As India is roaring forward being one of the countries with steady economic and market growth, P&B has also been reaping benefits. Report by Somnath Ray, Principal, AFRY Management Consulting.

India’s market leads among the world’s growing markets with much younger demographics, disposable incomes, improving living standards, rapid industrialisation, and development of tier 2/3 level cities. Additionally, several changes in government regulations and commitment towards a more sustainable and environment-friendly future have fuelled more interest and traction regarding the Paper & Board (P&B) industry segment. This brings he Indian market into much more focus, and more questions remain unanswered, especially in the case of the tissue paper segment. The question remains on the minds of Indian and international producers – how much growth is there, and how much of this is possible to tap?

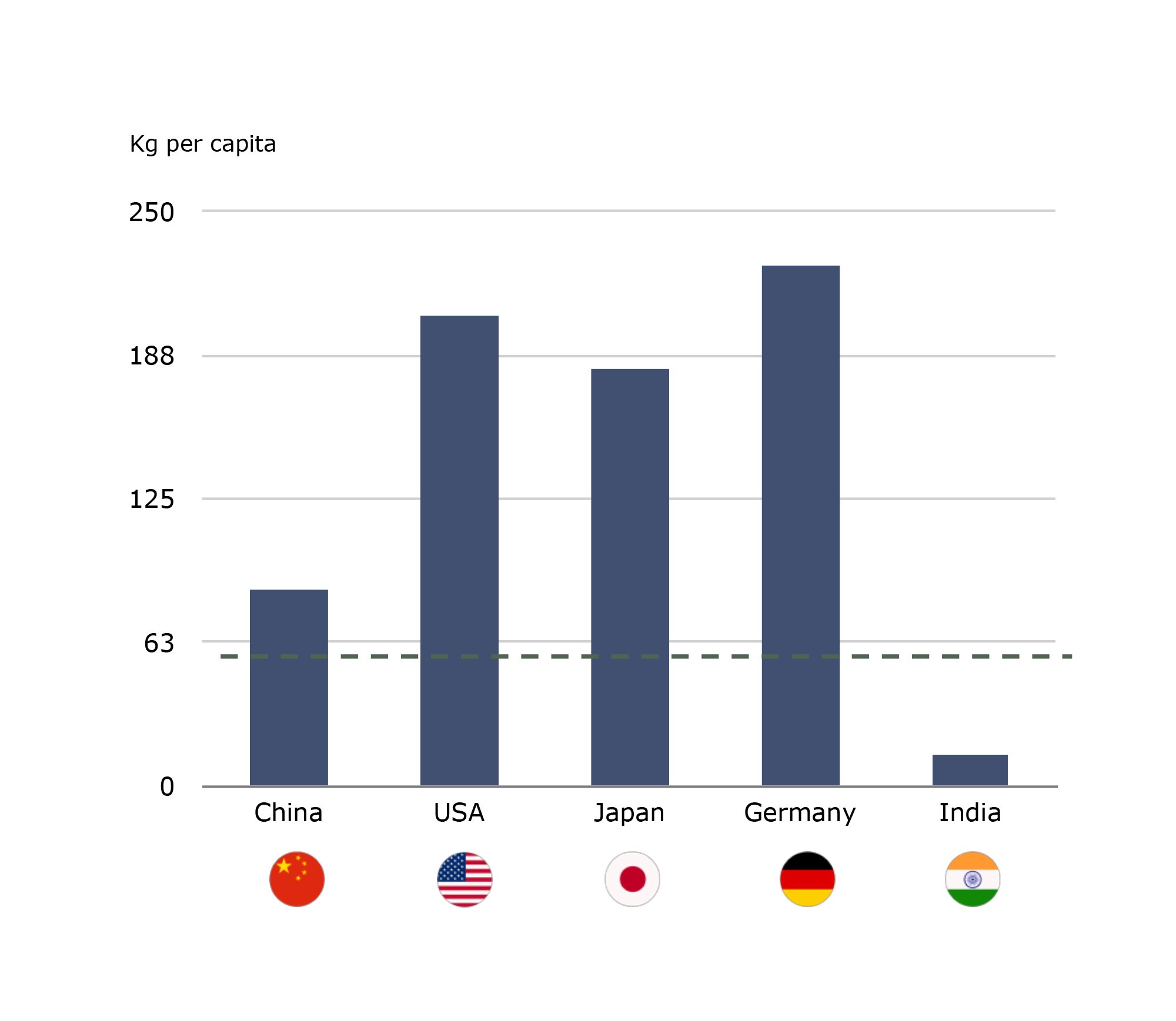

On the first comparison, India’s P&B market demand growth is projected at 2.9%/a (CAGR till 2030), above the global average of P&B, translating into around 7.9m tons of additional demand. This is a decent growth opportunity given that the current per capita consumption is at 14kg per capita, placing India at the very lower end than the top five countries listed in Figure 1. So, this is good news for domestic and international producers focused on the Indian market.

This potential market growth has triggered producers to pace themselves towards tapping into this growth with capacity increase, conversion, and new investment.

Albeit the other challenges intrinsic to the Indian P&B segment – raw material shortage, lower logistics, energy and water shortages, sustainability challenges, and competition from import – this growth potential has also attracted the attention of investment from other industry-leading producers from different parts of the world with several investment announcements being made in the recent past.

When we slice and dice this growth opportunity, we notice that the growth is unequal among the paper grades, which is not unusual compared to comparable regions/countries. However, a couple of exciting surprises come to our attention when we compare further.

The first is the resilience of the P&W segment, which still has a decent positive demand volume growth, and the second is the smaller market volumes of the tissue paper segment.

In terms of market, India’s tissue paper market growth is poised on a demand growth of 8.7%/a (CAGR till 2030), which is again above the global and Asia average. This translates into around 0.2m tons of additional demand, which is moderately good growth despite being on the lower end as a growing market. However, more interesting surprises are noticed when we look at per capita consumption levels and sub-segments.

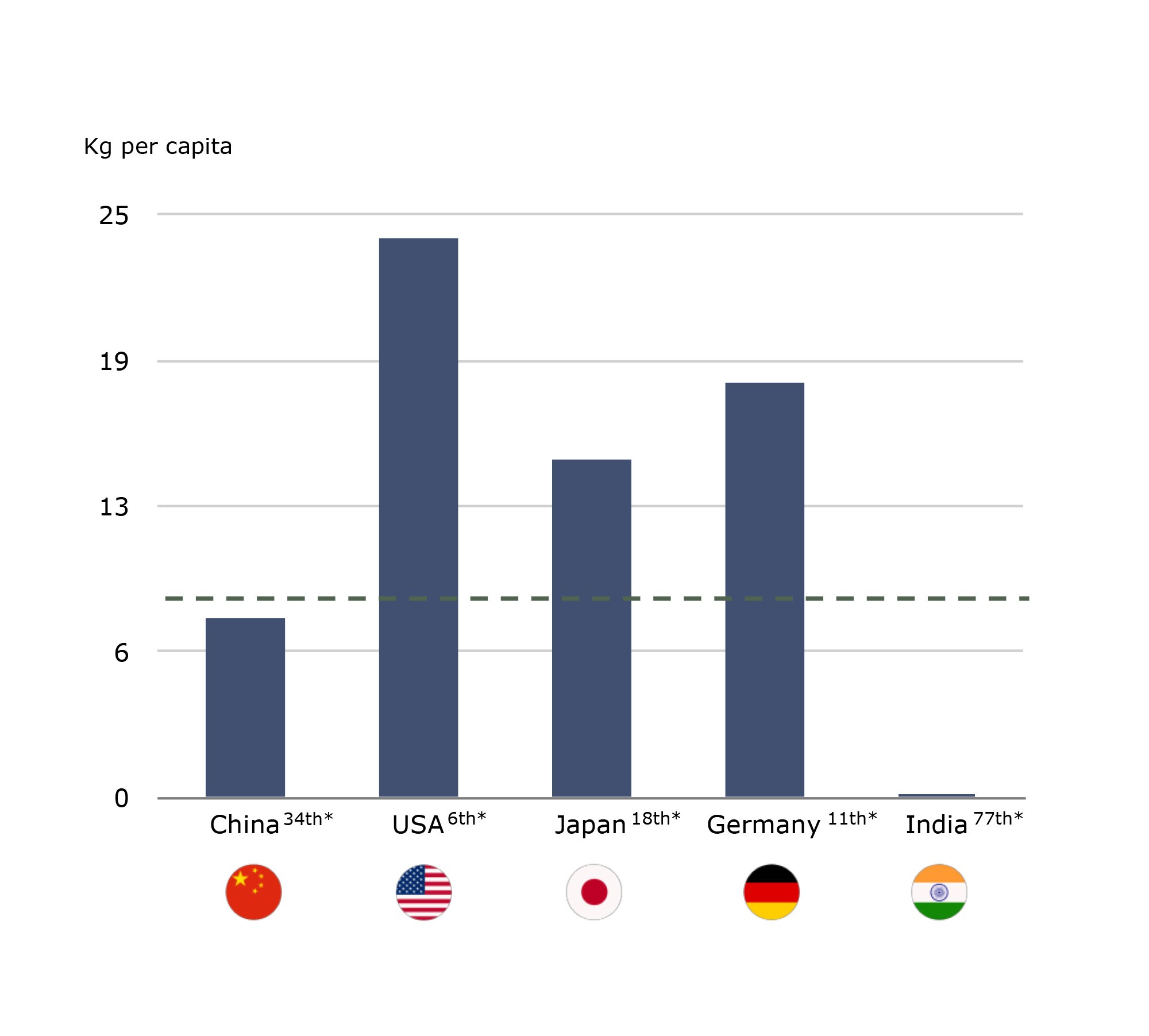

In terms of consumption per capita, the Indian market consumes less than 0.5kg/person, which is significantly much lower than other countries we have compared with. If we put a country ranking based on consumption per capita, then India’s tissue paper consumption per capita features at 77th rank.

This puts the Indian market far behind comparable countries from the top five P&B consumption per capita list we discussed earlier. Furthermore, this is much lower than the global average regarding tissue paper consumption.

This is an interesting dynamic that is important to understand. Clearly, the demand structure is very different than any other countries with a comparable market growth aspiration. This makes us wonder what additional elements are contributing to this. It is evident that apart from the known economic factors supporting market growth, some cultural nuances influence the demand.

To simplify this complex topic, we can highlight that India’s tissue paper consumption is influenced strongly by the cultural approach to hygiene and sanitation standards, perceptions of paper usage in general, availability of products, and value for money. As producers and marketers, these underlying factors fuelling the market growth are important to understand. Also, understanding these nuances of consumer behaviour will help bring innovation to products to meet the consumers’ unique needs.

We have seen that tissue paper consumption is highly linked to a country’s human development and health standards. I. Accordingly, high-income countries rank at the top of the list, and countries with low income and low health standards have the lowest share.

The worldwide increase in access to and improvement of sanitation facilities, human development, and healthcare directly affects tissue paper consumption. Robust growth is seen in middle-income countries as the infrastructure is further expanding. All these underlying factors seem applicable in the case of India; however, the average consumer in India still prefers other forms of cleaning and drying in terms of hygiene requirements.

Water usage is highly predominant even in urban settings, and so is the usage of reusable towels and other fabric, making the transition to paper hand towels and toilet tissue much slower. In earlier days and still in some places, washroom cloth towels were the key source of hand drying. Similarly, it has been the case in hotels and restaurants where high usage of reusable napkins is limited, albeit using paper as tablecloth in some settings. Interestingly, this is also supported by the notions of sustainability and the value of reusing resources.

However, this is slowly changing, and paper towels are increasingly finding their way into public washrooms. There is a transition to the usage of more toilet tissue paper instead of other means supported by the adaptation of more Western toilet formats and education in hygiene related to disposable paper. Similarly, more hotels and restaurants are opting for disposable napkins and tissue paper. The onset of Covid-19 has also triggered faster adoption of disposable hand towels and napkins in hotels and restaurants, which is becoming more convenient for these establishments.

Also, as the demand in the service sector and general wish for premium products are getting mainstream, these formats are more appealing as they offer the opportunity to further branding.

Several producers and brand owners have taken innovative approaches from educating their consumers and complimenting the existing tissue paper range with other hygiene and cleaning products – handwash dispensers, paper towels, facial tissues and napkins, toilet rolls, wet wipes, disposable bed covers, antibacterial and biodegradable liquid and foam handwash, hand-sanitiser, automatic odour neutralisers – and are adding to the range consistently.

These products are often targeted to cater to diverse enterprises such as offices, hospitals, airlines, and high-volume food processing industry and service facilities to start with and eventually trickle to home usage by trial.

The tissue paper segment is often perceived as an ‘unnecessary luxury’ and seen as a premium commodity. This also goes hand-in-hand with the limited availability of good quality or soft tissue. Not so far away in the past, most consumers were unaware of the superiority of soft tissue over MG Poster. They didn’t have access to some of the standard quality soft tissue paper as the market is served by cheap hard tissue (non-absorbent), which is poster grade. This made it inconvenient for proper usage and intensified the negative perception that good quality soft tissue paper is expensive.

To crack open the consumption in India, more so in the untapped tier 2/3 cities, it is imperative to generate awareness about soft tissue’s superiority and hygiene benefits over hard tissue, thereby influencing its demand.

It’s not an easy task, which has been tackled by investing in newer and better technology for tissue paper production and utilising a diverse mix of fibres while maintaining a competitive pricing strategy.

In summary, much work is carved out for the producers and brand owners to tap into India’s growing tissue paper market. It will need a delicate balance of educating the public about the benefits of using disposable tissue paper products while bringing forth reasonably priced yet good quality soft tissue paper. All would be eager to see how this market unfolds.