By Euromonitor International’s Svetlana Uduslivaia

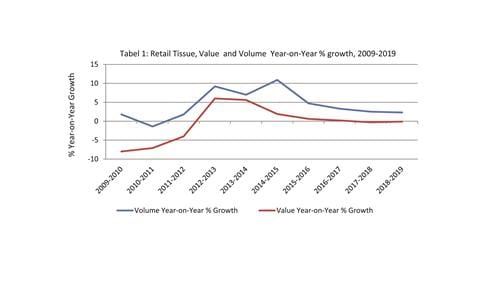

However, while still positive, the pace of growth started to slow down in 2014, compared to 2013, especially in value terms, as significant discounting practices and other cost-saving strategies translated into reduced industry revenues. These tendencies are projected to continue, with retail tissue sales set to achieve only a marginal increase over 2014-2019, at well under 1% CAGR in constant US$ value.

Coping with progressively shrinking wallets

Promotional activities and commodity status have been the key factors behind relative resilience of consumer tissue to the recession. However, with most product types not witnessing major losses in volume terms in retail, consumers have to manage on a much tighter budget in view of reduced household incomes.

Reaching US$212 million in retail sales in 2014, toilet paper is the largest category within retail tissue in Greece, with a nearly universal household penetration in the country. The category was also the best performing one in retail, registering double-digit increases in volume and value terms in 2013 and 2014. Interestingly, however, a spike in demand was partly due to an increase in the number of small-scale business and horeca operators getting their supplies from the retail channel. The recession forced many entrepreneurs to re-think their supply chain strategies and to avoid stockpiling large quantities of tissue products purchased from wholesalers. Decline in average selling prices in retail amidst significant promotional activities further encouraged the migration of away-from-home customers from wholesale to retail.

Although in value terms toilet paper did record a solid positive growth, the pace of growth was barely keeping pace with volume in 2014, as drastic promotions and discounts have become the key feature of retail.

Looking for best deals, many consumers also opted for larger packages and larger paper rolls. In kitchen towels, jumbo rolls originally designed for away-from-home use have become popular in retail, since they were perceived by many consumers as offering the best combination of quality, quantity and price. Initially available in private label only, jumbo roll format saw a steady increase in the number of branded products marketed by the leading tissue manufacturers competing with lower priced private label.

Source: Euromonitor International

Private label locked in the battle with leading brands over share of consumer spending

Private label often becomes a product of choice for consumers looking for lower prices and significant investments by leading retailers into private label products led to improvements in quality and product ranges offered by private label tissue products. These tendencies resulted in substantial gains experienced by private label tissue products in a number of markets, such as for instance the US and Germany.

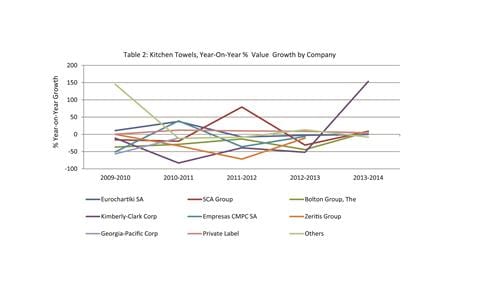

In Greece, private label also captured an increased share of the overall sales of retail tissue over2009-2014. However, in 2014 private label progress was challenged across many product categories. In kitchen towels, for instance, a number of brands experienced stronger growth in sales vis-à-vis private label as aggressive price promotions employed by manufacturers of branded products drew consumers towards their products. Mirroring the trend, the leading private label Lidl, marketed by hard discounter Lidl Hellas & Co, saw a significant slowdown in sales growth in 2014, compared to 2013, as it fought for a share of consumer spending with highly discounted brands.

Source: Euromonitor International

Future fraught with challenges for industry revenue growth

Retail tissue in Greece is expected to record only a marginal value growth over 2014-2019, although is projected to see 5% CAGR increase in volume. Price sensitivity will continue to shape up consumer preferences, likely encouraging further widespread price discounting.

In the conditions of austerity measures and economic hardships in Greece, coupled with expected slowdown in the number of incoming tourists to boost the demand, manufacturers’ strategy that focuses on lower prices to encourage purchases and secure at least some degree of brand loyalty is not surprising. The strategy, however, is a double-edge sword and can create problems for revenue growth in the long term, as consumers become accustomed to bargain shopping and expect low prices on everyday items even with economic recovery.

Looking at best practices from markets, brands and retailers that weathered the recessionary and post-recessionary times, a combination of strategies can help tissue product manufacturers and retailers in Greece to secure not only short-term growth but also ensure healthier recovery in the long term. These strategies include re-focusing the attention from “value” only to “value for money”, product development to meet diverse consumer needs, and packaging design. The latter can be an important aspect of brand strategy to grow brand loyalty without resorting to significant price discounting. Large packages and bulk buying can offer a good value and are cost-efficient for consumers, as demonstrated by the increased popularity of jumbo rolls in kitchen towels in Greece in 2014.

However, bulk buying comes with upfront costs that not everyone can afford. With increasingly restricted weekly budgets and high unemployment rates, many more Greeks find themselves in a situation where they are only able to afford a small quantity of tissue at a time to meet their immediate needs. The strategy to offer diverse packaging options has been successfully applied by many tissue and hygiene manufacturers across developed and developing markets to encourage purchases and secure long-term brand loyalty. It is likely to be successful in Greece as well, given current state of the marketplace and future projected demand for consumer tissue.