By FOEX Indexes’ Lars Halén and Timo Teräs

NBSK pulp Europe

UTIPULP (the group of European market wood pulp users) published the market pulp consumers’ consumption data in March, which was down by 1.8% from February for the total. However for BSKP, the retreat was much bigger at 6.7%.

Consumers’ market pulp inventories were up from end January by 13,000 tonnes, or by 2.2% but down for BSKP by 2.9%. European port stocks fell by 50,000 tonnes from the end of January but they were still very marginally, or by 0.8%, higher than at the end of February 2014.

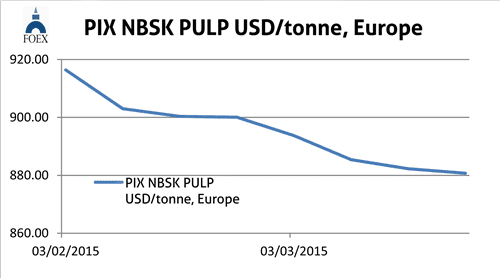

Weak demand and dollar strength maintain the downward price pressure in softwood in Europe as well as in other markets. The strengthening of the US dollar by 0.2% last week from the previous week’s average brought additional downside pressure on pulp prices in USD terms and kept the prices in euro moving upwards.

Our PIX NBSK index value fell again, this time by 1.54 dollars, or by 0.17%, and closed at 880.73 USD/tonne. Due to the moderate fall of the Euro against USD with last week’s average exchange rate, the benchmark value in Euro moved up by 50 euro cents, or by 0.06%, and the PIX NBSK index value in euro ended at 827.21 EUR/tonne on 24 March.

BHK pulp Europe

In BHKP, market pulp consumption in Europe in February was up against February 2014 by 1.7%, according to UTIPULP statistics. Also, the inventories of hardwood pulp at consuming mills were marginally down from a year ago but from end January 2015 the stocks were up by 20,000 tonnes, meaning a hike of two days of consumption.

Prices have been still edging upwards, however. One reason is the maintenance downtime wave which takes out over 250,000 tonnes of production in Brazil. Downtime is taken also in Europe, e.g. by ENCE. Our BHKP benchmark moved up this time by 46 US cents, or by 0.06%, and closed at 756.70 USD/tonne. The value of the Euro had depreciated by 0.2% against the US dollar (weekly average). When converting the USD-value into the weaker Euro, the PIX BHKP index value in Euro headed higher by 2.10 euro, or by 0.30%, and the 24 March benchmark closed at 710.72 EUR/tonne.

‘Consumption of paper and board within the developing countries and exports of paper and board to these markets have shown declines or, at least, slower growth than in the past.’

Paper industry

The rising optimism in the economic outlook over the US and European scene is counterbalanced by the struggling of many emerging economies. This is felt also in the paper industry where consumption of paper and board within the developing countries and exports of paper and board to these markets have shown declines or, at least, slower growth than in the past. This translates into pricing pressures as well, also in the exporting regions, such as Europe when production volumes are pressed to the regional market.

The first data seen over the paper and board markets is, once again, on the weaker side. European paper makers’ pulp consumption was down by just under 2% indicating lower volumes of paper production as well.

US containerboard and box shipments may have been affected by the weather. Box shipments were OK but containerboard numbers were a bit weaker than expected and, in addition, inventories moved up more than the seasonal norm. European paper prices have shown further retreat in Q1 2015.

[box]

FOEX Indexes produces audited and trade-mark registered PIX price indices for certain pulp, paper packaging board, recovered paper and wood based bioenergy/biomass grades. The PIX price indices serve the market in a number of ways. They function as independent market reference prices, showing the price trend of the products in question. FOEX sells the right to banks and financial institutions to use the PIX indices for commercial purposes, while RISI Inc. has the exclusive re-selling rights for subscriptions to the PIX data and market information. Please enquire for subscriptions at [email protected] or via the following link www.foex.fi/subscribe/.

Tissue papers are produced either from virgin fibre, recovered fibre and various mixes of both, depending on the end product. High quality hygiene tissue products like medical tissue products, facial tissues, table napkins or other such household and sanitary products are often made exclusively or almost exclusively from virgin fibre pulp, whereas the share of recovered fibre typically increases in tissue products for a variety of end uses outside personal hygiene, such as kitchen towels or towels for garages or other such industrial production facilities etc. Providing PIX pulp price indices gives the paper producer and buyer insight in the price trends with a weekly frequency. PIX indices are used as market reference prices e.g.

- by banks or exchanges that offer price risk management services for pulp buyers and sellers

- by buyers and sellers of pulp or paper in their normal supply contracts

- companies who want to employ an independent market reference price for internal pricing (e.g. pulp mill – paper/paperboard mill, paperboard mill – box plant) through licensing the commercial use from FOEX.

In addition, our price indices are widely used in financial analysis, market research and other such needs by all kinds of parties linked directly or indirectly to forest product or wood-based bio-energy industries.

This way the companies have better tools to budget their cost or income structure and profitability, and may concentrate on their core businesses with less time spent on price negotiations, which tend to increase in these days as the planning span narrows in the wake of the short, quarterly business cycles and, nowadays, in most cases, monthly raw material pricing decisions.

[/box]