With predicted declines in GDP growth in leading economies up to -10%, lower and relatively stable pulp prices have proved to be the main boost to the industry’s financial state of health. Pirkko Petäjä, Principal at AFRY Management Consulting, analyses performance in sectors and regions.

Economic hit from Covid-19

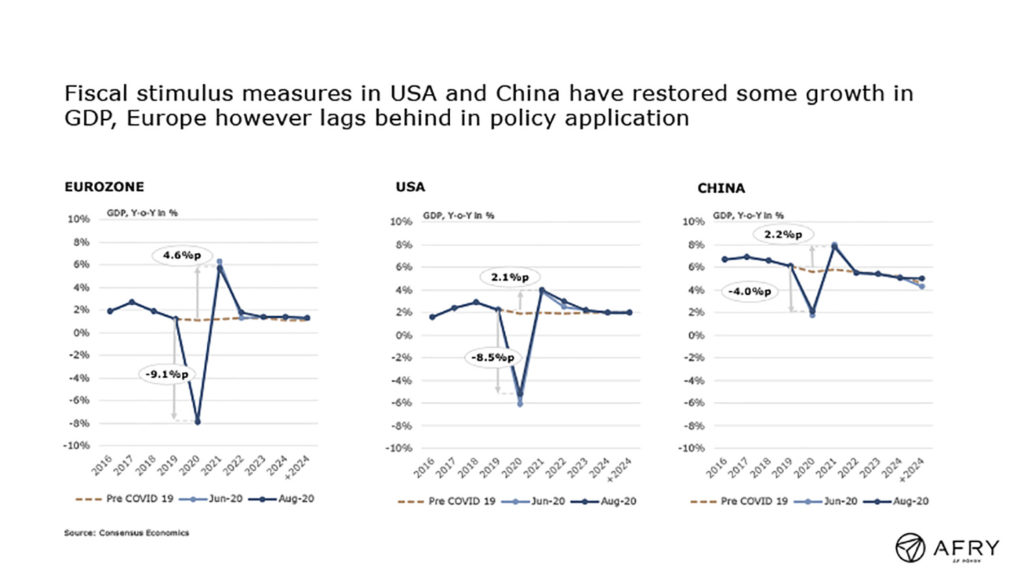

In 2020, the world is facing a major economic hit from the Covid-19 fallout due to both the direct losses caused by the pandemic and the consequences of closing down society and reduced business activity, travel and trade. The ensuing major rise in unemployment reduces private spending, the corner stone of economic growth. A similar drop in annual GDP growth was seen during the financial crisis in 2009, but that time the crisis, even if it had lasted longer, was not quite as deep and global as now. The Eurozone and the US will have the strongest hit from Covid-19. The forecasted drop in GDP growth from the annual growth seen in 2019 will be -9.1 %-points and -8.5 %-points respectively. In both regions, the economies declined drastically in Q2 and the annual GDP growth will also be clearly negative, in some European countries by more than -10 %. In Europe, Southern Europe and the UK will see the biggest dives, while Germany and Northern Europe have been doing a little better.

The recovery policy in the US has clearly worked and improved the situation from the earlier forecasts in the beginning of summer. Asia has been hit less hard. For instance, in China, the economic growth has slowed down by around 4% points, but remains positive with about 2% growth. Most economic analysts expect the rebound in 2021 to be strong as there are high hopes that the second wave can be controlled better and that the investments postponed in 2020 will materialise in 2021. The rebound is foreseen to be weaker in the US than in Europe.

How has the pulp market reacted to the economic hit?

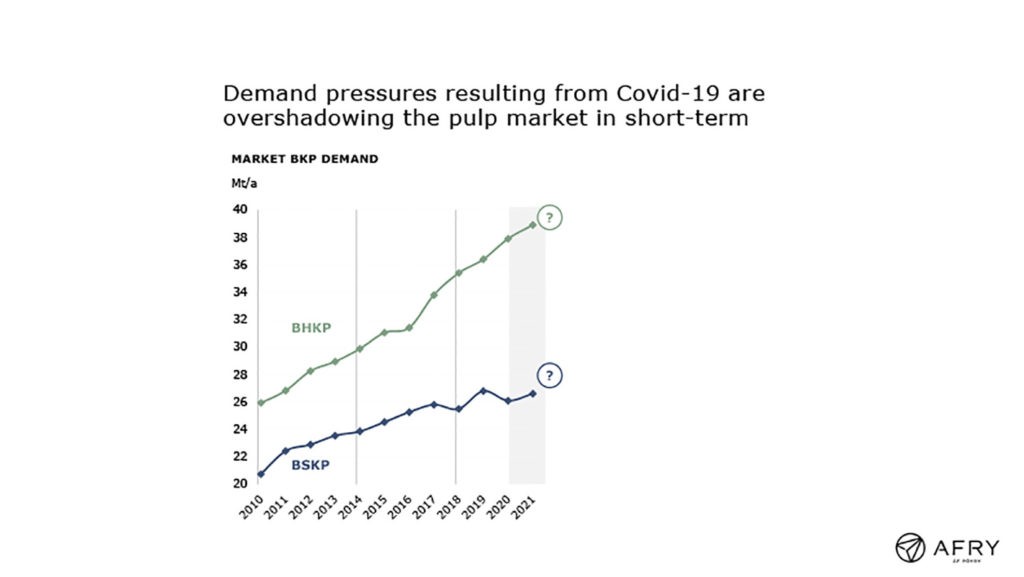

The pulp market correlates with economic development. Pulp demand typically decreases with a drop in economic activity. Demand and prices already started to decline in 2019. In 2020, the market continues to face multiple uncertainties, mainly due to the pandemic. The following main drivers apply –

Negative drivers:

The major negative drivers impacting the pulp market after the Covid-19 outbreak are the uncertainties linked to demand. While demand for market pulp has risen in the tissue end-use, the steep decline in the global graphic paper market is likely to more than offset the gains in other segments.

Pulp producer stocks were starting to trend down just before the Covid-19 outbreak, but were still above the long term average. Now the producer and port inventories remain high and the seasonal inventory declines of Q2 were this time not significant. Projected new rise of stocks in the supply chain over Q3 risks amplifying the challenges.

Market pulp supply has increased substantially with earlier integrated volumes offered to the market after paper machine closures and downtime. Pulp mill maintenance work, much of which is usually seen in Q2, has been postponed due to Covid-19 as such work brings more people to the mill-sites than normal production. Finally, very weak textile market and poor dissolving pulp prices have led to swings from dissolving to paper grade pulp.

Positive drivers:

The main positive driver in the near future is the limited supply increase, apart from the above-mentioned de-integration. The new project pipeline in 2020/2021 is thin. Also, some swing back from paper grades to dissolving pulp is expected once the textile market revives.

The other positive driver has already been the growing pulp demand in the tissue sector. Increased hygiene product demand and switches from recovered paper to virgin fibre pulp as raw material both play a role as does the inventory build-up. However, the fast growth seen over the early months of the year is already moderating and the remainder of this year risks being more challenging. Moderate growth is projected in 2021 and beyond.

Other positive drivers include the improving paying capability and recovery from Covid-19, especially in China. The Chinese economy remains strong enough to maintain the market pulp demand growth from that region.

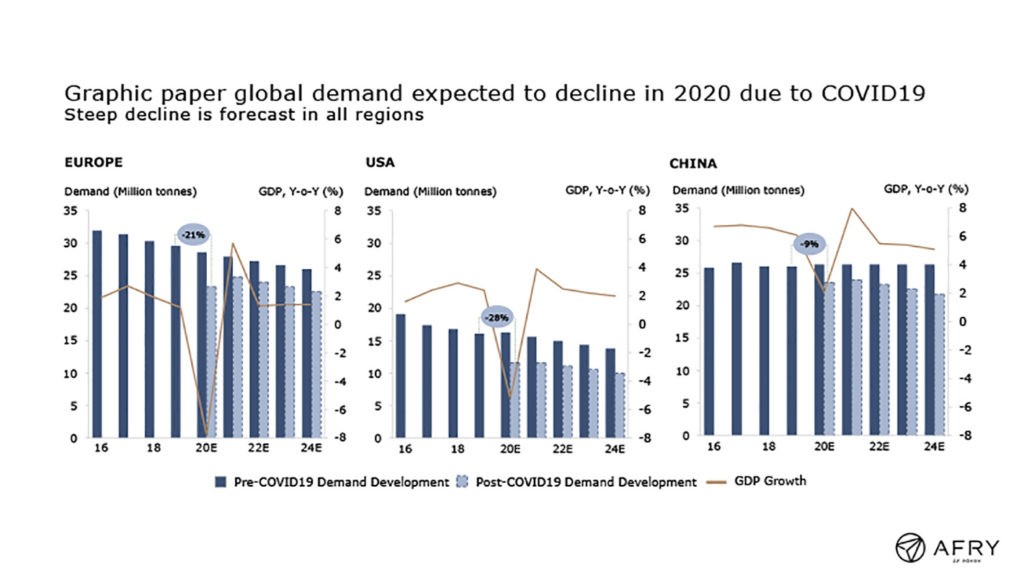

Graphic paper global demand is expected to decline

Graphic papers account for about 46% of world BKP use and 36% of the market BKP use. Graphic paper markets have a major impact on market pulp; when the paper market declines, it impacts the pulp demand directly and also when the integrated producers have to decrease their paper production, their pulp often ends up in market pulp supply. Already before Covid-19, graphic paper demand was declining at a rapid rate in Europe, in the US and in virtually all industrialised countries. The correlation to GDP growth was negative due to the shifts to technology/electronic media; the stronger the economic growth, the faster the demand decline. Typically, the decline in the western world has been -3-6 % annually.

Due to the Covid-19, a steep decline in graphic paper demand is forecast in all regions. A rebound to the normal deterioration speed will occur once normal activities resume, but the rate of demand decline in some of the segments, such as newsprint, may not get back to the lower rate of retreat seen before the crisis. Consequently, a step change to a lower level is expected for graphic paper demand in all regions. This will mean permanent demand drop for market pulp for this end-use. Impact from integrated pulp mills shipping more of their pulp to the market can also be bigger and more rapid than has been assumed before.

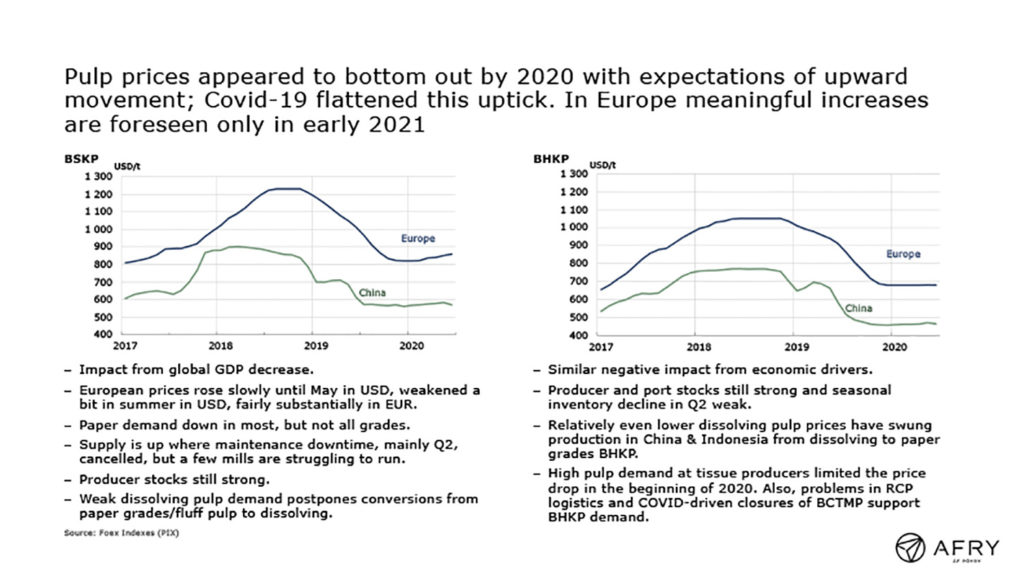

Impact on pulp prices

Pulp prices peaked in 2018 but started to decline at the end of the year and during 2019 prices came rapidly down to fairly low levels. Pulp prices rose slightly in the early months of this year in BSKP and remained flat in BHKP. After weakening in June-July, prices appear to have bottomed out in August with some price hikes announced from September.

Expectations of moderate upward movement in dollar prices during the remainder of the year or latest in early 2021 have risen, supported by the weakening of the US dollar. Prices in euro-terms are clearly lower now than in early 2020.

In the latest quotations, producers have announced price hikes in Chinese market. The pulp price increase appears to be starting in China, at least in BSKP. In Europe, most analysts foresee meaningful increases only in early 2021.

Indications for tissue producers

Profitability of tissue companies correlates quite strongly with the pulp price; the highest EBITDA margins have been reached when the pulp price has been low. From this perspective, year 2019 was good for tissue producers. As the pulp prices have remained flat, or fallen further, in the first half of 2020, this exceptional period has been from profitability perspective good for the tissue producers. Energy is the largest cost in paper manufacture after fibre. Also energy prices, both fuel and electricity have been generally on a downward trend due to the pandemic.

Contrary to chemical pulp, recovered fibre prices have in many cases increased as supply has been restricted with demand continuing. The interrupted collection and lockdown period have caused shortage of supply. From HG and other for tissue used grades’ perspective the rapid decrease of graphic paper demand will cause a permanent disruption to the RCP supply and causes upward pressure on prices.

Covid-19 has, due to the hoarding in the first months, impacted tissue demand in Q1 very positively in consumer, but in the beginning even in the AfH segment. Destocking started to show in May and tissue demand was typically below normal levels in the second quartile of the year.

The AfH sales were good over Q1 but the demand drop has been significant for Q2. The segment has been hit hard from the lockdowns, reduced travel and tourism, working from home, unemployment etc. Many of these factors are expected to continue impacting the AfH tissue demand towards the end of the year, even if some economic recovery is seen. Contrary to many other paper grades the tissue demand on annual basis is expected to remain almost normal in the consumer segment (that accounts for most of the market). As the pulp price due to the Covid-19 has remained low, the overall impact on tissue has been positive. Consumer segment, if reported separately, has typically reached very good financial results during the first half of the year.

However, the AfH segment continues to have problems with demand but also in supply, as the high RCP prices hit here the hardest. Typically, Q2 financial results are significantly below normal for all producers, especially so for the HoReCa segment. There are no winners in the pandemic situation, but the tissue producers – as all others whose business is based on essential needs – have, when it comes to demand, been fairly resilient to the economic crisis.

However, it is the low pulp price that has been the main contributor to the good financial performance during this exceptional period.