Online, bamboo tissue products – especially toilet paper – are on the rise with more enterprises offering impressive varieties to attract price-concerned savers, “green” loyalists and “white cloud” softness devotees. Industry analyst Gregory Grishchenko looks at its American future as production in China gears up.

After the unexpected tissue product run caused by the outbreak of the Covid pandemic almost a year ago all major grocery chains across the US effectively restocked supermarket shelves with pre-pandemic varieties of local brands.

Even during that time of extreme demand, bamboo tissue, which has seen an explosive but exclusive online trade growth, did not feature prominently in American retail outlets. However, this year Babo toilet paper brand made of unbleached bamboo tissue appeared on display at several CVS pharmacies in Florida.

CVS Pharmacy is the largest pharmacy chain in the United States with almost 10,000 locations, and among its merchandise includes household items as tissue goods.

Babo brand supplier is Vanov Group from Sichuan province in Southwest China, a region known for rich bamboo vegetation and being the homeland of giant pandas.

At present, Sichuan province stands for a bamboo pulp-leading source with annual production capacity of almost three quarters of a million tonnes. Vanov uses bamboo pulp as raw material to produce unbleached tissue products including toilet paper and napkins. The company established its US sales office in New Jersey, claims the annual capacity of 200,000 tonnes of bamboo pulp and (according to its website) employs over 3,000 in three factories.

With such a solid production base, its products in the US can afford a nominal profit margin (if there is one) due to shipping and handling expenses.

Other bamboo tissue brands also appeared in major US chains – Target (unbleached bamboo toilet paper brand Caboo) and Costco (similar brand Reel).

However, as the tissue production crisis eased, suppliers for major brands and private labels resumed full volume deliveries. Apparently, bamboo toilet paper did not pass always consumers’ cost/value test during the first months of the epidemic and was often the only product left on shelves at the tissue product isles after all conventional tissue goods were gone. Bamboo toilet paper moved back to websites.

Challenges of switching to non-wood tissue

There are two categories of virgin fibre raw materials for tissue making mainly classified as wood and non-wood fibres. Perhaps the most eco-friendly tissue paper option among wood fibre materials, recycled paper, uses no new resources and makes use of materials that should otherwise go to waste. However, for a significant number of consumers, waste paper as a source is a turnoff, mostly due to the presence of process bleach and chemicals used to make a product safe and attractive.

Bamboo as a raw material for tissue production creates a number of challenges in stock preparation especially for refining. Bamboo pulp has shorter fibres than virgin wood and is therefore structurally weaker, so refinery technology is applied to bamboo biomass in the pulping process in order to preserve the flexibility of bamboo fibre. In general it takes lower flow, higher motor power and additional apparatus to meet raw material specification for tissue.

Many newcomers in premium bamboo tissue have arrived in the playing field of Charmin, Angel Soft and Cottonelle. Without bleaching or with only mild bleaching the bamboo pulp remains relatively original colour. In order to achieve a competitive “whiteness”, the brand like No.2 points out the advantages of TCF (Totally Chlorine Free) mild bleaching process, using environmentally friendly bleaching agents such as oxygen, ozone, hydrogen peroxide and biological enzymes.

The brand Silk’n Soft, however, goes farther to whiten its 3-ply toilet paper. Its manufacturing plant processes ECF (Elemental Chlorine Free) bleached sulphate bamboo pulp using low chlorine content multi-stage bleaching and replacing chlorine with chlorine dioxide gas. Indeed, chlorine dioxide makeup is far away from chlorine’s toxic nature, still it can harm humans in the long run.

Greenwashing helps

In recent years American shoppers have become more ecologically aware. As a result, a growing number of online enterprises selling bamboo tissue goods offer an impressive range of tissue grade varieties to capture an entire consumer array from a price-concerned saver to a “green” loyalist to a “white cloud” softness devotee.

Bamboo tissue products, especially toilet paper, are definitely on the rise in the United States. In unbleached bamboo tissue category there are numerous direct-to-consumer companies with sleek websites and catchy names (Tushy, Betterway, Who Gives a Crap, Bim Bam Bo, Cheeky Panda, Noo Trees and Smitten) promoting eco-friendliness and camouflaging dubious light brown aesthetics of unbleached tissue with paper wrap (no plastic) and soy inks graphics (no solvents).

The brand Rebel Green amplifies its statement of eco-kindness by pandering to ‘bleeding heart’ millennials with the claim that their bamboo source for such toilet paper is not extracted from regions in China inhabited by pandas.

Wholeroll toilet paper brand claims that its virgin bamboo pulp comes from FSC-certified, responsibly “well-managed” bamboo forests. The company does not use chlorine bleach, BPA, or any other harmful chemicals in its production process, however, the word “organic” for advertising seems kind of excessive. The absence of bleaching process chemicals may or may not convert a health conscientious consumer of wood-based recycled toilet paper to bamboo, which in general has a higher price tag.

Production rise in China

Primarily bamboo paper was processed at small factories using abundant local plant vegetation and providing hundreds of thousands of local residents with a way to make a living. The Chinese government was the original owner of the bamboo paper industrial units and later even patronised private business groups that took over bamboo tissue production by awarding them special permits.

They were not only authorised to harvest and process bamboo plants but also given a certificate recognising social and environmental efforts as beneficial for the country.

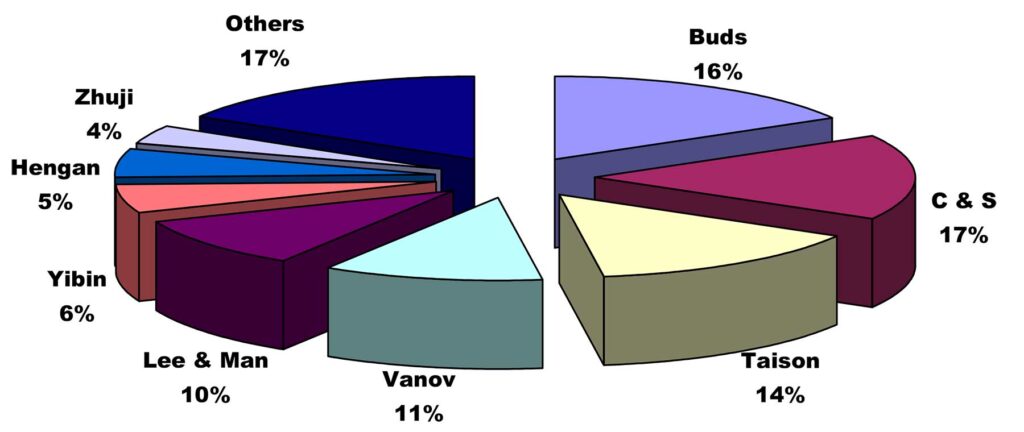

In the last decade the makeup of bamboo tissue manufacturing has changed drastically. Output volume from big players grew at the expense of small and mid-size companies. Adopting bamboo tissue production as an important part of business strategy, the major paper groups Taison, Lee & Man, Vanov, C & S, Hengan and Yibin are replacing outdated narrow trim and low speed tissue machines with state-of-the-art crescent formers from leading Western suppliers Andritz (Austria), A.Celli (Italy), Voith (Germany) and Valmet (Finland) supplied with entire stock preparation plants. Responding to this challenge, smaller businesses must choose between upgrading (with lower cost domestically made tissue and converting equipment) or go bankrupt.

The Taison Group is one of the largest producers of paper, board, and tissue in China, with a total tissue (including bamboo) capacity of over five million tonnes in 2018. The group planned to reach half a million tonnes of bamboo tissue a year by 2020 making it one of the key bamboo tissue processors in the country.

The group assigned the most modern tissue machines from Andritz to paper mills at Suzhou (Jiangsu Province) and Chishui (Guizhou Province) for bamboo tissue production. Two crescent former tissue machines PrimeLineST at Suzhou with a design speed of 1,900 m/min, a paper width of 5.6m, 18 ft. Steel Yankee and a total design capacity of up to 120,000 tonnes of tissue per year may also process conventional virgin or recycled wood-based fibre pulp. The other two identical tissue machines, PrimeLineST are at Chishui with design speeds of 2,000 m/min and a width of 5.6m, each combine high performance PrimeDry 20 ft. Steel Yankees (among the largest in the world) with PrimeDry steam-heated hoods. Along with PrimeLineST tissue machines, Andritz also supplied complete stock preparation lines.

A few years back Andritz also delivered a smaller tissue machine for bamboo processing to Zhuji Paper mill in Nanxiong, Guangdong province. The new tissue machine has a trim width of 2.85 metres, a design speed of 1,600 m/min, a PrimeDry Hood ST with steam heating and an automated stock preparation system.

Hong Kong-based and privately owned Lee & Man Paper Manufacturing is one of the top suppliers of paper products to the Chinese market. It specialises in paper packaging, especially in containerboard. The company gained interest in tissue products and between years 2014 and 2018 purchased nine Advantage DCT 200 HS crescent former tissue machines with stock preparation systems from Valmet.

All these machines have a width of 5.6m and a design speed of 2,000 m/min, using virgin fibre or bamboo fibre slush as raw material. Lee & Man’s Chongqing mill in the bamboo rich Sichuan area mainly uses bamboo fibre slush benefiting from the combination of steam-heated hood, Advantage ViscoNip press and cast Yankee dryer, a reliable configuration that enables low energy consumption with high production rate. The company is also experimenting to run different types of modern crescent formers from Voith (Germany) and Kawanoe Zoki (Japan) on bamboo pulp to make unbleached tissue products.

Yibin Paper, from Sichuan province was known for making disposable paper cups and bamboo board. Currently, the 70-year-old company owns a bamboo pulp mill and sets the goal to be China’s largest bamboo tissue paper producer, using exclusively bamboo pulp (some bamboo tissue manufacturers add wood fibre pulp to improve strength and softness). The mill’s layout was designed for exclusive bamboo slush pulp use, from stock preparation to tissue machine. Yibin Paper ordered five high-speed iDEAL tissue machines from A. Celli Group (Italy), with a speed of 1,800 m/min, a paper width of 2.85m, and a production capacity of 25,000tpy each. Four modern crescent formers are currently in operation using 16 ft. and 18 ft. diameter Steel Yankee dryers and latest-generation steam hoods.

Growing bamboo in America

In terms of sustainability, affordability and global availability, there is no resource that can match bamboo with its claimed three foot a day growth and unlimited usefulness. Naturally bamboo is becoming a popular alternative to trees as raw material and eco-friendly bamboo toilet paper may certainly become a choice for more people concerned with climate change. However, reducing carbon footprints also means sourcing materials from places close to home. Bamboo tissue goods in the US are currently all coming from China and the Far East, which makes it a snag.

There is some commercial bamboo farming in the area around the Gulf of Mexico. Only in these hot and humid surroundings will the Moso bamboo plant achieve its full size. Bamboo, however, is not a native for American soil, and it generally flowers only every 60 to 120 years and then dies. It is hard to grow bamboo from seed and growing it by dividing existing plants is very tricky as well.

A trained eye can find bamboo plants everywhere in Florida, from wild patches in natural preserves to small forest areas around golf courses to five star hotel shrubbery. There a bamboo plant is considered more like decoration or food than a paper source.

The US land in the south and notably in Florida, where limited bamboo harvesting takes place, may not provide enough raw pulp fibre to justify local tissue production, however jumbo rolls of bamboo tissue shipped from China can be converted and packaged with local sources.

Despite successful experimentation with growing bamboo in test tubes, there are still risks with harvesting Asian bamboo in North America, when some very adaptive bamboo varieties may drive native eco-systems into extinction.

Forecast

Almost a decade ago the trend of using alternative non-wood fibre resources such as wheat straw, bamboo, sugarcane, reed, corn stalks and hemp for tissue products began in China. After cutting off secondary paper imports, China still remains the largest worldwide market for imported wood pulp, comprising 41% of global imports. Expanding export of non-wood tissue products seems to be an expected move. Surviving wood pulp price wars and numerous bankruptcies of non-wood fibre enterprises, the bamboo tissue industry in the country established itself as a single leader in the alternative tissue supply channels.

According to Pierre Bach from Hawkins Wright Research, UK, non-wood fibre tissue products (essentially 90% bamboo) have held onto their niche purposes fluctuating around 2.7 million tonnes worldwide for the last decade. While China established itself as a major virgin fibre tissue exporter with over 40% of the world production growth seen over the past decade, the consumption of non-wood tissue however is apparently expected to gradually erode over time.

In the current state of Chinese-American trade relations a domestic consumer’s perception in the United States may play a critical part in the development of bamboo tissue sales. A choice between coarse and brown feeling versus white and soft can make the near future of bamboo toilet paper look bleak. It will remain in a niche within 10% of imported tissue commodities coming to the US every year.