In September, Tissue World hosted eight hours of critical insights over the course of two days, analysing how the tissue market is preparing itself for change and emergence from the pandemic.

Key topics included consolidation, sustainability, drivers for tissue business post pandemic, global influences and trends, risk and resilience, consumer behaviour, manufacturing process developments, fibre and energy, converting solutions, process automation and optimisation.

Tissue’s route map is being refreshed. Here, we summarise key topics being raised.

Tissue World keynote speech:

Key drivers for the tissue business post-pandemic

Esa Kaikkonen, Chief Executive, Metsä Tissue

The tissue business has been volatile during the last year and half. The first few months we saw high demand for our products, and then soon after a shift to negative demand due to lockdowns. Gradually the volatility is going away, and we start to see the return of a normal business environment. Now we face new challenges and opportunities. I won’t touch on the high inflation that is applicable to all industries and which must be tackled by all of us as part of our commercial tactics. The key issues are:

Consolidation is likely to take place in the tissue industry

The tissue industry is likely to consolidate in the coming years in our main European markets. The reason for this lies in our customer base. Take consumer tissues, in the past couple of decades the retail sector has been consolidating, driven for example by the brisk growth of hard discounters. For instance, the German retail sector is controlled by the four largest companies, claiming a combined market share of almost 90%. This consolidation amongst our customer base has happened in the past couple of decades and has meant lower margins for the industries that provide goods to them.

The German food retail market can currently be characterised by consolidation, market saturation, strong competition and low prices. This development in the central European region has left shrinking margins in our businesses, and it’s been going on for far too long. Powerful retailers can negotiate cheaper offers from suppliers to keep the retail segment profit high.

While strong players are controlling the consumer retail segment, this same consolidation can’t be said for the tissue business. In the future, and to be able to share the large retailers’ business, the tissue industry is likely to consolidate. Currently the tissue market in Europe is fragmented, and a consolidation would have happened earlier if the interest rates were higher. The low interest rates have supported the trend of low margin business.

Even in other B2B industries we’ve seen intense investment activity – the same can’t be said for the tissue industry. This will eventually lead to a deterioration in the assets base, and the tissue business itself. The comparable operating results are also clearly lower in Europe than in the USA. I believe business owners will not tolerate these losses in Europe for much longer.

The tissue industry in Europe is fragmented, but to be able to serve large retailers effectively the industry is likely to consolidate. Larger producers could then deliver big volumes demanded by large retailers, reach higher efficiency and have more power in commercial negotiations. Currently the capacity of some 11 million tonnes is divided between about 140 companies, and the six largest producers account for 50% of the capacity.

Operating results in the European tissue industry are clearly lower than in North America – consolidation could help in improving the relatively weak profitability.

Demand boosted by improved hygiene standards

Demand is expected to continue to be boosted from improved hygiene standards and the increased use of paper towels. During Covid-19, I’m truly convinced that improved hygiene standards will turn the market favourable for us in the coming months and years. It seems clear that tissue is the preferred way to fulfil the function of hand hygiene. This is likely the best opportunity for the industry post-pandemic.

Tissue market dynamics post-pandemic are likely to change, with increased remote working and changing travel habits shifting some consumption from the Professional to the Consumer segment. Hygiene standards have improved due to the pandemic, and this will boost consumption both in Professional and Consumer segments with the main drivers including increased hand washing, substitution of air dryers, consumer acceptance on new and innovative paper towels.

There are many opportunities to increase consumption at home if we are innovative. It is expected that more people will stay home than pre-pandemic, so more actions are needed here in order to grow.

Sustainable fresh fibre is a key to success

Graphic paper decline continues to reduce the availability of RCP and the pandemic has accelerated the decline with no prospects of bounce-back.

Today one third of our production is based on recycled fibres. This is a huge issue but also a great opportunity for the industry to increase the value of their offering.

Digitalisation continues to reduce the consumption of graphic papers. With the declined availability, increased collection rates and filler content of graphic papers, the quality of RCP has gone down. The only way forward is to digitalise processes that don’t require physical movement of goods or people. This would mean less wood fibres in circulation. This will continue with elevated speed.

As the availability of recovered paper reduces and competition for the raw material tightens, tissue producers are the first ones to be left without RCP. This is due to the fact that the RCP paying capability in tissue is clearly lower than in packaging and fine paper grades (WLC, UWF). RCP prices have exceeded the paying capability of tissue producers already, making the use of virgin fibre more lucrative.

Locally sourced fresh fibre based on renewable, responsibly grown wood is the sustainable raw material alternative in tissue. Use of fresh fibre has also advantages in tissue manufacturing process in terms of sustainability and resource efficiency.

Business is about to become even more local

Tightening legislative measures will lead to substantial carbon price increases as per the “Fit for 55” targets. Long distance hauling is neither economically nor environmentally viable anymore since carbon emissions will be priced also in transportation. Local production based on best available technology needs to be developed further to cut emissions. The younger generation consumers appreciate locally produced products and services – sustainability is of utmost importance.

Sustainability will be one of the main drivers in the market. I feel very optimistic for the tissue industry, we have a set a new hight at the bar with the production of hygiene papers. When consumers are outside, we are one of the industries that help with self-living ad hygiene. And at home, the penetration is pretty low in the European side, so we can really push forward our value by introducing new papers to replace the non wovens.

We are in a unique position because we are fully integrated with Metsä Group and we have invested in circular bio economy for the past 10 years. This gives the flesh on the bones because you do concrete actions. All our mills will be fossil free by 2030. By 2030 we aim to have a completely plastic free offering.

Retailers have also started to develop carbon calculators for consumers to evaluate their product’s carbon footprints. Change is in the air.

What impact will carbon emissions have on the tissue industry?

Urban Lundberg, Senior Consultant, Fisher International

Extreme flooding and forest wildfires occurring around the globe are calling attention to the ever-growing issue of countries’ carbon footprints and fuelling the momentum behind the movement to reduce emissions. As a result, many individual governments have implemented legislation or enforcement mechanisms to limit these emissions.

The European Commission recently adopted the ‘Fit for 55’ package that was created to achieve a 55% reduction in emissions by 2030. The proposals included in the package outline the EU’s path towards its 2030 climate reduction to make the 2050 carbon neutrality objective attainable.

Although Europe is at the forefront of this movement, many other regions are increasing their efforts as well.

In the US, for example, President Biden has stated that energy and climate change are key initiatives within his campaign. Since being elected, the US has re-joined the Paris Climate Agreement and proposed a $3.5 trillion infrastructure bill, including components that address climate change. The goal is to achieve carbon neutrality no later than 2050.

Furthermore, President Biden is considering an “enforcement mechanism” to limit carbon emissions. California currently operates the largest carbon regime in the US with its Emission Trading System (ETS) or “cap and trade” system.

China has also acted. The country’s 2060 Carbon Neutrality Pledge – Guiding Opinions on Promoting Climate Change Financing – was announced by Chinese President Xi Jinping in September 2020. The goal of this is to peak emissions before 2030 and to achieve carbon neutrality by 2060.

Carbon emissions and the footprint they leave behind are impacting the global tissue market in many ways. Some of the most important areas that will be impacted are manufacturing footprint (location), inter and intra-regional trade, investments, and TM technologies.

The European tissue industry has lower carbon emissions than both Asia and North America, and the significant ‘carbon spread’ between countries is mainly driven by their different fuel uses. There is a 3X difference between the lowest and highest emitters in Europe, and this ‘spread’ is mainly caused by the huge differences in energy mix among countries.

Today the tissue industry is already a more local/regional business with relatively limited volumes of inter-regional tissue trade. The local/regional industry character is expected to further strengthen, which will make justifying long-distance shipments increasingly more difficult.

As an example, China and especially Indonesia are two of the main exporting countries of tissue to Europe. The carbon footprint for both these countries is considerably higher than for European producers. In addition, the emissions caused by the long-distance transportation need to be added.

In the near- and mid-terms, the tissue industry will develop into an even more local business than it already is today.

EU wide and national legislative initiatives to curtail carbon will increase in the near future. However, the strongest demand for change will likely come from retailers in the near-term and from end-users in the mid-term.

There will also be consequences within Europe where market proximity, cost position and carbon emission factors all need to be assessed and optimised for the most sustainable manufacturing footprint.

All future major mill capex decisions will need to be assessed, including an understanding of its carbon emission impact. This will undoubtedly over time lead to a changed European tissue manufacturing footprint.

Advanced tissue machines have considerably higher carbon emissions by weight when compared with conventional machines. However, to make a fair comparison we need to also look at product usage. Advanced TMs use approximately 20% less fibre than tissue from Conventional TMs.

Accordingly, there is a corresponding lower weight of a sheet/roll/case of tissue produced on Advanced TM’s. A comparison of emission by product (used) would make the emissions more equal between the technologies, and the high carbon emissions created when producing tissue with Advanced Technology can and need to be compensated with lower fibre usage.

Global insights on pulp market dynamics

Hampus Morner, Senior Consultant, AFRY Management Consulting

What can we expect in the immediate future for pulp prices?

Tissue has become the most important end-use segment for market pulp with almost 40% of global pulp demand attributed to the sector. This share will only continue to grow. Pulp is also the predominant cost driver for tissue production.

In 2020, pulp prices were flat for most of the year in both China and Europe. Pulp prices peaked in mid-2021 after having surpassed previous historical highs seen in 2018. There are many events behind this increase; economic recovery and pent-up demand, for instance. The market was also spurred by speculative buying, both physical and non-physical. There was also a lot of re-stocking activity.

Prices eventually started to come down in China. In mature markets like Europe, which usually lags behind China, it remains to be seen what will happen and to what extent it will follow China. Compared to previous price cycles, this one was more aggressive and distinctive. Some volatility seems to have been in place more than usual.

Logistical constraints and rising/elevating freight rates have also hiked up prices, as well as the postponed maintenance shuts and other production curtailments at the beginning of 2021. Unplanned production downtime brings volatility and is foreseen to grow; supply disruptions have had a major impact on prices historically.

We see the risk of supply disruptions picking up due to ageing assets especially in BSKP (equipment failures), continued market volatility (market downtime) and climate change, which can also negatively affect logging and logistics. In addition, the increasing scale of mills also brings some additional risk as any equipment failure means a higher level of absolute volumes lost than for a smaller mill.

With high investment activity, China’s impact on the global fibre markets will only increase. China is and will continue to be a major factor for global pulp.

In terms of market pulp end use, almost 40% is in China, about 25% in Europe and 10% in North America.

Pulp capacity in China is mainly integrated to paper and paperboard production. In the next few years, domestic pulp production might double in theory if all paper and board projects in China demanding virgin fibre are realised. To meet this demand, traditional fibre sources may not be enough. Options for the pulp producers are, for instance 1) To gain shares from domestic fibre sources at the expense of other sectors than pulp; 2) To increase imports from close proximity countries such as Vietnam, Myanmar, Laos and Thailand, or from traditional sources such as Australia; 3) Or to explore new frontiers such as Eastern Africa. Whatever strategy that is chosen, it is clear that China’s appetite for fibre will continue to increase.

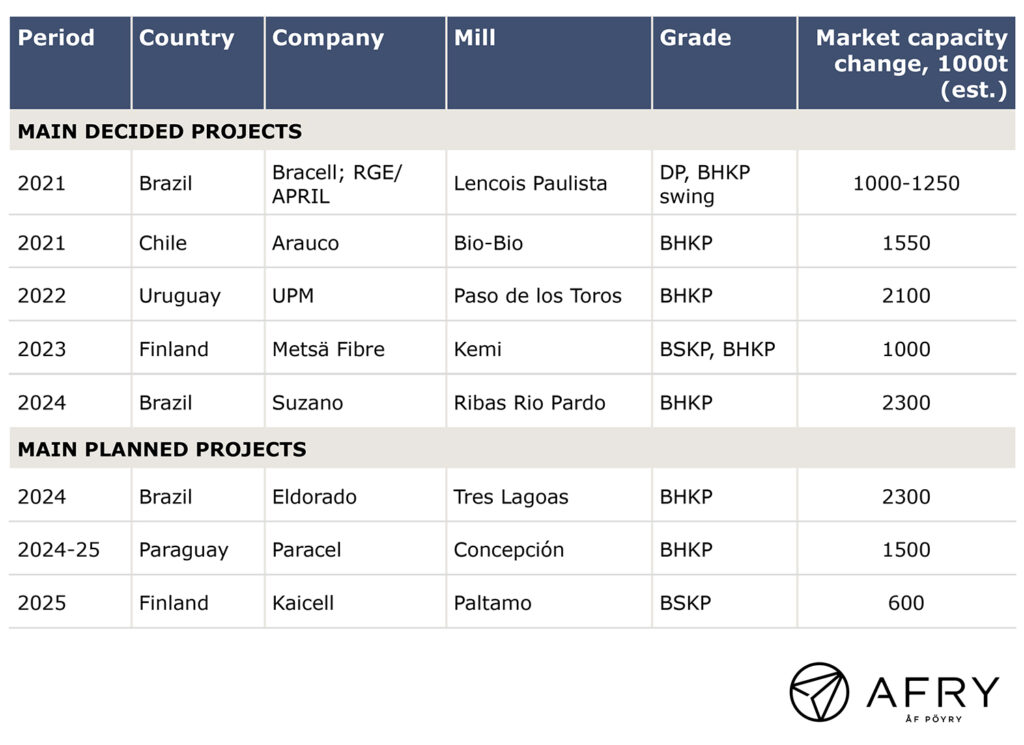

We have a period behind us with no significant market pulp supply additions globally, but looking forward, this is changing as the product pipeline is turning thick again. However, potential exits and swings are more of an uncertain factor. In 2021, the main projects include Bracell/APRIL in Brazil and Arauco in Chile. For the coming two to three years, there are Lenzing and Suzano in Brazil, UPM in Uruguay and Metsä Fibre in Finland. The projects ahead with a less certain timeline include Eldorado in Brazil in, Paracel in Paraguay and KaiCell in Finland.