With disposable income in Serbia set to decline during 2020 and consumers expected to rationalise their spending, the country’s 3% pre-Covid-19 value sales increase likely to stall.

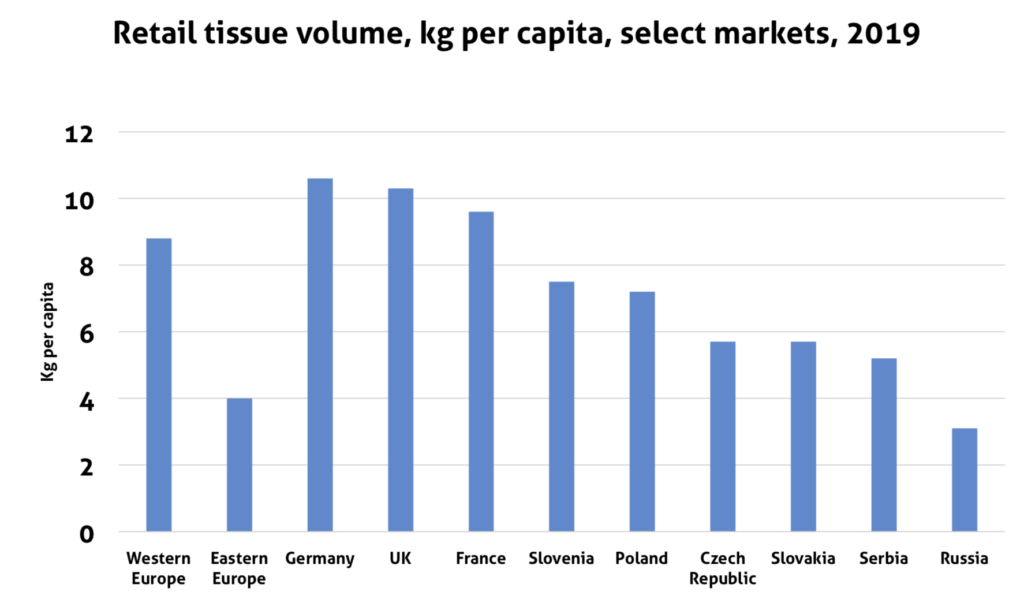

Standing below per capita retail tissue consumption compared to developed regions, the Serbian market leaves room for organic growth in the coming years. It is particularly the case in product categories like paper towels and napkins. In 2019 retail sales of consumer tissue in Serbia saw an increase of 3% in value to reach US$168m (2019 fixed exchange rate, real value) and 2.5% growth in volume to a total of 36,000 tonnes.

Paper towels recorded particularly strong performance, above the overall consumer tissue growth in value and volume terms, as the category continued to gain acceptance among Serbian households.

In early 2020, concerns over supply chain disruption and policies of home seclusion led to a surge in sales for a range of food, personal, and hygiene care products in the country, much like in many other markets. Toilet paper was among the categories in high demand. The surge, however, is expected to subside through the second half of 2020. Moreover, as economic fallout of Covid-19 is increasingly felt across markets and households, many consumers in Serbia will likely be rationalising their spending and placing essentials and affordable options on the top of the shopping lists. Per capita disposables incomes in Serbia are projected to decline by over 1% in 2020.

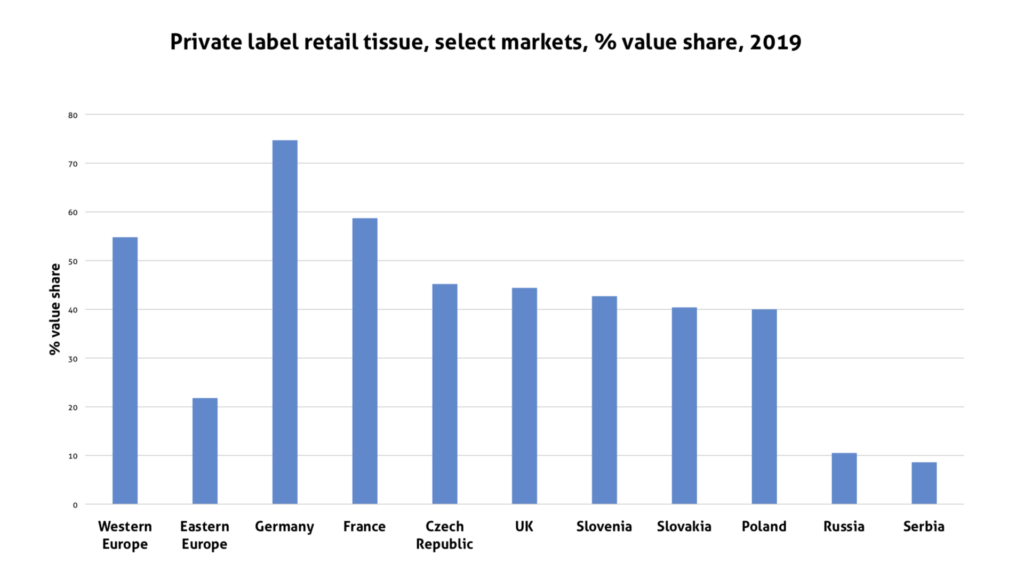

Expected stronger focus on affordability, at least in short to medium term in the aftermath of coronavirus, is likely to create further platform for private label expansion in Serbia. In 2019, private label consumer tissue penetration in the country stood well below that of developed Western European markets and even some Eastern European markets. As the country’s modern retail landscape continues to evolve, it opens up opportunities for further product development and wider access to private label tissue.

The entry of Lidl into the Serbian market in 2018 was met with substantial public interest, with consumers forming a large queue to enter the retailer’s first outlet. Lidl supported its launch into the country through a television campaign and opened 23 new outlets by the end of 2018.

The retailer continued its expansion throughout 2019, becoming the fourth most popular player in modern grocery retail in Serbia in that year.

The expansion of Lidl adds to the competitive landscape in the country, including private label. Delhaize, Univerexport, and Mercator are among the established private label players in retail tissue in Serbia. All three opened more retail outlets in 2019, thus giving broader platform to their own store brands.

Wider access to private label across modern retail and improving quality of its tissue products, coupled with competitive pricing, have been helping retailers to grow private label tissue sales.

Lidl’s activity in Serbia is likely to spur further innovation and dynamism in store brands, also tapping into increased consumer need for cost savings in view of Covid-19 economic downturn.

With private label and affordability high on the agenda, the pressure is on branded tissue products to innovate and compete on quality. While many brands in Serbia have been focusing on discounts and promotions to draw consumer attention and share of spending, the development in premium segment also continues, with products like Zewa Deluxe line of toilet paper by Essity promoting its design, softer cushions, high absorbency, and Aqua Tube core that is said to be 100% biodegradable.

The company has been also increasingly utilising social media, including YouTube, to communicate with consumers in Serbia. Zewa Deluxe advertising campaigns and videos on YouTube aimed at consumers in Serbia generated over four million views.

Over 2019-2024, Serbian consumer tissue market is expected to see 2% value (US$, 2019 fixed exchange rate, real value) and 2% volume CAGR growth. The aftermath of Covid-19 and the resulting depression of household incomes and spending power are expected to put downward pressure on revenue growth in short to medium term, with value segment of consumer tissue likely being front and centre in retail.

Long-term opportunities certainly exist across price segments in Serbia, including premium tissue. However, broader Covid- driven consumer shifts will put more pressure on the premium segment to convey to consumers quality and efficiency, with tangible benefits to households that continue to re-think their approach to “value for money”.