By FOEX Indexes’ Lars Halén and Timo Teräs

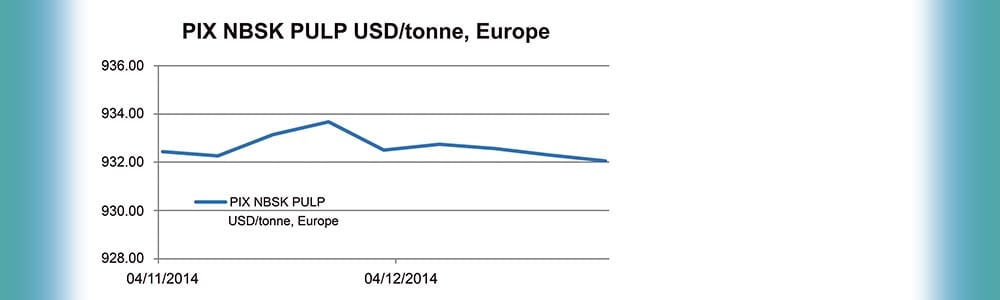

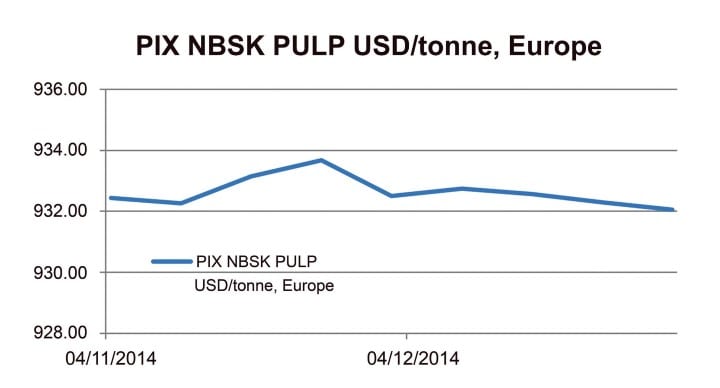

NBSK pulp Europe

The pulp market remained fairly firm over the fourth quarter as the share of market pulp of the global fibre consumption has continued to grow. November numbers from PPPC came out with predominantly positive news for the pulp producers. The stalling of the demand growth in BSKP with PPPC-member country shipments down by 1% over the first 11 months, and down even more if fluff pulp was excluded, causes some concern, however, especially over the first quarter when maintenance downtime is typically not taken in the Nordics or North America.

These downside risks put southward pressure on prices as well, even if the producer stocks remain below long-term average. Our PIX NBSK index value retreated again quite marginally, in dollar-terms, as it came down by 23 cents, or by 0.02%, and closed at 932.06 USD/tonne. The confidence interval was still quite narrow at 931.44 to 932.68. Euro weakened again, this time by 0.5% against the US dollar. When converting the dollar-value into the weakened euro with the exchange rate, the benchmark moved upwards by 3.54 euro, or by 0.47%, and the PIX NBSK index value in euro ended at 762.80 EUR/tonne.

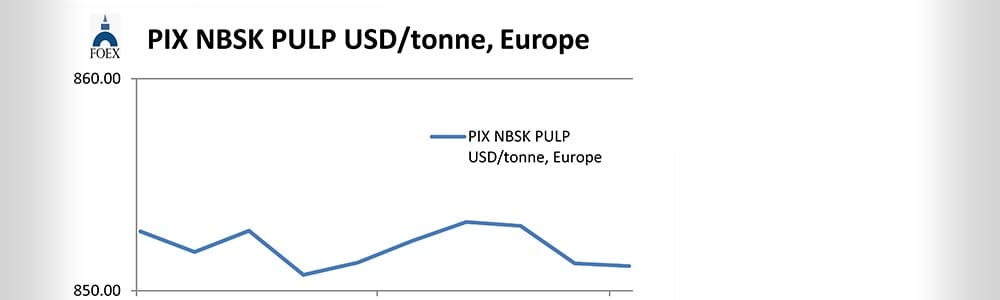

BHK pulp Europe

In BHKP, the global demand has been growing at a healthy pace over the past 3-4 months. Coupled with closures of market BHKP capacity in Spain and in North America and with delays of starting up new capacity, the market situation for BHKP grades is, at present, better than expected. Global shipments were up from last year, just from PPPC member countries by more than one million tonnes over the first 11 months. Also, the producer stocks, seasonally adjusted, were three days’ worth of supply lower than at the end of November 2013.

The price differential to BSKP has started to shrink but it is still wide enough to support further furnish changes in favour of hardwood pulp. But, it should also be remembered that capacity growth will continue in 2015 and more than one million tonnes of market BHKP will be added, taking into account the tail-end of the 2013-14 capacity increases.

The value of Euros depreciated by 0.5% against the US dollar. With the further weakening of the Euro, the PIX BHKP index value in Euros headed higher by 3.11 euro, or by 0.51%, and landed at 607.99 EUR/tonne. The PIX BHKP index value in dollars continued to move gradually upwards, this time by 17 cents/tonne, or by 0.02%, and closed at 742.90 USD/tonne.

The confidence interval narrowed and was this time from 741.82 to 743.98.

Paper industry

With another difficult year behind us in the pulp and paper industry, it is time to look into the year 2015 to see what is likely to be in store for the industry over the next 12 months. One thing is certain. There will be surprises – hopefully this time more of these will be on the positive side than what we saw during 2014.

The global economy does not seem to lend much support for demand for paper and board products, maybe with the exception of the US where a fairly strong economic growth appears assured at least over the first half of the year. The structural decline of printing and writing paper demand in the industrialised countries is quasi-certain to continue and the trend is also spreading to the higher income developing economies. In the lower income countries, the demand for graphic papers will continue to grow but as it grows from a low base, the global demand is still likely to continue to go down.

However, there are high hopes that the supply/demand balance in the graphic paper sector will improve. The total volume of the recent or firmly decided up-coming closures in North America and Europe is bigger than 12 months ago. Furthermore, the speeded-up closures of old capacity in China and the delays of some of the new machine installations will, most likely, improve the global balance a bit.

Packaging sector demand will continue to grow, even with a modest economic growth. Environmental advantages of the virgin wood fibre and RP-based products over the competition from other products, mainly plastics, is becoming more and more evident.

[box]

FOEX Indexes produces audited and trade-mark registered PIX price indices for certain pulp, paper packaging board, recovered paper and wood based bioenergy/biomass grades. The PIX price indices serve the market in a number of ways. They function as independent market reference prices, showing the price trend of the products in question. FOEX sells the right to banks and financial institutions to use the PIX indices for commercial purposes, while RISI Inc. has the exclusive re-selling rights for subscriptions to the PIX data and market information. Please enquire for subscriptions at [email protected] or via the following link www.foex.fi/subscribe/.

Tissue papers are produced either from virgin fibre, recovered fibre and various mixes of both, depending on the end product. High quality hygiene tissue products like medical tissue products, facial tissues, table napkins or other such household and sanitary products are often made exclusively or almost exclusively from virgin fibre pulp, whereas the share of recovered fibre typically increases in tissue products for a variety of end uses outside personal hygiene, such as kitchen towels or towels for garages or other such industrial production facilities etc. Providing PIX pulp price indices gives the paper producer and buyer insight in the price trends with a weekly frequency. PIX indices are used as market reference prices e.g.

- by banks or exchanges that offer price risk management services for pulp buyers and sellers

- by buyers and sellers of pulp or paper in their normal supply contracts

- companies who want to employ an independent market reference price for internal pricing (e.g. pulp mill – paper/paperboard mill, paperboard mill – box plant) through licensing the commercial use from FOEX.

In addition, our price indices are widely used in financial analysis, market research and other such needs by all kinds of parties linked directly or indirectly to forest product or wood-based bio-energy industries.

This way the companies have better tools to budget their cost or income structure and profitability, and may concentrate on their core businesses with less time spent on price negotiations, which tend to increase in these days as the planning span narrows in the wake of the short, quarterly business cycles and, nowadays, in most cases, monthly raw material pricing decisions.

[/box]