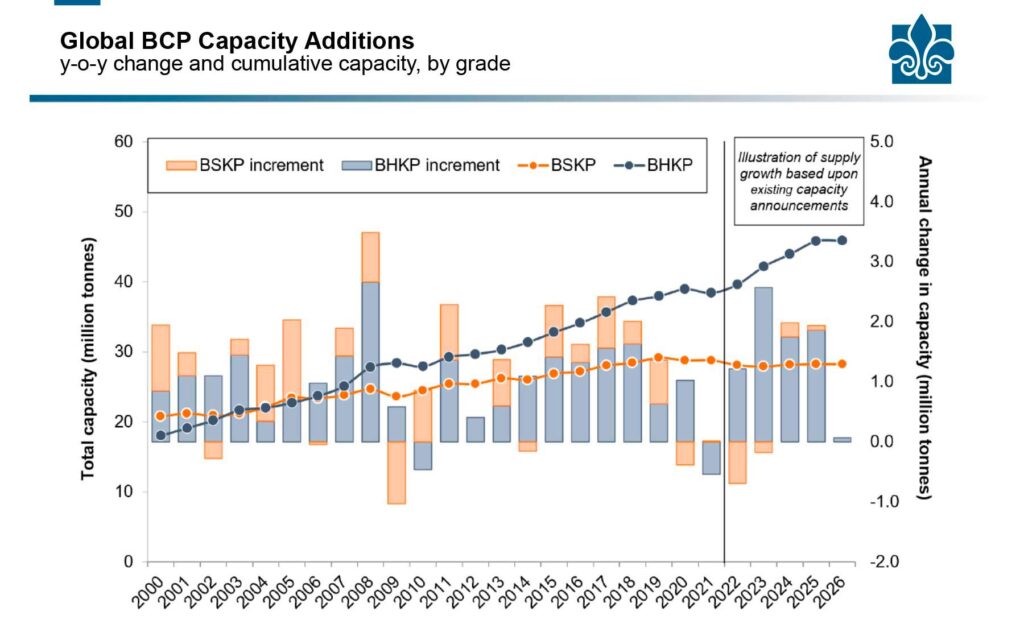

Total BCP capacity shrank by just over 0.5Mt last year – the first contraction since 2009 and only the second on record. Report for TWM by Hawkins Wright’s Research Managers Michael J Long and Pierre E Bach.

Current estimates place global market Bleached Chemical Pulp (BCP) capacity at 68Mt. This volume is allocated to various paper grade pulps (28.1Mt of BSKP, 39.6Mt of BHKP and 0.3Mt of sulphite), to which one can add 4.6Mt of high yield pulp capacity and 4.0Mt UKP capacity. Hardwood pulp from Latin America continues to grow in prominence while the softwood sector experiences a slowdown in investment focus, a trend which implies potential undersupply

further down the line.

Total BCP capacity shrank by just over 0.5Mt last year – the first contraction since 2009 (and only the second on record). This follows a significant investment cycle through 2015-19 and was mostly attributable to the first full year of closure at Paper Excellence’s Pictou and Mackenzie mills, to increased integration at certain mills, and to Arauco Valdivia’s full conversion to dissolving pulp production.

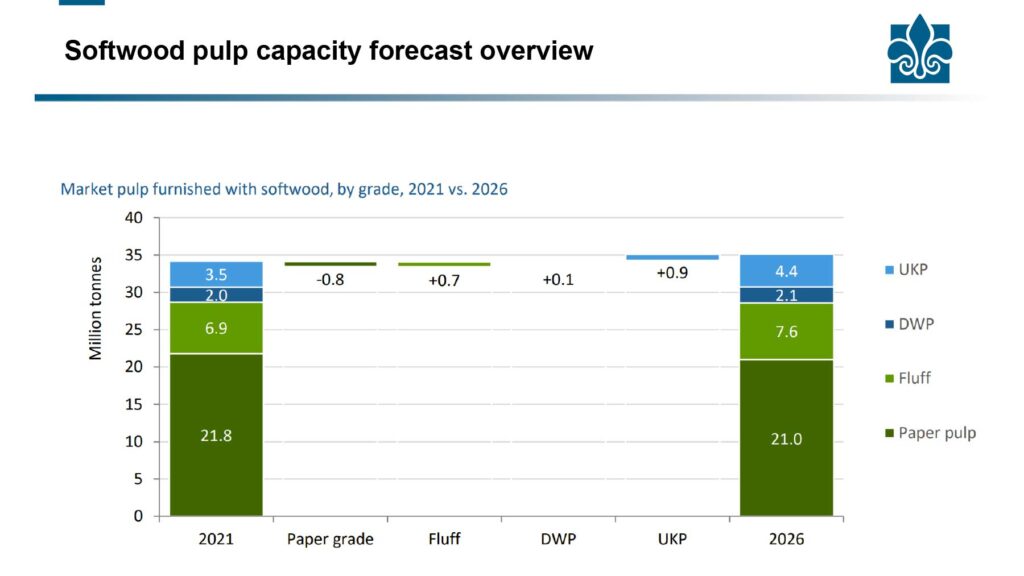

During 2022, we have witnessed the unexpected closure of West Rock’s Panama City pulp mill which displays the degree to which many companies are evaluating their pulp assets even as prices (both list and net) have breached record highs. The timing points to broader structural challenges that many older assets throughout the northern hemisphere face. This case illustrates willingness on the part of pulp and paper companies to focus on their core business (e.g., WestRock & packaging). The closure has removed some 0.3Mt of softwood (fluff & paper grade) capacity from the market and places additional stress on fluff pulp buyers to secure new supply. As CAPEX requirements have grown over the years many pulp producers may need to idle older and less efficient assets.

Looking ahead, total market pulp capacity will grow by 6.4Mt during the 2023-26 period, at an average rate of +2.3% pa. The growth comprises +0.1Mt in BSKP and +6.3Mt in BHKP. Separately, high yield pulp capacity is set to grow by +0.2Mt and UKP by +0.4Mt over the forecast period. The major expansions include Bracell’s Project Star (start-up in Q4 2021 and now ramping up), Arauco MAPA (launch expected for September 2022 after several project delays), UPM Paso de los Toros (Q1 2023), Metsä Kemi (Q3 2023) and Suzano’s Cerrado project in Mato Gross do Sul, due to start in 2024. As Arauco’s recent experience with their MAPA project suggests, supply chain and labour challenges threaten the timely start-up of such projects, posing a risk to the outlook for supply. Aside from Latin American BHKP, the only other meaningful pulp capacity growth to 2026 will take place in Scandinavia, with Metsä Fibre’s investment at the Kemi mill.

Another risk to the BCP capacity forecast stems from growth prospects across specialty grades. Most visibly, swings to UKP have occurred at an increased rate of late, driven in part by high bleaching and chemical costs or by efforts to curb mills’ environmental footprint. We quantify this increased interest in UKP production in our Outlook for Unbleached Fibre report which has just been updated in June 2022. Recent examples include Fibre Excellence’s French mill in Tarascon, or the recent conversion at West Fraser’s Hinton mill. Already, some 0.4Mt of NBSK capacity have been thus converted to UKP – and more are on the way, including Paper Excellence and ND Paper which are in the process of making significant swings to UKP production in North America.

In fact, paper grade BSKP capacity is set to contract over the forecast period, not only due to conversions to UKP but also due to increased focus on the fluff and dissolving pulp specialty sectors. Our analysis shows that almost 2Mt of existing supply looks likely to be converted – more than offsetting growth in BSKP supply derived from any greenfield investment or debottlenecking work. In fact, given the age profile of the softwood industry, we expect more closures to be announced during the coming years meaning that shipments of softwood market pulp for paper making purposes have probably peaked. One caveat that is not yet accounted for in our models is the evolution of birch production in Scandinavia. At present, producers are no longer able to procure Russian birch logs and chips. This will likely pave the way for some additional NBSK, but companies have yet to make their medium- and long- term plans clear.

Naturally, any market pulp capacity projections carry some inherent risks. We do not incorporate assumptions regarding mill closures, although we know that about 2.5Mt’s worth of annual paper grade pulp capacity has closed over the last ten years, implying an average rate of attrition of about 0.25Mt/y. Furthermore, lines can restart at relatively short notice, as evidenced by the restart of Nordic Kraft’s mill in Quebec, or the restart of both Wickliffe and Old Town in 2018 and 2019 after the mills were acquired by Chinese investors.

There are also unforeseeable events related to extreme weather, natural disasters, geo-political conflict, mechanical failures, and logistical disruptions. Other variables at play include supply from integrated mills and swing capacity, which fluctuate according to market dynamics and prices, and can have a significant impact on supply and demand balance.

Nonetheless, we are on the brink of another significant investment cycle which has generated a consensus view that the market will soon become oversupplied, likely stimulating a pricing correction. However, historical precedent demonstrates that this should not be a forgone conclusion.

As we enter a new investment cycle, supply disruptions are already to the fore, as supply chains remain beset by Covid-induced bottlenecks. Meanwhile, despite a recent strengthening of the US dollar, most pulp producers are battling against rising fibre, logistics, energy, and chemical costs which are inflating the cost base of the global industry. These dynamics will yield a strong influence in dictating pulp prices during the coming months, perhaps more so than the start-up of new capacity.