By Bill Burns, senior consultant, Fisher International

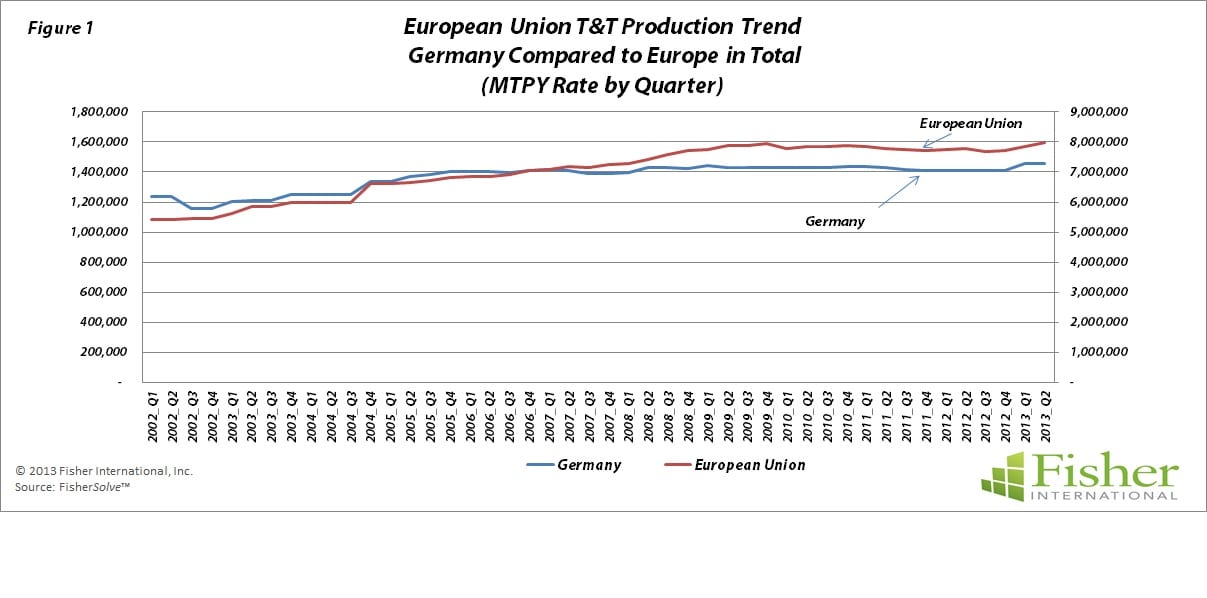

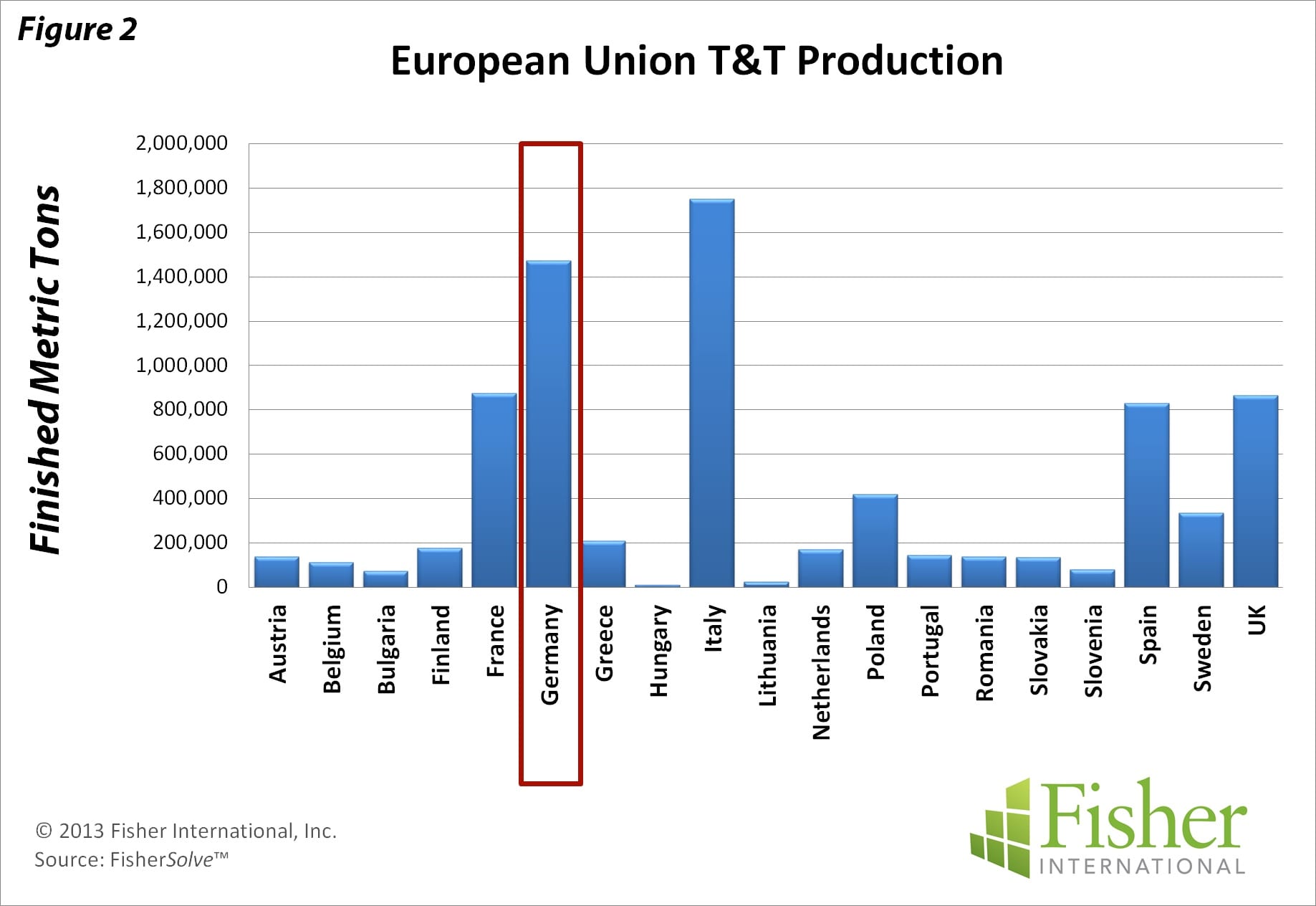

Germany is the European Union’s (EU) largest economy and the second largest producer of Towel and Tissue (T&T), making nearly 1.5 million MT/Yr. That means Germany, second only to Italy, represents about 20% of European Union capacity. Germany went through a series of economic reforms between 1998 and 2005. The reforms addressed chronically high unemployment and low average GDP growth. As a result, there was strong growth in 2006 and 2007 as well as a reduction in unemployment. These improvements, in addition to government subsidised reduced working hour schemes, led to a relatively modest increase in unemployment during the 2008-09 recession and an eventual decrease to 6.5% in 2012. GDP contracted 5.1% in 2009 but grew by 4.2% in 2010, and 3.0% in 2011, before dipping to 0.7% in 2012 driven by investment uncertainty and the decreased exports to recession-stricken periphery countries. Nevertheless, the EU and German T&T business managed to sustain growth through these poor economic times (Figure 1).

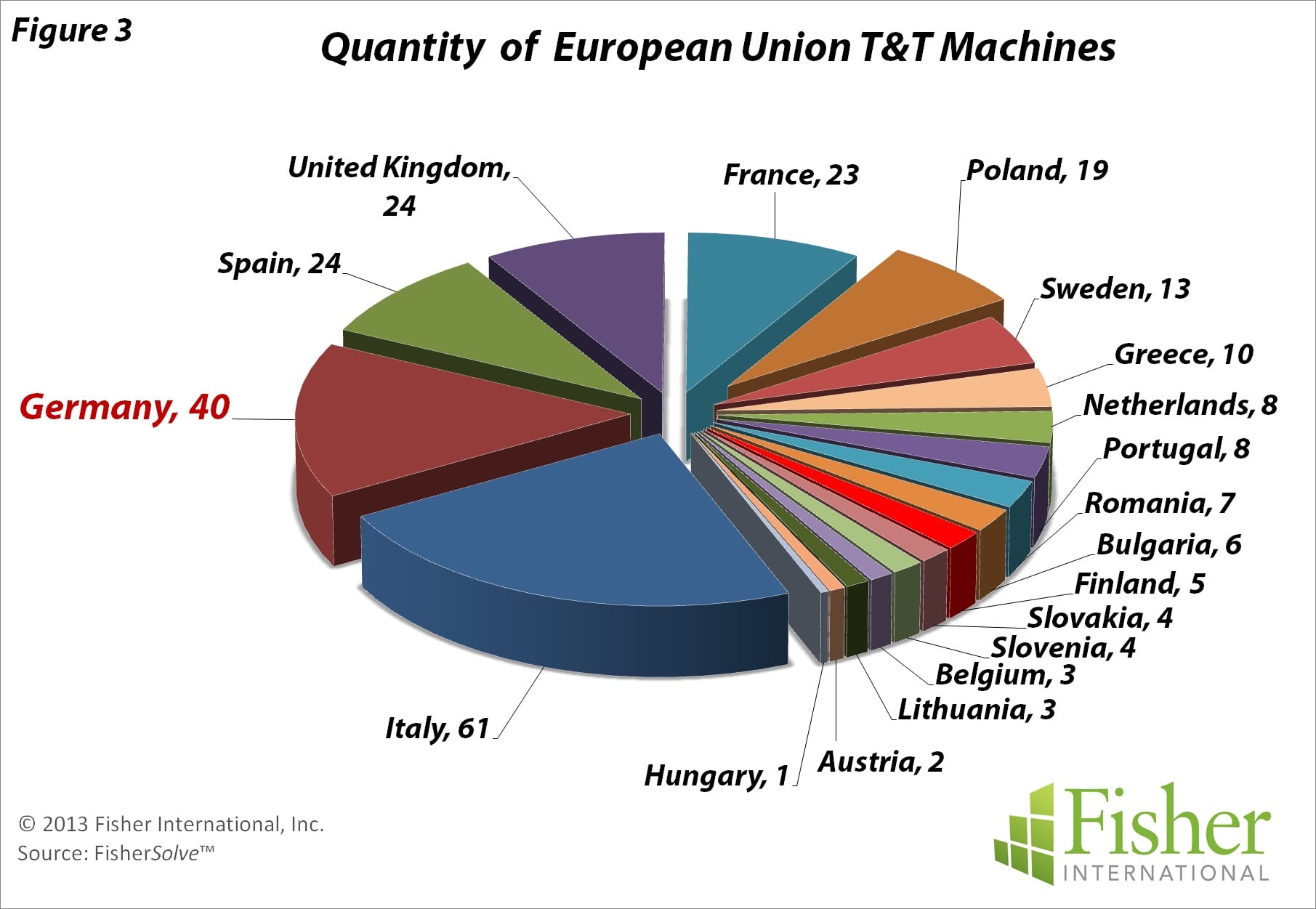

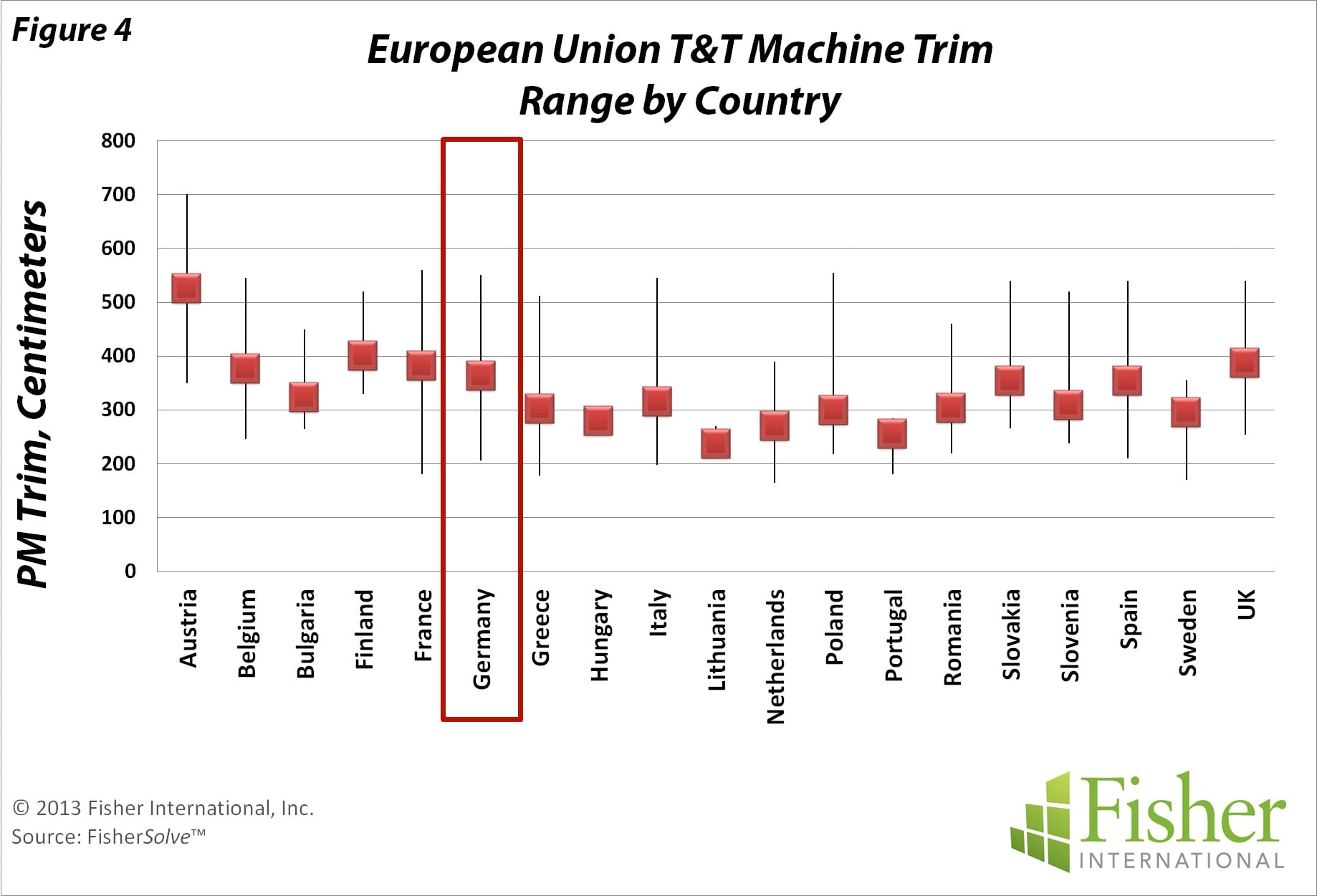

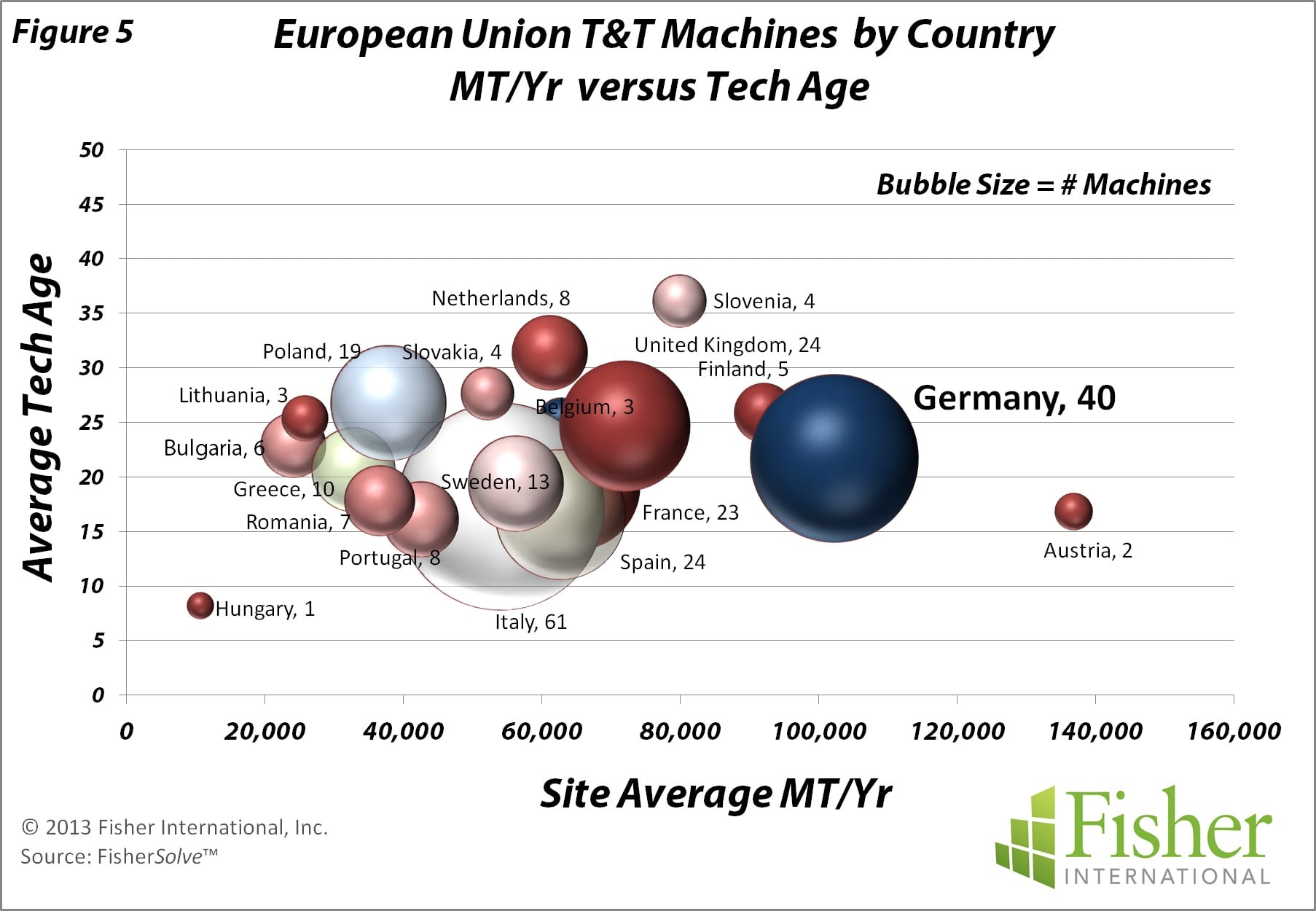

German T&T mills are geographically dispersed throughout the country with the largest concentration in the Rhine Valley (Map 1). Germany ranks second among T&T producers in the EU (Figure 2) and second in the number of operating machines (Figure 3). T&T machines in the EU vary from narrow two-metre machines to six metres. Machines in Germany are typical in terms of the trim range for the region, with the average being 3.6 metres (Figure 4). Mill production in Germany is, on average, on the high side compared to other producing countries in the EU at nearly 100,000 MT/Yr while the technical age of German machines is a little above average (Figure 5).

‘Germany’s cost position in the EU is slightly disadvantaged by higher labour and energy costs’

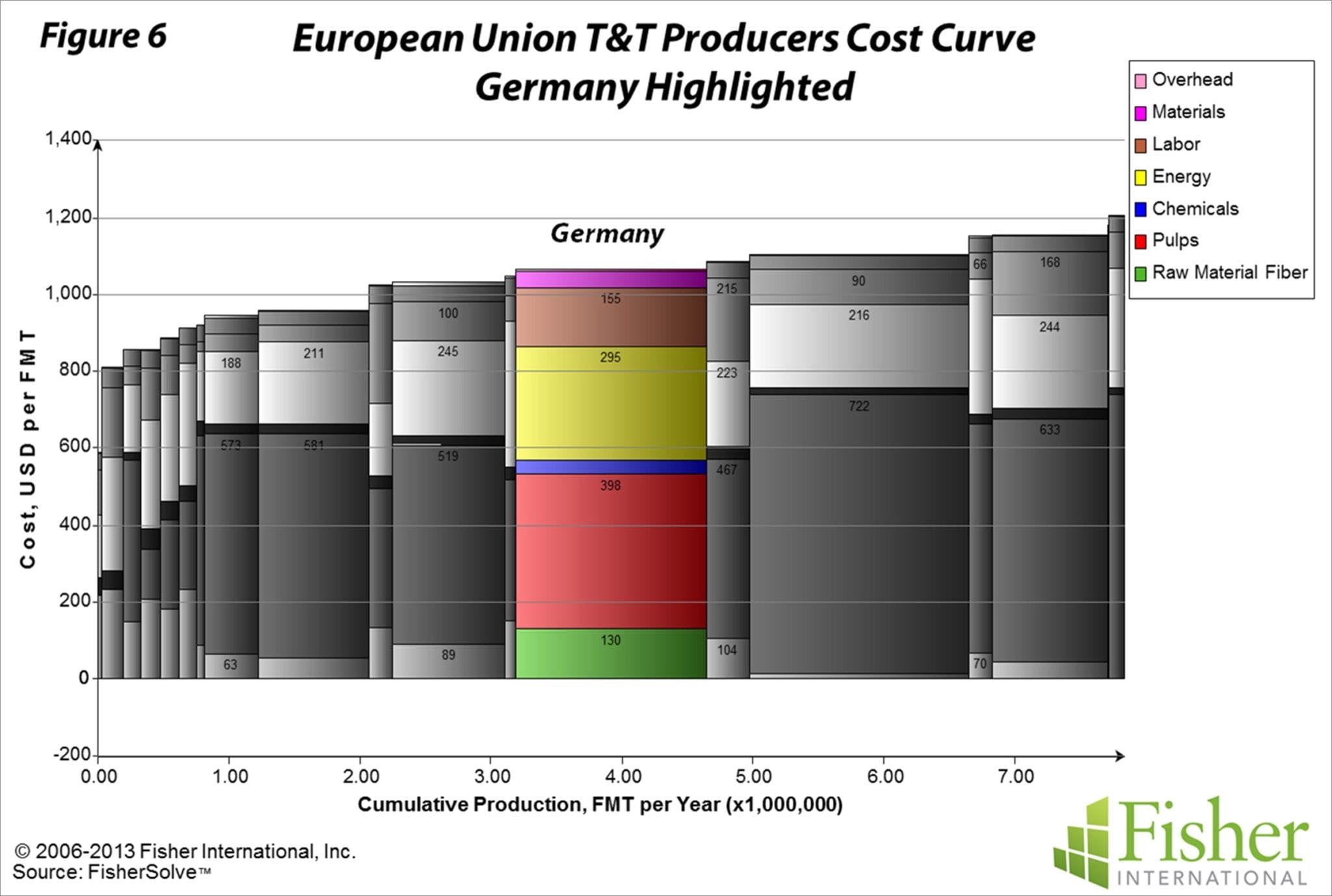

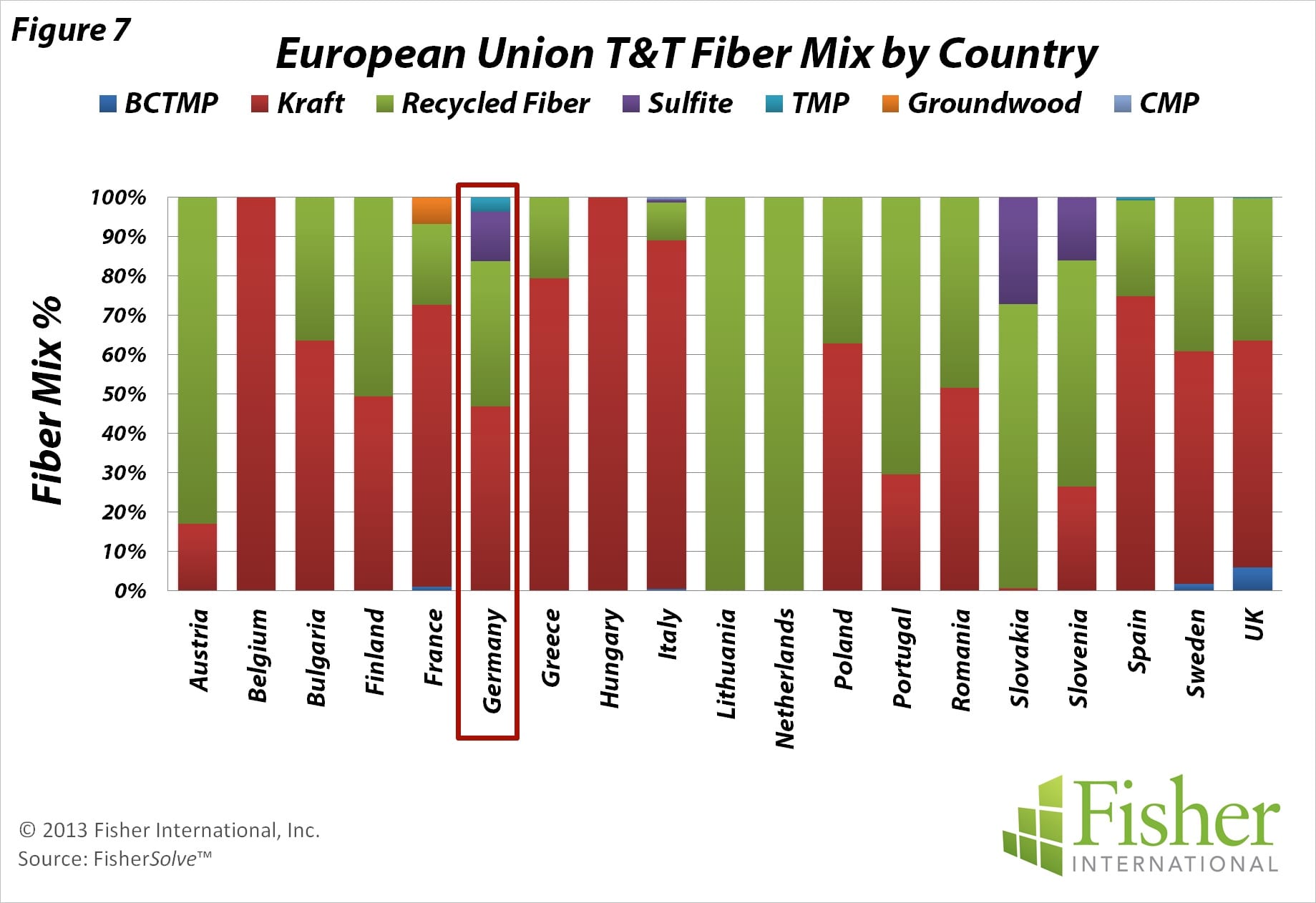

Germany’s cost position in the EU is slightly disadvantaged by higher labour and energy cost than someof the smaller producing countries (Figure 6). Fibre mix in German mills is 47% market kraft pulp with the remaining being recycled, Sulfite and some TMP (Figure 7). While recycled fibre is present in most countries, it is not in heavy use by major producers. Integrated recycled fibre does provide some smaller producing countries with an advantage over the purchased fibre consumed by larger producing countries like Germany.

‘Integrated recycled fibre does provide some smaller producing countries with an advantage over the purchased fibre consumed by larger producing countries like Germany.’

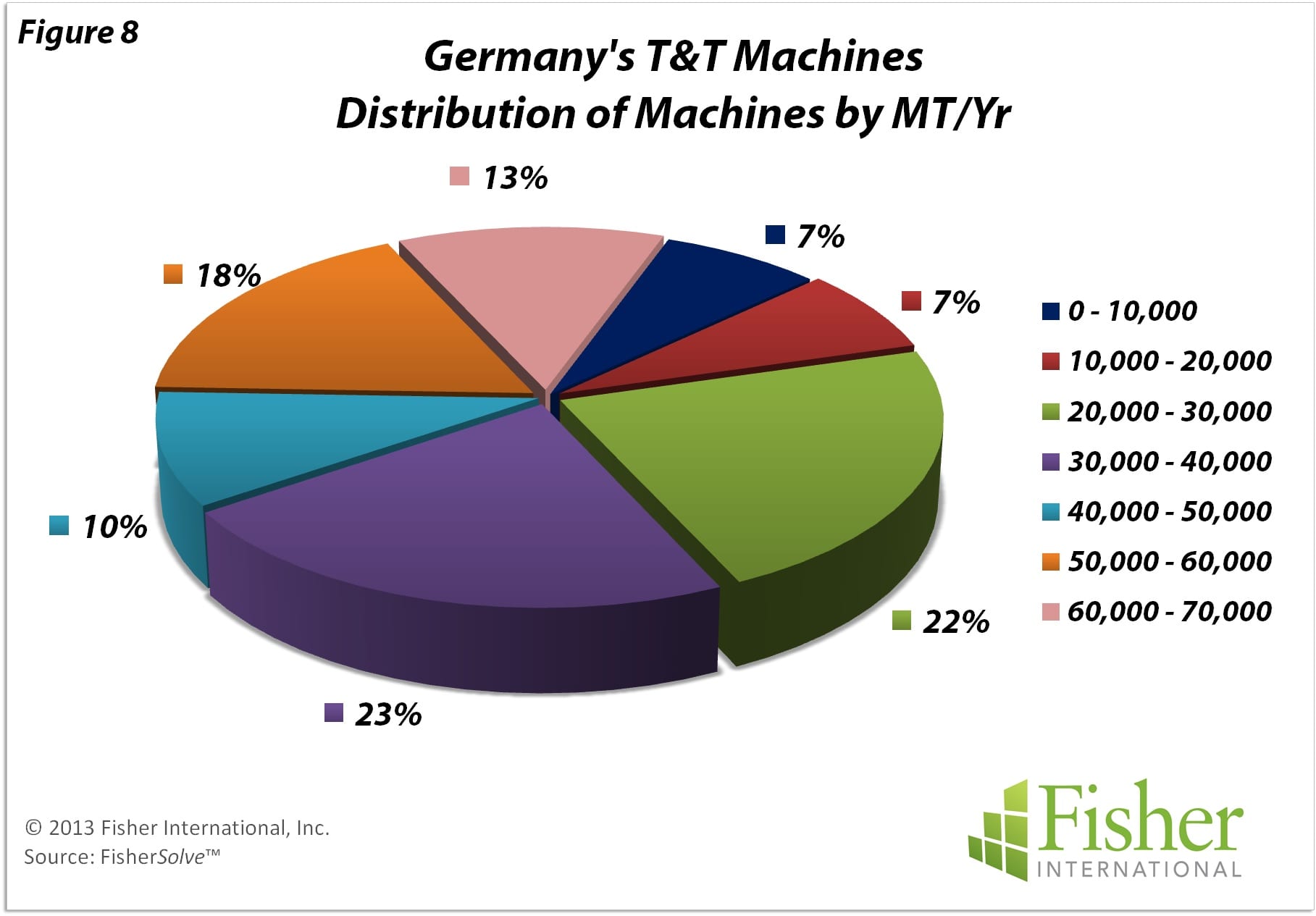

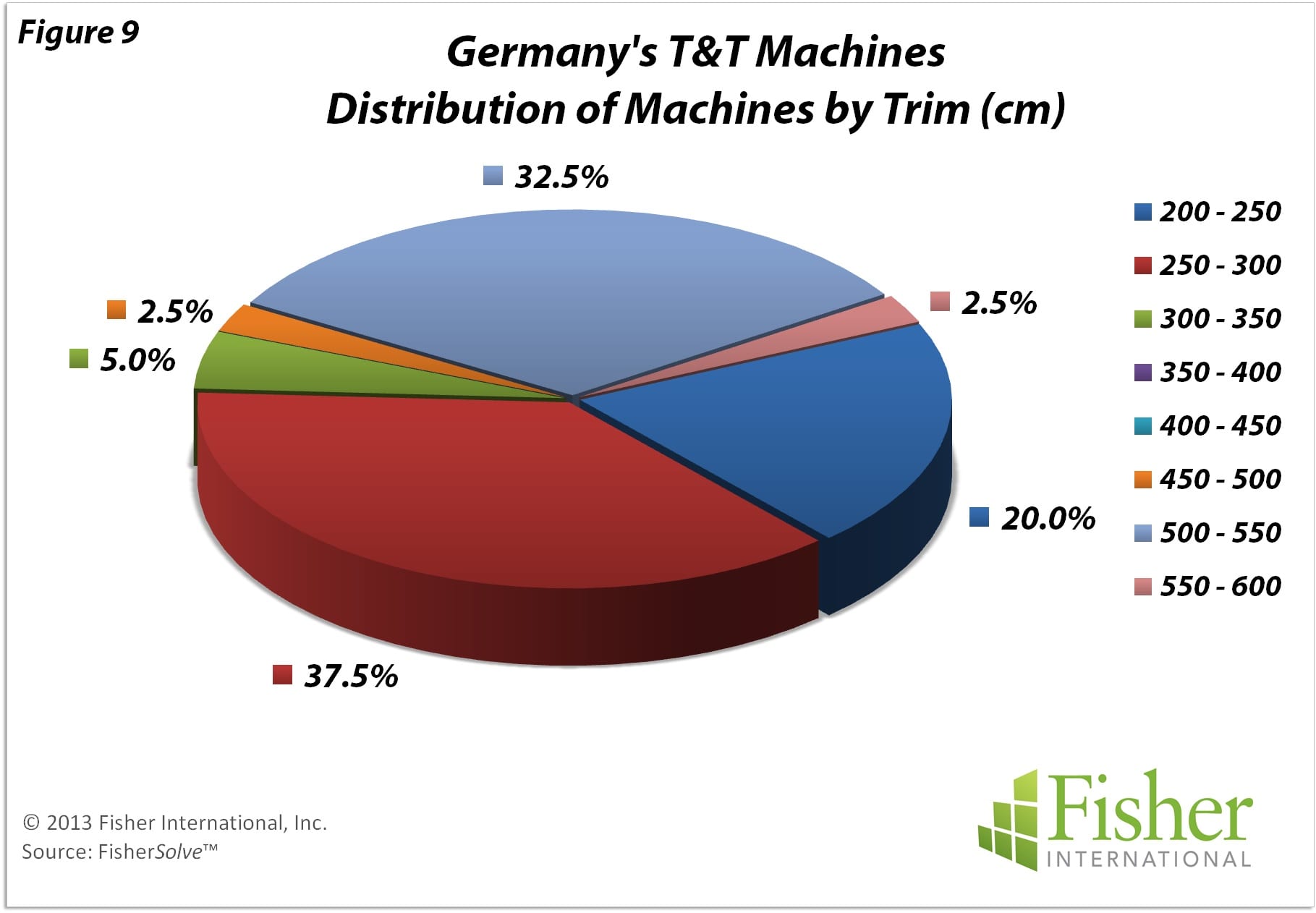

German T&T machine production rates are split between machines ranging among the smallest, producing less than 40,000 MT/Yr, and those at more moderate levels, producing in the 40,000 – 60,000 MT/Yr range (Figure 8). Machine trims are narrow with more than half of the machines being less than 3.5 metres (Figure 9). About a third of the machines are wider, falling in the 5.0 – 5.5 metre class.

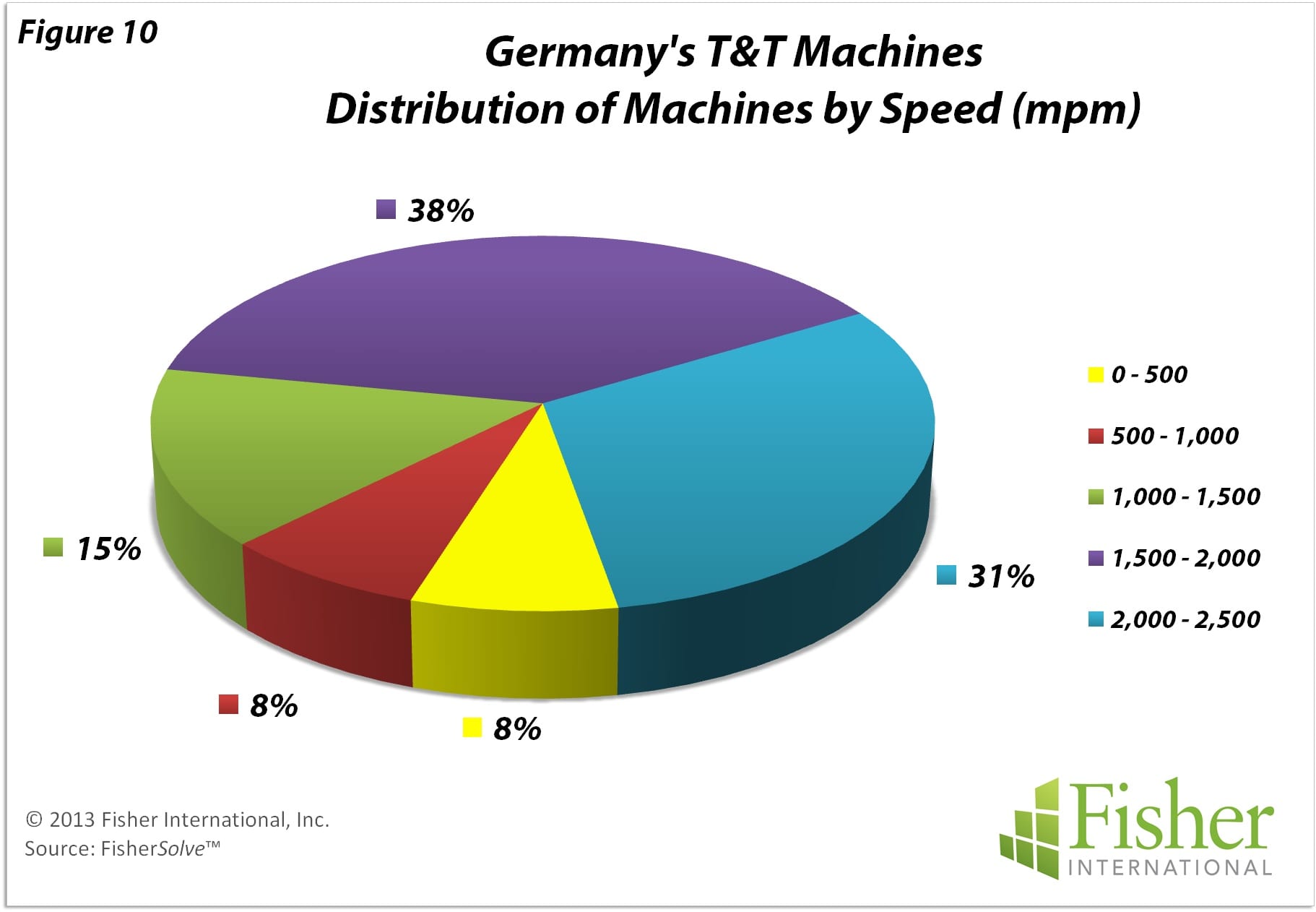

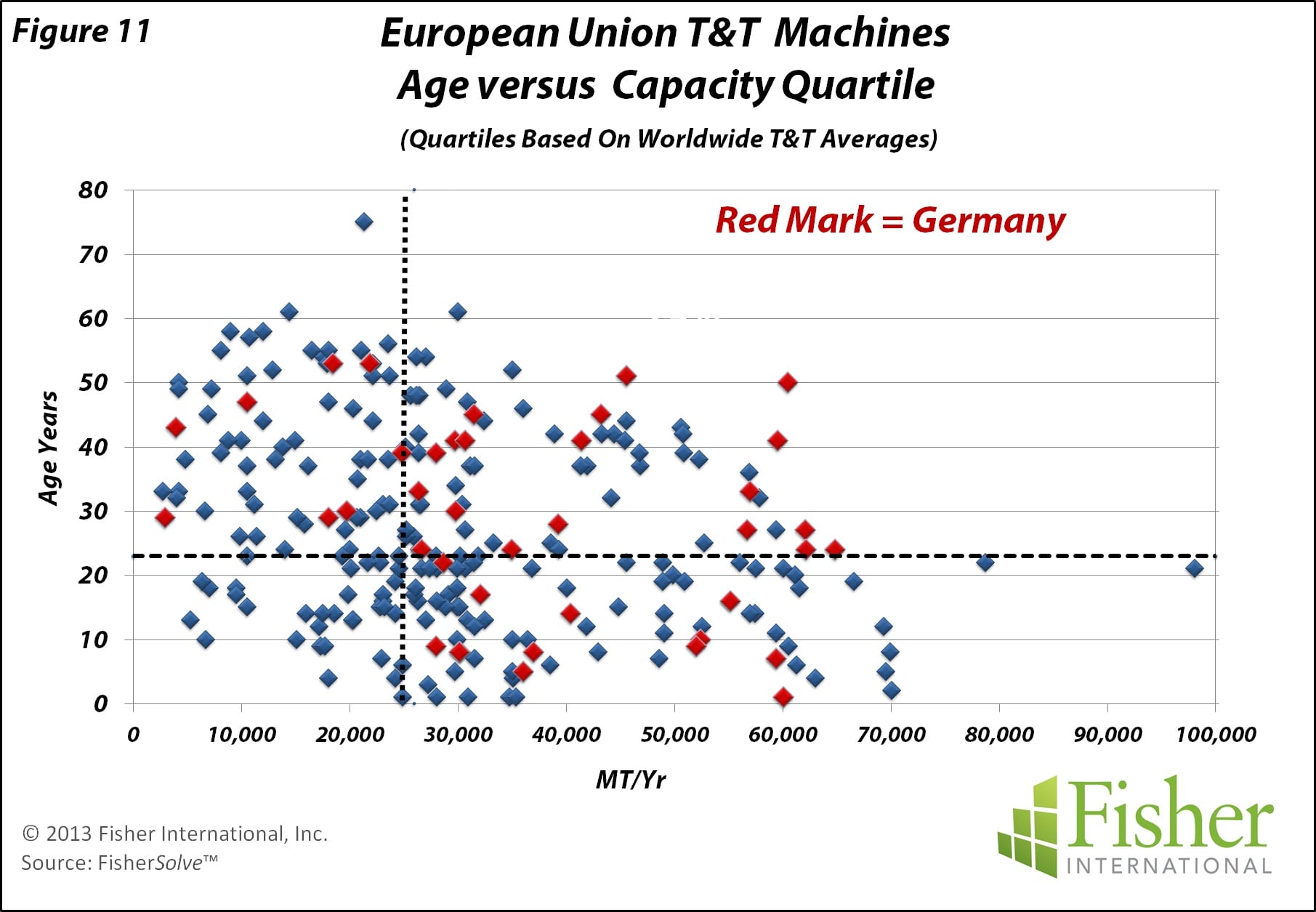

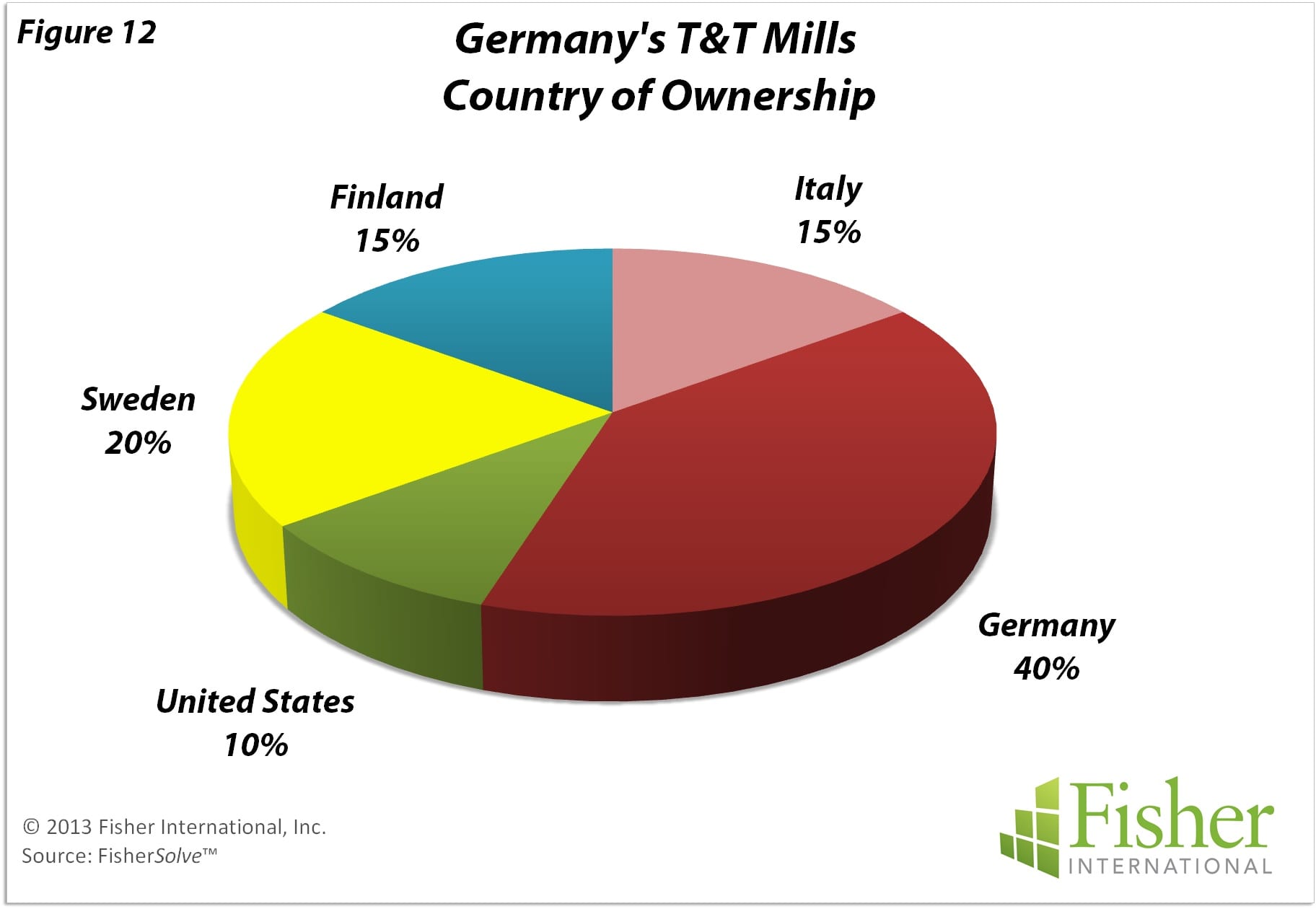

Machine speeds are respectable with nearly 70% of the machines above 1,500 mpm (Figure 10). Only 16% fall in the low speed ranges of less than 1,000mpm. On the international scale, capacity-wise, German machines bias above the average with a large proportion at very competitive capacities. Age of Germany’s machines has a wide dispersion above and below average (Figure 11). A noteworthy observation is that the German T&T business is international in ownership with 60% of the mills being headquartered outside of Germany (Figure 12).

The source for market data and analysis in this article is FisherSolve™. Data tables behind Figures 1 – 12 can be obtained from Fisher International. Email requests to [email protected].

Germany in numbers

1.5m MT/Yr of T&T produced annually

20% Germany’s tissue capacity in the European Union

3.6m Average trim range of tissue machines

70% Machine speeds above 1,500mpm

60% German T&T business that is internationally owned

[box]

About Fisher International, Inc.

Fisher International has supported the pulp and paper industry for over 25 years with business intelligence and management consulting. Fisher International’s powerful proprietary databases, analysis tools, and expert consultants are indispensable resources to the industry’s producers, suppliers, investors, and buyers worldwide.

FisherSolve™ is the pulp and paper industry’s premier database and analysis tool. Complete and accurate, FisherSolve is unique in describing the assets and operations of every mill in the world (making 50 TPD or more), modeling the mass-energy balance of each, analyzing their production costs, predicting their economic viability, and providing a wealth of information necessary for strategic planning and implementation. FisherSolve is a product of Fisher International, Inc.

For more information visit: www.fisheri.com or email [email protected] USA: +1-203-854-5390

[/box]