By Bill Burns, Senior consultant, Fisher International

With the constantly changing habits of US consumers continuing to challenge tissue companies across America’s tissue belt, being fit for purpose is more crucial than ever.

What a difference a few degrees of latitude make. This issue of TWM focuses on northern USA so we’ll see what a profile of the region reveals. Within that narrow band of just 14 degrees of latitude, there’s a wealth of diversity in the tissue and towel (T&T) segment.

We hope this short tour of that diversity will inspire you to heed the advice of Bruce Henderson, founder of the Boston Consulting Group, who said that the only three important things to do in business are to “segment, segment, and segment.”

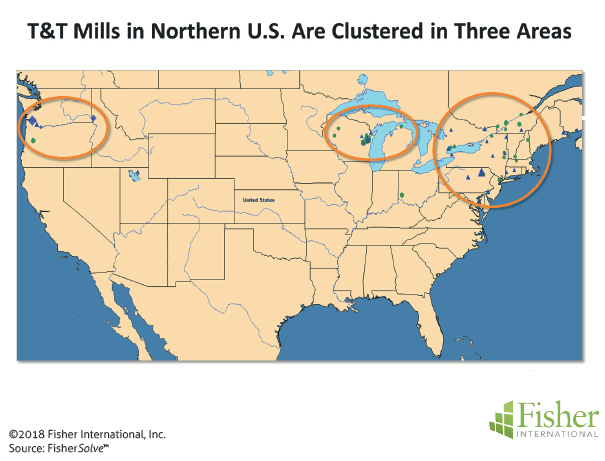

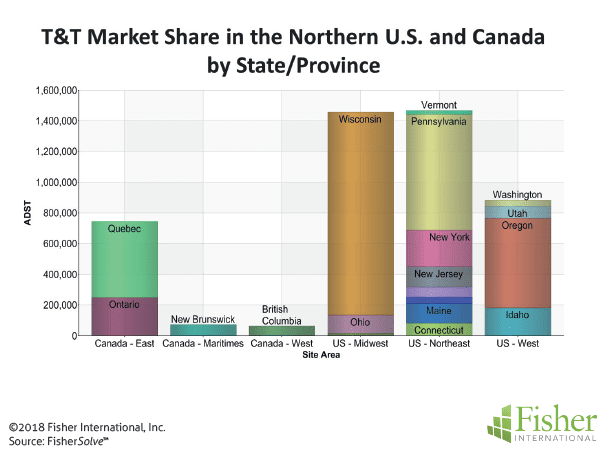

First, notice that T&T production is grouped geographically with a cluster in the northeast, a tight cluster in Wisconsin and another in Washington/Oregon States on the West Coast (Figure 1). Another way to see the clustering is shown in Figure 2 which reveals the northern region’s production capacity.

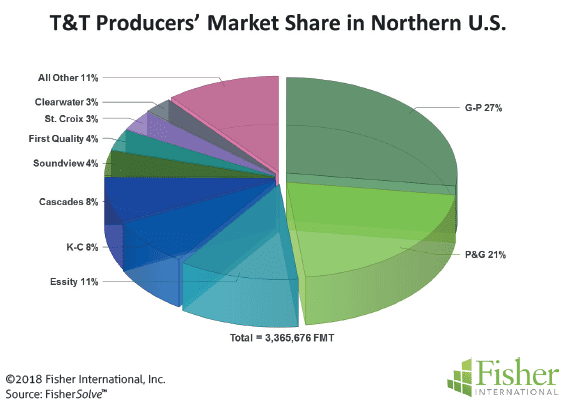

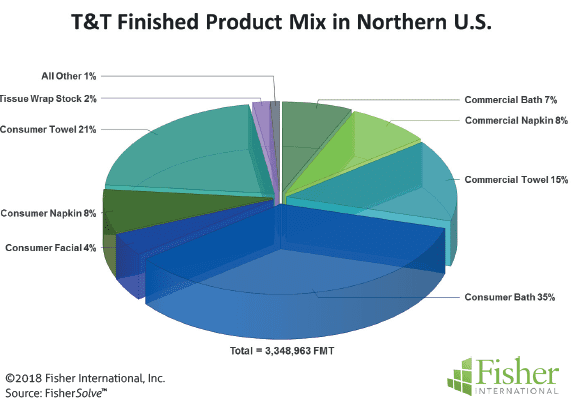

Profiling T&T production in those northern USA mills, we can see that two companies dominate with close to half of total capacity (Figure 3). Figure 4 details their mix of finished products.

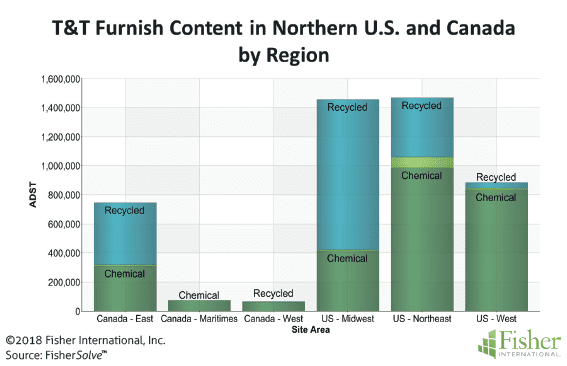

The inhabitants of each geographic cluster differ from their peers (Figure 5). For example, those in the west, Canada, and the northeast use mainly chemical furnishes whereas mills in the midwest produce a sheet using a high recycled content.

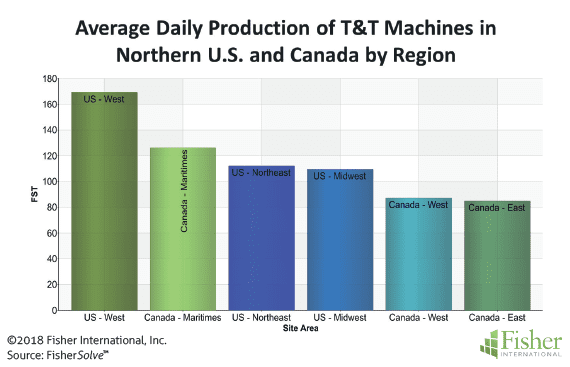

Machine size also matters. The average T&T production of USA machines is considerably higher in the west than the other regions (Figure 6).

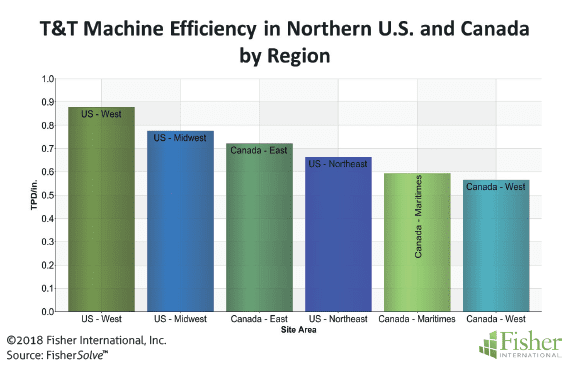

A part of the reason for the west’s higher production rate is its machine efficiency. Figure 7 measures T&T machine efficiency, showing the average tonnes per inch delivered by machines in each area of the northern USA and Canada. The more efficient (USA west) averages about 50% more productivity than the least efficient.

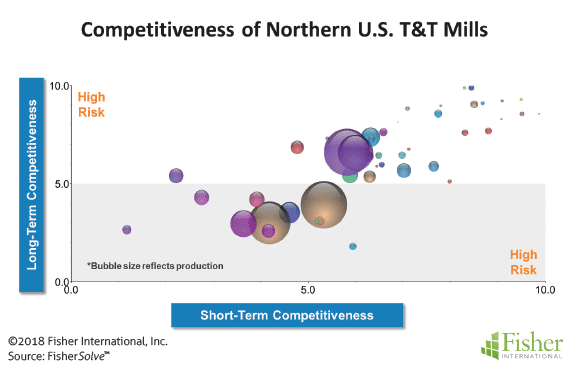

Mills in northern USA also vary considerably in their competitiveness and staying power. As American consumer buying habits continue to change and new entrants build more capacity for making structured sheets, competitiveness will matter even more.

Less efficient conventional machines will experience increasing pressure and some will close. Figure 8, taken from FisherSolve™ Viability Benchmarking, shows which ones those are likely to be.

In the upper left-hand quadrant, you can see a large number of assets that fare poorly in both short- and long-term competitiveness. They are the ones most likely to close as the segment changes.

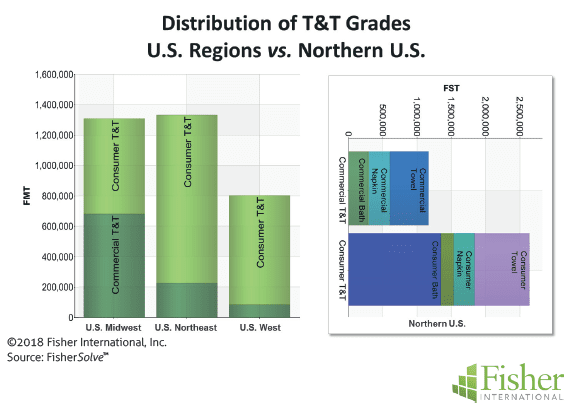

Northern USA also differs from other regions in the types of products they make. For instance, Figure 9 shows that capacity in the midwest is much more focused on AfH (commercial) products than consumer grades, unlike the Northern USA and other areas of the country.

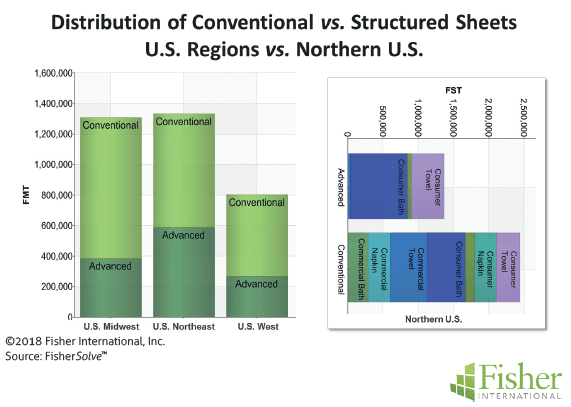

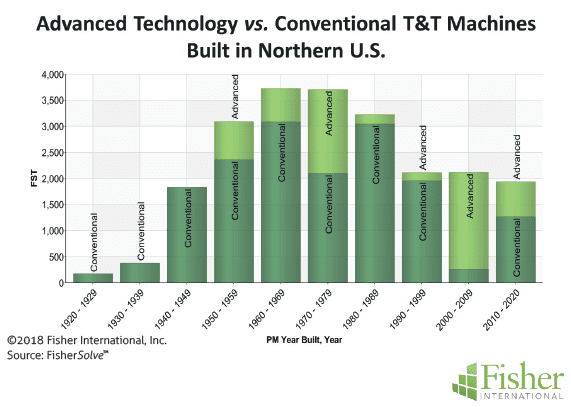

Broken out by region, Figure 10 shows that the northeast makes more “Ultra” quality tissue using advanced technologies like TAD, NTT, and Atmos than other areas. The pressure on conventional machines can be seen with the growth of Advanced T&T technology represented by the light-green stacks in Figure 11.

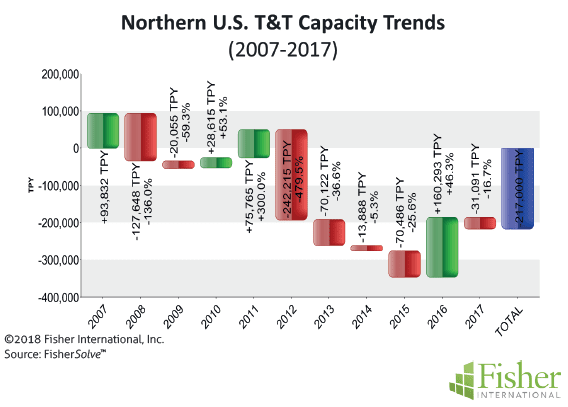

On the x-axis, you see a measure of short term competitiveness which is made up of cost and machine efficiency metrics. On the y-axis, there are several measures of long-term viability – for example, capital requirements, technical age, size, and other factors that are hard to change without substantial capital investment. We’ve already seen considerable turnover in T&T assets in the region. Figure 12 shows a net decline in its capacity since 2007, albeit in fits and starts. Those represent older assets being replaced by newer assets capable of making products and qualities the demand for which is growing. We hope this short survey has convinced you that, even in limited geographies, there are big differences between assets and enough turbulence in the base of capacity, with important competitive advantages to be had from understanding them through an active use of business intelligence.

The source for market data and analysis in this article is FisherSolve™.

About Fisher International, Inc. Fisher International supports the pulp and paper industry with business intelligence and strategy consulting. Fisher International’s rich databases, powerful analytics, and expert consultants are indispensable resources to the industry’s producers, suppliers, investors, and buyers worldwide. FisherSolve™ is the pulp and paper industry’s premier business intelligence resource. Complete and accurate, FisherSolve is unique in describing the assets and operations of every mill in the world (making 50 TPD or more), modeling the mass-energy balance of each, analysing their production costs, predicting their economic viability, and providing a wealth of information necessary for strategic planning and implementation.

FisherSolve is a product of Fisher International, Inc.

For more information visit: www.fisheri.com or email [email protected] USA: +1-203-854-5390

To get an up-to-date picture of the North American tissue industry, join the largest tissue industry gathering in North America – Tissue World Miami , taking place at the Miami Beach Convention Center from March 21 – 23, 2018.