By Marco Martins, Msc Science Forest and Chemical Engineering – Klabin’s Customer Technical Service Manager, and Rodrigo Fantini, Msc Industrial Engineering – Klabin’s Customer Technical Service Specialist.

Today, discussions about carbon footprint, renewable, recycling, non-wood fibre alternatives (such as straws, bagasse, bamboo, reeds and grasses), water consumption, etc, could be considered market drivers to reinforce the business models that have been developed and implemented by Brazilian pulp producers for over forty years.

The Brazilian pulp and paper industry has been offering a pulp product that has in mind the importance of tissue-maker quality and performance perception (optimisation in bulk, softness and tensile strength), cost competitiveness, front-edge of forest and production technology, with an intense work and continuous investment covering all governance matters, in particular environmental and social issues (ESG).

There is room for all kind of pulps (from non-wood to recycled) in the tissue paper fibre furnish composition, but it is essential to have in mind the sustainable principles and concept of global environmental demands. That is the reason for the historic success of eucalyptus and, more recently, pine pulps produced in Brazil.

Introduction

In the early 70’s, Borregaard formerly open the international pulp markets to the eucalyptus wood planted on Brazilian soil. Historically, this raw material was developed and well known for its pulp characteristics by domestic producer Suzano at least twenty years earlier.

Companies, such as Klabin/Riocell/Bacell, Aracruz, Suzano, Jari, VCP, Lwarcel, and Cenibra, were responsible for showing the benefits of this new fibre to the world’s paper industry. In the beginning of this marketing strategy, the technical expertise was focused on optimising the performance of eucalyptus pulp for the printing and writing segments. Technical agreements with global tissue manufacturers have mainly reinforced the advantage of tactile softness and the substitution of long fibre in the tissue paper’s fibre composition.

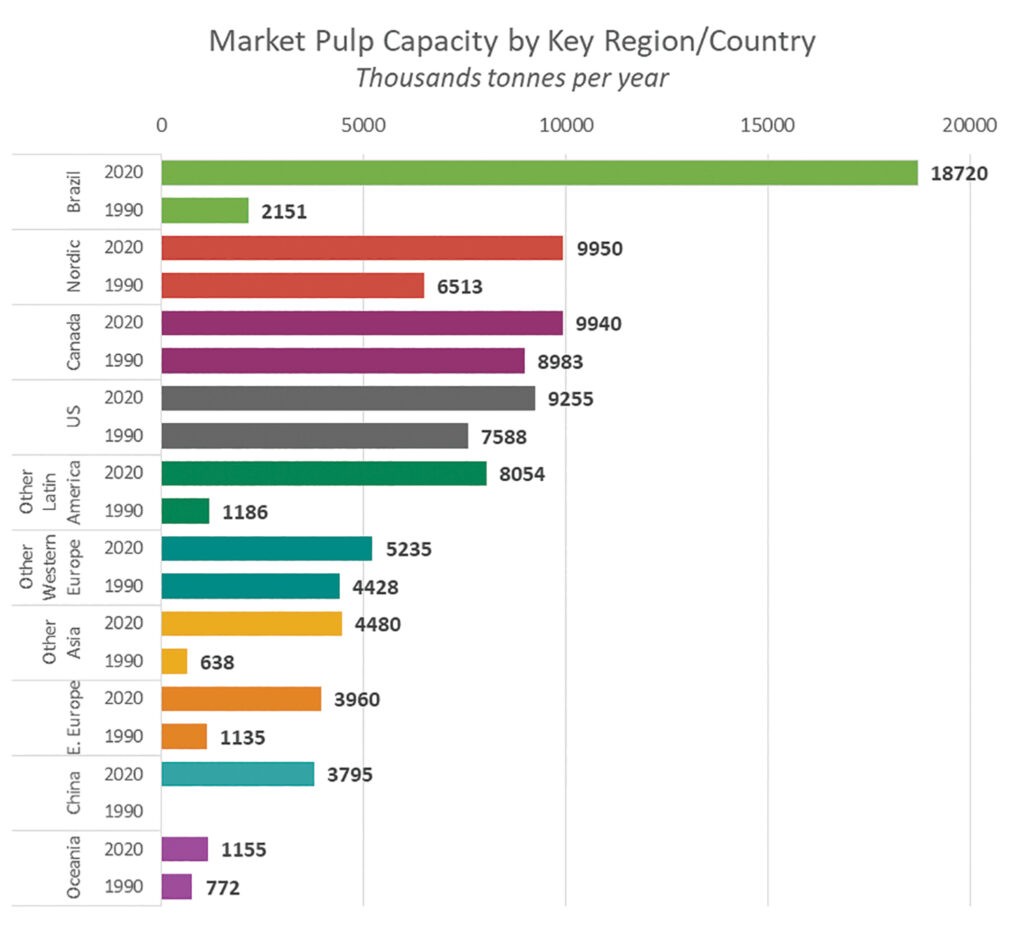

Five decades later and we can see the use of Brazilian eucalyptus fibre spread across a wide range of paper segments, as well as in pulp derivatives. Eucalyptus pulps correspond to almost one third of all global market pulp, and is still growing significantly in Latin America.

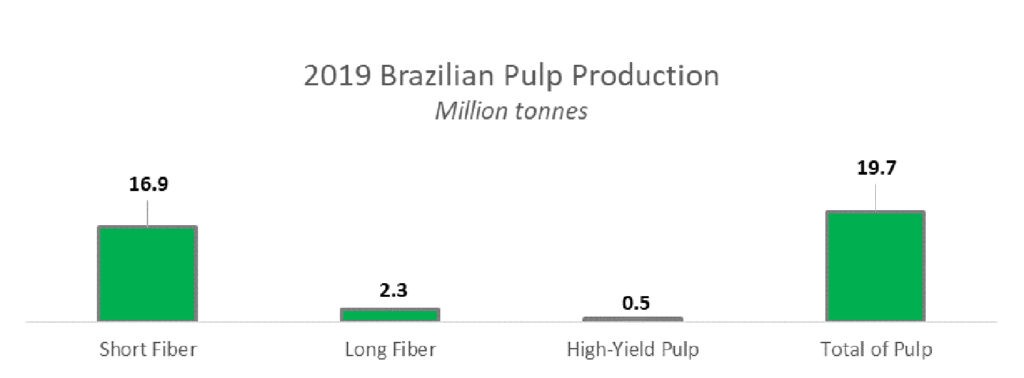

Figure 1 illustrates a comparison of market pulp capacity from 1990 to 2020 (Fastmarkets RISI, 2021). In line with this movement, it shows the eucalyptus expansion in Brazil, while Figure 2 shows the current Brazilian pulp production (IBÁ,2020 – Tree Brazilian Industry – Indústria Brasileira de Árvores).

Is there a business and technical formula for the global acceptance?

There is. The answer could be represented by some strategic pillars, such as: innovation in tree breeding and forest management, Industry 4.0, R&D and product quality, ESG/sustainability, forest and products certifications, technical services and suppliers partnership. As a result, the papermaker has been receiving a very stable and homogeneous product on top of the agreed pulp quality properties.

Tree breeding and forest management

Based on productivity and competitiveness, Brazilian pulp producers have been working on evaluating each eucalyptus species (grandis, urophylla, dunnii, saligna, etc) on their behaviour in soil and climate, pest resistance, fibre morphology, and many other wood characteristics.

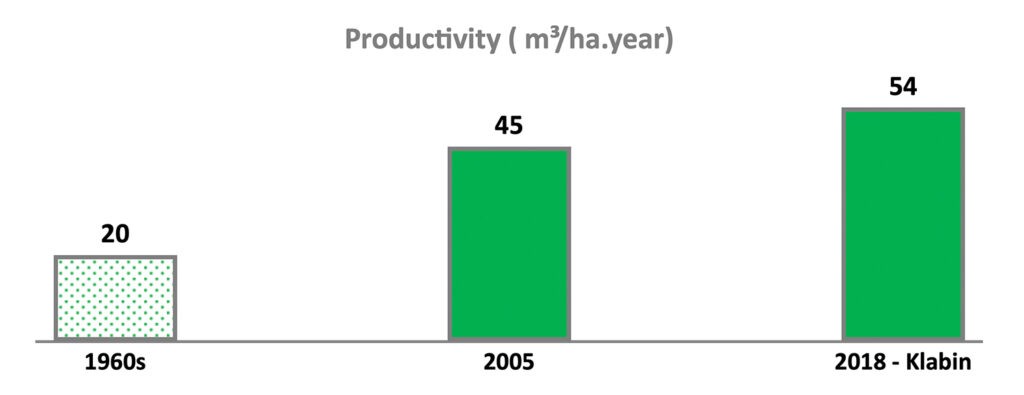

This long-term forest innovation process has as a baseline the commitment to combine and align the eucalyptus wood properties with the best practices in forest management, industrial processes optimisation and paper application, which has resulted in clones responsible for improving more than double the productivity over the past 50 years, reaching figures closer to 50 m³/ha.year in the current market, and with a clear new path throughout this decade.

When analysing forest productivity in different countries and regions, due to scientific work and techniques, as well as soil and climate, Brazil is among the most competitive in the world.

Brazil’s wood scientists work with a varietal mindset, searching for the best fibre and clones properties assemblage to optimise the papermaking operations. That is a rule to make homogeneous and very competitive eucalyptus forest plantation. As a consequence, the very balanced wood chips density in the target range allows a better control and uniformity of pulping conditions, such as: temperature, white liquor composition and kappa number (lignin correlation).

The cooking process stability is also important for the remaining bleaching, pulp sheet formation and drying operations. Therefore, despite the huge change in the daily production increase in recent years, the off-specs material was also substantially reduced to levels below 0.5% mainly due to the combination of wood quality supply, chips dimensions and pulping process control.

FSC (FSC-C001941), PEFC and other forest certifications confirmation the benefits of working in partnership and respecting neighbouring communities, sharing forest knowledge and bringing new logistics software to upgrade living standards, can reduce negative impacts of wood and product transportation. Moreover, they help maintain a balance with the natural and planted forest through mosaic pathways, protecting fauna and flora, preserving river springs and creating green corridors. Klabin Mosaic Strategy was the first company in the pulp and paper sector in the Southern Hemisphere to obtain FSC in 1998.

These are clear examples of an industry committed to sustainability at all stages of the supply chain.

Industry 4.0, and more artificial intelligence to come …

From the single mill line of 200,000tpy capacity in the 1970s to close to 1,400,000tpy in 2021, there is significant industrial advancement in all aspects covering equipment, technology, environmental legislation, and product application.

Nevertheless, there is no doubt that this production capacity increase could only be achieved with the technicians’ continuous learning, support of technology and process automation in all pulping, bleaching, recovery, causticising, energy and logistical processes. It is essential to outstanding the role of companies like Andritz, Voith, Valmet, Siemens and their partnerships with Brazilian professionals that could achieve this new level of capacity while improving the pulp quality profile and environmental performance.

In addition to production profile growth along the years, we could also see the elimination of elemental chlorine in the bleaching stages and anthraquinone in the pulping process; the introduction of oxygen compounds as chemical agents, technologies to upgrade cooking and drying machines, as well as a permanent implementation of process control automation and artificial intelligence.

The introduction of a second reactor of oxygen delignification brought also more selectivity to remove the lignin components and a positive increase of the hemicellulose content. Moreover, enhancing the average pulp viscosity as well as improving the final product characteristics homogeneity. In terms of papermaking, there are positive gains noticed and measured in the Brazilian market pulps, such as very tight variation level of brightness, higher strength properties and a complete alignment with the paper reference specification.

R&D and product quality

In the last two decades of the 20th century, the Brazilian eucalyptus market pulp producers have concentrated their R&D on forest productivity, as well as developing technical articles and visits to demonstrate the paper benefits and correct applications of eucalyptus fibres in paper manufacturing.

Klabin/Riocell (partnership with Beloit) and Aracruz developed refining pilot plants to support many studies to check the pulp performance at different SEL (Specific Edge Loads) as well as the correct refiner settings to evaluate single pulps or blends of fibres. Later, Voith installed a complex tissue mill facility in São Paulo that has been very helpful to pulp and tissue producers.

In recent years, with new capacities and players in Brazil, there has been intense R&D work by the main pulp producers such as Klabin, Cenibra, Eldorado and Suzano, investing in lab equipment, pilot plants, technology centres and people-learning related to new paths of business innovation to the corporations.

The focus on nanotechnologies, such as MFC (microfibrillated cellulose), has been an important new target to cover potential demands of the packaging and tissue segments, and a reason why Klabin invested and installed a pilot plant with a 1,000 kg/day capacity.

There are already many studies/investigations developed by some international institutes such as North Carolina State University and the University of Maine, covering the benefits of the MFC. New doors will potentially open to Klabin and the Brazilian market pulp competitors to develop new technical and commercial strategies on this field.

Klabin has been also conducting extensive research in the uses of lignin in their pilot plant, focusing on the development of sustainable technologies and applications such as resins, fibreboards, plywood and abrasives; in plastics, by increasing the percentage of renewable raw materials; and in carbon fibre, by replacing the use of fossil-based materials. The wide base of different wood species processed at the mills gives a great opportunity to be a future producer of both softwood and hardwood lignin in South America.

On top of that, since the beginning of the 90’s the Brazilian pulp industry has been working hard on a quality continuous programme based on improving process conditions to enhance product homogeneity at higher specification level. This has been characterised by many actions on implementing new quality systems (on top of ISO 9000 and 14000) and environmental requirements (ISO 50000, ISO 45000, SMETA, Ecolabel, EU Flower Label, Nordic Swan, LifeCycle, etc).

ESG – Environment, Sustainability, Governance

The current ESG’s trend in the global industry could be considered a standard rule for the Brazilian market pulp industry in over 50 years, since the famous Borregaard´s pollution episode in 1973.

In memory of Brazilian environmentalist Jose Lutzenberger’s green environmental model and life concepts, the Brazilian pulp industry developed its own ESG business handbook so it could be ahead of the market when using technology to treat and to prevent in all fields (carbon footprint, water and wastewater reduction, greenhouse emissions, specific raw materials and energy, consumptions, etc), as well as implementing the circular economy business concept, among other management actions. On top of that, significant work is being done with all neighbourhood communities, creating and sharing values through social sustainability pillars. That is the main reason there is a growing industry in a market/consumer awareness that demands new environmental, social and governance attitudes and responsibilities along all product life cycle.

The Klabin Agenda 2030 (KSDG – Klabin Sustainable Development Goals) prioritises ESG themes aligned to the company’s growth plan, and says: “The strategic goals enshrined in the KODS are the responsibility of all Klabin’s areas and units and were designed to create value for all stakeholders (biodiversity, communities, employees, business partners) in line with the United Nations Sustainable Development Goals”. In 2021, Klabin also launched a panel on its website with all the company’s ESG KPIs, where it is possible to observe the evolution of the 23 goals (KODS) to be achieved by 2030.

Customer technical services

Technical services are not restricted to just technical assistance, but with the customer satisfaction cycle from performance to product development. That is the business strategy that over the decades has been managed by the Brazilian bleached eucalyptus market pulp companies to overcome initial technical restrictions to a new fibre in the late 1970’s, selling not only a cost competitive product but adding value to the different paper segments.

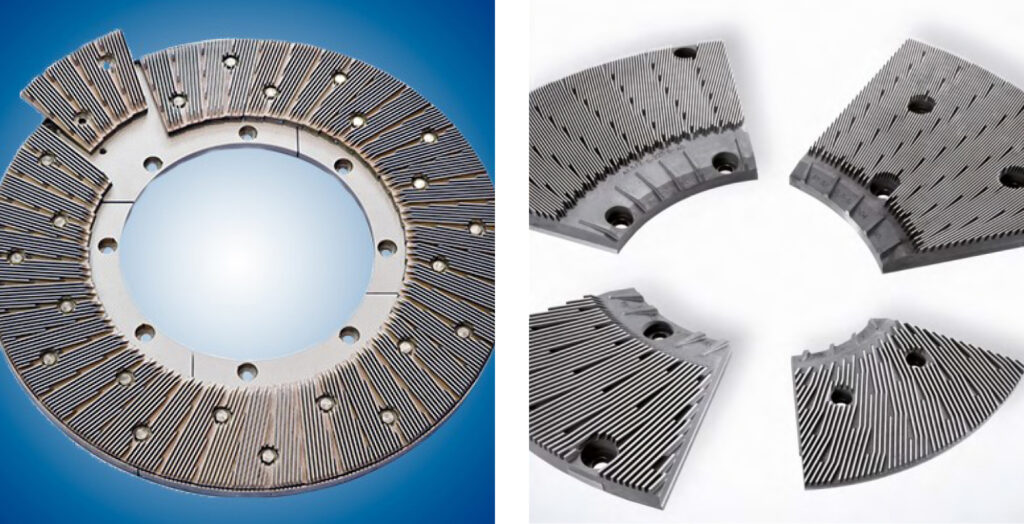

Since the 1980s and 1990s, pulp manufacturers such as Riocell and Aracruz have had pilot refining plants in their facilities to evaluate the performance of fibres and establish co-relationships with the properties of the producers of papers using their pulps. “This example of refining pilot plant is equipped with a single disk refiner (12-inch diameter) with an automatic system to assure a positive pressure inside the refiner. The refiner can be operated at different rotational speeds. Pulp flow through the refiner is controlled by a positive displacement pump and can be changed to allow different of net energy application. It is possible to run both single and multiple-passes under nominal consistencies from 2.0 up to 6.0 % (MANFREDI, 2006).”

Klabin’s technical services area has been consistently seeking actions that aim to make a difference in the pulp market with customers, carrying out customised technical workshops for customers, guided technical visits by cross-functional teams, shared development projects and the search for technical synergies.

Supplier’s partnership

The importance of the supplier’s chain partnership has been vital to our industry, involving raw materials/inputs, technology, process performance and innovation, among other fields. Nowadays, the refiners have disks designed to work with eucalyptus fibre (Figure 5 and Figure 6), reducing eventual problems with vessel elements and/or fibre cutting. This is thanks to some players and their expertise on disk refining design, such as Voith, Valmet, Andritz, AFT Finebar and Calpher, companies that have developed refining plates with low refining intensity.

The art of producing different papers has already involved adjusted formulas to control process conditions related to the specificity of the eucalyptus pulp raw material (disintegration time, consistency in the hydrapulper, join or separated refining, fibre composition proportion, pulp supplier characteristics, etc). For example, Valmet’s tissue pilot plant in Sweden can carry out a series of setups referring to the newest technologies available and existing raw materials from pulp, and all this in a real way similar to industrial plants.

R&D programmes involving chemical suppliers develop chemical optimisation to operate with eucalyptus fibre in the papermaking operation, keeping the control of the wet and dry areas (zeta potential, conductivity, fines, dust, etc) as well as in the converting area of tissue makers. That is a result of an integration synergy from pulp producers and equipment/chemical suppliers, providing papermakers with the business support and technical expertise needed to make Brazilian eucalyptus pulp an important player in their fibre composition.

Eucalyptus’ future on tissue and other paper grades

The entire pulp and paper cycle synergism was obtained due to a global chain of supply, companies partnerships, and product development focused on customer feedback. This has enabled Brazilian eucalyptus players to produce a very homogeneous eucalyptus fibre as well as a top-quality pulp profile over the past 50 years.

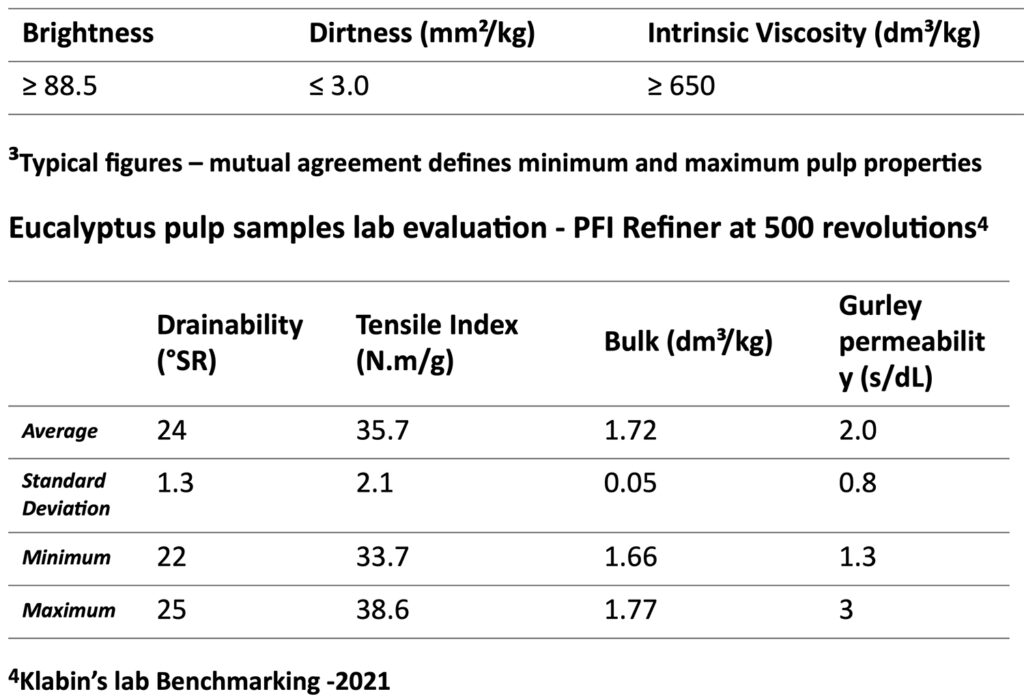

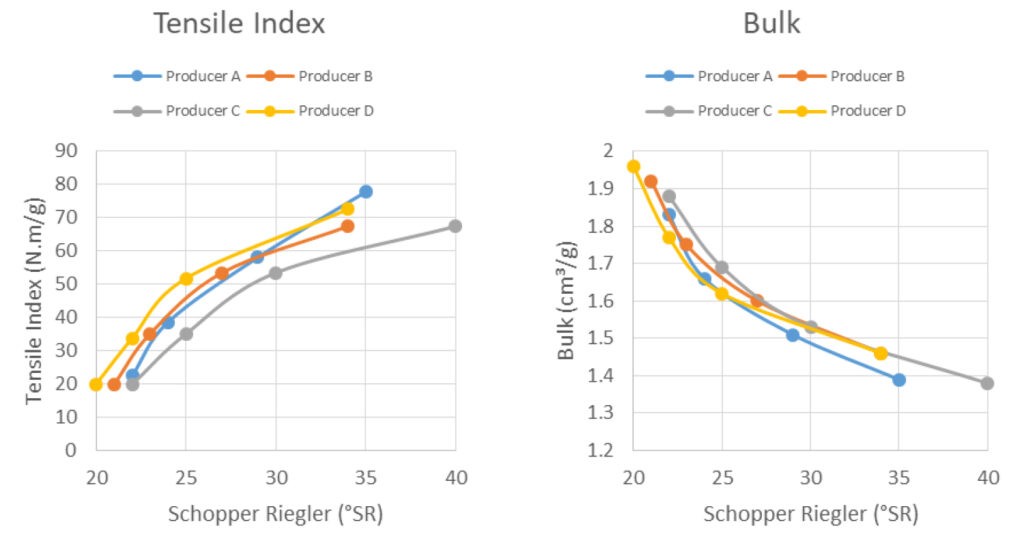

Amongst the Brazilian pulp players, there are slight differences mainly associated with wood profile (age, climate, soil, region, species, clones, density, etc) and production technology (cooking mill process, chemicals, bleaching sequence, etc). However, lab pulp samples cross-check (benchmark studies) show that they are within a specific narrow range that enable papermakers to use most of their pulp in different fibre formulas without significant impact on their process.

The eucalyptus suppliers pulp properties differences are much narrower in the low drainability refining, which characterise the tissue production (Figure 7 and 8). Its combination with a very homogeneous fibre anatomic distribution and a product specification that mitigates the negative potential impacts that pulping and bleaching process variation bring and enhance papermaking stability. It is essential to mention that this statement doesn´t take into consideration any future studies developed by one or more eucalyptus pulp suppliers that could launch a product with optimised characteristics into the tissue segment, such as softness or strength improvement. So far, the homogeneity properties obtained from the forest to the drying machine enable the use of one or another Brazilian pulp supplier with some slight process adjustments, whenever is necessary.

From now on, what will come next in eucalyptus fibres?

By aiming to replace part or all of the use of long fibre, there is demand coming from the tissue market for a higher strength eucalyptus pulp, without losing tactile softness, and other paper segments looking for a significant reduction on refining energy. There are already some patents working with enzymes and starch, among other components, to increase the eucalyptus strength properties (mainly tensile), but with relative little success so far. It looks that the MFC (microfibrillated cellulose) and nanocellulose solutions could be the right path to cover this market, but still need to reduce cost and increase the technical information to be communicated to the tissue makers.

The Brazilian contribution to the long fibre pulp development

The Puma project implemented by Klabin in 2016 aims to cover the main needs of the paper and absorbent hygienic products had as objective to offer complete fibre solutions: eucalyptus and pine pulp in bales as well as fluff pulp (reels). It currently produces around 1.15 million tonnes of eucalyptus and 0.45 million tonnes of pine market pulps to the tissue and other paper markets as well as fluff pulp to hygienic and absorbent products. We offer ECF (Elemental Chlorine Free) pulp grades to the tissue market. There are also some products under developments covering TCF (Total Chlorine Free/semi-bleached), wire free bales (paper strapping), single use plastic substitution, MFC as a strength additive, as well as new techniques on tree breeding such as somatic embryogenesis, genomic wide selection, chromosomic duplication focusing on long-term wood productivity.

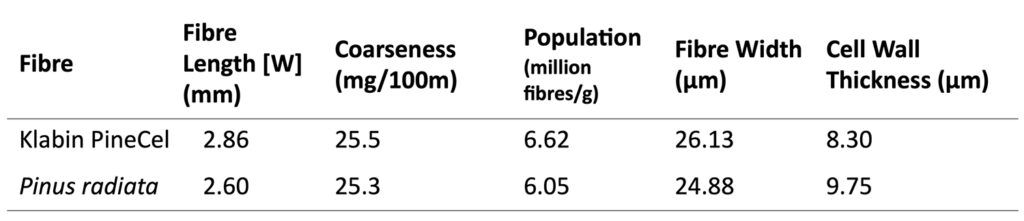

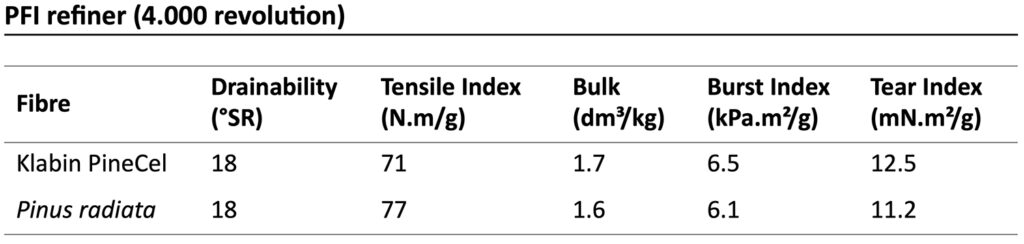

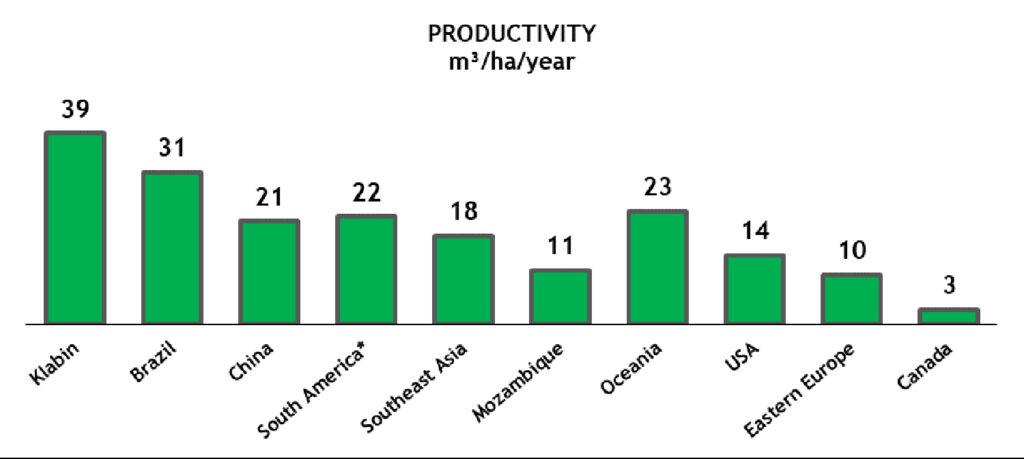

Klabin has been working on pine tree seedling for more than 70 years, reaching a high standard of fibre homogeneity to create a market pulp (brand name PineCel) that fulfills the quality requests of the packaging, fibrocement, specialties (filter, label, adhesive, decor, currency, etc) and tissue papers. Due to its fertile soils and favourable climate, Brazil has a higher forest pine productivity compared to other countries/regions, as shown in Figure 9.

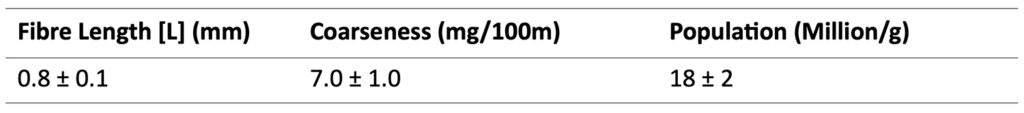

The main species planted by Klabin are loblolly and slash pines, and the business concept is focused on fulling the market pulp demand instead of wood application. As a consequence, there is very homogenous plantation and fibre morphology, enabling a market strategy quite similar to the radiate pine developed by the Chileans.

In our woodpulp market perspective, it is quite clear that the Brazilian pine could be in the same commercial and technical range reference in comparison with the radiata pulp producers, when we are considering business pillars, forest and fibre homogeneity, as well as pulp properties/applications. In general terms, taking into consideration a comparative evaluation with the USA Southern Pine, the Brazilian Pine has a more homogeneous fibre anatomic distribution and a quite similar technical performance in the absorbent product segments, such as fluff pulp.

The current experience shows that the use of 20-30% of Brazilian pine in the tissue brings benefits to the paper production process (machine speed) as well as to paper strength properties (tensile, burst and tear index).

Final comments

Brazilian market pulp producers are completely committed to the long-term sustainability, competitiveness and innovation business drivers, not as a current trend, but as a historic way of seeing the consumer market since the 70’s. Based on those principles, we have invested on continuous quality improvement, Industry 4.0, nanocellulose and lignin products, green energy, biomass, effluent and CO2 reduction, as well as capacity optimisation (debottlenecks) and expansion (greenfield mills).

At the same time, we are also focused on the short term, implementing internal and open innovation through domestic and international partnership covering a broad spectrum from the forest to the final product. As a result, in our opinion this decade should be characterised as a new path to our Brazilian industry, reinforcing its importance and leadership in the global tissue scenario as well as other paper segments and cellulose derivatives.

References:

ABTCP – Sustainability as a competitiveness factor for the Brazilian Pulp and Paper Sector. Revista O Papel, pages 68-70. October 2020.

MANFREDI, Vail. Evaluation of refining strategies for combined use of softwood and eucalyptus pulps in papermaking. Pan Pacific Conference, 2006.

MARTINS, Marco AurÈlio Luiz Martins; KILPP, SÈrgio; FREITAS, Guilherme.; ABDALLAH, Munir. Atendimento ao cliente e tendÍncias de mercado para celulose de eucalipto. Newsletter: O papel, july, 1995.

RATNIEKS, Edvins. Overhaul of South American economic climate and market opportunities emerging acceptance of eucalyptus fibre ñ Tissue Makerís Perspective, Tissue World S„o Paulo, May, 2015.

CAMPOS, Edison da Silva; FOELKEL, Celso. A evoluÁ„o tecnolÛgica do setor de celulose e papel no Brasil, ABTCP, 2017

FINEBAR, https://aft-global.com/index.php/pt/products/discos-refinadores-minisegment (2021).

FOELKEL, Celso; RATNIEKS, Edvins. Uma discuss„o teÛrica e pr·tica sobre polpas de Eucalipto para fabricaÁ„o de papel Tissue, 29∫ Congresso anual de celulose e papel da ABTCP, realizado em S„o Paulo, Brasil de 04 a 08 de novembro de 1996;

FOELKEL, Celso. Eucalipto no Brasil, histÛria de pioneirismo. Vis„o AgrÌcola N∫4, ESALQ, julho, 2005;

FOELKEL, Celso. Reflexıes acerca da competitividade da ind˙stria brasileira de celulose kraft branqueada de eucalipto – Eucalyptus Online Book and Newsletter, April, 2012;

FOELKEL, Celso. A sustentabilidade das florestas plantadas de eucalipto na rede de valor da celulose e papel no Brasil, Eucalyptus Online Book and Newsletter, chapter 30, December, 2012;

IB¡ – Instituto Brasileiro De ¡rvores. RelatÛrio 2018. S„o Paulo: IB¡, 2019.

IB¡ – Instituto Brasileiro De ¡rvores. RelatÛrio 2019. S„o Paulo: IB¡, 2020.

KLABIN S.A., https://esg.klabin.com.br/en/ (2021).

VALMET, https://www.valmet.com/board-and-paper/board-and-paper-machines/technology-center/ (2021).

Special acknowledge reference: Brazilian researchers Celso Foelkel, Luiz Barrichello, Claudio Ergilio-Silva, and in memory of environmentalist Jose Lutzenberger.