Lower birth rate and shift away from tradition families towards single or two-people households without children will affect future market. By Paula Ferolla, São Paulo-based Consumer Insights Consultant, Euromonitor International.

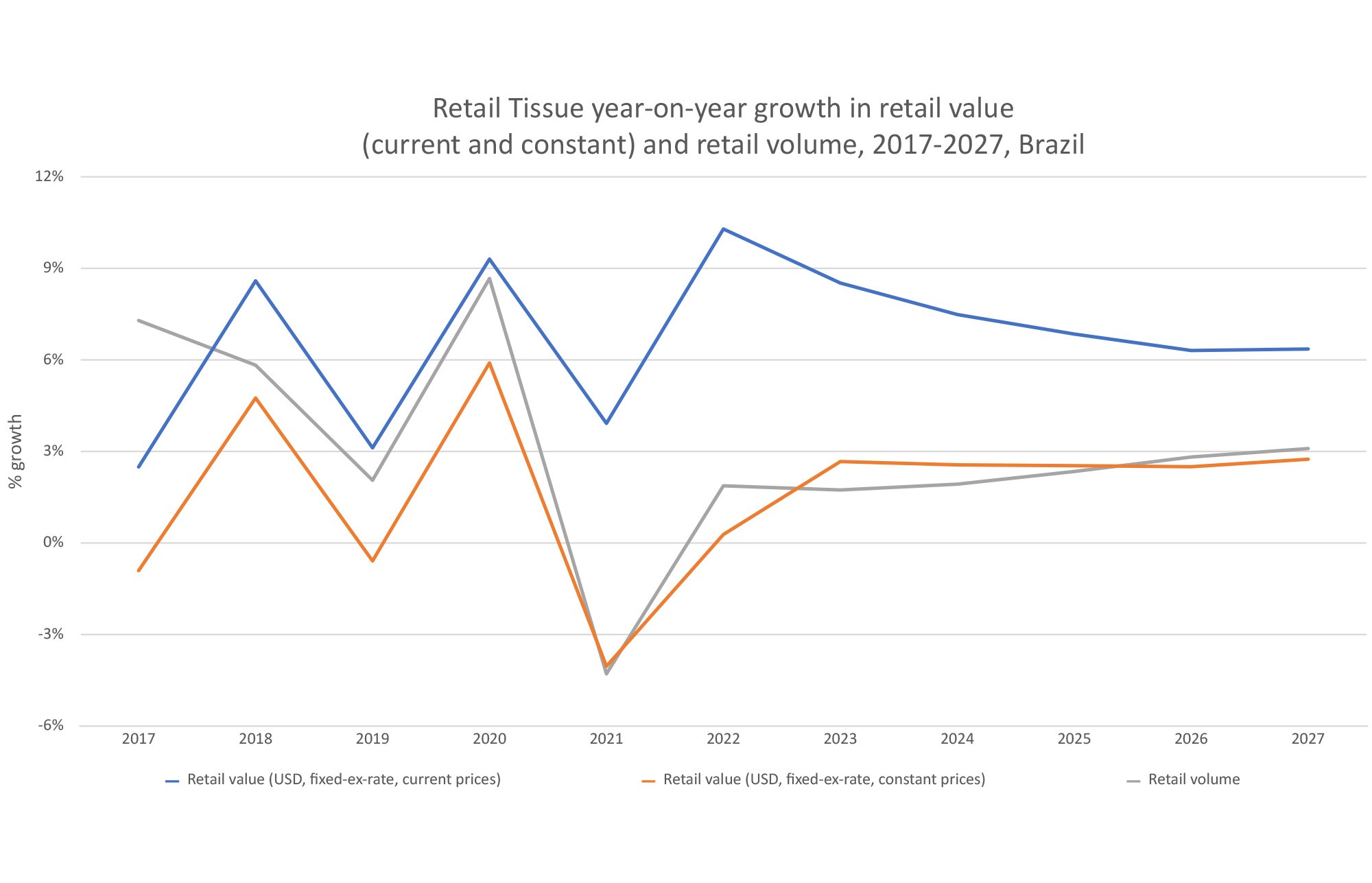

In recent years, inflation was the top theme across many channels and categories in Brazil, including tissue. The recent post-pandemic supply chain disruptions, additionally affected by the Russian-Ukrainian war, have unbalanced the cellulose supply and demand relation. Consequently, manufacturers have increased average prices in Brazil or compensated cost pressure through shrinkflation, especially on toilet paper and paper towels. Packaging diversification has also been a retailing strategy across tissue brands, whereas a wider portfolio can account for different buying power fitting to a diverse set of consumer’s budgets between two ends of polarization – between value and premium.

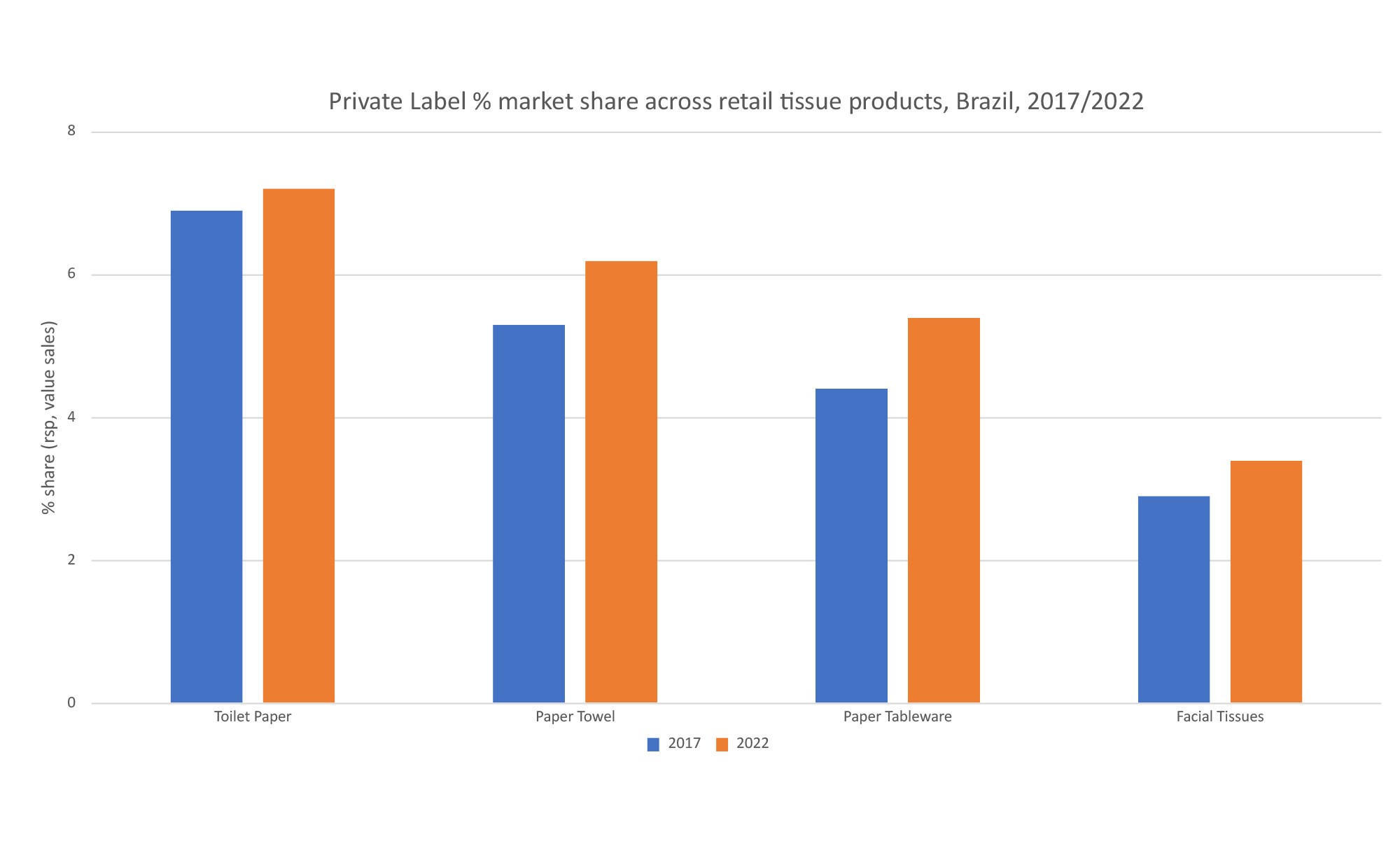

As such, the tissue industry in Brazil has seen negative volume performance in 2022, while inflation boosted a slow but positive retail value growth. As the controlled inflation ceiling has recently remained above that observed in many developed countries, Brazilian consumers continuously need to accommodate their household budget among grocery categories. Within social classes stratification, economically disadvantaged consumers from classes D and E account for more than 75% of the population, according to Euromonitor’s data based on national statistics. Overall, consumers struggle to maintain their purchasing behaviours in turbulent socio-economic scenarios, while the national minimum wage hasn’t increased accordingly to inflation, often choosing private label options or more affordable brands as an alternative, especially on napkins and toilet paper.

Increasing price-sensitivity and inflation have led Brazilian consumers to spread out their grocery shopping throughout the month and explore different purchasing channels. This has had a direct effect on warehouse clubs’ growth since 2020, as low and medium-income consumers are eager to find affordable prices and buy in bulks, as a better cost-benefit decision. Some chains’ expansion strategy was based on advantageous locations with higher populational density and diverse socio-economic profiles. In 2023, several warehouse club chains continue on expansion, including Assaí, Atacadão and Fort Atacadista, along with the increase of brand and product availability and customer service improvements.

Interestingly, this scenario has not deterred launches targeting premiumisation, such as Santher’s 3-ply toilet paper, which highlights natural fibres and sustainable attributes as well as product claims such as comfort, resistance and softness. The regional player Copapa introduced the toilet paper brand Carinho Ecológico in 2022, with a packaging 100% paper-based, and quality standards supported by green labels such as EuReciclo and SOS Mata Atlântica. Such premium offers are directly targeted to more affluent consumers. In fact, about 8.4% of Brazilians still fall into the social class A category.

Looking ahead, retail tissue should perform on 2.4% CAGR in retail volume in the forecast period (2022-2027), whereas demand is influenced by improvements in economic drivers and ongoing societal shifts that consequently lead to different purchase behaviours. For instance, according to IBGE (Instituto Brasileiro de Geografia e Estatística), lower birth rates and fertility rates in recent years are indicative of a demographic shift in Brazil, resulting in changes in family composition in favour of single or two-people households without children, which may lead to purchases of smaller packs of tissue goods.

Travel and foodservice recovery supports AfH tissue demand despite shifting working practice

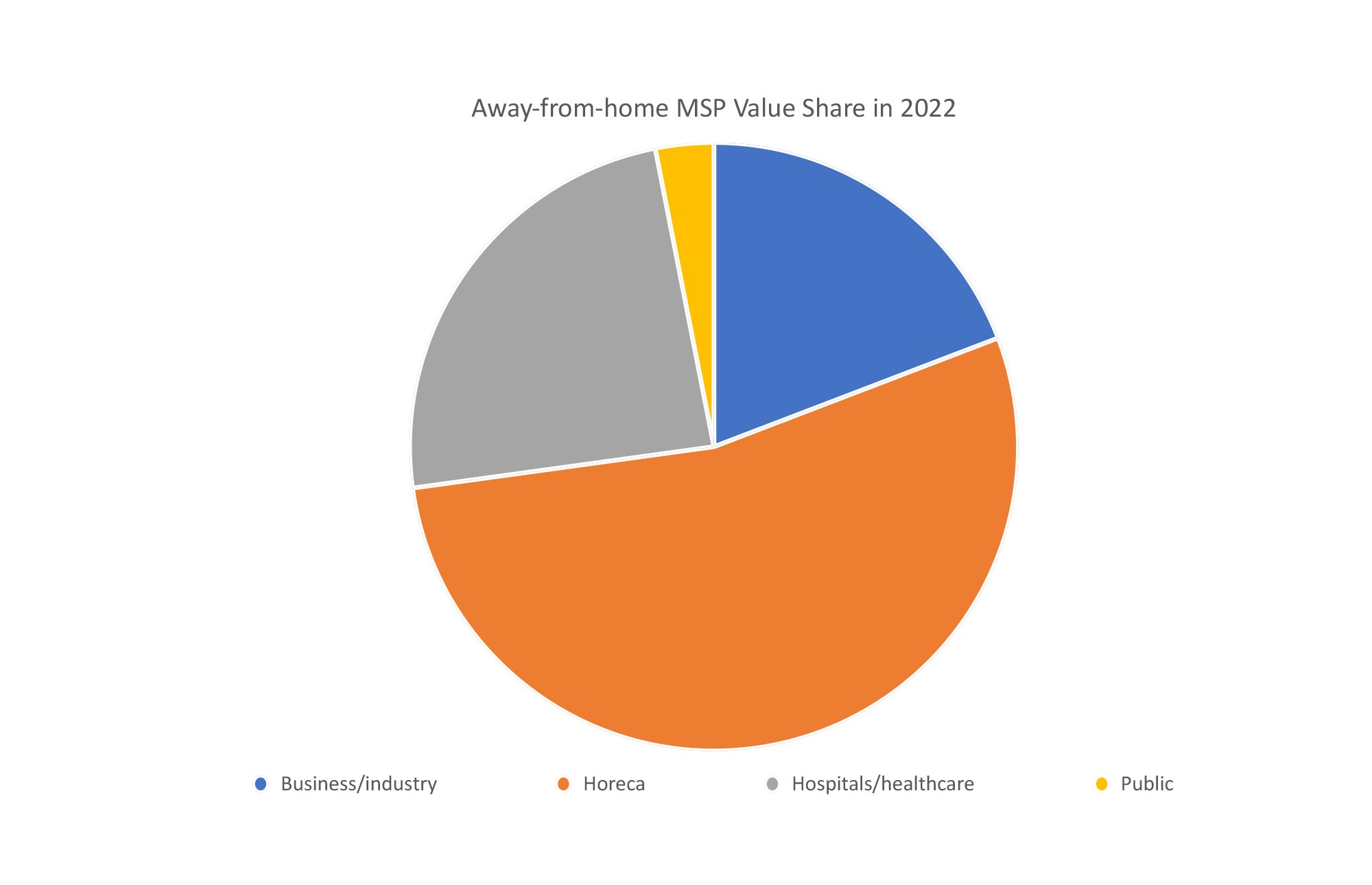

The pandemic disruptions have severely hindered the demand for AfH tissue products, which showed more definitive signs of recovery in 2022 and 2023 from 2020. Currently, AfH sales represent slightly more than 18% of total tissue market in Brazil, with more than half of consumption derived from HoReCa channel, including hotels, foodservices providers such as restaurants and catering establishments. The channel performance has shown positive signs, with travel and business activities gradually recovering.

As pandemic-related restrictions further eased, tourists were encouraged to resume travel plans. Despite that, unfavourable exchange rates, inflationary economic pressure, and skyrocketing airline tickets in 2022 have negatively affected overall spending, hindering a robust recovery. In 2023, the AfH market has been positively impacted by the travel’s industry growth of 18.4% in constant retail value (on fixed exchange rate), as a result of a strong flow of inbound arrivals and outbound departures. The positive recovery also impacted sales especially on wipers, napkins, and toilet paper.

Additionally, the revival of business activities will also apply to the AfH tissue market landscape as many employees returned to workplaces. According to Euromonitor’s Lifestyle Survey, in 2023 some 35% of Brazilians against 38% in 2022 are weekly working from home. While the results show that a part of the population still live the remote work reality, gradual return to the office should support tissue usage through foodservices.

In the forecast period, 2022-2027, AfH tissue should grow 3% CAGR in volume, surpassing the 2019 level and benefitting from Brazil’s preponderance as the largest consumer foodservice market in Latin America, a positive tourism performance, a consistent demand from the public healthcare system and the growth of private healthcare institutions in Brazil.

Vertically integrated consolidation bodes well for Brazil’s long-term tissue performance

The opportunities in the Brazilian consumer tissue market – its population size and consumption potential – are already well known, with the country seen not only as a large tissue consumer market but also a key global cellulose supplier. With the States of Mato Grosso do Sul, Bahia e São Paulo collectively contributing the most significant share to the Brazilian cellulose production, and local pulp and paper producer Suzano Papel e Celulose marking the world’s largest cellulose producer, and the country’s overall resilience as a consumer tissue market is expected to contribute to long-term growth.

Overall, the outlook for Brazil’s tissue is promising as indicated in a slew of high-profile consolidations backed by supply chain optimisation in recent years.

In 2023, Suzano further built its local prowess by acquiring Kimberly Clark’s local tissue assets, including manufacturing site in Mogi das Cruzes, São Paulo, and the licensing rights of the brands Kleenex, Neve, Scott and K-C professional line. In 2020, Japanese player Daio Paper acquired Santher – Fábrica de Papel Santa Therezinha, a local company with important brands in the portfolio such as Personal, Snob and Kiss. The subsequent year saw CMPC acquiring Carta Fabril, the owner of several brands, such as Cotton, Deluxe, Coquetel, GranFinale, Leblon Soft Blanc, Looping, Klass and Looney Tunes. Besides, in the first semester, Brascell has concluded the acquisition process of OL Papéis, a tissue and hygiene manufacturer focused on the Northeast of the country, with brands across paper towel, toilet paper and diapers.

These examples highlight a key underpinning strategy shaping the Brazilian tissue production: verticalisation, which allows the centralisation of all the processes in the production chain, from the raw materials manufacturing to the distribution of the final product, enabling tissue producers to achieve greater production efficiency, stock control on cellulose and paper production, as well as independence from external stakeholders.