In 2018 retail sales of consumer tissue in the US remained flat in nominal value terms (declined in real value), although still generating a very respectful USD18bn. In volume terms, the market has seen a decline in 2018, and it is projected to remain largely in the negative territory over the next five years. As key macro- fundamentals continue to shape demand and sales, slowing economic projections and persistent low levels of population growth (well under 1%) will continue to impact the industry. On the positive side, spending in AfH space picked up, as more US consumers dined out and have been traveling more.

In fact, the number of nights spent at hotels in the US increased in 2018, pushing up the demand for tissue products. US remains one of the key global markets for the tissue industry, although now ranking second after fast developing China in value and volume terms. Subsequently, understanding challenges and opportunities ahead in the US market, coupled with consumer sentiment with respect to private label vs brands and pricing, will remain of significant importance to the industry.

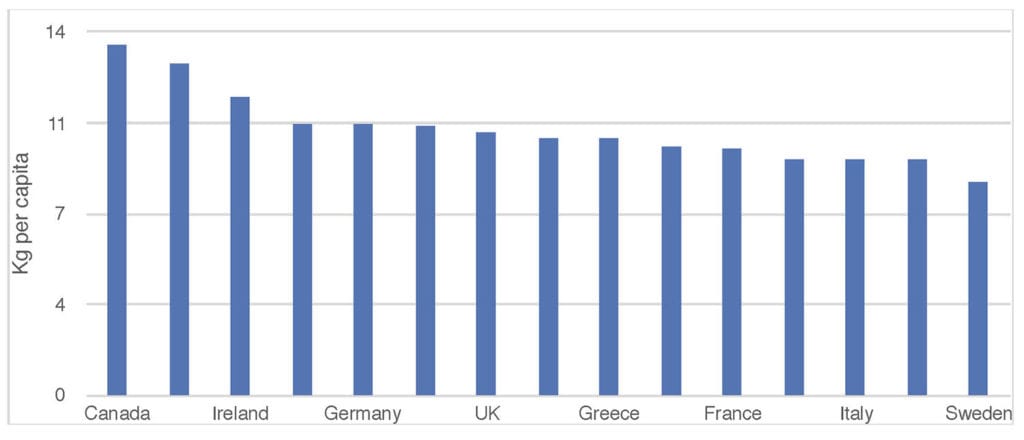

On the whole, the US retail tissue market has long reached its potential in terms of per capita consumption. In fact, per capita consumption of tissue products in the country is already among the highest in the world, far ahead of many other developed markets, leaving no room for the industry to drive organic growth to any significant extent. Slowing GDP projections, lack of significant boost to birth rates (not the least also due to the fact that more women chose not to have children), and ongoing risks of US-China trade wars can further reduce the expected growth in the market. Trade wars can lead to further increases in prices in retail, in addition to price increases already implemented in 2018, thereby forcing consumers to re-evaluate their spending priorities.

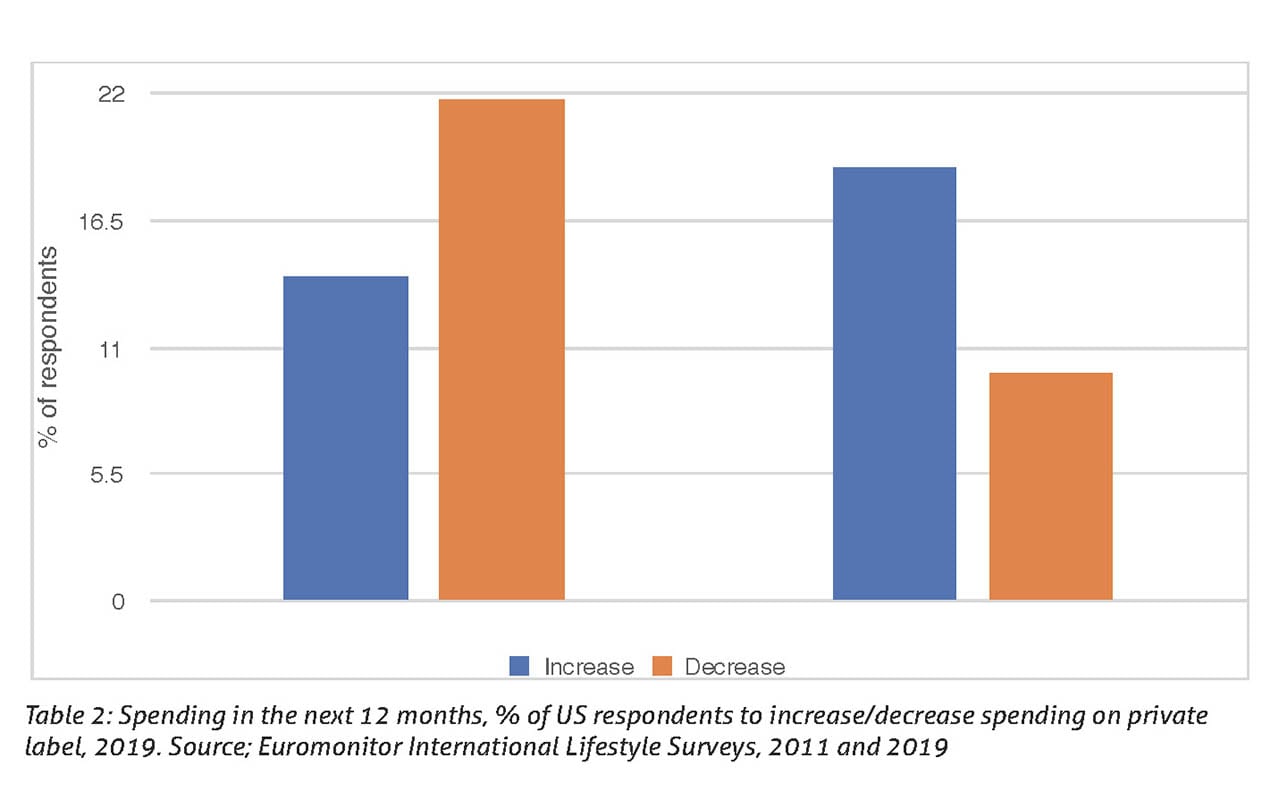

Further price increases on consumer products, including tissue, will likely face challenges. While there is certainly a consumer base of higher income households that is not likely to change their spending patterns dramatically, Euromonitor lifestyle surveys continue to demonstrate that many consumers in the US intend to increase their spending in discounters and spend more on private label in 2019. In fact, the proportion of respondents planning to increase their spending on private label in the coming 12 months went up from 14% in 2011 survey to 17% in 2017 survey to 19% in 2019 survey, backing up an upward demand trend for value segment and private label.

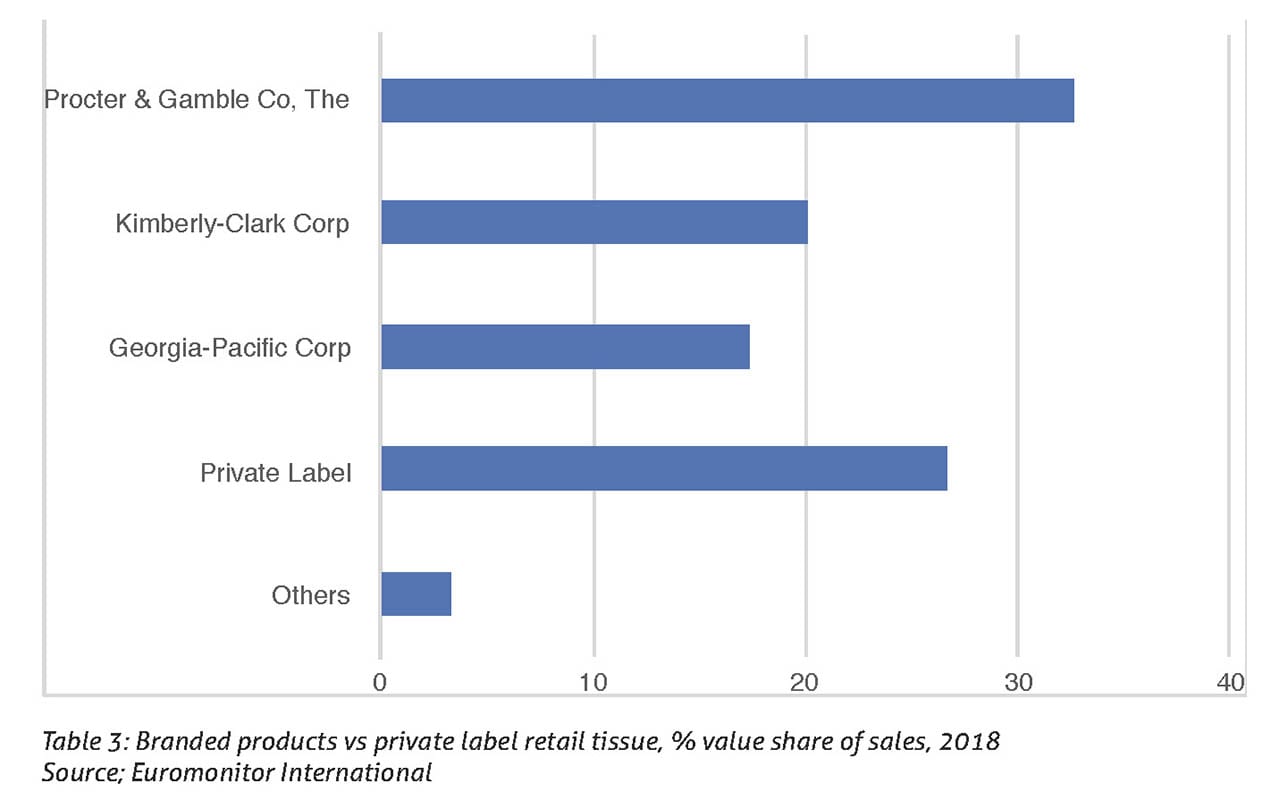

In 2018, private label in the US accounted for 27% of retail tissue sales. While concerns (or hopes – depending which side you are on) that the private label in US can capture more share of sales to reach the levels of Western Europe remain unfounded, current strength of private label and solid consumer base of private label tissue already put sizable pressure on branded products, often at times pushing innovation further into polarising domains of premium or value on the part of both brands and private label.

Adding to the pressure is continuing expansion of Amazon into private label space. The retailer’s own Presto! tissue brand appears first and front with currentsearch on, for instance, toilet paper. Furthermore, search results loudly and proudly announce that Presto! is among the top rated Amazon’s private and select exclusive brands.

While pressure from private label continues on the one hand, there is also a range of smaller niche brands gaining ground in retail tissue. Some of these brands are tapping into the convenience trend, with online direct to consumer (DTC) shipping. Many insurgent brands also appeal to those who seek to be more environmentally-friendly as well as seek out brands with social and community-oriented agenda. An example can be found in a rising Australia-based brand Who Gives a Crap, now available online in a number of markets, including the US. The brand allows users to order once as a trial or start a subscription to receive products monthly. The brand also features products made from recycled fibres as well as premium positioned products made from bamboo fibres. The company also donates half of its profits to build toilets in places where there were previously none, mainly in the developing world. A combination of DTC model, environmental and ethical messaging as well as community involvement have appeal to a large portion of consumers. Euromonitor lifestyle survey released in 2019 indicated that 57% of US respondents strongly agree/agree that they try to have a positive impact on the environment through everyday actions.

This is not to say that all is gloom and doom for the key industry suppliers and brands. As Euromonitor discussed in previous analysis, products that provide tangible benefits to consumers always have their place in the households. Thus, for instance, the paper towels category in the US saw a somewhat better performance in 2018 compared to the previous year. While price increases did play a role in boosting nominal value up, product positioning and improvements in quality and strength also continue to support the category. Paper towels are viewed as multifunctional products – from cleaning houses and surfaces to cleaning hands. Availability of paper towels in different formats and sizes also help the category, as they respond to a variety of household needs

Paper towels continue to be popular purchases at home improvement stores such as Lowe’s and Home Depot, where consumers have been increasingly buying household essentials for home maintenance and cleaning.

All in all, the US retail tissue market will remain challenging for the industry, with estimated unmet potential at about USD360m. Hence, the battle for share of consumer spending between brands – mainstream and insurgent – and private label will remain fierce. Cost efficiencies will be the focus to improve margins, since price increases can only go so far in view of strong attention on discounters and private label by a large portion of consumers.

On the competitive side, product quality, sustainability, ethical messaging, and community involvement will be increasingly important to secure consumer attention.