Capacity increases in converting and tissue machine output are being boosted by further investment as the company plans to “create a market” and then build the processing capacity to meet it, says Wanda Ciesielczuk, Vice President, Production & Technical Director. Report by TWM Senior Editor Helen Morris

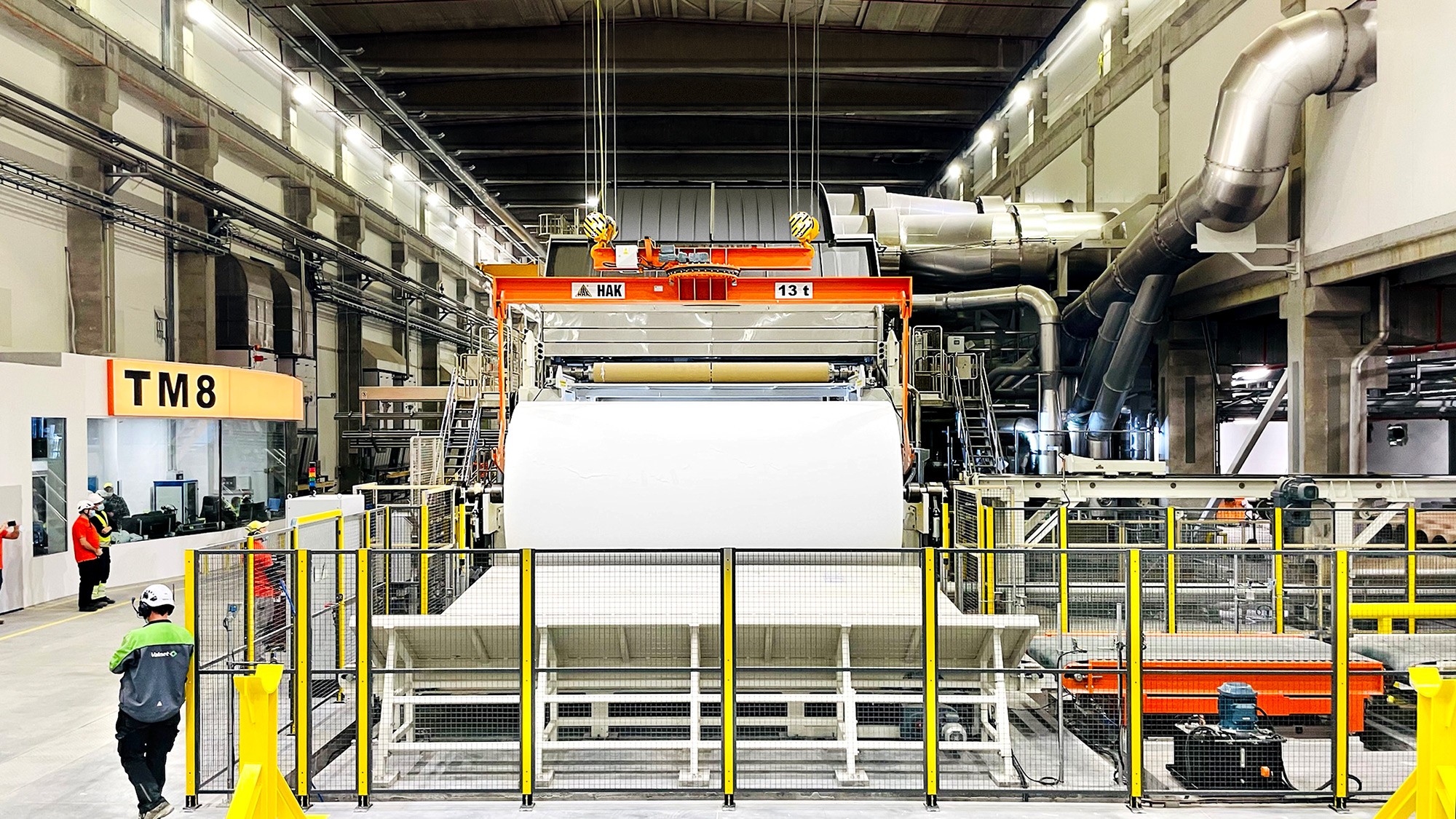

The recent pace of growth at Polish consumer tissue manufacturer Velvet Care – which on 11 December was acquired by Partners Group – has been little short of dynamic. A planned third paper machine in five years is part of a PLN364m investment. It means annual capacity will increase by about 40% to 210,000 tonnes. That is on the back of more than 60% production capacity increase to the business following the start-up of TM8, the plant’s second Valmet-supplied Advantage DCT line, in June 2022.

The company currently has two production facilities, its headquarters in Klucze, Poland, and its Moracell unit in Zabcice, Czechia. The acquisition of a third facility, family-owned Polish tissue converting company Almus, was announced in January and is awaiting approval from the country’s competition regulator. Before adding Almus, the business today has three tissue machines based in Klucze and 18 converting lines: 16 at Velvet Care’s headquarters, and two in the Czech Republic. The company’s expansion in recent years also included the 2020 acquisition of Moracell, the largest manufacturer of paper hygiene products in Czechia.

TWM put the question to Vice President, Production & Technical Director Wanda Ciesielczuk – what is the strategy behind such volume expansion? “Our business strategy is to create a market and then build the converting capacity using outside supplies of tissue. We then build our own paper machine to ensure we have regular supplies of the highest-quality raw materials.

“We’ll also need a new source of raw materials for Almus once the deal goes through. We’ve signed an agreement with the Kraków Technology Park, which is part of Poland’s scheme of special economic zones for investors. We’ll receive tax incentives for this investment, TM9, which will be our fourth operational paper machine.

“Since 2017, our converting capacity has increased from 88,000tpy to 184,000tpy in 2023, whilst our tissue machine capacity has increased from 36,000tpy in 2017 to 94,000tpy in 2021 and then to 154,000tpy in 2023.”

Fundamental to the business is diversification. There is no focus on any one category or sales channel: “We’re developing and growing in all three areas: our Velvet brand – which is Poland’s most popular in the hygiene paper category – as well as private label, and also AfH products.

“The pandemic offered us a very clear lesson of the dangers of orienting the company to just a single area. When restaurants and hotels were all shutting down, AfH producers found themselves in a nightmare scenario. By contrast, we were able to shift resources to meet demand from consumers who suddenly were now spending more time at home. That’s why diversification is important to us: if we run into difficulties in one sales channel, we can make up for it in the others.”

Given the stable branded product market and growth in private label in Poland, which streams does she see providing growth opportunity?

“We’re not seeing the kind of shift away from branded products that’s happening in Germany, where private label currently dominates by around 85%.

“We continue to assume that our three pillars of branded products, private label, and AfH, will keep on supporting our business, delivering success over the long haul.”

And emerging trends among consumers?

“Purchasing habits and trends in the region remain unchanged. Toilet paper is the main category in the drugstore shopping basket. The structure of sales of other products in the hygiene category remains the same: first toilet roll, then paper towels and finally paper handkerchiefs.

“The Covid-19 pandemic caused a shift in that last category away from pocket packs to facial tissue in boxes. But this category remains the smallest of the three.

“In the future we expect steady growth of the entire market, spread quite evenly across all three categories.”

Ciesielczuk believes the post-Covid recovery of AfH will be maintained, and that Velvet Care is well positioned to respond to the major consumer trend which is emerging across many markets, including in Europe and the US … the shift towards premium products.

There are further ambitious plans for growth, acquisitions, and a possible TM10: “With our purchase of Moracell in Czechia in 2020, by tripling the unit’s revenue since the transaction we have proved we can carry out a successful acquisition, integrating the target company into our operations.

“But our investment plans are also organic to our existing facilities. Our heat and power plant project will allow us to supply our own electricity needs using natural gas, cutting our carbon footprint by half. And we’re also looking at investments in our logistics infrastructure, including an automated high bay warehouse.”

That organic response is geared to fostering a mutual understanding of the new market realities between company and clients. Inflation in particular is a central reason why diversification is the key to strategy.

“This applies to product categories and sales channels and also to raw materials and clients. We have to react to significant increases in the prices of electricity, gas and cellulose, and that is reflected in the prices of our products. Here again diversification means that if one client isn’t ready to accept these changes, we can work with others as we wait to build a mutual understanding.

“However, our response to inflation isn’t just about our relationships with suppliers and clients. We’re also constantly working to make our production and logistics more efficient. Every optimisation and efficiency gain can mean a lot.

“We do expect that the challenges we’re currently facing will largely remain the same for the coming years: electricity and gas prices will continue to be an issue, as well as the price of our main raw material, cellulose. The availability of labour, including specialists, is also a challenge.”

Recent challenges to trading conditions across the region – the aftermath of the 2008 crash, Covid-19, military conflicts – have been formidable. How has the market been affected?

“During the Covid-19 pandemic we noted higher growth in the paper towels category, as well as a shift of consumers from hygiene tissues in plastic pocket-sized packets toward boxed facial tissues. The initial period of the pandemic drove significant growth in hygiene products – we found ourselves among the strategic producers. We all still remember the images of empty shop shelves, where toilet paper, rice and flour were sold out.

“But those huge supply-chain blockages from the start of the pandemic ended up reducing demand over the longer term, which is only natural – the amount of product a consumer uses over the course of the year is quite stable.

“The pandemic did have a significant negative effect on AfH products: restaurants were shut down, hotels reduced their orders. But thanks to our strategy of diversification, this didn’t affect us negatively.”

And the market since the start of the conflict in Ukraine early last year?

“The power and gas markets have stabilised, and cellulose prices have come down. The tissue market is fortunate in that our products are basic necessities, and there will be demand for them no matter what the macroeconomic situation is.

“During difficult times we do see price pressures, and consumers begin searching for bargain products. But we also see greater awareness among consumers that it doesn’t always make economic sense to buy a small-volume product with a higher unit cost, rather than a larger package that works out to be less expensive per sheet. This change is also being driven by increasing environmental consciousness among consumers, who are seeking to reduce plastic packaging waste and becoming aware of the reduction in CO2 emissions that comes from more efficient logistics.”

The risks of overcapacity have been prominent in planning development.

“In the Polish market, in addition to the big players such as ICT and Sofidel, smaller producers are still present, and these aren’t necessarily companies with integrated production facilities. At a time of high volatility in the prices of energy inputs and raw materials, they’re the most affected.

“In the case of the big players, we stand out because of our newer machine park: the average age of our equipment is just six years. Cutting-edge technologies allow us to improve efficiency, significantly reducing electricity and heat usage, and saving both water and raw materials. Our recent investments in automation are also helping us to improve our efficiency.”

ESG planning is an integral part of strategy, she confirms. A first ESG report has been published with reference to the Global Reporting Initiative Standard. CO2 emissions and water usage per tonne of output have been cut by half since 2013 while tissue production has risen four times.

While coal is still dominant in Polish electricity production, Velvet Care plans to produce its own electricity from gas, reducing external purchases. Cogeneration is projected to cut carbon footprint by half.

Ciesielczuk adds: “We’ve been ISO 50001-certified for many years. In this area we work not only with our equipment suppliers but also internally: within our organisation we motivate our employees through a system of awards for ideas for improving energy efficiency. We also continue to implement our Eco Agenda 2025/2030 programme, whose goals include reducing the usage of plastic, other packaging materials and water.

“Most recently, in October we reached an impressive milestone after becoming B Corp-certified. Velvet Care is now the first Eastern European tissue company to gain B Corp-certification, and one of the first across the whole of the EU. The B Corp standards serve as a strategic compass for us, and we have incorporated extra measures across our business including areas such as energy efficiency, water consumption and recycling.”

“We will continue to prioritise ESG reporting, and aim to be carbon-neutral. A key factor in achieving this will include a gas-fired heat and power plant, which the company has won a grant from Poland’s National Fund for Environmental Protection and Water Management. When it’s complete, the plant will slash our Scope 1 and 2 emissions by 46% from the 2022 level.”

Steady growth in the entire hygiene paper sector is scheduled in the near-term. No sudden leaps. As the entire market develops, growth is expected across all current categories – toilet paper the largest, paper towels, and paper handkerchiefs expected to maintain their position. AfH to continue its rebuild, more environmentally-friendly products with less plastic content, more product per package or per pallet: “In Poland, per capita usage of hygiene products by weight remains lower than in Western Europe, including Germany. So we also expect premium products, which remain less popular on the Polish market, to increase in significance, with consumers purchasing them more and more often.”