By FOEX Indexes’ Lars Halén and Timo Teräs

UTIPULP (the group of European market wood pulp users) April market pulp consumption data came out showing a nice, nearly 4% increase in consumption, compared to April 2014. However, inventories were up as well by 1.2% against March 2015 and by 7.2% against end April 2014. To compensate, port stocks, published by Europulp came down by as much as 84 000 tonnes from end March. Those stocks were also down by nearly 40,000 tonnes against end April 2014.

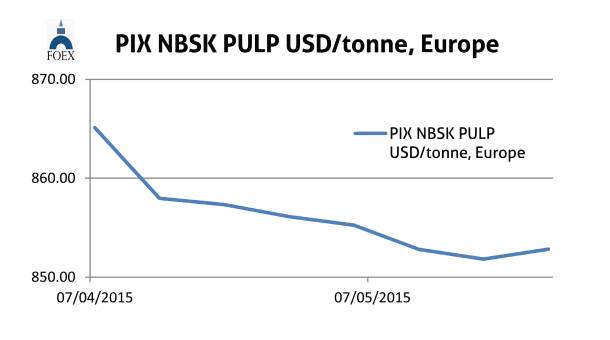

Following the example of Asia, the downward slide in BSKP prices appears to have finished towards the end of May, and at least temporarily, also in Europe. The re-weakening of the Euro by 0.6% (weekly average of wk 21) against the US dollar sent the Euro-prices back up clearly more than the USD prices. Our PIX NBSK index in dollars moved this time back up by exactly one dollar, or by 0.12%, and closed at 852.83 USD/tonne on 26 May. Due to the weakening of the Euro against the US dollar with the reporting week’s average exchange rate, the benchmark value in Euro headed higher by 5.82 euro, or by 0.77%, and the PIX NBSK index value in euro ended at 761.66 EUR/tonne.

BHK pulp Europe

In BHKP, the global and European market has remained tight while waiting for the impact of the early May hardwood market pulp supply increases to be felt on the market. The almost simultaneous start-up of CMPC’s Guaiba mill and re-start of Paper Excellence hardwood BCTMP unit at Chetwynd, B.C. add jointly about 1.5 million tonnes on an annual basis, matching more or less the 2014 market BHKP demand increase over 2013. Naturally, it will take quite some time to get the product to the customers and even more time before the mills are running at their full capacities.

The narrowing of the price gap between NBSKP and BEKP to only 5 USD/tonne in China and to under 70 USD/tonne in Europe is likely to slow down the furnish change from softwood to hardwood pulp during the second half of 2015. That change was still quite rapid in late 2014/early 2015.

Our BHKP benchmark moved up this time by 3.34 dollars, or by 0.43%, and closed at 786.42 USD/tonne on 26 May. During the reporting week, wk 21, the value of the Euro depreciated by 0.6% against the US dollar (weekly average). When converting the USD-value into the weakened Euro, the PIX BHKP index value in Euro moved up by 7.51 euro, i.e. by 1.08%, and closed at 702.35 EUR/tonne.

Paper industry

China Paper Association (CPA) published week 21 the 2014 production and consumption figures for China’s paper and paperboard sector. After a fall in 2013, modest gains were reported over the last year. Production growth in packaging and tissue compensated the fall reported now also in China in the production and consumption of graphic papers, led by a nearly 10% drop in newsprint production. Total paper and paperboard production moved up by 3.6% from 101.1 Mt in 2013 to 104.7 Mt in 2014. Linerboard with 6.9% growth, fluting with a 7% gain and tissue with a 4.4% increase over the previous year were the big winners. Paper and paperboard consumption was 4 million tonnes smaller than production, the difference being the volume of net exports and changes in inventories.

CEPI

The Confederation of European Paper Industries (CEPI) published in turn its preliminary statistics on paper and paperboard production in 2014. Total production of paper and paperboard in the CEPI countries peaked in 2007 at approximately 102 million tonnes, after which the trend has been a downward sloping one. In the last two years 2013 and 2014 total production has amounted to about 91 million tonnes. The decline from 2013 to 2014 was only 0.2%.

Different grade groups recorded different changes in the produced amounts. Graphic papers, without newsprint, declined by 3% in 2014, while newsprint itself is expected to show a 7% drop in the final statistics. Packaging grades have fared better as the production rose by 1.9% in 2014. In the production of hygienic papers, there was an estimated fall of 0.3% last year compared to 2013. Hygienic papers accounted for 7.6% of total paper and paperboard production in the CEPI countries in 2014.

[box]

FOEX Indexes Ltd produces audited and trade-mark registered PIX price indices for certain pulp, paper packaging board, recovered paper and wood based bioenergy/biomass grades. The PIX price indices serve the market in a number of ways. They function as independent market reference prices, showing the price trend of the products in question. FOEX sells the right to banks and financial institutions to use the PIX indices for commercial purposes, while RISI Inc. has the exclusive re-selling rights for subscriptions to the PIX data and market information. Please enquire for subscriptions at [email protected] or via the following link www.foex.fi/subscribe/.

Tissue papers are produced either from virgin fibre, recovered fibre and various mixes of both, depending on the end product. High quality hygiene tissue products like medical tissue products, facial tissues, table napkins or other such household and sanitary products are often made exclusively or almost exclusively from virgin fibre pulp, whereas the share of recovered fibre typically increases in tissue products for a variety of end uses outside personal hygiene, such as kitchen towels or towels for garages or other such industrial production facilities etc. Providing PIX pulp price indices gives the paper producer and buyer insight in the price trends with a weekly frequency. PIX indices are used as market reference prices e.g.

– by banks or exchanges that offer price risk management services for pulp buyers and sellers

– by buyers and sellers of pulp or paper in their normal supply contracts

– companies who want to employ an independent market reference price for internal pricing (e.g. pulp mill – paper/paperboard mill, paperboard mill – box plant) through licensing the commercial use from FOEX.

In addition, our price indices are widely used in financial analysis, market research and other such needs by all kinds of parties linked directly or indirectly to forest product or wood-based bio-energy industries.

This way the companies have better tools to budget their cost or income structure and profitability, and may concentrate on their core businesses with less time spent on price negotiations, which tend to increase in these days as the planning span narrows in the wake of the short, quarterly business cycles and, nowadays, in most cases, monthly raw material pricing decisions.

Subscription – For access to the latest PIX Pulp and Paper index values and commentary, please subscribe to the “PIX Pulp and Paper Service” via the following link www.foex.fi/subscribe/

[/box]