A November 2020 report by China National Household Paper Industry (CNHPIA) Association looks at margins, soft and hardwood pulp and parent roll prices, investment, capacity, import and export and e-commerce business levels across China’s tissue companies.

In 2020, China’s tissue paper industry was mainly influenced by four factors: the Covid-19 pandemic, investment, pulp prices and overcapacity.

In the first quarter, production and logistics of industrial manufacturers were affected and the total production and sales volume decreased year-on-year. However, investment was still high throughout the year and new capacity launched by the end of November exceeded the whole level of 2019.

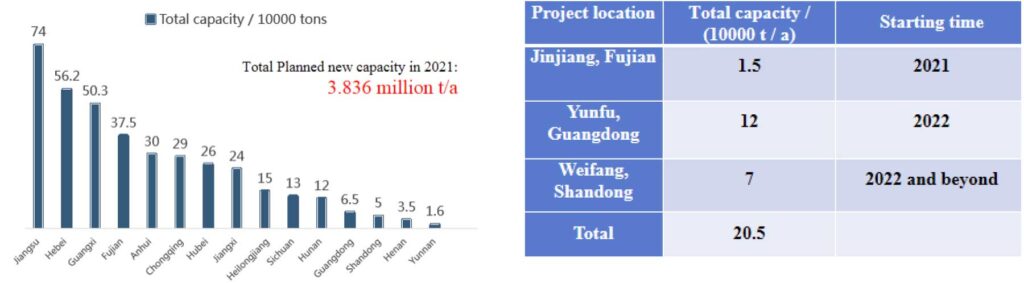

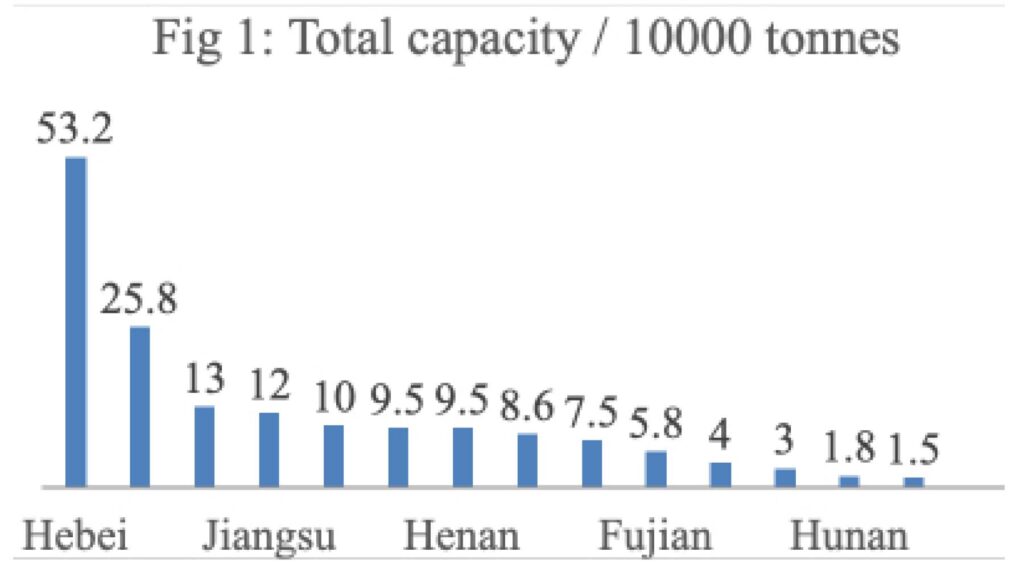

Overcapacity continues to be ever-present across the Chinese tissue industry, with the intense market competition meaning that projects are delayed and the average product price of the whole industry is still low. Figure 1 shows the distribution of new capacity in all provinces: by the end of November 2020, new capacity reached about 1.65 million tonnes, exceeding the total of 2019.

The new capacity includes 60 companies in 14 provinces. Some 84 tissue machines were put into operation in total, including domestic tissue machines launched by SME companies and four imported tissue machines. The new capacity is mainly located in Hebei and Guangxi.

The top four companies including Hengan, Vinda, Gold Hongye and C&S didn’t launch any new capacity.

At present, only three listed companies take tissue paper as their main business. The performance of the three companies greatly increased this year, mainly because of low pulp prices and continual optimisation of product structure. This is from data from the first half year or the first three quarters of 2020.

Vinda: In the first three quarters of 2020, its gross margin increased by 8.8% points, reaching 38%.

C&S: In the first half of 2020, its net profit in tissue paper business rose by 65%, reaching four hundred and fifty-three million yuan. It expects that net profit belonging to the shareholders of listed companies in the first three quarters of 2020 was about six hundred and fifty-seven million to seven hundred and forty-four million yuan, up 50% to 70% over the previous year.

Price of raw materials and products

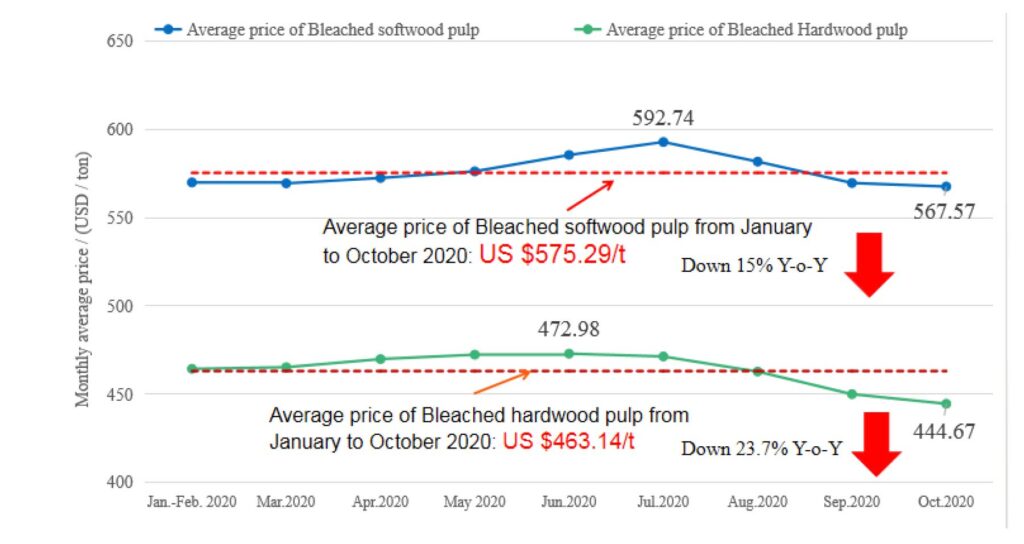

The price of imported market pulp remained low throughout the year. This figure is based on the customs’ pulp import data. From January to October 2020, the average price of China’s imported hardwood pulp and softwood pulp fell by 23.7% and nearly 15% year-over-year.

This figure shows the monthly average price of imported pulp in China from 2013 to 2020. We can see that the average prices of softwood pulp and hardwood pulp from January to October 2020 were the lowest in seven years.

Low prices of wood pulp will benefit tissue paper companies, reduce production costs and increase the gross margin of products. The price of wood pulp sharply fell, greatly affecting the manufacturers using non-wood pulp such as bamboo pulp and bagasse pulp, and increasing the material cost of companies. The profit of bamboo paper companies in Sichuan and bagasse paper companies in Guangxi was lowered.

This figure shows the monthly average price of non-wood pulp in 2020. We can see the low price of non-wood pulp this year.

This figure shows the monthly average ex-factory price of tissue parent roll in 2020 according to the statistics of Sublime China Information. In 2020, the price of tissue paper started to rise in February, but fell from mid-April until now. Let’s take December as an example:

In Hebei and Shandong, the average ex-factory prices of tissue parent roll with wood pulp as raw material decreased by 8.8% and 11.8%.

In Sichuan and Guangxi, the average ex-factory prices of tissue parent roll with bamboo pulp and bagasse pulp as raw material decreased by 8.3% and 4.1%. We can see the low price of tissue this year from historical data.

This figure shows the average ex-factory price of domestic tissue parent roll from 2012 to 2020. It shows that the price of tissue parent roll in the second half of 2020 was the lowest in eight years.

Product upgrade and innovate

In 2020, product innovation is mainly about lotion tissue, flushable toilet tissue, embossed tissue and unbleached tissue continuously upgraded. Antimicrobial and sterilising lotion tissue and more novel embossed tissue were introduced to make products more soft and comfortable and absorb oil and water well. More companies were involved in the production of these products.

New equipment and technology

Foreign new technology of tissue machine includes: NTT, QRT and other technology of Valmet and TEX technology of Andritz strengthened their presence in the Chinese market.

The use of new technologies will promote the quality upgrade of high-end tissue paper products in the Chinese market. From the domestic suppliers of tissue machines, this includes:

• Baotuo built an intelligent manufacturing cloud service platform;

• Qingliang has introduced remote intelligent management system;

• Dazheng and Weituo are promoting energy-saving tissue machines;

• Xinhe introduced the wide width tissue machine and hand towel machine;

• TAD tissue machines developed by Bingzhi is now being marketed.

New technology of processing equipment includes:

• Baosuo introduced the high-speed ultra-wide slitter in China, automatic plastic-pack tissue production line compatible with “glue-free lamination” and “four-sides positioning embossing” technology, and rewinding production line of toilet rolls;

• OK introduced the wide width plastic-pack facial tissue automatic folding machine;

• Fabio Perini – now Körber Tissue – brought the tissue paper processing line adopting Aqua-Bonding embossing technology to the Chinese market.

Further combination of equipment companies

Valmet acquired PMP Group in 2020. This acquisition will cover more customers, improve the centralisation of global toilet tissue equipment suppliers and benefit small and medium tissue paper companies in the Chinese market.

A.Celli announced its acquisition of PMT Company in 2020. This acquisition helps to strengthen A.Celli’s competitiveness in the field of tissue machine.

Change of marketing channel

In order to reduce the risk of virus infection caused by offline shopping during the pandemic, consumers shifted towards online shopping, the advantages of e-commerce were enhanced, and the shares of e-commerce channel grew rapidly.

In 2020, driven by the pandemic, marketing channel quickly transformed in domestic market, such as cooperation with e-commerce platforms, and live commerce. Affected by the pandemic, offline channels were blocked, and companies paid more attention to the promotion and expansion of online channels.

From the annual reports of listed companies, we can see that the e-commerce accounted for 33% of Vinda’s revenue in the first half of 2020, up 7% points compared with the same period of 2019.

Hengan’s revenue of e-commerce business exceeded 2bn yuan in the first half of 2020, accounting for 18% of total sales of the group.

Import and export market:

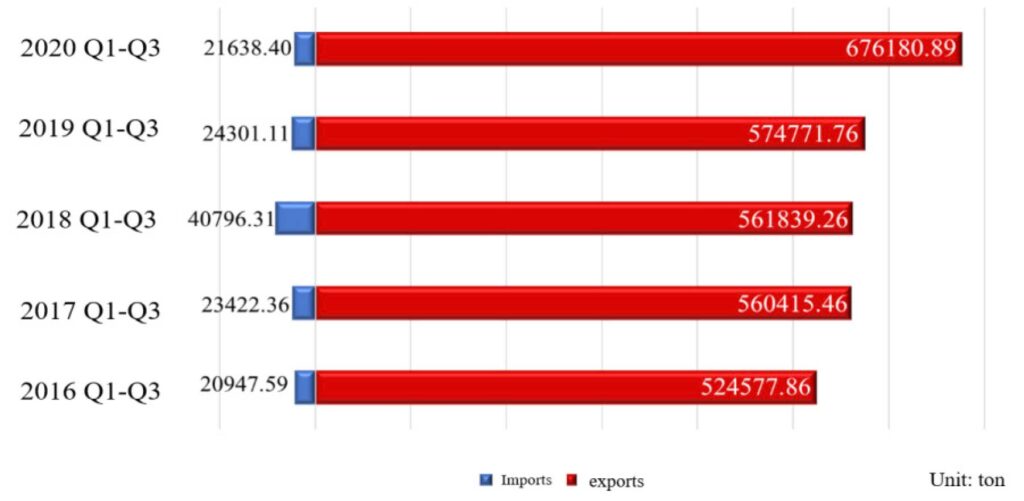

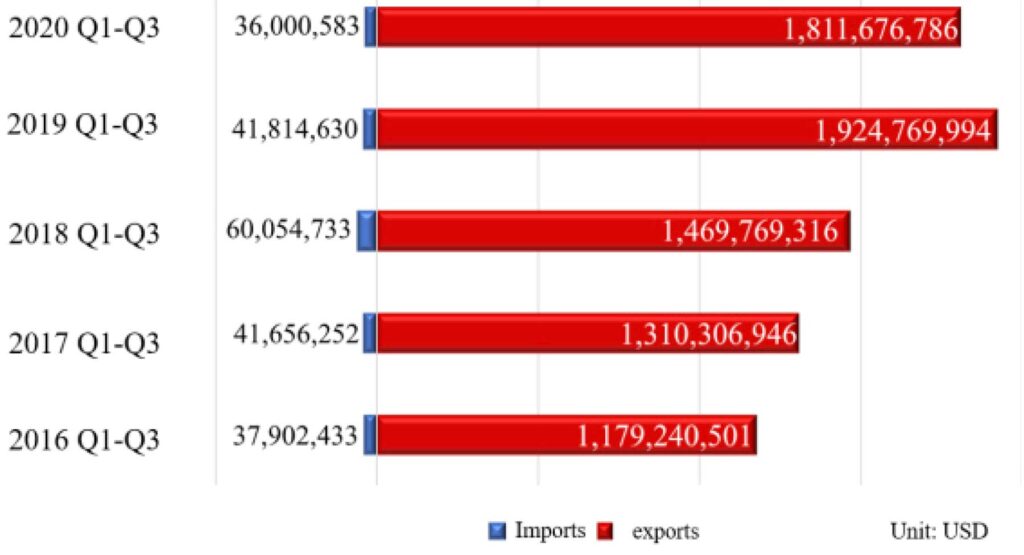

This figure is based on the customs’ data. We can see the contrast of tissue paper import and export volume and value in China from 2016 to the first three quarters of 2020.

Import:

According to recent import data, China’s tissue paper can completely satisfy the consumer demands of the Chinese market, so import volume is very low each year. Only twenty-one thousand six hundred tonnes were imported in the first three quarters of 2020, with lower proportion in total market consumption.

Export:

In spite of the pandemic, the export of tissue paper continued to grow in the first three quarters of 2020. The total export volume rose by 17.6%, reaching six hundred and seventy-six thousand two hundred tonnes. The export value declined by 5.88% on year-on-year basis, and the average price of exported products fell by nearly 20% on year-on-year basis, but was still higher than average price of domestic market.

The export took on the trend of quantity increase and price fall as a whole. The export volume and value of tissue parent roll maintained growth, with export volume up 50%, total export value up 33.3% and average export price up 12.6% on year-on-year basis. The average export price of other finished tissue paper fell sharply.

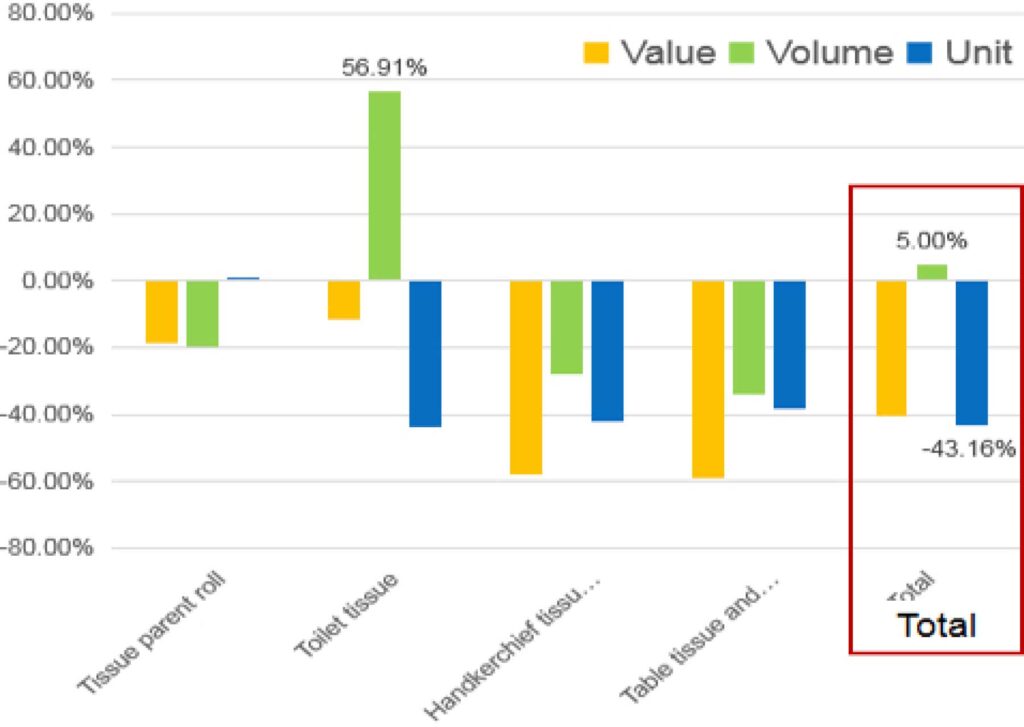

Exports of tissue paper to the USA increased. In the first three quarters of 2020, China’s export volume to the USA was ninety-two thousand three hundred tonnes, up 5%, and average price fell by 43.16% on year-on-year basis. The fall in price is because the tissue paper exported to the USA is mainly toilet tissue, accounting for nearly 60% of total export volume. Moreover, the export volume of toilet tissue rose by 56.91% on year-on-year basis. The export volume of tissue parent roll and other products declined.

Tissue companies increased the production of anti-pandemic supplies

Some tissue paper production and equipment companies switching to the production of masks and mask machines during the pandemic. While supporting the fight against the pandemic and taking social responsibility, these companies have also achieved certain economic benefits.

Future projects:

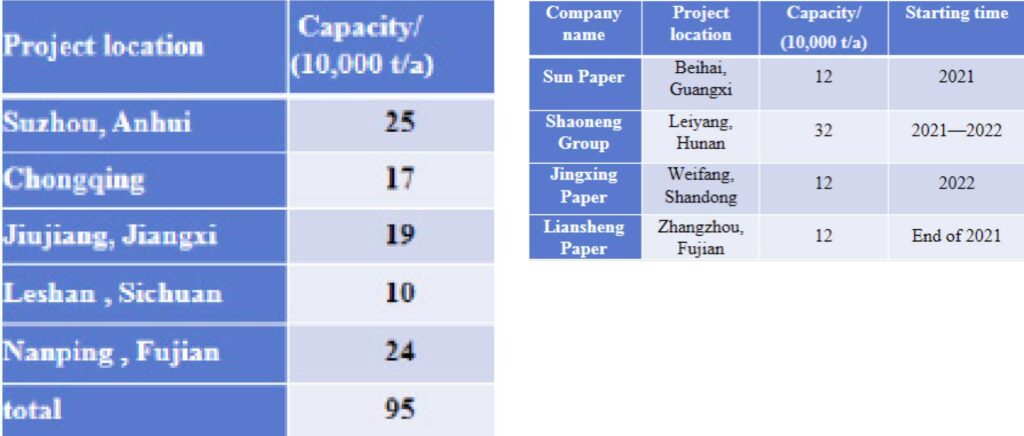

By the end of November 2020, modern capacity announced to be launched by industrial companies in 2021 exceeded 3.8m tonnes.

This table lists the provinces, number of companies and tissue machines, and capacity in 2021, and these machines are mainly located in Jiangsu, Hebei and Guangxi. Some 163 tissue machines will be put into operation in total. Modern capacity to be launched in 2022 and after was nearly nine hundred thousand tonnes.

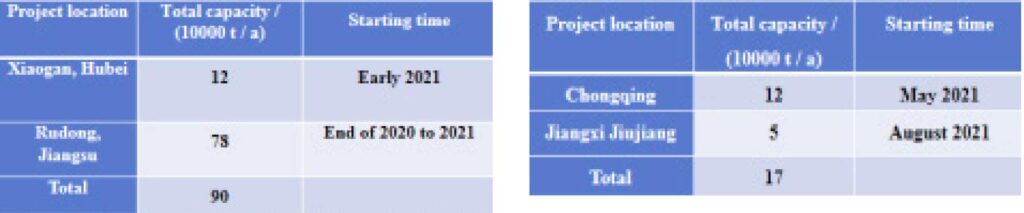

Major planned projects in 2021 to 2022 include:

Hengan will launch a total capacity of two hundred thousand tonnes.

Gold Hongye plans to launch a total capacity of nine hundred thousand tonnes.

C&S plans to launch one hundred thousand tonnes of capacity in 2021. Lee & Man plans to launch a total capacity of one hundred and seventy thousand tonnes in 2021.

Taison plans to launch a total capacity of nine hundred and fifty thousand tonnes in 2021.

Sun Paper, Shaoneng Group, Jingxing Paper, Liansheng Paper, and so on, also plan to continue expanding capacity.

Seen from new capacity to be added, capacity growth will be higher than the increase of market consumption and market competition will be more intense. But at the same time, in order to improve the market competitiveness of manufacturers, new technology for tissue paper production will be promoted and applied.