Mixed picture follows increased hygiene awareness, AfH was hit by 23% decline, big increases in VAT, lost value share, extensive price discounting … set against an organic growth in population.

While retail tissue in the Middle East contributes a modest 2.3% of total world tissue consumption, it continued to grow in 2020. Saudi Arabia, Israel and the United Arab Emirates collectively constitute 44% of tissue value sales in the Middle East and are the core contributors to the trends that influence the region as a whole. Whilst global retail tissue volume sales grew by 7% in 2020, with North America recording the fastest retail volume growth of 12%, the Middle East followed with regional growth of 8% to reach 1.1 million tonnes, which is still far lower than US per capita consumption but does indicate room for further expansion.

Covid-19’s impact on tissue in the

Middle East

Retail tissue performed relatively well in 2020 in the Middle East due to increased consumer awareness of the need for stringent cleaning and hygiene in both their homes, and on a personal level. Major influences, especially for retail tissue including toilet paper, were that many consumers remained at home for long periods of time due to social distancing and lockdown mandates in an attempt to control the spread of the virus, which resulted in a surge of remote working and studying. The fact that international travel was also halted for an extended period led to cancellations of travel plans, thereby contributing to a natural decline of 23% in value sales of tissue via the AfH channel in 2020.

A common trend noted across the Middle East has been a shift in consumer behaviour; the initial shock linked to the emergence of the pandemic and the subsequent lockdowns resulted in a temporary shortage of some tissue products as demand surged, supported by some panic buying.

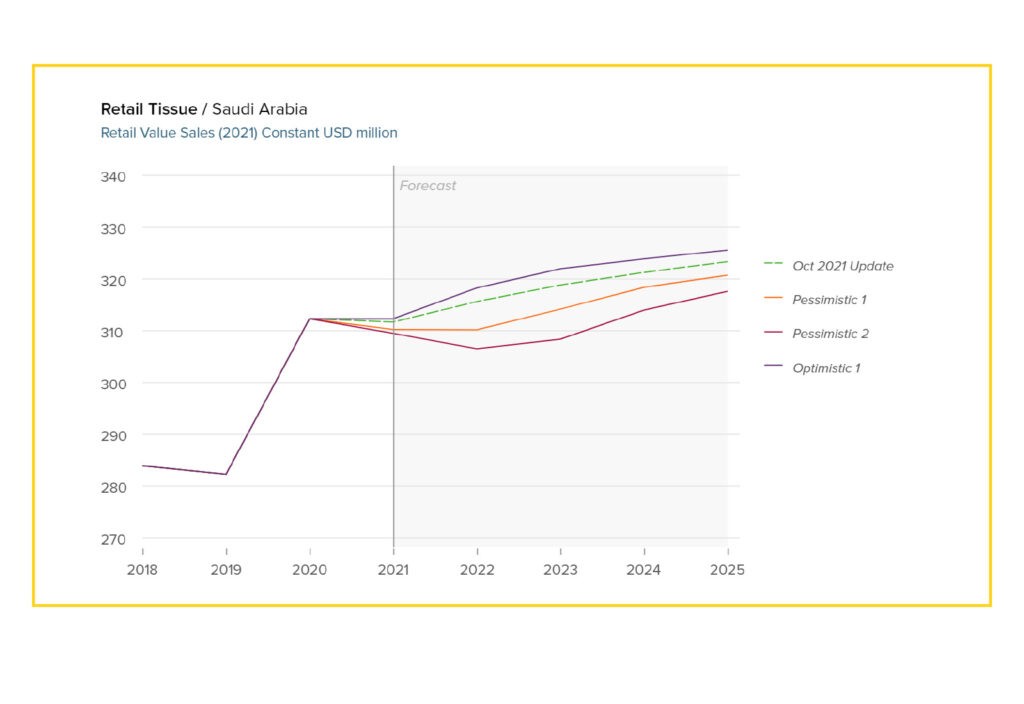

An illustration of the importance of tissue products to consumers came from Saudi Arabia, where in July 2020 retail VAT was increased from 5% to 15%. Despite decreasing disposable incomes due to wage reductions or unemployment (seen across the region),

Saudi Arabia retail tissue value grew by 12% in 2020 compared to 2019. In Saudi Arabia, Hygienic Paper Co Ltd (Fine) maintained its lead with 23% market share in retail tissue in 2020. It is the local representative of The Nuqul Group in the Kingdom, offering the well-known international brand Fine.

However, many tissue brands witnessed a decline in value share in 2020, as consumers shifted to lower-priced options due to the implementation of 15% VAT, which came as a blow, especially to low- and middle-income consumers. Companies responded by offering extensive price discounts (30-40% in some cases in Saudi Arabia), as well as dual/triple pack offers, free units, changes in pack sizes and value pack offerings in a bid to stay afloat and provide some kind of relief to consumers.

In particular, promotional activities and discounts have been used to stimulate interest in categories which have seen high growth due to consumers having to stay at home, and those with antibacterial properties.

Recent developments in Middle East

tissue market

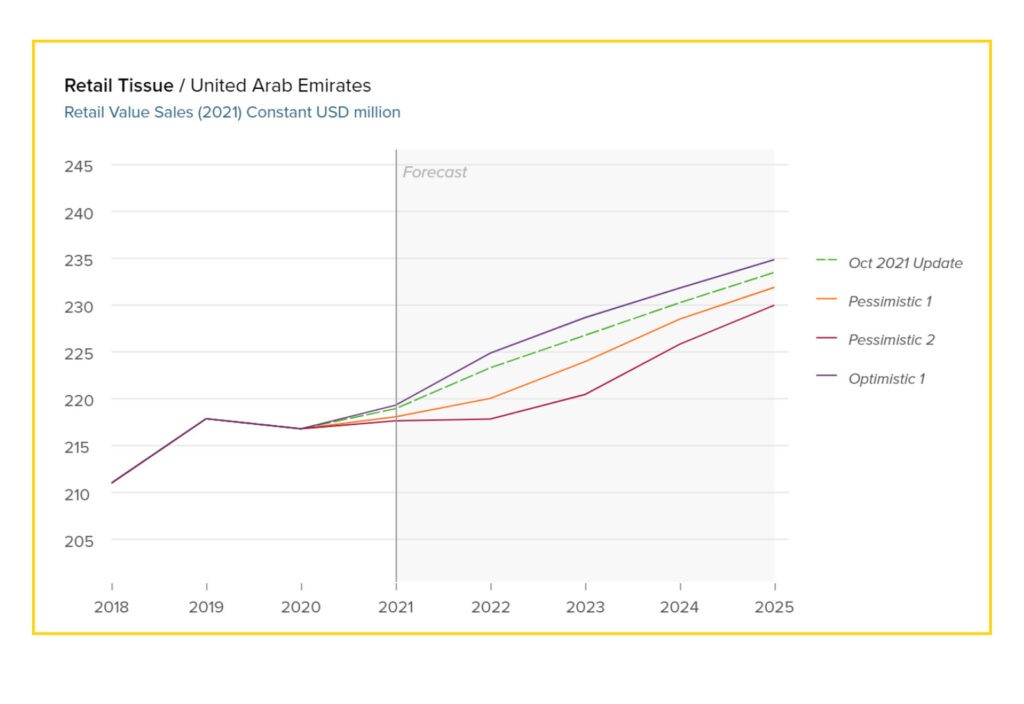

Retail tissue is set to continue to experience increasing normalisation in 2021 and beyond, as the threat of Covid-19 wanes due to social distancing, mask-wearing and the rollout of vaccination programmes. However, having witnessed a pandemic on such a scale, it seems highly unlikely that all consumers will immediately return to previous routines. There is likely to be some relaxation of hygiene and cleaning routines, although demand for many products, especially those directly related to home care and personal hygiene, will remain higher than before the pandemic. The continued rise in the population will also help drive further demand. By 2025, organic growth in the population is expected to contribute an additional three million consumers to Saudi Arabia.

Meanwhile, AfH tissue is expected to experience an improved performance in 2021, which will in part be due to the rebound from a strong decline witnessed in 2020. Domestic consumers are expected to regain their confidence in visiting foodservice outlets, whilst the return of tourists will also contribute to the improving performance; tourists significantly contribute to sales in the AfH channel. Generally in developed markets such as the US or Europe, AfH tissue’s value approximately constitutes 40% of tissue’s value, which is similar to trends in the Middle East.

Tourism is expected to gradually recover in major Middle East markets in 2021 and onwards, as religious pilgrimages open up again for international visitors in Saudi Arabia, Expo 2020 in Dubai, and the United Arab Emirates. Although unlikely to return to the levels of 2019, AfH demand for tissue will certainly improve compared with the huge decline witnessed in 2020.

Five trends shaping the retail tissue market

1. Affordability in focus; premium re-evaluated

With developing markets still lagging behind in terms of income levels and developed regions feeling the economic impact of Covid-19, affordability is high on the agenda in tissue, with value for money often taking priority over a premium positioning. For example, in the United Arab Emirates, average unit price per kg for toilet paper is expected to decline by a CAGR of 1.5% over 2020-2025.

2. Private label gains share of sales

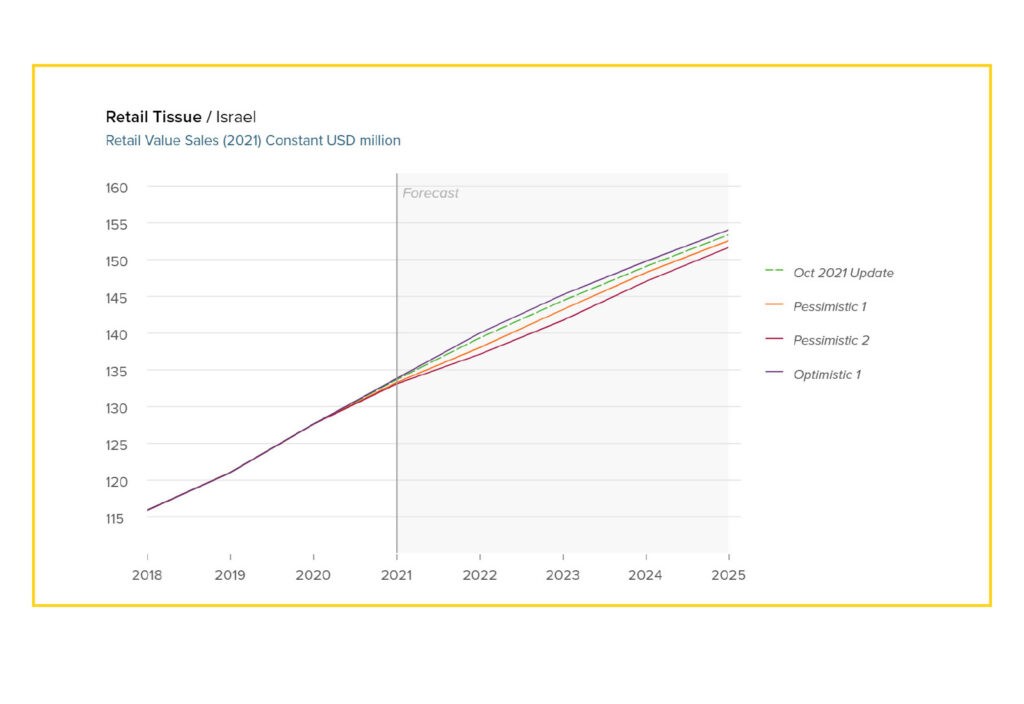

Private label is a significant contributor to sales in developed markets and has gained traction as increased availability across retail networks, particularly discounters, and consumers’ growing price sensitivity have favoured this segment worldwide. In Israel, private label held a 14% value share of retail tissue in 2020, which is expected to grow by a 4% CAGR to 2025.

3. Direct-to-consumer (D2C) insurgents drive purpose-led innovation

As an increasing number of consumers embrace e-commerce, rising D2C brands’ multi-faceted approach to building a purpose-led identity that embodies not only unique product features, but also authenticity, sustainability, and wellness, will become more entrenched in future branding. In Saudi Arabia and the United Arab Emirates, Fine Hygienic Paper FZE for Nuqul Group, launched The Fine Shop, an online store which gives consumers around the world access to the full range of Fine sterilised, wellness-related products.

4. Strong health focus catalyses adoption of wellness positioning

Consumers’ growing health concerns and hygiene awareness have prompted tissue players to dial up manufacturing transparency, as well as multifunctional cleaning and skin care properties in ingredient formulations and brand communications.

5. Sustainability remains an untapped opportunity for the tissue industry in the Middle East

Sustainability remained relevant even during the pandemic and continues to drive new product development and positioning. With it still being an untapped area, or limited in some areas of the global industry, the opportunities range from alternative fibres to overhauls in supply chain and environmental certification.

Future of tissue in the Middle East

Retail tissue in the Middle East will also continue to see strong demand early in the forecast period and is expected to reach $3bn by 2025. However, over time as the threat of the virus wanes and consumers start to spend longer periods of time outside of the home, including returning to their places of work, there is likely to be a subtle shift back towards AfH tissue through the horeca and business/industry channels, a trend which will be further supported by the eventual return of international tourists.

While overall tissue value growth slowed in 2020 due to a noticeable trend towards value-for-money products as a result of increasing price sensitivity in the Middle East, it is expected to eventually recover to record a stronger performance (at constant 2020 prices) compared to the review period. Beyond the immediate threat of the virus and economic shock where it is likely to take some time for the economy to fully recover, players are likely to attempt to add value to the market by improving functionality and softness of tissue and hygiene products using more natural components, whilst addressing the increasing demand for greater sustainability.

The influence of megatrends

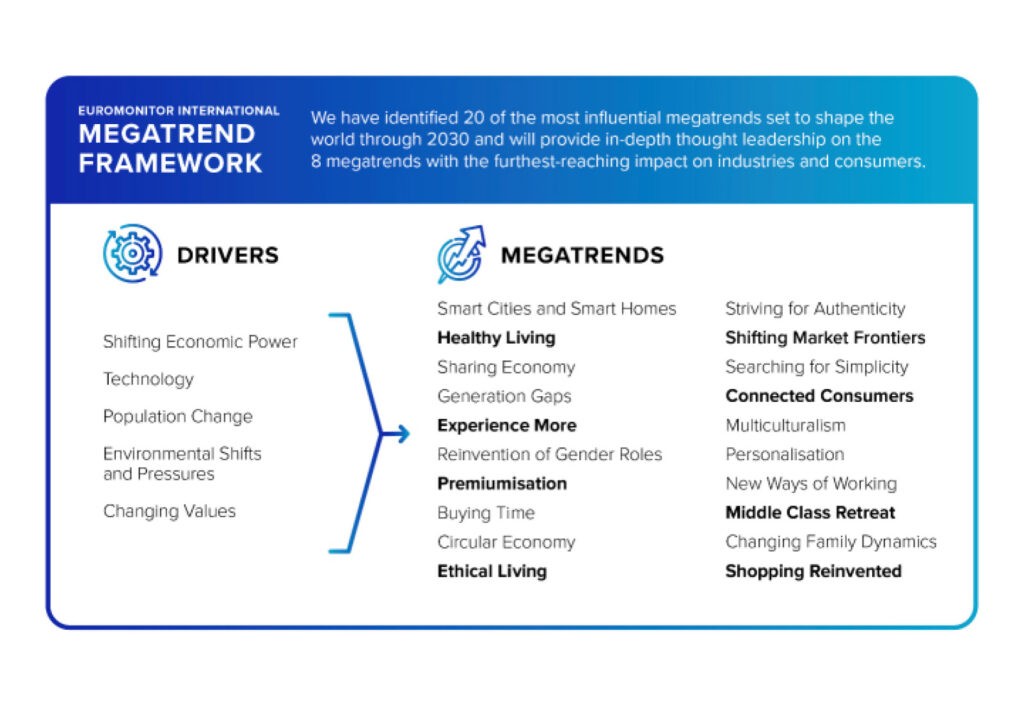

As with all FMCG, tissue sales will largely be governed by a broad set of five socioeconomic drivers generating and shaping consumer trends. These long-term shifts explain the ongoing changes we see in consumer behaviour and ultimately tissue selection.

1. Shifting Economic Power: The Covid-19 pandemic is likely to boost existing global decoupling trends by deepening divides between global economic partners, and to allow China to secure its position as an economic power centre on a par with the US. China is a major non-oil trading partner for the Middle East with exports of raw material and finished tissue products.

2. Population Change: Lockdowns and economic recessions triggered by Covid-19 are resulting in short-term disruption in global migration and urbanisation trends, which directly affect the expat population in the Middle East, constituting 89% of the United Arab Emirates and 25% of Saudi Arabia’s total population.

3. Environmental Shifts and Pressures: Competition for resources and increasing awareness of environmental challenges are having a transformative effect on consumer behaviour – sometimes at a rapid pace. A sustainable eco-friendly tissue industry is on par with expectations.

4. Technology: It plays a pivotal role in consumer decision-making and the ability of businesses to meet the needs of today’s consumers. It has created upheavals in consumer expectations, lowered the barriers of entry and inspired new business models. For example, tissue players in the Middle East have developed cost-effective ways of producing perfumed tissues and rolls with high water absorbent features.

5. Changing Values: Covid-19 is likely to embed long-lasting fear and anxiety, resulting in consumers re-evaluating their values, priorities and behaviour, with some permanent shifts expected.