At US$160 million, the Romanian retail tissue market is, on a global scale at least, a relatively small prospect – but that’s not to say it should be overlooked. Underdeveloped categories combined with rising disposable incomes and a low per capita spend on retail tissue in general mean there are certainly rewards to be had for the right strategy.

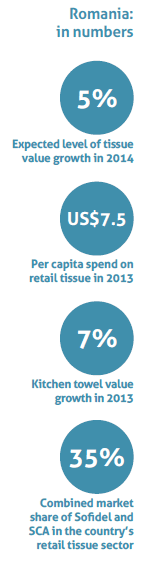

Although too early for annual data, 2014 looks to be continuing on the same steady upward trajectory as was seen in 2013, when value growth stood at 5%, volume at 4%. Spurring on this healthy retail tissue market is a steadily recovering economy, bringing higher purchasing power to Romanian households. Since 2008 annual per capita disposable income has risen by just shy of US$1,000 to reach US$5,530. And, as disposable incomes have risen, per capita spend on retail tissue has also increased year-on-year, reaching US$7.5 in 2013. This level of spend, however, remains one of the lowest in the region, suggesting further room for growth.

Private label changes the face of retail tissue

The growth seen in Romanian tissue is not all down to the easing of the country’s economic circumstances – retailers have also played their part in driving the category. Recent years have seen a shift in the retail structure of the country, with the arrival of more supermarkets, hypermarkets and discount stores, and this evolution in retail has also heralded the arrival of private label products in tissue.

The country’s newly developed retail channels have instigated this shift from standard to economy. Supermarkets and discounters have invested heavily in their private label brands so that packaging looks the part and performance claims are substantiated. Consumers who traded down out of necessity have found that economy paper meets their needs in terms of performance, and are now unlikely to trade up again, even if incomes allow. In fact, many consumers are unaware that they are buying private label at all and instead perceive the product simply as a good-quality, affordable brand.

So, despite the economic recovery, in the years ahead private label is expected to experience further growth, primarily at the expense of local economy brands rather than international players, which operate in a different price spectrum altogether. It will be the local brands without the financial clout to invest in promotion and developing brand identity that suffer most as the market polarises between premium and economy.

‘Despite the economic recovery, in the years ahead private label is expected to experience further growth, primarily at the expense of local economy brands rather than international players.’

Kitchen towels attract consumer attention

Frequently, value growth in retail tissue is spurred by one stand-out category, but this isn’t the case in Romania, where healthy growth comes from across the board, with only tissue a little below par, as the category remains underdeveloped. Kitchen towels have, however, been the stand-out performer of late, registering value growth of 7% in 2013 – the highest of any category.

Consumer income and purchases of kitchen towels are strongly linked, with growth in disposable income levels matching the expansion of the kitchen towel category. A country’s per capita disposable income has to surpass around US$4,000 before consumers can begin to consider adding kitchen towels to their shopping lists instead of reusable cloths. This benchmark was passed in Romania in 2008 and the category has seen steady growth ever since. Once the product becomes affordable, first the novelty then the convenience factor quickly appeals. Manufacturers, meanwhile, have made great efforts to grow this new-found appetite for the category, investing in awareness-raising campaigns.

‘As competition increases between international and local brands as well as private label counterparts, the key to winning share will be to offer added-value products at competitive prices.’

At US$27 million, kitchen towels accounts for just 17% At US$27 million, kitchen towels accounts for just 17% of the country’s retail tissue market, remaining, for the time being, limited to higher-income consumers. However, providing the economy doesn’t falter and disposable incomes continue their upward trajectory, growth is certain to continue in the years ahead. SCA and Sofidel lead the way in the category, taking the top three spots with their Zewa, Volare and Onda brands. However, it was local player Asil that saw the only increase in share during 2013 through its Senza brand.

Romanian consumers’ weigh up quality and price

For Romanian consumers quality and price are a constant balancing act. Rather than opting for a tissue product simply because it is affordable, consumers instead seek to balance good quality at an affordable price – and, of late, this has served to benefit local player Asil. In kitchen towels, in particular, Asil has been able to leverage its relative competitive advantage in domestic production to offer less expensive products, while, at the same time, investing in raising brand awareness and ensuring product quality. Although Sofidel and SCA take the top two spots in Romanian retail tissue and combined account for 35% of the market, Asil, with its Senza and Gala brands, was the only branded manufacturer to see its share of the retail tissue market grow in 2013.

Investment and innovation a must

In the years ahead, this trade-off between price and performance will define consumer purchasing decisions, influencing the path of tissue product innovation in Romania. While there is nothing revolutionary about consumers wanting to feel like they got a product worthy of the price they paid, whether a brand is positioned at the top or the bottom of the price spectrum, the key to success in Romanian tissue is appearing to the consumer to offer value for money.

As competition increases between international and local brands as well as private label counterparts, the key to winning share will be to offer added-value products at competitive prices relative to the price bracket. Innovation and investment is paramount across all categories and any reliance on price-based promotion could well prove counterproductive, damaging consumers’ quality perceptions of the product involved and impacting on value sales. Packaging and product development, plus plenty of supporting marketing activity, should be high on the agenda for manufacturers.

‘Packaging and product development, plus plenty of supporting marketing activity, should be high on the agenda for manufacturers’

A sure thing for steady growth – providing the economy holds

Looking ahead, the Romanian tissue market is predicted to register a 4% constant value CAGR over the forecast period to reach US$190 million in 2018, although it must be noted that any slowdown in economic recovery would be a threat to category growth. All things considered, while there are many faster-growing markets out there, for steady gains across all tissue categories Romania shouldn’t be overlooked.