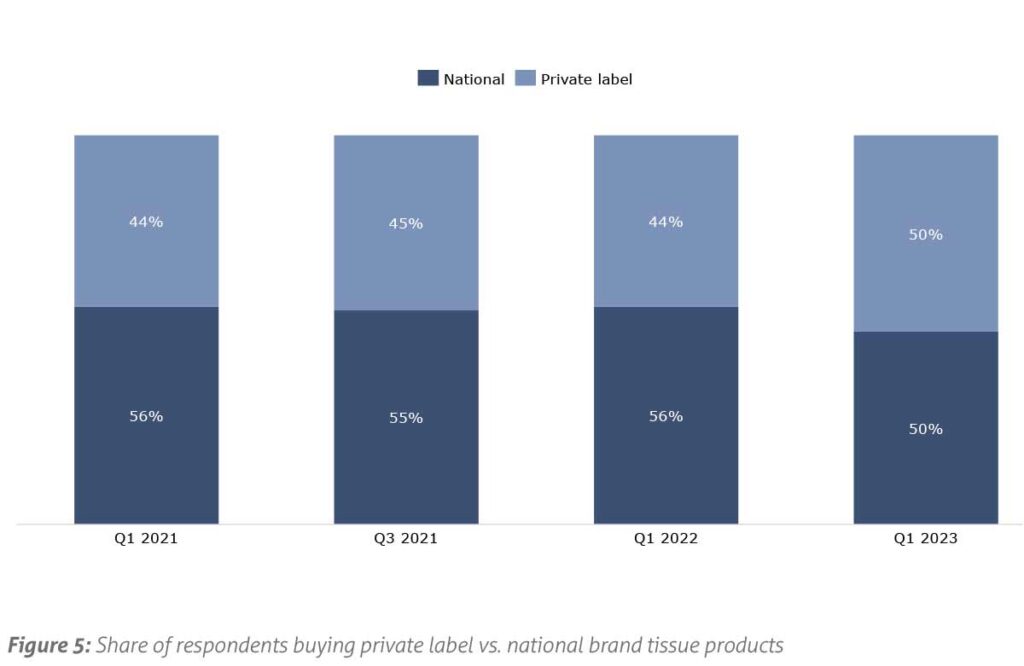

In our consumer pulse surveys, 44% to 50% of respondents have reported buying private label tissue products since 2021 (Figure 5). It is important to note that the surveyed consumers are not always buying private label tissue products, but also shop national brands, and the survey does not give visibility into purchased volumes which are likely to inflate the survey results compared to the overall market share of tissue private labels. However, the survey supports the growth trend of private labels and records the highest share of consumers likely to buy tissue private label products rather than national brands in January 2023 at 50% of respondents.

Growth in private labels can be attributed to the younger generations of shoppers, especially the Millennials. According to a study by the National Retail Federation, looking at private label products overall, 77% of Millennials reported they would not want to buy the same products their parents did. Similarly, the highest share (57%) of the Millennials in our survey sample favoured private label tissue products over national brands.

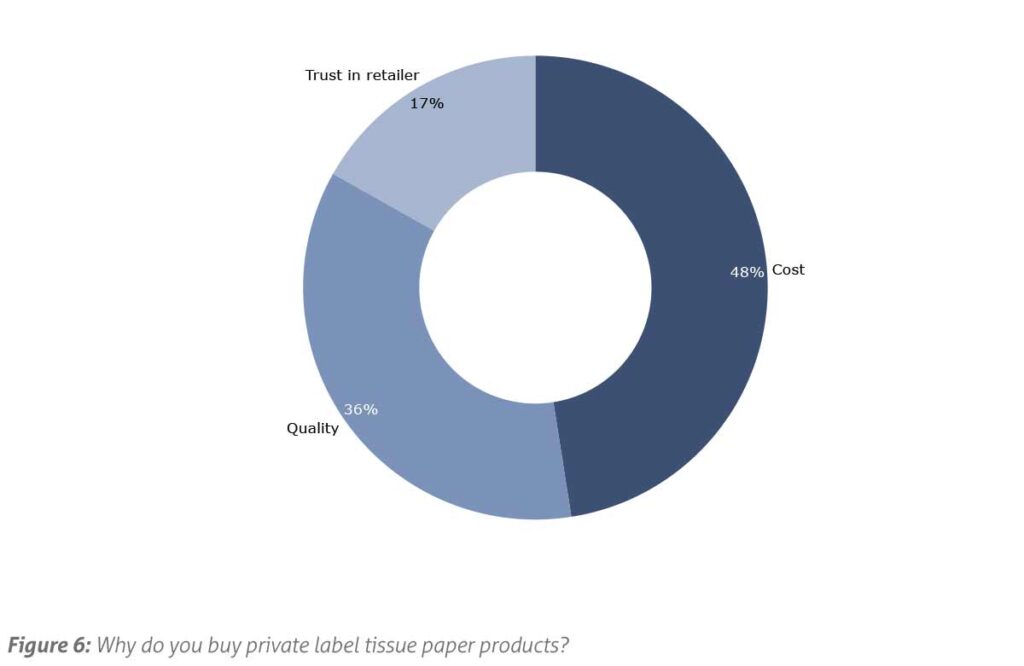

Consumers, and especially the younger generations, are opting for private label tissue products mostly driven by their cheaper price point (Figure 6). Close to half (48%) of the survey respondents named private labels being a cheaper option as the main purchase driver, followed by good quality of the products by 36% of the respondents. Only 17% of the respondents indicated that trust and loyalty with the retailer was the main draw for them to buy private label tissue products.

More use for kitchen paper towels

In addition to gaining visibility into consumers’ tissue inventory building habits and private label purchasing preferences, we wanted to take a snapshot of how the pandemic has increased the use of kitchen towels for keeping kitchen and other home surfaces germ free. Some 40% of the survey respondents specified that they indeed have increased the use of kitchen paper towels since the Covid-19 pandemic.

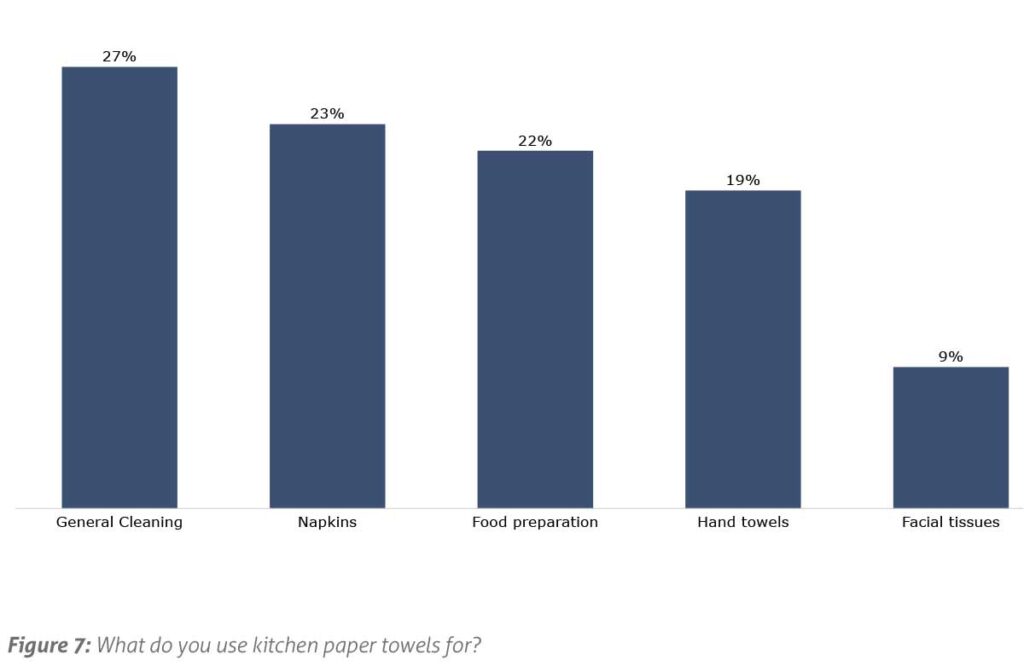

Figure 7 summarises the variety of ways and purposes people are using kitchen paper towels. Some 27% of the respondents are using paper towels for general cleaning purposes, which is likely up since the pandemic. Paper towels substituting napkins has been a trend among the younger consumers. Accordingly, 23% of the respondents reported using paper towels as napkins, followed by 22% in food preparation and 19% as hand towels, which share is likely also up since the pandemic. Only 9% of respondents use the harsh textured towels as facial tissue. However, that seemed to bother the male respondents less. Women favoured paper towels used for general cleaning and hand towels more than the men.

These trends should positively impact kitchen towel demand in 2023, and beyond.

Outlook for 2023 tissue demand

AFRY’s tissue consumer survey results indicate continued positive outlook for the AfH tissue segment, but more stressed market conditions, or at least more cost conscious consumers, for AH tissue in 2023.

Recovery of the AfH tissue demand is likely to continue, but at an even more moderating rate. The double digit up and down swings in demand should be behind us, as people continue to steadily increase their patronage across service sectors where AfH tissue products are mainly consumed. Office buildings are the only key tissue end-use segment where we see AfH tissue consumption to structurally remain below pre-pandemic levels.

Consumers’ concerns over spending power are curbing the desire and ability for some consumers to buy in bulk and have tissue products sit in home inventories. Therefore, smaller pack sizes and products with value market positioning should do well. Private label products are poised to continue to take market share, as consumers continue to find them to be low cost, good quality product alternatives.