By FOEX Indexes’ Lars Halén and Timo Teräs

In spite of the narrowing price gap to hardwood and the ensuing support on softwood pulp demand, the BSKP market fundamentals remain shaky. Market weaknesses are a combination of demand softness which persisted at least still in July, and of a sneaking up of the supply with additional market pulp volumes being gradually released from the earlier integrated use. The earthquake in Chile jolted the market for a day or two but no cuts in supply have been published. A labour action at Arauco’s Alto Parana mill kept the SBSKP and fluff pulp mill down for a week and the stoppage of the Finnish pulp and paper mills on Friday, 18 September meant another supply loss.

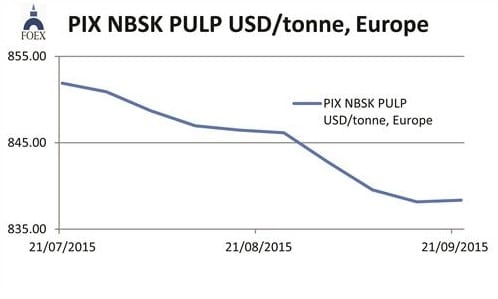

About 25,000 tonnes of market pulp supply was lost in September in these two events combined. The fall of our PIX NBSK index value in dollars came to a halt, at least for the second week in September, as the benchmark value moved up by 18 US cents, or by 0.02%, and closed at 838.35 USD/tonne.

The US dollar weakened against the Euro by 1.2% (weekly average). Due to the weakening of the US dollar against the Euro, the benchmark value in Euro, converted from the dollar index, fell by 8.91 Euro, or by 1.19%, and the PIX NBSK index value in Euro-terms ended at 740.79 EUR/tonne.

BHK pulp Europe

With most of Rizhao’s capacity back in operation and with production volumes still moving up from the new mills in Brazil and Uruguay, the supply of BHKP is rising at a similar pace to that seen in the demand. Some tonnage has, however, been lost in September, in a small way in Finland due to the labour action and, more importantly, through the maintenance downtime taken, as usual at this time of the year, in Brazil.

Compared to the first half of the year, hardwood pulp volumes are more readily available from the spot market. This seems to have led to a pause, at least temporarily, in the long string of price increases in this grade. On the other hand, a good demand pull continues from the tissue producers and hardwood pulp market remains relatively firmer than the softwood side.

This applies also to the European demand, although the falling demand and production of graphic papers have reduced the demand also for BHKP. Our BHKP benchmark in Europe headed this time very modestly downwards, by 10 US cents/tonne, or by 0.01%, and closed at 809.37 USD/tonne. In the previous week, the value of Euro appreciated by as much as 1.2% against the US dollar (weekly average). When converting the USD-value into the stronger Euro, the PIX BHKP index in Euro headed down by 8.85 Euro, or by 1.22%, and closed at 715.18 EUR/tonne.

Paper industry

The first August data over the paper industry performance and the other recent market news give a mixed picture. The US box data was disappointing as the box volumes were up by only 0.5% from a year ago and inventories moved up by 66,000 tonnes. In containerboards, the US production was up by 3% from a year ago and operating rate remained above 96%. But, the production capacity risks rising more than 3% over the next 12-15 months. The decline in US uncoated free sheet shipments, by 0.5%, was less than the cumulative performance over the first eight months.

In Europe, the only statistics so far available are buyers’ consumption and inventory data for softwood pulp. Those statistics show softwood pulp buyers’ consumption down from last year, but only by 0.9%, which suggests that paper production (and consumption?) are down less from 2014 than the cumulative decline. The reports from the market support this view.

In several graphic paper grades, the seasonal decline appears to have been somewhat softer than on average. This has helped the paper producers to get some traction on their price increase initiatives as also seen from our paper price index data with all the benchmark values up at this time. While this is partially driven by the modest weakening of the Euro against the basket of non-EMU currencies, the rise of most of the indices included also at least partial acceptance of the price hikes from the July/early August price negotiations. Prices have crept up also in the containerboard sector. In other packaging grades, not followed by our indices, prices are up in some of the kraft papers and at least one producer is out with price announcements in folding boxboard from 1 November.