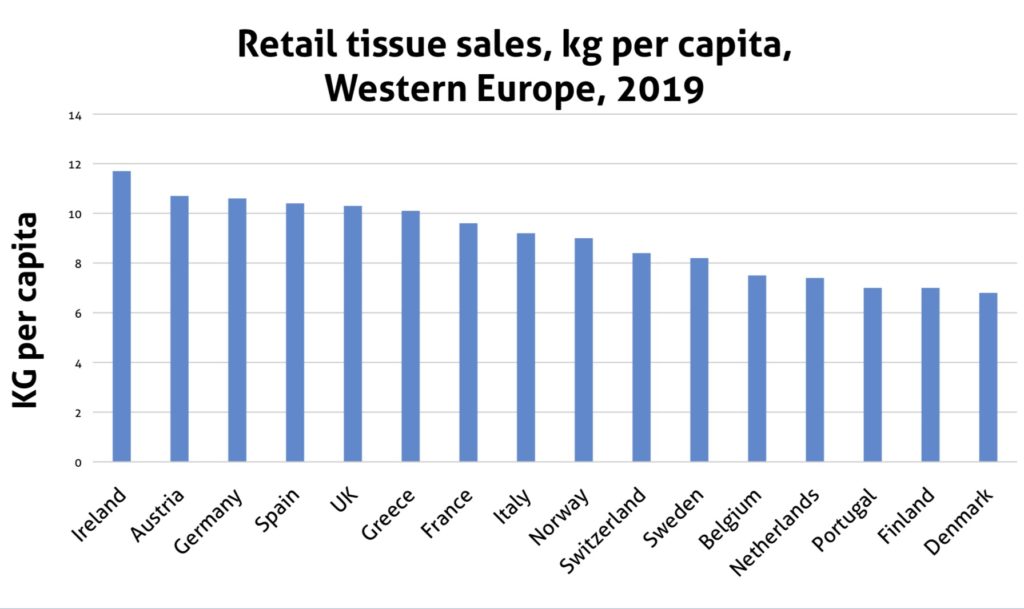

At 7kg per capita in retail consumer tissue, Portugal falls somewhat behind its European counterparts, with room to grow especially in categories like toilet paper and facial tissue. It is worth noting, though, that Portugal is among European countries with a high penetration of bidets, which limit the demand for toilet paper.

Companies like Banita continue to promote and sell bidet in the country, also emphasiaing bidets as an eco-friendly solution that is said to reduce the use of toilet paper by as much as 75%.

Untapped consumer and product innovation will likely be supporting positive, albeit slow, growth in retail tissue in the country in the next five years and long term, at projected 0.6% in CAGR retail volume (measured in tonnes) over 2019-2024.

This is despite expected weak birth rates and negative growth in population in Portugal over the same period of time, indicative of some opportunities in the market in terms of household penetration.

These projections, however, do not yet fully take into consideration the impact of COVID outbreak.

COVID-19 disruption and full 2020 forecast

While the full extent of COVID-19 outbreak is yet to be defined, a number of scenarios can be considered. Similarly to other markets impacted by COVID, tissue manufacturers and suppliers in Portugal are reporting higher consumer demand for tissue products, as consumers have been stockpiling in the face of uncertainty as well as slower business activities, school closures and move to work-from- home options.

Depending on the length of the stay- at-home practices and the higher need

for at-home products, Portugal can see further boost to demand through the 2020, adding somewhat to the projected sales in volume and value of retail tissue. However, if ongoing COVID pandemic leads to prolonged economic downturn and further losses of jobs and incomes, consumers are likely to scale back on purchasing non- essentials like paper towels, napkins and facial tissue, turning instead to cheaper alternatives and shaving off estimated nearly 2% from the projected already modest growth in retail tissue revenues.

Current Euromonitor Industry Forecast Model indicates best case scenario at 1.2% rise in volume vs COVID-19 recession scenario at flat growth in volume, at about 0.2%, for the full calendar 2020. However, as the situation changes rapidly, the scenarios might change further, as new government measures and shifts in macro- economic scenarios take effect.

Additionally, AfH demand and sales are expected to decline as recovery of business activity, travel and tourism will take longer to comeback to pre-COVID normal. Pe- COVID projections indicate AfH retail tissue in Portugal to gain 5% CAGR in value terms and 3% in volume. However, prolonged COVID downturn is likely to throw growth rate into a negative territory.

Path to innovation for long-term growth – from value and convenience to eco- friendly and premium

While COVID-19 pandemic will have an impact on consumer purchasing across product categories in 2020, a number of trends have been playing out on the market that can help plan for longer term growth in consumer tissue.

Looking at various product categories, boxed facial tissues still has a low penetration in the Portuguese market, offering an opportunity for long term growth. Historically, suppliers of facial tissues have been using packaging to differentiate between products. Renova, for instance, invested in themed products within its Pop line, also featuring images associated with school and offices to draw consumer attention.

In toilet paper and paper towels, compact coreless rolls have been gaining traction across brands and price tiers. Giant rolls have also been gaining acceptance among consumers in the country, while additional cost-efficiencies and functionality were offered by a new line of Colhogar Adapt paper towels. The new line allowed for a sheet of towel to be split in two and avoid unnecessary waste. The brand also released a new XXL paper towel roll, offering extra absorption even in wet conditions.

Furthermore, tendencies towards products with eco-friendly positioning have been noted in packaging innovation, like that by Renova. The company introduced paper packaging for its tissue products in 2018 to respond to the trend towards reduction in the use of plastic.

While 2020 is expected to be challenging for the industry, looking ahead there are opportunities in driving further household penetration of products like facial tissue as well as innovation alongside of cost-efficiencies, absorbency, added functionality, and environmental positioning.