The strongest motivations fade when set against the cost. Pirkko Petäjä, principal, Pöyry Management Consulting, explains the hard-nosed reality behind the environmental issue.

Many consumers say that they prefer the eco-friendly products, but in reality a large number of consumers actually pass this preference and buy the cheapest product. Some studies show that slightly over 60% of consumers have bought a product with social or environmental benefit during the last year and slightly under 60% would purchase a product with lower quality or efficiency if it were more socially or environmentally responsible.

The estimates of what share of consumers actually would be willing to pay more due to environmental reasons varies depending on the study, the geographic area, type of business and especially of the size of the green premium, i.e. the additional charge paid for having a green product.

The biggest differentiator is the size of the green premium. With a premium lower than 10%, more than half of consumers in all branches are willing to pay it, but when the premium goes to over 25% only a single digit percentage of consumers are willing to pay a premium.

Paying extra for environmentally friendly products varies, but for any really significant premiums actually only a few percentages are ready to pay. The share of hard-core environmentalists from total consumers is estimated to be only some 1-2%. These consumers drive the market for the most ecological niche in all product groups, including tissue. They would not compromise their choices regardless of price and alternatives. These types of consumers make always an environmental choice, also in tissue. However, such consumers are a very small minority.

Climate change continues to be the environmental issue with the highest attention generally, as also seen in the tissue industry

Climate change is the environmental topic currently with the highest attention everywhere, including in the tissue industry. Another issue with high general attention is resource efficiency that in tissue refers to water and energy efficiency which partially also relates to the greenhouse gas emissions, i.e. the climate change issues.

Illegal logging, fibre certification, RCF usage are all issues that are clearly less topical than the climate change. Toxicity has relatively high general attention and interest is increasing currently somewhat in tissue and hygiene. Biodiversity and clearcutting are currently not very hot environmental topics.

Does recovered fibre based mean the same as environmentally friendly?

The general perception is that recovered fibre usage in tissue is more environmentally friendly than virgin fibre. Also NGOs such as WWF and Greenpeace promote the usage of recovered fibre for instance over the usage of certified fibre.

The European Commission’s Circular Economy Package drives reduction of waste and recycling. It has no direct reference or impact on recovered fibre usage in tissue but it puts recycling and resource efficiency in to the top of environmental discussion.

Some governmental entities and companies have published environmental targets that may include usage of recovered fibre. For instance the UK government buying standards state that ‘tissue paper must have 100% recycled content’.

This is the general perception, yet it has not led to the increasing usage of recovered fibre though the environmental awareness is increasing and quite common. The environmental awareness recognises facts and therefore the 100% recovered fibre content is not very typically requested from tissue.

Why is this? This is simply because other factors that work against increasing the share of recovered fibre content overcome the drivers for the increase. What is considered better is in some cases due to some realities not considered important enough or possible to follow in practice. Cost advantage of RCP against virgin fibre is clearly the key driver for using recovered fibre in tissue. As the cost advantage deteriorates due to tightening availability of white recovered fibre combined with lowering yield especially in tissue, the recovered fibre share in tissue continues to decline regardless of the limited share of demand that is environmentally motivated and requesting recovered fibre content. When the cost advantage of recovered fibre disappears, most of the environmental motivation fades away.

The EU Green Public Procurement Policy and the European Commission Circular Economy Package give guidelines requiring 100% recovered fibre content in copy and graphic papers but do not include tissue.

Recovered fibre usage in tissue is declining

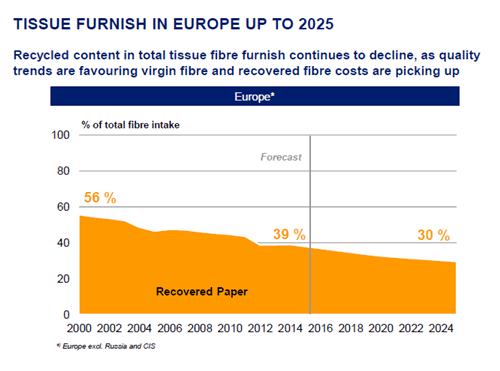

Despite the environmental issues tissue manufacturing is shifting towards virgin fibre. In Europe the RCF share of fibre intake is slightly below 40% compared to 56% some 15 years ago. The share is expected to further decline, reaching some 30% in the next ten years.

Declining share of recovered fibre through the 2000s has mainly been driven by the new capacity utilising virgin fibre. DIP capacity is foreseen to remain stable also in the future with no major DIP investment coming to tissue mills, though tissue capacity is increasing. The relative share of RCP based tissue declines.

This is the situation in Europe in general, but the same principles apply globally; the cost pressure on RCP due to tightening availability will impact in the interest to invest on additional de-inking capacity in tissue mills. There are pockets in Europe where the RCP balance is still better, such areas include for instance large parts of Eastern Europe.

Globally there are emerging markets where the general quality requirements make it easier to operate with recovered fibre creating an economic benefit; price level can be so low that virgin fibre based tissue cannot compete.

Environmental requirements in virgin fibre based tissue

However, environmental requirements especially in selected geographic regions are important also for virgin fibre based tissue. In the 1990s the TCF issue was the number one item on the environmental agenda of the NGOs and the industry and a large number of pulp mills were trying to produce TCF without being technically designed to do so. After the demand cooled off many such mills stopped producing TCF and the number of mills producing TCF today is clearly lower than 1994 when the mills not suited for the TCF production were forced to do so, (also rapid decline of sulphite capacity has here an impact.) Several mills that have some kind of possibility to produce TCF have not done so for over 10 years. The TCF capacity is still more than the actual production.

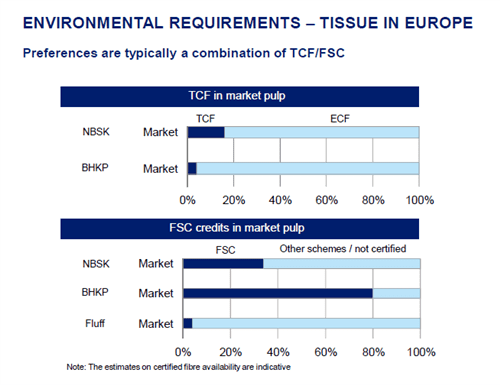

In the 2010s the ‘true demand’ of TCF has grown again on fluff and tissue paper sectors in both Europe and the US. TCF demand has always concentrated on German speaking Europe. Nordics also have some TCF demand (as many of the products target the German markets). Most of the TCF pulp used outside these regions goes into products related into either food production or hygiene (UK, US).

TCF kraft market pulp production represents some 10% of the market BSKP demand and slightly over 2% of total market BHKP demand. Sulphite pulp mills typically do not use chlorine compounds in bleaching and most of the sulphite pulps in the market are therefore automatically TCF. However, sulphite capacity has declined rapidly over the last few years and that has reduced TCF offering, when in fact the kraft demand has increased.

Part of the TCF demand is supply driven, as some important especially market pulp producers (as for instance Södra) have TCF pulp available. In BHKP market pulp, the volumes are smaller (some, especially Iberian Euca and some Birch pulp from Södra).

Typically the preference is combination of TCF and FSC certification over the other options. This is because it is the same clients that often have both requirements, and once you have to worry about a requirement it is easiest to do it all at the same time.

However, a limited number of market pulp producers have capabilities to meet both these preferences at the same time. It is more common for BSKP where also the TCF capacity is higher, but in tissue hardwood has a higher share and TCF bleached FSC certified market pulp has a limited supply while the demand is increasing.

Summary

- Environmental issues are important, but a limited number of consumers will pay a green premium.

- Climate change is the environmental issue that has the highest attention.

- Recovered fibre content is generally perceived as environmentally friendly.

- Recovered fibre content is declining in tissue due to availability and cost issues.

- TCF bleaching and FSC certification from virgin fibre are requested at the same time.

- Pulp suppliers providing the combination especially for BHKP are only few while the demand is increasing.