By Bill Burns, Senior consultant, Fisher International

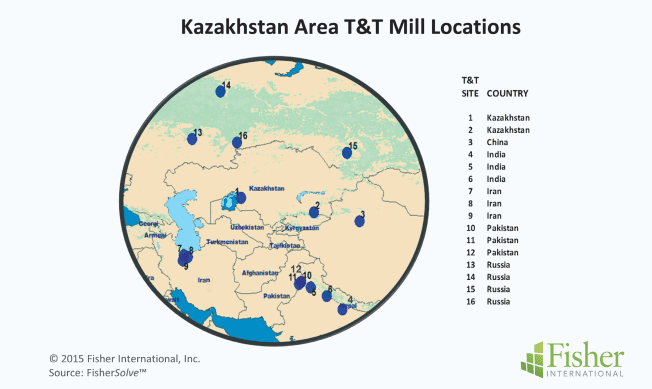

With a territory larger than Western Europe, Kazakhstan is the northern most of the five Central Asian countries that once numbered among the republics of the former Soviet Union. Sparsely populated, land-locked and located in a mountainous area lacking the forest resources to nurture strong paper making operations (Map), Kazakhstan’s population is clustered around a few cities and scattered among nomadic tribes across the country.

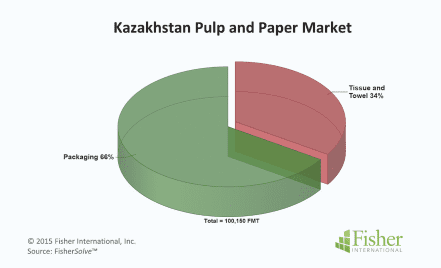

There are two paper mills of size in Kazakhstan. One of these is a multi-grade mill making some Towel and Tissue (T&T) along with Packaging grades. The second mill is dedicated to T&T. Kazakhstan is the only T&T producer among the five Central Asian countries. All told, the country makes a little over 100,000 metric tonnes of paper per year of which one third is T&T with the remainder being packaging (Figure 1). There are no market pulp mills in the country.

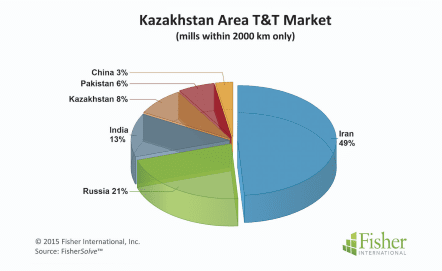

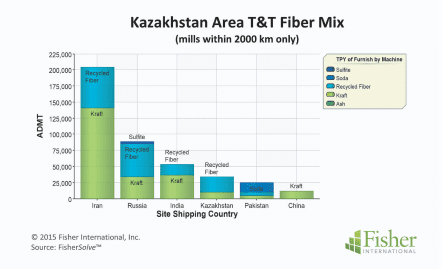

You would have to travel a long distance to find other T&T producers within the vicinity of the Kazakhstan mills. For the purposes of regional comparison in this article, we have identified 14 other T&T producers within a radius of about 2,000 kilometers in Russia, Iran, China, India and Pakistan. Collectively, they represent a diverse range of markets and machines. Within the selected area, Kazakhstan’s production represents 8% of total T&T capacity (Figure 2).

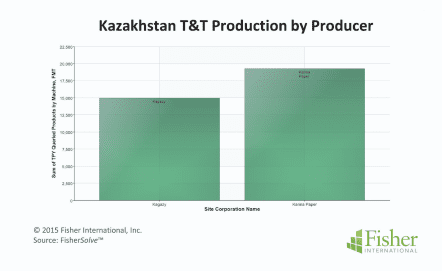

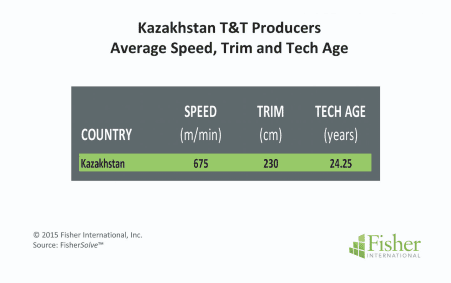

The T&T market in Kazakhstan is shared by two companies Karina Paper and Kazakhstan Kagazy (Figure 3). The technology base among the 16 mills in the area is fairly diverse. Kazakhstan’s machines fall in the two plus metre class with operating speed between 500mpm and 1,000mpm (Figure 4). Technical age of the Kazakhstani machines average about 25 years.

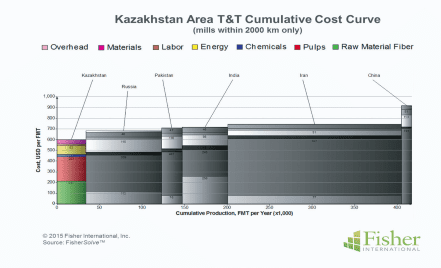

Competitive cost position in the area tends to be driven by fibre choices. Kazakhstan’s fibre base is heavily weighted to recycle fibre while its counterparts use a combination of recycle, non-wood fibre and market pulp (Figure 5). On average, Kazakhstan’s mix is comparable with all but the Iranian and China-based mills which, at up to $600 per metric tonne of fibre, are at a distinct disadvantage. The Iranian mills have the lowest energy cost giving them a $50 per metric tonne advantage over Kazakhstan and as much as $65 per metric tonne over Russia and China in this cost category.

Nevertheless, overall, Kazakhstan has the lowest cost of the selected area mills. The advantage ranges from $80 to $300 per metric tonne with China’s area mill being the highest cost (Figure 6).

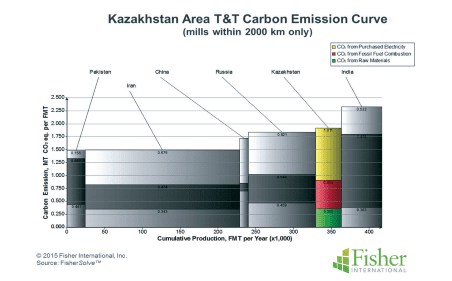

Competitiveness must also consider a country’s impact on the environment. With climate change becoming more important globally, carbon emissions have the potential to impact both cost positions and the ability to compete in the future. When carbon emissions for the mills in the region are modelled, Kazakhstan’s T&T mills’ emissions are higher than the other area mills except for the Indian mills which are significantly higher (Figure 7) and in the fourth quartile among all T&T mills globally.

The source for market data and analysis in this article is FisherSolve™. Data tables behind Figures 1 – 12 can be obtained from Fisher International. E-mail requests to [email protected].

About Fisher International, Inc.

Fisher International has supported the pulp and paper industry for over 25 years with business intelligence and management consulting. Fisher International’s powerful proprietary databases, analysis tools, and expert consultants are indispensable resources to the industry’s producers, suppliers, investors, and buyers worldwide.FisherSolve™ is the pulp and paper industry’s premier database and analysis tool. Complete and accurate, FisherSolve is unique in describing the assets and operations of every mill in the world (making 50 TPD or more), modeling the mass-energy balance of each, analyzing their production costs, predicting their economic viability, and providing a wealth of information necessary for strategic planning and implementation. FisherSolve is a product of Fisher International, Inc. For more information visit: www.fisheri.com or email [email protected] USA: +1-203-854-5390.