US women – who drive up to 80% of all consumer purchasing decisions – are traditionally more loyal to national tissue brands. However, with the effects of the pandemic, their buying habits may be pushing them towards private label tissue products, a segment already favoured more by men. Report by Sivashankari Bharathi, Analyst, and Sanna Sosa, Senior Principal, AFRY Management Consulting

However, during the Covid-19 ‘paper panic’, more US consumers, regardless of age or gender, were exposed to private label products as for many, they were the only option on the supermarket shelves.

The US retail tissue segment expects to grow from around six million metric tonnes to seven million metric tonnes over the next decade. The increase is primarily driven by the stable growth in population, and what we believe will be a permanent increase in tissue products consumed at homes. Retail tissue demand soared throughout the initial months of the pandemic due to increasing stay-at-home orders, business closures, and people working from home.

However, Away-from-Home tissue received the shorter end of the stick with a dramatic decline of 30% in the early part of 2020 as travel, leisure activities and education closed down.

Private label tissue consumption has been on a rising trend in the US. At-home private label bath tissue share is expected to grow by 10%-points within the next decade. Private label growth is highly attributable to millennials, who have proven that they are not as loyal to national brands as their parents and grandparents have been.

According to a study by the National Retail Federation, looking at private label products overall 77% of millennials reported they would not want to buy the same products their parents did. Some 88% further said that private label products are just as good as the others. Millennials have opted for these products due to their cheaper price point and similar quality to national brands.

To adhere to millennials and their lifestyles, retailers have been heavily investing in their private label programme development. Some retailers have invested by creating new private label brands, while others have added new products to their existing private label portfolios. cFor example, in 2019, Kroger introduced more than 750 new items into its private label portfolio.

American retailer Target announced a new private label for its grocer section and now houses more than 45 different private label brands across all of its product categories sold. Supermarket Albertsons aims to reach a private label penetration level of 30%, and retail drugstore chain Rite Aid stated that it eventually wants private label sales to make up around 23% of its total sales.

Retailers have also been introducing new private label tissue brands. In 2019, the Wakefern Food Corporation introduced new tissue private label brand Paperbird into their lineup. Along with Wakefern, in May pharmacy chain Walgreens launched Complete Home, a label that consists of tissue, plastic, and household cleaning products.

To better understand the changing tissue purchasing trends, AFRY Management Consulting recently surveyed 568 US consumers. Questions asked were regarding bath and paper towel tissue products, tissue purchasing habits, and how consumers adjusted their tissue product purchasing during the pandemic’s ‘paper panic’.

Millennials driving tissue private label demand

Millennials are the core age demographic – and the primary reason why private labels products have grown over the last few years. Although mature consumers (defined here as consumers over the age of 37) sometimes purchase private label products, they tend to stick with the brands they typically use and have used for years.

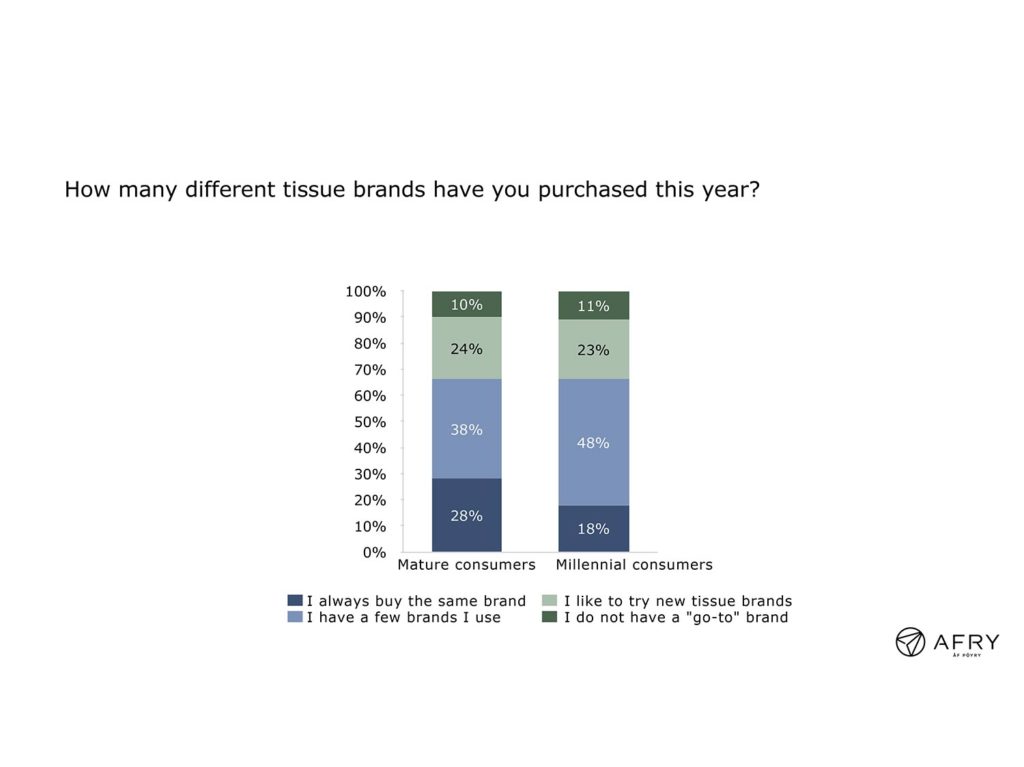

Based on our consumer survey, 28% of mature consumers only buy one specific tissue brand vs. only 18% of millennials having such loyalty. Unlike mature consumers, millennials are more likely to experiment and have more than one brand they are comfortable buying [Fig.1].

When analysing the national versus private label purchases, 43% of mature respondents answered that they primarily buy private label tissue products. Millennials on the other hand were 50% likely to favour private label tissue products over national brand products.

Along with brand loyalty, mature consumers ranked quality as a key reason why they were not as prone to purchasing private label products. They also noted that if the quality were to increase, they would be more open to buying private label products.

Overall, millennials are far more open and willing to purchase private label tissue products due to their lower cost and similarity to national brands in terms of perceived product quality.

Males are more open to buying private label products than females

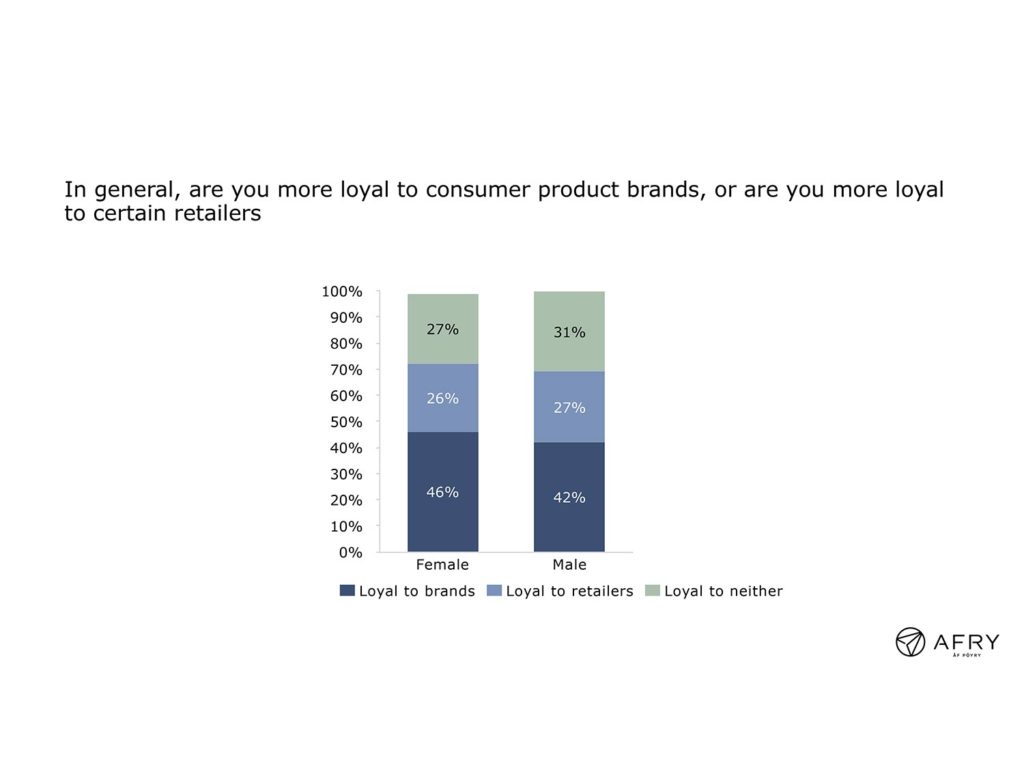

Women drive 70-80% of all consumer purchasing decisions within the US. According to a Nielsen study, 85% of women say that if they like a brand, they will remain loyal to it. AFRY’s survey aligned with Nielsen’s finding, as 46% of females in our survey reported that they were more loyal to brands than retailers [Fig. 2]. Some 42% of men also stated that they were loyal to brands, but males were also 31% likely to answer that they were not loyal to brands or retailers.

Looking at private label tissue brands versus national brand products, 53% of males were more likely to pick private label tissue products versus 41% for women. The majority of women, around 59%, typically purchased national brand tissue products instead. It seems that male consumers are more open to trying private label products and value price over quality more than females do.

Covid-19 impact on tissue purchasing habits

With the pandemic still looming over our heads, the tissue sector has had an exciting two quarters. As the pandemic’s initial months drove a spike in tissue sales due to the pandemic’s stockpiling that swept across the nation, consumers ransacked both e-commerce and brick and mortar stores, and only left empty shelves where tissue products previously sat.

Tissue product manufacturers have been reporting incredible sales growth caused by the pandemic. For instance, during Clearwater’s company Q2 earnings call, they reported having shipped up to 16 million tissue cases, up 28% from a year ago.

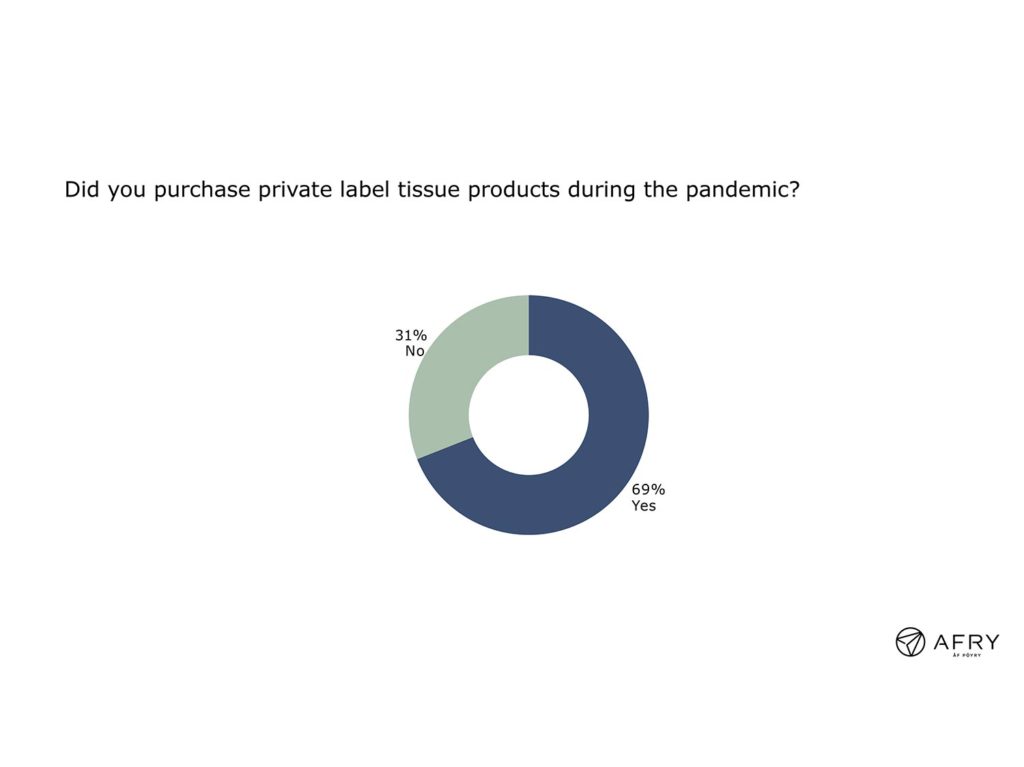

Based on our survey, 61% of consumers purchased a new tissue paper brand during the pandemic, and 69% of the respondents reported to have bought private label tissue products [Fig.3], indicating an increase in private label tissue consumption.

Mature consumers and females, who are not used to purchasing new tissue brands, had a sharp turn in purchasing behaviour due to the pandemic, primarily driven by product availability.

Due to the lack of availability of most tissue brands and the decline in household incomes caused by all-time high unemployment levels, regardless of gender and age demographics, consumers resorted to purchasing private label products.

This new exposure to private label tissue products could also increase female and mature consumers’ purchases of private label products long term if they get a positive experience of the private label tissue products’ value in terms of price and quality.

A look into the future

We expect retail tissue private label demand to be on the silver lining of the pandemic’s disruption across markets and sectors of our economy and industries. Tissue private label brands will continue to gain market share, with continued private label segment expansion highly attributable to millennials driving the segment.

Along with millennials, males will continue to be more inclined to buy private label tissue products than more brand-loyal female shoppers.

Retailers are also continuing to push and expand their private label programmes, including the launch of private label tissue products.