With the end of government aid packages helping consumers purchase basic household goods, the industry will need to establish new supply channels.

Brazil remains the epicentre of the Latin American tissue market, replacing Mexico as the largest value contributor to regional sales as far back as 2007. This single market accounted for roughly a quarter of regional value sales in 2020; a figure which continues to creep upwards annually from just shy of 20% in 2006. While all the metrics look positive, this belies a low per household expenditure level of USD29; way below Mexico ($43) China ($39) or even globally ($38). The Brazilian market therefore continues to hold great potential, but after a decade of reporting on the tissue market, I’m still asking the same question: can this potential be realised?

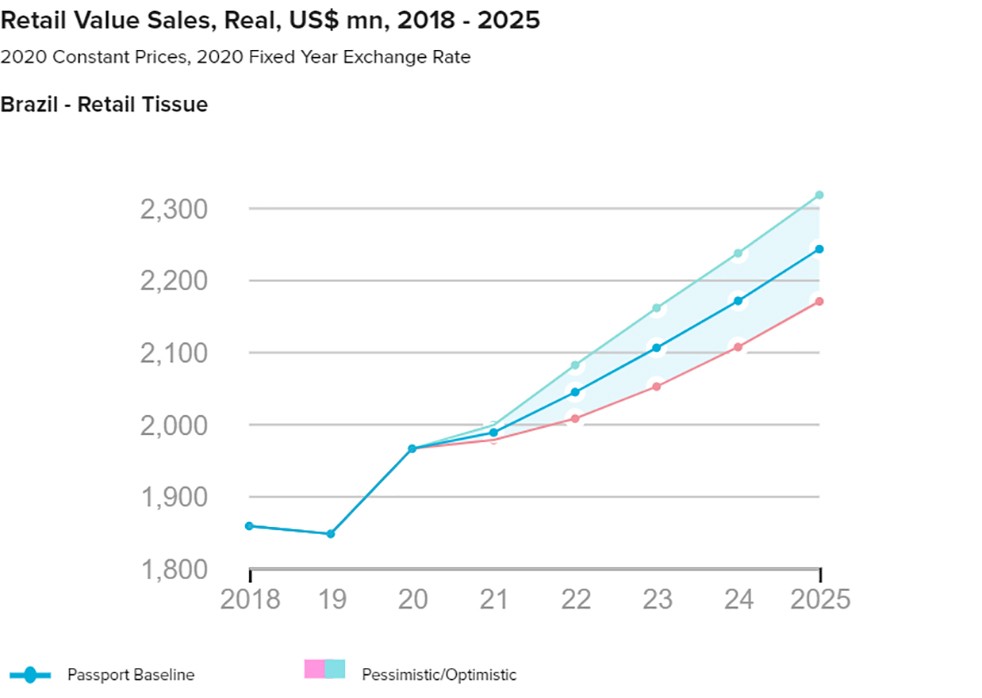

In 2021 we expect the Brazilian market to finish the year at around the $2 billion mark. This is significantly up on the 2019 (pre-pandemic) level of USD1.85 billion. Before we get into the influence of the pandemic in detail, this is potentially a defining moment for tissue for the coming decade, and it is worth considering the market potential in more detail. Given demographics, income, product availability and consumption culture, it is not unreasonable to surmise that brands should prepare for a market that is twice its current scale. Habit persistence remains a key component of future growth, meaning that once consumers are engaged with tissue there is an overwhelming tendency to continue purchasing. This is the area where the influence of the pandemic presents a huge opportunity beyond the windfall 6.5% value growth reported in 2020, namely, an opportunity to broaden the appeal and usage of tissue products beyond the confines of what came before.

Behaviour change

Consumer crisis behaviour during the pandemic was typical of what was witnessed as a global trend: Brazilian consumers opted for stockpiling as the crisis unfolded. This was seen in the form of ‘panic-buying’ of several products in order to stock them at home in case of an eventual lockdown. As a result, sales of toilet paper skyrocketed during Q2 2020, with many manufacturers reaching their sales targets for the year by Q3. Nevertheless, unlike other products, for which stockpiling helped to increase consumption, this was not the case for toilet paper. Although stockpiling toilet paper did not lead to an increase in total usage per capita, retail consumption did increase due to all household members spending more time at home. After initial stockpiling, sales decreased due to running down domestic stocks, and the market normalised by Q4. While 2021 has been a further year of disruption, tissue sales are forecast to continue to grow at around 1% in value terms.

Social gatherings

While the core toilet paper category benefited from home seclusion others were not so fortunate. As consumers quarantined, social gatherings at home also reduced drastically. This negatively affected sales of napkins (paper tableware), as more limited household usage put the brakes on consumption. Despite an easing of Covid-19 restrictions, 2021 is yet to see a return to pre-pandemic lifestyles and this has been further compounded by economic uncertainty. Brazilian consumers are trading down and purchasing fewer premium products not just in paper tableware but across all retail tissue categories.

Multifunctionality wins

Although household gatherings were put on hold, the pandemic did bring with it an uptick in household cleaning frequency as well as range, shining a light on preventative health and hygiene. This caused paper towels to be even more widely used for increasingly diverse purposes, driving it to see the fastest growth in retail tissue. Versatility was much appreciated by consumers who often reported using paper towels as a direct substitute for napkins, being convenient, cost effective and helping to rationalise shopping journeys. While in other markets the rapid rise in demand improved the position of small and medium sized players, as well as encouraged away-from-home producers to branch out into retail, the situation in Brazil proved to be contrary.

Supply chain disruptions

Small players account for the largest share of value sales in retail tissue, highlighting the highly fragmented nature of the category. However, as panic-buying and stockpiling increased product demand drastically during Q2 2020, access to raw materials and packaging was more difficult, making it easier for larger players to fulfil new orders. Suzano, one of the largest cellulose and pulp suppliers, leveraged its capabilities and was less impacted by disruptions, therefore managing to increase the presence of its Mimmo brand. Also, the leading players Santher, Mili and Kimberly-Clark benefited from smaller players having more limited access to raw materials and packaging, therefore growing their value shares in a competitive category. However, after stockpiling ended, this generated an oversupply of retail tissue products, causing manufacturers to use their spare capacity for private label products.

Channel shifts

Despite overall distribution shares remaining largely unchanged in 2020, growth did vary across channels, and some factors helped to shift these dynamics. E-commerce, despite accounting for a low share of sales, nearly doubled its size and grew 10 times faster than the average across all retail channels in retail tissue during 2020. Thanks to large internet retailers such as Magazine Luiza, online retail tissue sales grew dramatically, and it became an important channel amongst more wealthy consumers. Meanwhile, supermarkets, hypermarkets and traditional grocery retailers grew aligned with the category average and remained the main distribution channels for retail tissue, especially when consumers stockpiled. However, convenience stores, despite accounting for a low share of value sales, also saw significant growth in 2020, as their location in residential neighbourhoods meant they were easily accessible to consumers. The growth of this channel, which is characterised by smaller outlets and is intended for smaller purchases, will require manufacturers to adapt to offering smaller pack sizes.

Trading down

In previous years, premium-positioned products such as two-ply toilet paper increased their mainstream reach, as they were becoming accessible beyond higher income households. However, with the economic crisis due to Covid-19 many consumers faced losing their jobs and relied on government aid to keep purchasing basic household goods, such as toilet paper. With the end to this aid, even stronger trading down is being seen in 2021, meaning that lower-income consumers in particular will rely on one-ply toilet paper due to affordability. Lower-income consumers usually also lack space at home to store large packages, making the option of buying in bulk to get better deals, harder. As a result, manufacturers will have to position themselves effectively and work with pack sizes that make them affordable to a broader base of consumers.

The shape of things to come

Although Brazil’s experience during the height of the pandemic and in this latest phase is far from unique, the tissue market does emerge as an overall beneficiary of lifestyle changes. The big question for the industry remains, can the economy support consumers’ changed relationship with tissue and reinvigorate categories that were left behind? Given the scale of economic disruption coming it is increasingly difficult to discern if this particular glass is half full or half empty, our forecast model concurs with this observation.