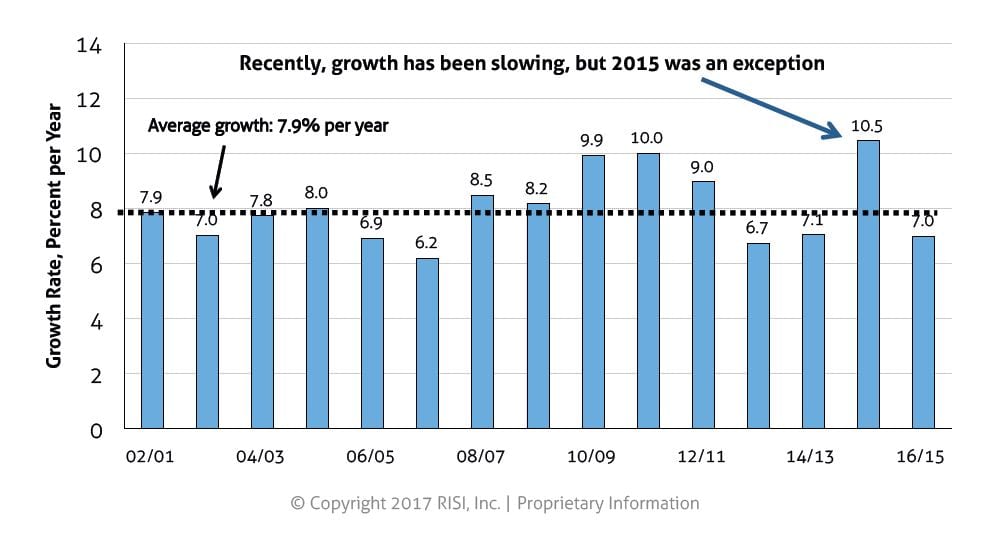

According to a recent talk by Zhang Yulan, of the China National Household Paper Association (CNHPIA), in 2016 the Chinese tissue business maintained growth, and the expansion of the tissue industry continued at a good pace – tissue continues to be the fastest growing category within the paper industry.

Based on the 2016 figures shown in her presentation, Chinese tissue parent roll production grew by 6.6% from 8.024 million tonnes to 8.552 million tonnesin 2016, and domestic consumption grew by 7.0% to 7.876 million tonnes.

We use the production figure published by CNHPIA as the base for our analysis, but our foreign trade figures are slightly different as we include also the category 48.18.90 in converted tissue products in our figures.

This Harmonised System category includes various smaller groups of converted products, including base paper rolls narrower than 36cm, which are used for converting facial tissue, hankies and napkins. For this reason, our net export figure is more than 130,000 tonnes higher and, consequently, our tissue consumption figure is correspondingly lower.

So, based on our calculations, Chinese tissue consumption grew by 7.0% from 7.225 million tonnes in 2015 to 7.731 million tonnes in 2016, the same growth rate as shown by CNHPIA but with consumption at a slightly lower level. Our forecast for 2016 was 6.3% growth, so we were too conservative.

Growth in tissue consumption in the two past years has exceeded our expectations, which shows that the business is in a strong upward move despite the slowing economy.

In the past, growth in tissue consumption lagged behind economic growth with an average ratio of 0.8-0.9, but recently this trend has broken and the ratio is now above parity (1.08 in 2016).

This development is showing that factors other than economic growth, such as accelerating urbanisation, revitalised population growth (the policy change from one child to two children) and rapidly rising overall hygienic standards are having an increasingly strong influence on consumption of tissue and other hygiene products.

One major ongoing trend in the Chinese tissue market is the move from white tissue to unbleached brownish tissue, which seems to be a hot topic in the country at the moment.

The authorities have planned regulation for restricting the brightness of tissue paper below 80°, but so far it is not clear how far along the current plan is and no new standards regarding this issue have been introduced. But the market seems to be in a move in this direction.

Unbleached bamboo pulp used for tissue manufacture in central China is perhaps the main driving force, led by companies such as Lee & Man, who is in a very strong growth phase with its recent diversification into the tissue business, followed by straw pulp with Shandong Tranlin Group as a major player. And even products made of unbleached wood pulp were seen at stands at the 2017 CIDPEX event.

Today, local players estimate that the market for unbleached products is not more than 5% or slightly less than 400,000 tonnes of the total market – we doubt if it is even that high.

In the panel discussion of the recent CIDPEX conference, the participants, including representatives from Lee & Man and Shandong Tranlin, were optimistic – overly, in our opinion) – concerning the future of unbleached tissue products, expecting their share to be around 30% of the total market within the next five years!

With the current growth, this would mean about three million tonnes of unbleached tissue. If the industry were to move that quickly in this direction, the available raw material base could be a major bottleneck, based on currently available non-wood-based pulp capacities and resources for possible non-wood pulp expansion.

And as people generally think white means clean, will unbleached products be able to convince consumers that they may be more environmentally friendly than bleached products?

The second major feature of the Chinese tissue market is the increase in online tissue sales. We do not have any statistics available covering the whole country, but we do have reports from some major players.

Vinda Paper, the number three player in the country, reported that in 2016 about 18% of its tissue sales were done online, up from 12.9% in 2015 and 7% in 2014.

The share of the revenue was even higher, almost 22%. This may not be representative for the whole industry, but we think that online sales of tissue are more popular in China than elsewhere in the world and the national share of online tissue sales could be in the range of 10-12%.

For comparison, in the USA online tissue sales account for only roughly 5% of the business.

Investments in the tissue industry continue to bloom. There was a phase when many new entrants emerged in the Chinese tissue business, but in 2016 most of the new project announcements came from the existing players.

Only three new enterprises announced their entry into the tissue industry in 2016, namely Jiangxi Huawang Paper Co. (a plan for 100,000 tonnes per year of capacity), Sichuan Jintian Paper Co. (100,000 tonnes), and Sichuan Qianwei County (420,000 tonnes). However, these plans are still on the drawing board.

New capacity additions continue to exceed demand growth in China, although project delays are also typical. CNHPIA reported that the total capacity planned to launch in 2016 was about 1.8 million tonnes, but as about 30% of projects experienced delays for various reasons, the actual new capacity that came on stream last year was 1.3 million tonnes. But there were also a substantial number of closures of old capacity.

For example, the Baoding tissue paper base in Mancheng, Hebei, alone invested in about 370,000 tonnes per year of new capacity, but also recorded about the same volume of capacity closures, according to CNHPIA.

In the country as a whole, closures may have been in the range of 400,000- 500,000 tonnes, if not more. We are still updating our mill data base and checking which mills still exist, a process that will likely take another couple of months at least.

The structural change in the Chinese tissue industry is continuing at a very fast pace, with a lot of world-class capacity coming on stream by the main players.

And at the same time, equipment at small and medium-sized enterprises is being upgraded, and this process has actually recently accelerated.

However, competition is quite fierce, and it is obvious that not all tissue enterprises will be able to survive the current competitive environment. The game in the Chinese tissue market is very tough right now.