Tissue producers faced multiple challenges in 2021 as demand cooled down and input costs increased significantly. During the third quarter of 2021, modelled manufacturing costs in Europe and North America exceeded previous historical levels on both sides of the Atlantic. For good reasons, companies are increasing their attention towards additional fibre sources and energy efficiencies to take on cost fluctuations. Here, AFRY Management Consulting’s Pirkko Petäjä, Principal, Hampus Mörner, Manager, and Santtu Koskinen, Analyst, assess the situation.

In the wake of the pandemic, the tissue industry has been experiencing two very different but also somewhat extreme years. In short, 2020 was characterised by strong global sales (At-Home) combined with low and mostly stable input costs, while 2021 was the opposite in the form of declining or modest sales growth combined with soaring input costs. Last year, the tissue industry was exposed to surging fibre and energy costs simultaneously. A rare situation hardly observed historically. This overall rise in commodity and energy costs had of course a negative impact for all raw material and energy intense industries, including tissue.

Reading from available financial results, the negative impact from increasing manufacturing costs on profitability seems to have lasted throughout the most part of 2021.

Management Consulting

Signs of improvement started to become visible only towards the end of the year in the form of costs being passed on to the clients in prices and early easing of fibre costs (at the time of writing, financial results from the fourth quarter are still to be released).

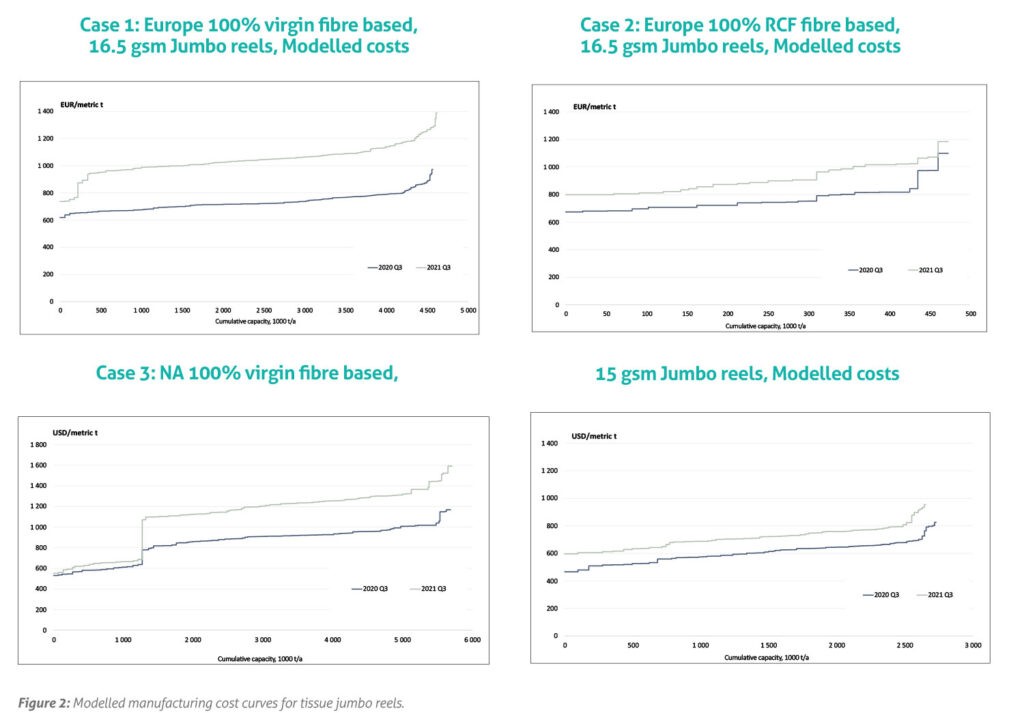

Based on AFRY’s unit price databases and cost modelling tool, manufacturing costs for selected European and North American tissue machines were modelled. The analysis covers most of the production footprint in North America and Europe and is divided into four different cases depending on fibre base and region.

Fibre and energy took a major toll on manufacturing costs

Full usage of the main fibre is assumed, no virgin/RCF mixture furnishes are considered in the analysis. For fair comparison, every tissue machine in each respective case is assumed to be producing comparable products with similar grammage (gsm) and fibre furnish.

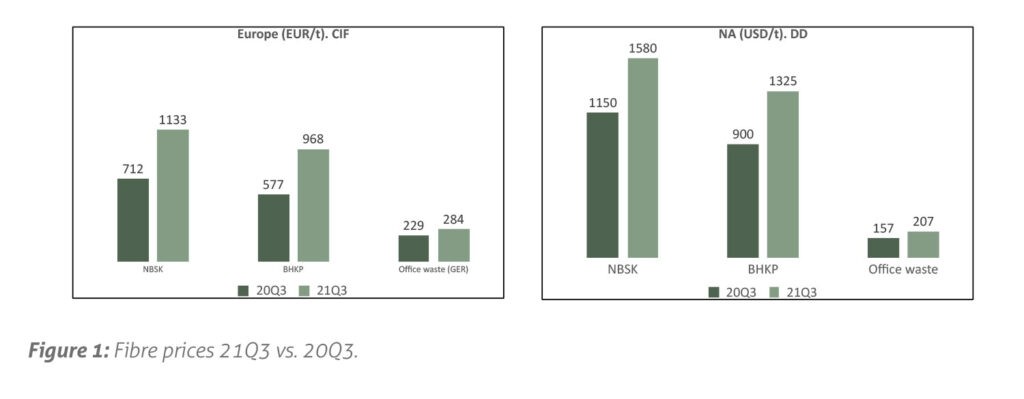

Unit prices refer to the third quarter of 2020 and 2021. Fibre prices and the movement over one year are stated in Figure 1, where pulp prices are before any adjustments for discounts.

Each of the modelled tissue machines are plotted on the cost curves above (Figure 2), where those with the lowest total manufacturing costs are found to the left and those with higher costs further to the right. The two main components determining the total costs are fibre and energy. The manufacturing costs among tissue producers, depending on case, increased on average according to the below (21Q3 vs. 20Q3)

Case 1: 320 EUR/t (+43%)

Case 2: 148 EUR/t (+19%)

Case 3: 260 USD/t (+30%)

Case 4: 110 USD/t (+17%)

For cases 1 & 3 (virgin fibre), fibre made up for about 85% of the cost increase while in cases 2 & 4 (RCF based) this share was about 55-75% where North America was in the higher end of the range. Although fibre was the main component of the increase, energy also made up a significant share of the cost inflation. Energy prices increased some 40% in Europe and 20% in the US (gas also impacting the price of electricity and being the main driver behind cost increases in both regions). This major increase in energy prices is dwarfed by the fibre price rally, although energy costs also represents a major concern to the producers.

Tissue machines at lower cost levels, regardless of the case, tend to hold advantages such as geographic location, for instance close to a harbour, fibre integration (more common in North America than in Europe), high tissue machine speed and width (scale). The energy concept also came to play a very important role during 2021 where for instance access to co-generation was of great advantage. Tissue machines with these advantages also proved to be less volatile to the rise in input costs last year.

Modelled tissue machines in North America typically come out at lower cost levels than in Europe in the analysis (currency adjusted). Tissue machines and mills in North America tend to be larger than in Europe, offering prospects for economy of scale.

However, the major factors behind the lower cost levels and volatility are lower energy prices than in Europe, a higher share of integrated pulp and more companies befitting from higher pulp discounts due to their size as a buyer.

To the right on the North American curve (case 3), numerous tissue machines producing structured and textured tissue grades are found (such as TAD). These technology concepts demand more energy per produced tonne compared to conventional concepts (like DCT).

Upsides come in the form of higher bulk, softness, absorbency and price premium. In addition, if looking in terms of converted products where the TAD has a fibre cost advantage per roll due to the higher bulk, the cost position of standard vs. structured tissue machines can be reversed. AFRY estimates that about 40% of the total installed tissue production capacity in North America is within structured and textured qualities in which TAD dominates.

Regardless of the case, the 2021 increase in manufacturing costs was above any previous movements observed in AFRY´s tissue cost modelling. Also, in several cases the costs were dangerously close to or even above levels considered profitable. With such turbulence experienced in the last two years, tissue producers are increasingly seeking ways to mitigate risks and volatility in input costs.

Initiatives to lower costs and to mitigate the cost fluctuation

Tissue producers see an increasing need to control cost fluctuation and, if possible, reach in general lower manufacturing costs. To achieve this, fibre and energy are two obvious areas to address. For instance, new and additional fibre sources are becoming more relevant.

Although based on the above analyses the cost increase for RCF based tissue was considerably less than for virgin fibre, the shrinking availability of traditional material (bright & sorted) limits or complicates significant increase of RCF usage. However, new less traditional sources are being addressed to a larger extent, like for instance recovered paperboards.

Clearly, the ability to source, handle and market products based on these “new” fibres opens opportunities for increased RCF availability and costs savings. Alternative virgin fibres, such as grass, straw and bamboo (with short rotation times) are being increasingly investigated and invested in among tissue manufacturers. These sources can be cost efficient and mitigate exposure to cost fluctuations compared to wood pulp, although the supply is limited.

Also worth noting is that while the access to fibre hedging tools has improved over the last years, traditional stakeholders within pulp and paper (including tissue) might be participating or investigating these opportunities to a larger extent than before.

In order to tackle the impact of increasing energy costs, higher energy efficiency is targeted by most producers and the effort is supported by technology providers. Specific energy consumption has decreased through technology developments in the press and drying section, water and heat recovery improvements, etc. Energy concepts have a significant impact on exposure to energy price fluctuations. Such concepts include own generation of power, usage of steam or exhaust gas in hood, etc. The switch from fossil fuels to biomass/biogas may require investments but offers a more stable cost environment.

Sustainability requirements and cost issues can be combined

Like in most industries, an increased focus on sustainability and especially carbon footprint, is becoming of greater importance. Multiple “green” options are addressed of which many are related to fibre and energy. Therefore, important sustainability requirements can often be addressed together with the means to improve cost efficiency – and stability.

Alternative virgin fibre sources are motivated by appearance as a “green alternative” whether this is always the fact or not. In any case, these fibres can mitigate the impact of market pulp price fluctuations to some extent. In recovered fibre, new sources help to tackle not only the decreasing availability of bright sorted material and price fluctuations but are also seen as green, circular and innovative solutions.

As for energy, carbon reduction is a major driver behind actions taken, but can simultaneously mitigate the impact of cost fluctuations for fossil fuels. Increased investments and initiatives in technologies to utilise hydrogen, biogas and geothermal heat have been seen worldwide through the last years. In addition, concepts like full usage of biomass-based energy (steam heated hood) have been developed to be used even for fast running tissue machines (improved dust removal and large diameter Yankees).

Besides fibre and energy alternatives comes the overall improvement of efficiency and reduction of specific consumption figures. These are sustainability issues that have a clear correlation to the total manufacturing costs. In order to achieve these reductions, investments in improved technology as mentioned above are observed. This concerns water consumption, energy consumption and quality and volume of effluents.