With a tissue market worth US$1 billion, Russia dominates the Eastern European retail tissue landscape, accounting for 31% of sales in the region – and it’s not just size, growth is also strong. In 2013, the Russian tissue market registered 15% current value growth, the second highest in the region. With this fast growth forecast to continue, Russia is a key market for tissue players, but what is behind this growth and which categories are benefiting?

Growth hinges on rising disposable incomes

More than anything else this impressive growth hinges on favourable economic circumstances. Disposable incomes have steadily increased across the country, with consumers living outside the major cities seeing the largest rises in their disposable incomes, despite earning less overall. This extra income has facilitated consumers both trading up and entering new categories, spurring the category’s growth. Despite a more moderate economic forecast for the years ahead as escalating tensions with Ukraine impact, disposable incomes should nevertheless continue their upward trajectory – a 17% rise is predicted to 2018 – and so healthy growth should continue to be seen in retail tissue in Russia.

SCA and local players lead competitive landscape

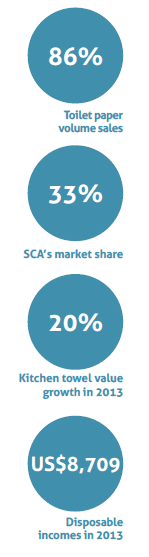

SCA leads retail tissue in Russia, holding 33% of the market, gaining share year-on-year over the last decade and making great strides thanks to its acquisition of Georgia-Pacific’s tissue operations. Its products have a strong reputation for quality – Zewa, for example, has a strong reputation in toilet paper, winning Russian Product of the Year on an annual basis throughout the review period. This reputation for quality means the company has naturally benefitted from consumers trading up when incomes allow.

While SCA is the clear leader in Russia, Kimberly Clark lags behind with 7% of the market, down two percentage points over the review period, with domestic players holding their own. Although lower down the price spectrum, they are also benefitting from consumers trading up. Of the top 10 players in 2013, six were local, with Syassky, Syktyvkar Tissue, Naberezhniye Chelny, Bumfa, Hygiene Kinetics and Kondrovskaya Bumazhnaya Kompaniya together accounting for 29% of retail value share.

Domestic players have the advantage of a strong distribution reach, taking them outside of the major cities to areas where disposable incomes are increasing at a faster rate. SCA, Syassky and Syktyvkar have all recently invested in upping their production capacities in Russia – a sign that the battle for market share is steadily intensifying.

Toilet paper dominates Russian tissue

Toilet paper accounts for 86% of volume sales and 68% of value sales in Russian tissue. It is also by far the lowest-priced product in the category, with a unit price of RUB75/kg in 2013, compared to unit prices of more than RUB190/kg for all other product areas. Despite consumers being happy to trade up when incomes allow, affordability still dictates purchasing decisions, and, as a result, many households use toilet paper for all their retail tissue needs, hence the large size of the category.

Luxury products registered the strongest value growth in toilet paper in 2013 at an impressive 21% – the highest in retail tissue. As disposal incomes allowed consumers to trade up, savvy local manufacturers catered for the increased demand by launching new two- and three-ply products. Syassky, which steadily gained share over the review period, upgraded its production facilities in 2011 to allow production of better-quality products at more affordable prices than foreign brands. This proved a smart move – Syassky gained more share than any other domestic player in the category over the review period as a result.

‘Luxury products registered the strongest value growth in toilet paper in 2013 at an impressive 21%.’

Indeed, Syassky is one to watch in the years to come. In 2013, it launched premium brand Kleo, with the intention of competing with the likes of Zewa, Kleenex and Lambi. In so doing it became the first local player to set its sights on an area of the market that has traditionally belonged to the multinationals. It seems certain that other leading local players will follow suit, but Syassky, with its strong distribution network in place, stands to benefit from first-mover advantage.

‘Consumer income and the purchasing of kitchen towels are strongly linked, with growth in disposable income levels matching the expansion of the kitchen towels category.’

Despite the strong growth seen in luxury tissue, the majority of Russian consumers remain price sensitive and have relatively low disposable income levels. Because of this, recycled – typically low priced and low in quality, akin to Western European economy paper – and standard toilet paper still dominate, accounting for 47% and 39% of the category, respectively. What this indicates, however, is that as incomes continue to rise there is plenty of room for further growth at the premium end of the category – SCA and Syassky have everything to play for.

Despite toilet paper accounting for the vast majority of the Russian tissue market and its value sales set to remain strong, its future evolution doesn’t offer much “spark”. Aside from upping paper ply, there is little in the way of innovative flair from manufacturers – and this is unlikely to change anytime soon. Kitchen towels, however, offers more in the way of excitement.

Kitchen towels saw strong value growth in 2013, up 20% to reach US$177 million. As is the case in toilet paper, this impressive growth again hinges on rising disposable incomes. Consumer income and the purchasing of kitchen towels are strongly linked, with growth in disposable income levels matching the expansion of the kitchen towels category. A country’s per capita disposable income has to surpass around US$4,000 before consumers can begin to consider adding kitchen towels to their shopping lists instead of reusable cloths.

Once per capita disposable income reaches US$8,000, however, kitchen towels can become a regular purchase – around 2kg use per annum or 15 standard rolls per household. Russia has just reached this sweet spot, with disposable incomes hitting US$8,709 in 2013, up from US$7,848 in 2012 – facilitating the strong growth seen in kitchen towels. The hygiene, health and wellness trend currently gaining momentum in Russia has ensured that consumers have entered the category as it has become affordable, attracted by its disposable, hygienic nature and the fact that kitchen towels can be used to drain fat from food.

Looking ahead, because kitchen towels is, by its nature, positioned as more of a luxury product, there may be room for more premium innovations. Printed or coloured kitchen towels are one option, while another is to extend usage occasions beyond the kitchen, positioning the product as a replacement for napkins or for use wiping hands in the garage – tactics that have proven to pay dividends in North America and Western Europe.

Of course, Russia is a country of great income disparities – it boasts the greatest socioeconomic disparities in Eastern Europe – and higher-income consumers are driving kitchen towel growth. However, as incomes rise, more consumers are likely to enter the category for the first time and the category is forecast to see an extra US$3 spent per household to 2018, adding US$166 million and almost doubling the size of the market.

Again, this represents a real opportunity for the likes of SCA and Syassky, which, as in toilet paper, dominate the category. For the time being at least – as long as disposable incomes continue to rise – there looks to be opportunity enough for local and global players in Russia.