By FOEX Indexes’ Lars Halén and Timo Teräs

NBSK pulp Europe

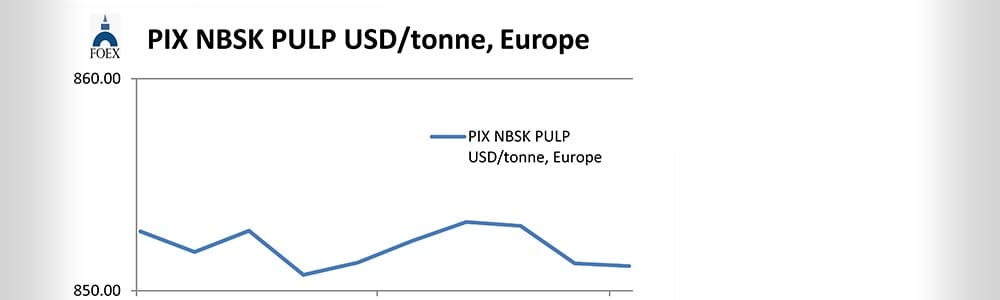

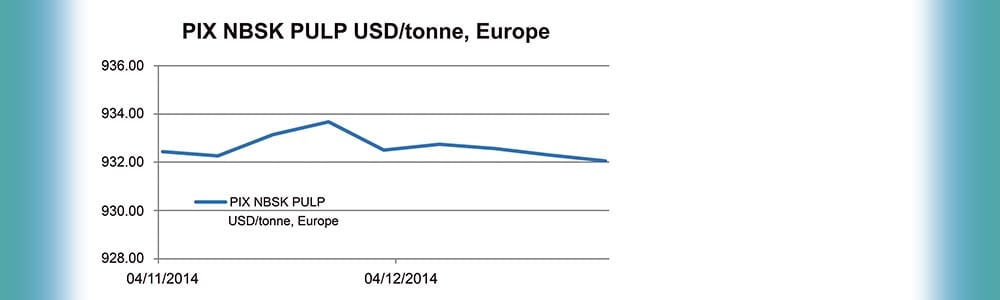

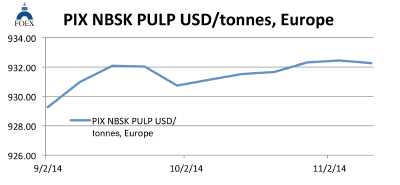

September 2014 market pulp statistics were stronger than expected, even when taking into account the seasonal factors. Delivery numbers were stronger than expected and the fall of the producer inventories was larger than what most analysts had anticipated. Maintenance downtime-related and other production losses were still quite significant, compensating in BSKP the continued weakening of the demand. In addition to the losses of about 200, 000 tpa at Pöls, which will continue to run with the old recovery boiler until summer 2015, production was also lost in the various maintenance stops and in some unforeseen stoppages. Our PIX NBSK index value moved down by 18 cents, or by 0.02%, and closed at 932.26 USD/tonne. Euro weakened by 1.0% against the US dollar. When converting the dollar-value into the weakened euro, the benchmark moved up by as much as 7.73 euro, or by 1.04%, and the PIX NBSK index in euro ended at 752.25 EUR/tonne.

BHK pulp Europe

In BHKP, some production losses were also seen during the fall, especially in Latin America where September is traditionally a month of maintenance downtime. On the flip side, production volumes continued to be ramped up at some of the new mills. The recent capacity increases and production records show also in the shipments when comparing the performance between the different grades. The two closures of BHKP mills, Old Town and Huelva, have removed over 600, 000 tpa of market BHKP during the year 2014 which partially compensates the big increases in production elsewhere. The value of Euro fell by 1.0% against the US dollar. With the weakening of Euro continuing, the PIX BHKP index value in Euro headed again north quite clearly, this time by 8.21 euro, or by 1.41%, and landed at 591.87 EUR/tonne. The PIX BHKP index value in dollars increased, too, this time by 2.52 USD/tonne, or by 0.34%, and closing at 733.50 USD/tonne.

‘The two closures of BHKP mills, Old Town and Huelva, have removed over 600,000 tpa of market BHKP during the year 2014 which partially compensates the big increases in production elsewhere.’

Paper industry

Tissue sector volumes have been clearly disappointing this year as at least 2% global growth was anticipated by the industry analysts and hardly any growth has been seen so far. Only a limited amount of September data is available. Based on that, the month of September may have been slightly better than the industry average so far. Still, tissue industry growth has been very slow, especially when taking into account the large investments into this sector, most of them proportionally in Asia and Middle-East.

The structural downward trend continues in the publication and office paper sectors in the industrialised countries and capacity closures, or conversions to non-publication paper products continue to be seen, especially in North America and in Europe. China continues to close old, polluting paper and board machines, most of them non-wood pulp based. The difference seen between the North American and the European markets has been the timing of the capacity exits. In North America, the supply reductions come together with the loss of demand and order books, while in Europe the companies seem to react “after-the-fact” to the already materialised declines.

The reports from the packaging sector are more positive and September volumes were, most likely, up more against 2013 than the average of the first eight months. For instance in the US, paperboard production was up from last year in September by over 4% whilst the cumulative growth, including September, stands at just +0.9%. Good demand growth is needed too as also in this sector the capacity growth is substantial.

Subscription – For access to the latest PIX Pulp and Paper index values and commentary, please subscribe to the “PIX Pulp and Paper Service” via the following link www.foex.fi/subscribe/

[box]

FOEX Indexes produces audited and trade-mark registered PIX price indices for certain pulp, paper packaging board, recovered paper and wood based bioenergy/biomass grades. The PIX price indices serve the market in a number of ways. They function as independent market reference prices, showing the price trend of the products in question. FOEX sells the right to banks and financial institutions to use the PIX indices for commercial purposes, while RISI Inc. has the exclusive re-selling rights for subscriptions to the PIX data and market information. Please enquire for subscriptions at [email protected] or via the following link www.foex.fi/subscribe/.

Tissue papers are produced either from virgin fibre, recovered fibre and various mixes of both, depending on the end product. High quality hygiene tissue products like medical tissue products, facial tissues, table napkins or other such household and sanitary products are often made exclusively or almost exclusively from virgin fibre pulp, whereas the share of recovered fibre typically increases in tissue products for a variety of end uses outside personal hygiene, such as kitchen towels or towels for garages or other such industrial production facilities etc. Providing PIX pulp price indices gives the paper producer and buyer insight in the price trends with a weekly frequency. PIX indices are used as market reference prices e.g.

- by banks or exchanges that offer price risk management services for pulp buyers and sellers

- by buyers and sellers of pulp or paper in their normal supply contracts

- companies who want to employ an independent market reference price for internal pricing (e.g. pulp mill – paper/paperboard mill, paperboard mill – box plant) through licensing the commercial use from FOEX.

In addition, our price indices are widely used in financial analysis, market research and other such needs by all kinds of parties linked directly or indirectly to forest product or wood-based bio-energy industries.

This way the companies have better tools to budget their cost or income structure and profitability, and may concentrate on their core businesses with less time spent on price negotiations, which tend to increase in these days as the planning span narrows in the wake of the short, quarterly business cycles and, nowadays, in most cases, monthly raw material pricing decisions.

[/box]