While Vietnam’s household disposable incomes are the lowest, on average, of all major Asia Pacific nations, long-term economic growth continues to support strong gains in the country. Aside from the rising incomes, urbanisation and improved household sanitation facilities are also among the key enabling factors in boosting demand for tissue products in developing countries, and Vietnam is no exception. The country has seen growth in urban population, which is expected to continue in the coming years at a rate faster than the average total population growth to add over four million more city dwellers by 2019.

Urbanisation and modernisation come with the improved hygiene infrastructure. Studies by the World Bank on sanitation facilities indicate a significantly higher use of improved sanitation facilities in urban areas in the developing markets in Asia, compared to rural use. According to the joint report released in 2010 by the World Health Organisation and UNICEF (with latest data sourced to 2008), in Vietnam 94% of the urban population reported the use of improved sanitation facilities versus 67% in rural areas.

Changing lifestyles benefit consumer tissue industry

Rising incomes and infrastructure development improve the living standards of Vietnamese consumers and influence their lifestyle changes, which lead, among other things, to stronger demand for modern hygiene and tissue products. To satisfy the rising demand and changing preferences for quality value-added tissue products, especially in urban areas, domestic production and product development have been stepped up in recent years.

In 2014, value of retail consumer tissue in Vietnam increased by 12% to a total of US$128 million (US$, constant value, fixed 2014 exchange rate), while volume grew by a very healthy 9%, over 2013.

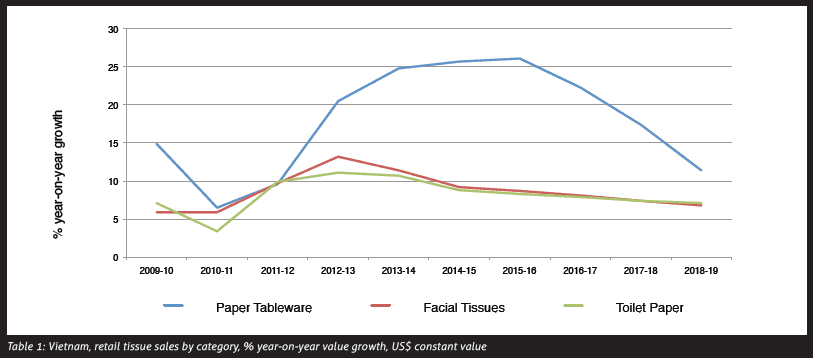

Toilet paper still makes the biggest contribution to retail tissue sales, with regular consumption on the rise in urban and rural areas. However, paper napkins recorded the fastest retail value growth, at 25%, in 2014. The popularity of cable TV, growing internet access, educational opportunities abroad (and hence acquired habits), and the growing number of expatriates living and working in Vietnam all contributed to the emergence of Western culture in the country and help to drive demand for paper tableware. Furthermore, manufacturers encourage the demand further by introducing napkins in small packaging sizes to promote the use of napkins as economical boxed tissues for those on a tighter budget.

Aside from napkins and toilet paper, facial tissues continue to gain acceptance. In the past few years, boxed facial tissues enjoyed robust growth thanks to the ongoing manufacturers’ advertising efforts and expanding portfolio of products in all price ranges.

International manufacturers enjoy a good competitive position in Vietnam. New Toyo Pulppy Viet Nam Co, Cellox Paper Co and Asia Pulp & Paper Co target mainly urban middle- and high-income consumers, willing to pay a premium for high quality products with added benefits. On the other hand, domestic manufacturers, such as Ha Noi Truc Bach Paper JSC or Linh Xuan Paper JSC, focus more on low- and middle-income consumers who look for good quality at a lower price.

Reaching Vietnamese consumers to expand consumption

Product innovation and the growing number of more affluent households in the country are likely to result in higher demand for more sophisticated consumer tissue products, thereby supporting industry growth in the coming years. Moreover, the changing lifestyles in the country create additional venues for the manufacturers and brand marketers to reach consumers, expand consumption, and build brand loyalty.

Internet and social media are becoming an important source of information for Vietnamese consumers, especially younger generations. According to a survey conducted during June 2015 by market research companies Epinion and OMD, Facebook is the main portal for Vietnamese youths searching for information about brands. 52% of those surveyed said that Facebook content from brands they followed was an important source of information. Meanwhile, Smartphone Usage in a Vietnam report, which was published by DI Marketing in 2015, found that social media was the top online activity for more than 80% of mobile phone users aged under 25 years.

Additionally, Vietnam has seen a significant increase in the number of Internet users. Although cash remains the principal method of payment in the country, online retailers are adapting to a cash-dominated society, for instance by opening showrooms for the Vietnamese to see the products and pay in cash for goods delivered later to their homes. Further promoting online shopping, in late August of 2015, the Vietnam E-Commerce and Informatics Agency (VECITA) launched a month-long ‘Autumn Online Shopping Day’ campaign, and thousands of businesses were able to offer discounted products on the VECITA website.

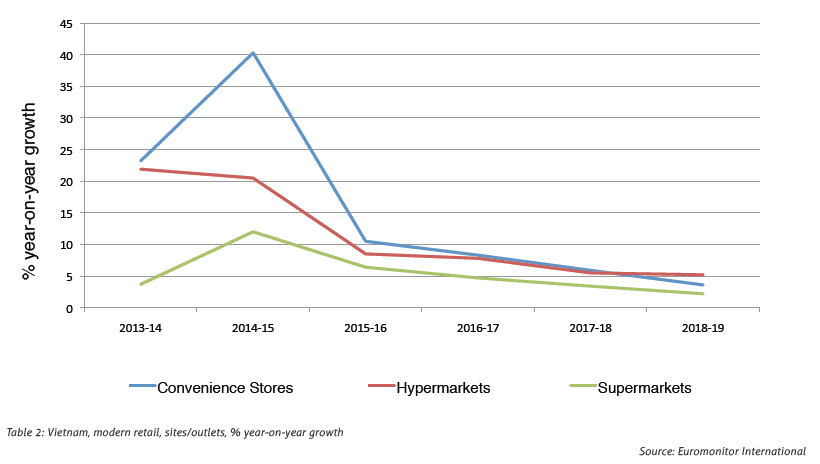

Aside from online retail and social media use, the country also sees a significant expansion of modern retail concepts which present a good opportunity to promote tissue products, such as napkins and paper towels placed next to food and beverages. For instance, convenience store chains are expanding nationwide. Family Mart now has 72 convenience stores in Vietnam, 52 of which also serve fast food, including sushi, stews, dried food and sandwiches. Also, filling stations in the country increasingly offer fresh coffee and baked goods.

It has to be noted, however, that while modern retail offers great opportunity to build and expand customer base of urban and more affluent consumers, traditional retailers still account for nearly half of all retail tissue sales. Ensuring good retail distribution through these retailers is a must, especially to reach lower income consumers and those living outside of major urban areas.