As the hygiene and AfH sectors reach opposite extremes, many manufacturers are repurposing some AfH-oriented manufacturing capacity to make more consumer-quality products. By Liying Qian, Research Analyst, Euromonitor International.

In true Dickensian fashion, the 2020 North American tissue industry looks to be a tale of two cities, with retail tissue experiencing an unprecedented boom while AfH tissue taking a record nosedive. With another deadly wave of the coronavirus outbreak taking a grip of both the US and Canada in the winter, it becomes clear that the bifurcating landscape in tissue will likely last for quite a while.

The spike in retail tissue demand has been mainly driven by shoppers’ higher-than-usual demand for toilet paper, paper towels and facial tissues due to extended home seclusion. Although suppliers have been scrambling to play catch-up by rationalising assortment and maximising production capacity, demand and supply seem to still be out of balance. By early December, certain tissue products remained hard to find.

In contrast, AfH tissue tumbled due to pandemic-induced lengthy lockdown and travel restrictions, with toilet tissue, paper towels and facial tissues feeling the worst pinch.

In fact, to ease the loss, many manufacturers have converted higher-end AfH tissue products such as toilet paper to meet record retail demand or repurposed some AfH-oriented manufacturing capacity to make more consumer-quality products.

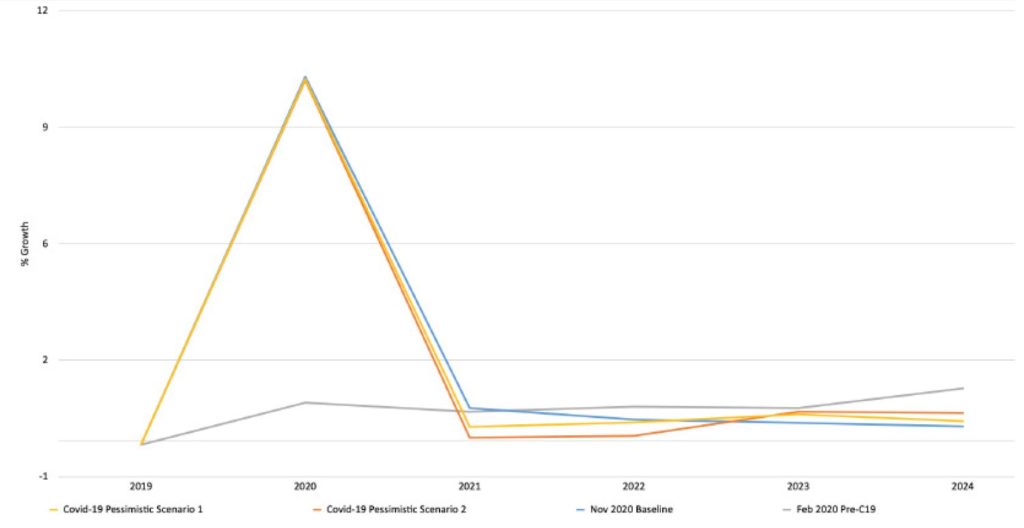

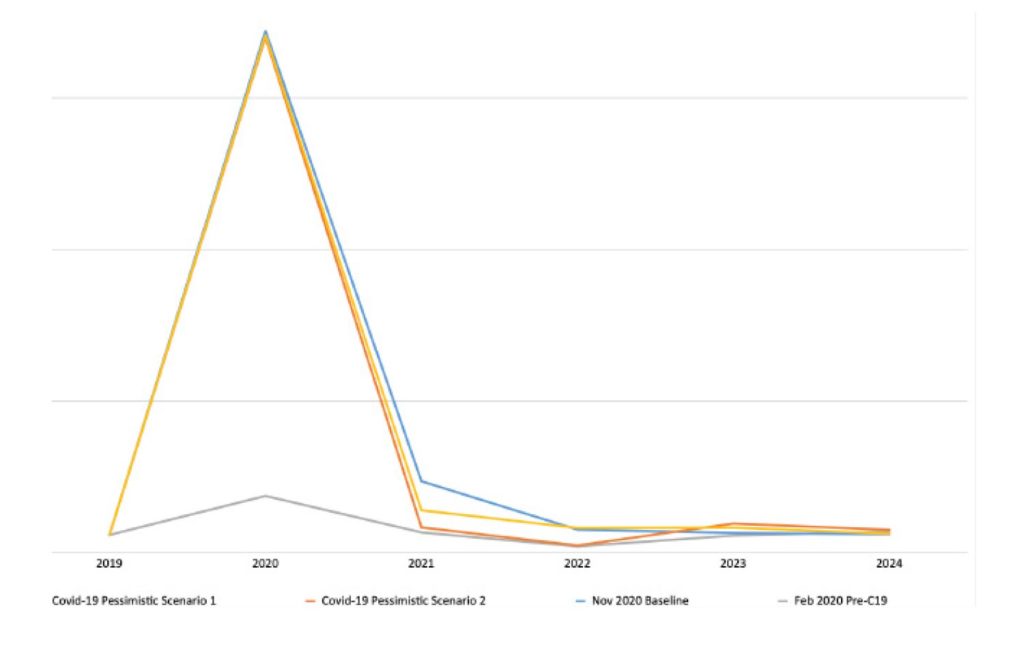

Looking at the five years ahead, retail tissue demand in North America should soften significantly as the pandemic retreats and shelter-in-place order loosens, with fundamentals like population growth gradually moving back to the driver’s seat.

Per capita consumption of toilet paper, paper towels and facial tissues will stay slightly above pre-pandemic levels due to extended work-from-home practice and more frequent at-home cleaning.

Meanwhile, it’s worth noting that further economic fallout and job loss will squeeze Americans’ budgets and force more to switch to cost-efficient alternatives such as washable cloths and bidets, subsequently diminishing gains in categories like paper towels, facial tissues and toilet paper.

Though news of several effective Covid-19 vaccines offers some light at the end of the tunnel, the recovery for a beleaguered AfH sector may still take years to come true, if ever, and, no matter the timing, will likely look different than it did pre-pandemic.

On the products level, the recovery will be uneven, with paper towels expecting the most palpable rebound in the following years, benefiting from the shift away from jet air dryers to paper towels, while paper tableware projecting the slowest return as displaced demand for in-restaurant dining due to safety concerns and stressed disposable income is unlikely to snap back.

Euromonitor International’s new preliminary projections for 2020 (to be released in February 2021) place the overall annual performance of the US and Canada retail tissue in the mid-teens growth. AfH tissue in both countries will likely conclude the year with a slightly above 20% decline in both volume and value followed by slow recovery.

Private labels eye a bigger share as shoppers seek bargains and manufacturing capacity swells While Covid-19 has posted considerable challenges for many companies, it has created opportunities for some, particularly the private labels. Shelves empty of brand-name products and consumers tightening belts have led to an increase in willingness to try and potentially commit to private labels.

It also helped that private labels have over the years closed the quality gap to a point where consumers, particularly less brand-loyal millennials, no longer associate premium quality with higher-priced name brands only.

In case of a further economic fallout, private label products will appear even more attractive to price-sensitive consumers and hence expect a stronger share gain.

Meanwhile, ongoing investments by manufacturers to build additional tissue production capacity largely dedicated to private label products provide another sure sign for optimism in the long run.

Euromonitor International preliminarily estimated private label to gain about 2% volume share in retail tissue in both US and Canada in 2020.

Sustainability is here to stay

Sustainability may not be the top priority for consumers during the acute initial phase of Covid-19 when immediate attention turned to securing supply of goods. However, continued investments made by manufacturers and brands to ensure green sourcing, production and packaging, as well as the growing consumer interest in alternative fibres indicate that sustainability is here to stay.

It’s also worth noting that a slew of eco-friendly direct-to-consumer start-ups such as Bim Bam Boo, Bippy, Peach, Who Gives a Crap, and No. 2 are having a moment. Not only have their agility during stockpiling and proactive digital customer engagement helped fast-track growth in 2020, their aesthetically and sustainably made products continue to allow them to differentiate and build an emotional bond with consumers.