By Luc Vanden-Abeele, Marketing Research Advisor, Axium Robotics and Automation

After an explosion in choices of packaging and sizes – 15 different bath tissue packs for example – factories are stepping up automation to keep increased production runs as smooth as possible. Luc Vanden-Abeele, Axium Robotics and Automation’s marketing research advisor reports.

For companies that make tissue products, upstream is where all the pulping, bleaching, rolling and cutting take place. While downstream is where products are put into primary packaging, then secondary packaging, with cases then stacked onto pallets and pallets then lifted onto transport.

The upstream area of a tissue plant sees lightning speeds within an automated process that has been tweaked, improved and made even faster over the years. Not so, at the downstream end, which requires numerous people to not only keep up with the pace set by the machines but also to adapt to the ever-changing requirements of the retailer.

Think single pocket tissues, rounded tissue boxes, megapacks of 48 toilet paper rolls and all the other sizes of packaging we see today. Niche marketing and big-box stores have fuelled this explosion of choice, and factories have been trying to adapt to the higher number of production runs that have resulted. As an example, there are now over 15 different choices of bath tissue pack sizes.

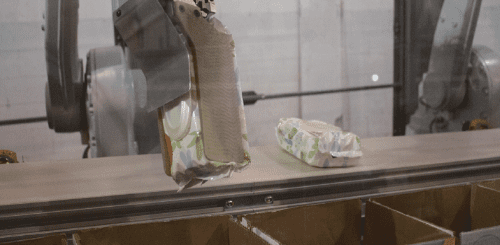

Robots have come to the rescue. Their flexibility, speed and tirelessness have successfully taken on the wide varieties of packaging at the downstream end, where different sized boxes come down the line and different stacking formations are needed. Robots pick up items with a variety of grippers that in seconds can be programmed to be changed and grab a different size box. They can also be programmed to stack boxes in various ways, even making sure that in those large wrapped pallets of tissue the decorative side of the box is seen and not the less pleasing bottom-of-the-box product details.

The tissue sector has seen higher profits than other areas of the paper industry, but that does not negate production engineers looking for efficiency. In one of Axium Robotics and Automation’s recent tissue factory designs, five robots were able to expedite 150 products per minute 24 hours a day, automatically changing over to accommodate for product sizes, case sizes and, different loading orientations throughout the day.

A recent trend calls for mixed product case packing. Without the flexibility of robotics, putting various packaging formats in a corrugated box in an efficient way might be close to impossible.

Distribution centres are where downstream processes have gained momentum and where automation has been key. Robotics companies like Axium Robotics and Automation are now automating the way orders get filled and the way products enter and exit the centres.

The rise in SKUs has pushed the centres to become more flexible. With more package sizes and more varied store needs, automation has been key to respond to these changes. Robotics are well placed to do the mixed load palletising, which brings various box formats together on one pallet, as well as mixing together secondary packaging.

All that distribution centre activity has resulted in bigger operations, more expenditure and more employee hires.

According to a recent survey about warehouse and DC operations, 2015 saw a 13.5% increase from 2014 in the average square footage. It is the same situation with the labour, where it has gone up steadily as well, with a 20 percent increase from 2012 to 2015. But the astounding figure is the average number of SKUs found in the facilities, which went up by 18.5% in 2015 alone. More SKUs, and the increasing demand for less than full pallets, mean larger warehouses and more people to handle them, with more logistical needs and more complex processes … if nothing new is done to deal with those changes.

This is where robotics can pull warehouse and DC managers out of this Catch-22. The ability of industrial robots to build mixed case pallets while optimising product density, as an example, provides a unique alternative to meet the increasing demand of mass customisation. These technologies have been improving to keep up with the complexities being demanded by the tissue sector and other industries seeing their distribution needs becoming ever more detailed.

Investing in robotics can be expensive. But those technologies enable processors to deal efficiently with the flexibility needed to cope with SKUs proliferation. Therefore, the ROI is there. Many large players are increasingly looking to robots to make their downstream packaging and palletising flow just as quickly as those fast moving upstream operations. And when that starts to spread even further through the sector then maybe those engineers can get some time off to go fishing.