By FOEX Indexes’ Lars Halén and Timo Teräs

Producer country statistics from PPPC were not very good in April in terms of delivery volumes. But substantial losses of production in both BSKP and BHKP grades led to a decrease in producer stocks. European consumer stocks and port stocks came down as well. Total market pulp shipments (PPPC) were up globally by 0.6% year-on-year in April. The cumulative gain stood at 3.1%. In BSKP, shipments were down by 0.8% in April against April 2015. Cumulatively, the advance was bigger at 2.9%.

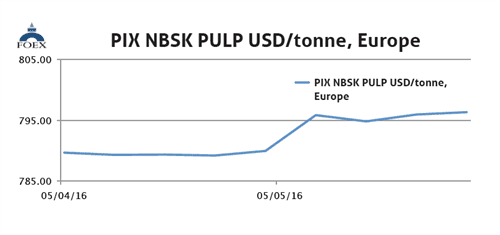

Data on European shipments was weak. Total shipments to Europe were down by 3.2% in April year-on-year, and down also cumulatively by 0.2%. Softwood pulp deliveries to Europe were down by 3.3% in April and by 2.2% cumulatively. BSKP producer stocks came down, seasonally adjusted, by one day to 28 days, and were below the long-term average. Our PIX NBSK index headed further up but this time only by 39 cents, or by 0.05%, and closed at 796.34 USD per tonne.

BHK pulp Europe

In BHKP, April was a stronger delivery month than in softwood but also here below the early 2016 average. Total BHKP shipments from PPPC member countries were up by 2.0% in April and now up by 3.0% cumulatively. Shipments to Western Europe were down by 3.3% in April year-on-year and up by only 0.6% in the first four months.

With substantial losses in actual production volumes, producer inventories headed down, seasonally adjusted by two days. At 46 days they were still clearly above the level at the end of April 2015 and also above the long-term average. Most of the 35,000 tonne decrease recorded in the European port stocks was in hardwood grade in Italy. Our BHKP benchmark slid slightly further down, this time by 17 cents, or by 0.02%, and closed at 685.61 USD per tonne.

Paper industry

North American printing and writing paper statistics from PPPC over the activity in April show that in terms of total shipments, April was a slightly better month than the Q1 average with the total printing and writing paper shipments (excluding newsprint) declining by 3.5% while the cumulative retreat over the first four months stood at 4.3%. On the other hand, after cleaning out the net impact of imports versus exports, the regional demand fell in April by as much as 4.9%. This, in turn was a bigger drop than the cumulative 3.5% reduction over January-April 2015. Uncoated free sheet continued to do better than the publication paper grades.

The financial results of the first quarter from the public companies around the world show that although the price of pulp fell substantially during the first quarter, helping pulp buyers and hurting pulp producing companies, the firms with a high share of pulp in their turnover numbers did, on average, better than the paper companies.

The benefits of the weak producer country currencies and rising production volumes continued to outweigh the ill effects of the price decline. Among the paper producing companies, packaging and tissue producers did, on average, better than the printing and writing paper producers. Many of the latter were either writing off the closures or investing into converting their printing and writing grade machines into other grades. Also, the shipment-to-capacity ratios remained higher in packaging grades than in graphic papers.

About FOEX Indexes

FOEX Indexes Ltd produces audited and trade-mark registered PIX price indices for certain pulp, paper packaging board, recovered paper and wood based bioenergy/biomass grades. The PIX price indices serve the market in a number of ways. They function as independent market reference prices, showing the price trend of the products in question. FOEX sells the right to banks and financial institutions to use the PIX indices for commercial purposes, while RISI Inc. has the exclusive re-selling rights for subscriptions to the PIX data and market information. Please enquire for subscriptions at [email protected] or via the following link www.foex.fi/subscribe/.

Tissue papers are produced either from virgin fibre, recovered fibre and various mixes of both, depending on the end product. High quality hygiene tissue products like medical tissue products, facial tissues, table napkins or other such household and sanitary products are often made exclusively or almost exclusively from virgin fibre pulp, whereas the share of recovered fibre typically increases in tissue products for a variety of end uses outside personal hygiene, such as kitchen towels or towels for garages or other such industrial production facilities etc.

Providing PIX pulp price indices gives the paper producer and buyer insight in the price trends with a weekly frequency. PIX indices are used as market reference prices e.g.

– by banks or exchanges that offer price risk management services for pulp buyers and sellers

– by buyers and sellers of pulp or paper in their normal supply contracts

– companies who want to employ an independent market reference price for internal pricing (e.g. pulp mill – paper/paperboard mill, paperboard mill – box plant) through licensing the commercial use from FOEX.

In addition, our price indices are widely used in financial analysis, market research and other such needs by all kinds of parties linked directly or indirectly to forest product or wood-based bio-energy industries.

This way the companies have better tools to budget their cost or income structure and profitability, and may concentrate on their core businesses with less time spent on price negotiations, which tend to increase in these days as the planning span narrows in the wake of the short, quarterly business cycles and, nowadays, in most cases, monthly raw material pricing decisions.