Steady growth of Turkey’s economy

Turkey has demonstrated an outstanding economic growth performance over the last 15 years. GDP has tripled, and the number of foreign enterprises has increased more than fivefold, largely thanks to harmonising its laws and regulations with EU standards.

In 2017, although the Turkish lira markedly depreciated against the euro and the US dollar, the economy continued to demonstrate healthy growth and real GDP grew dynamically at 7.1%. Growth was very much underpinned by the government’s fiscal stimulus strategy, such as activating temporary tax exemption policies on durable goods and VAT exemptions in real estate purchases. Given the fact that growth was driven by increasing expenditure stimulated by this loose fiscal policy, a slowdown in economic growth is expected in Turkey in 2018.

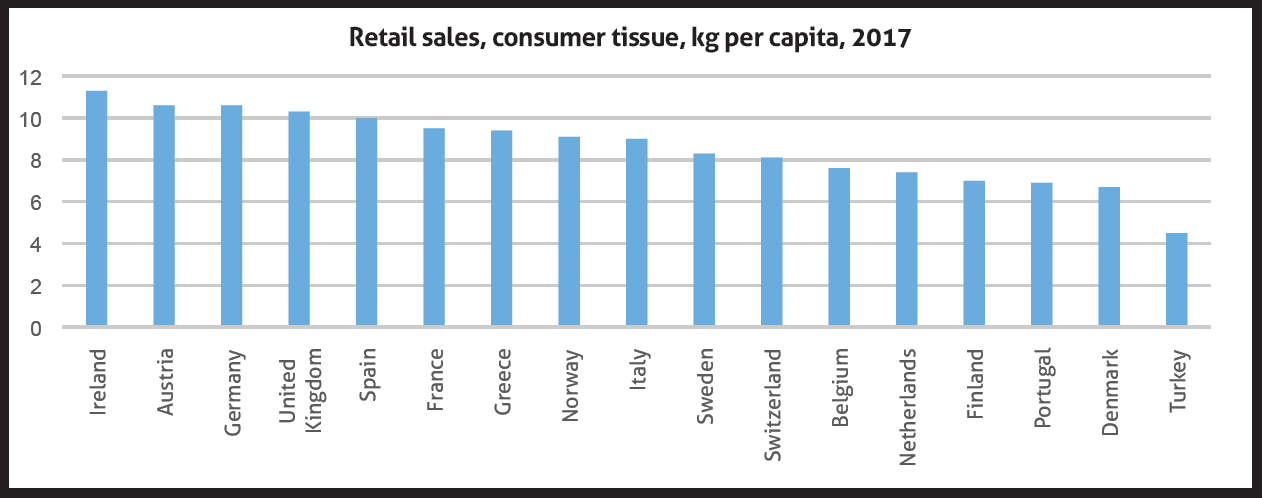

Retail tissue consumption increases in per capita terms

In line with the country’s economic growth, retail tissue has also registered sharp growth over the last ten years, with per capita retail consumption reaching 4.5kg in 2017, compared to 2.7kg in 2007. In addition to Turkey’s positive economic performance, there are two important factors behind this drastic increase in per capita retail consumption: rapid urbanisation over the last decade and the swift and widespread expansion of modern grocery retailers.

Following the country’s dynamic economic transformation, a significant proportion of workers left the agricultural sector for jobs in manufacturing, driving population growth in urban areas and accelerating urban expansion. Meanwhile, stemming from rising growth in expenditure, new players entered grocery retailing, particularly discounters, becoming widespread in the poorer neighbourhoods of the country,

where previously it was difficult to regularly access fast-moving consumer goods. As these developments brought about significant growth in the number of people now having easier access to a variety of household products, including tissue, retail tissue has registered major volume gains.

Toilet paper is the most common type of consumer tissue in Turkey

Toilet paper is the primary tissue type, constituting around 66% of overall volume sales of retail tissue in Turkey. In fact, toilet paper has had high availability in groceries in Turkey for decades. This is largely owing to the successful campaigns run by the highly-recognised, long-established companies in the past, raising awareness in order to overcome the strength of traditional beliefs and increase the use of toilet paper across the country.

When it comes to purchasing habits, absorbency shines out as the key factor affecting consumers’ decisions given the fact that the majority of toilet paper users in Turkey use water as well during cleansing. Which is why, in contrast with the trends that we observe in Western European countries, recycled toilet paper has a very limited base of sales, constituting just 2.7% of the entire retail volume sales of tissue in 2017.

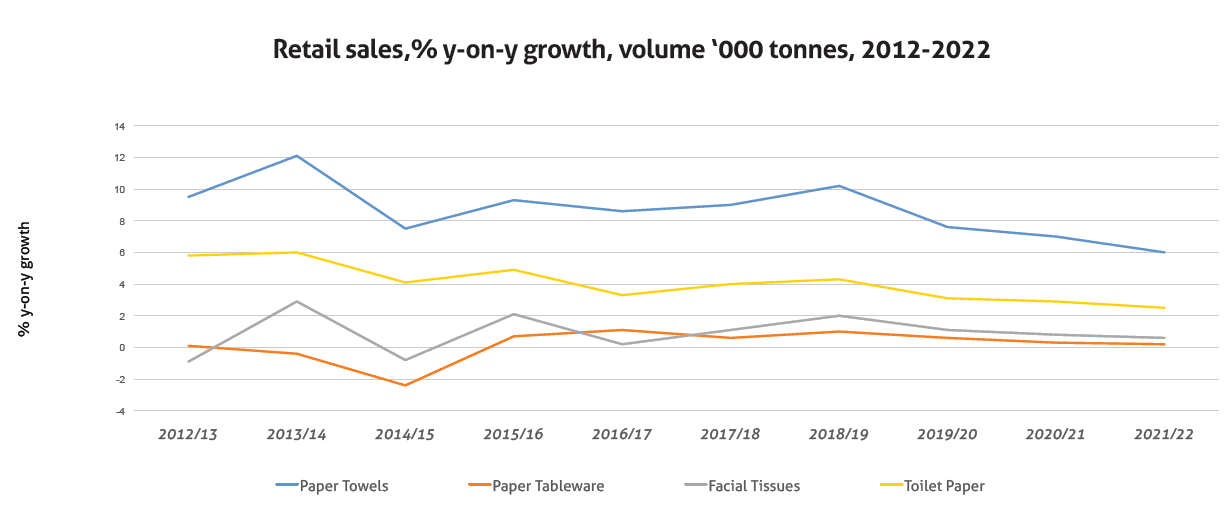

Sales of paper towels make a significant contribution to overall growth in retail tissue

While toilet paper continues to be the dominant tissue type, paper towels is the most dynamic category in terms of both volume and value growth in Turkey, mainly because of the convenience and practicality it provides. Along with rapid urbanisation, the participation rate of women in the workforce has also increased drastically over the past decade. This has brought about a sharp rise in the need for both hygienic and practical solutions in household chores. Paper towels has filled a part of this gap in Turkey, as consumers tend to use the product for multiple purposes, from drying the face and hands in the bathroom to wiping surfaces in the kitchen, and even to absorbing excess oil from fried food. Consequently, paper towels has experienced marked growth in retail volume terms; per capita consumption more than doubled to reached 0.9kg in 2017, up from 0.4kg in z007.

Positive outlook ahead but pricing pressures likely to increase

Rising incomes in Turkey and dynamism in its young and open-minded population, thanks to urbanisation, provide a good platform for further growth in demand for consumer tissue. The country still possesses significant potential for further growth in terms of per capita retail tissue consumption over the next five years. With ongoing modernisation in the retailing landscape also making a significant contribution to growth in retail tissue, it is predicted that per capita retail tissue consumption is set to reach 5.2kg by the end of 2022. Although retail tissue in Turkey has been growing at a fast pace, Euromonitor International estimates that there is still a significant gap between the country’s actual per capita consumption and its full potential. Turkey’s unmet consumer tissue potential in retail stands at over 400,000 tonnes, or close to double the current consumption levels in per capita terms, thereby leaving room for further industry expansion.

Given slower but still positive expected economic growth and the expansion of modern grocers and discounter outlets, it is predicted that price competition among tissue brands will continue to be fierce. These tendencies will bring to the fore an emphasis on price promotions and cost-friendly options, reflected also in production, product development and marketing communication strategies over the next five years.