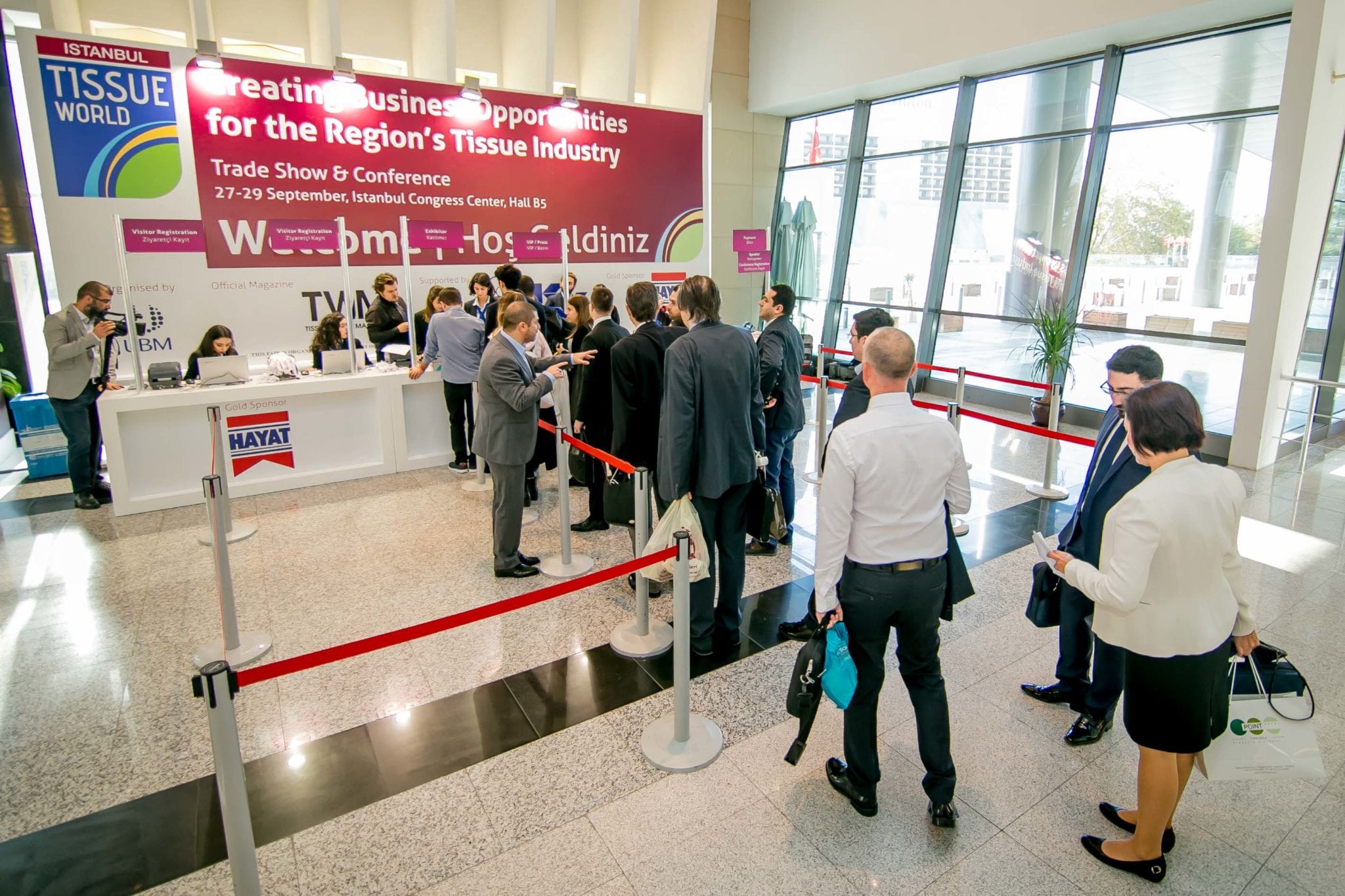

First dedicated event covering huge region attracted 1,602 attendees from 65 countries

Tissue World Istanbul 2016 concluded successfully after attracting 1,602 unique attendees – of which 1,231 were unique visitors – from across 65 countries.

Held in Istanbul from 27-29 September, the fully-fledged event was the first dedicated tissue exhibition and conference for the Middle East, Central Asia, Africa, Eastern Europe, Russia and the CIS tissue industry.

Some 67% of the participants were Turkish tissue industry players, while the remaining attendees came from 64 countries including the UK, Italy, India, UAE, USA, Saudi Arabia, South Africa, Morocco, Algeria, Iran, Russia, Egypt and the UAE.

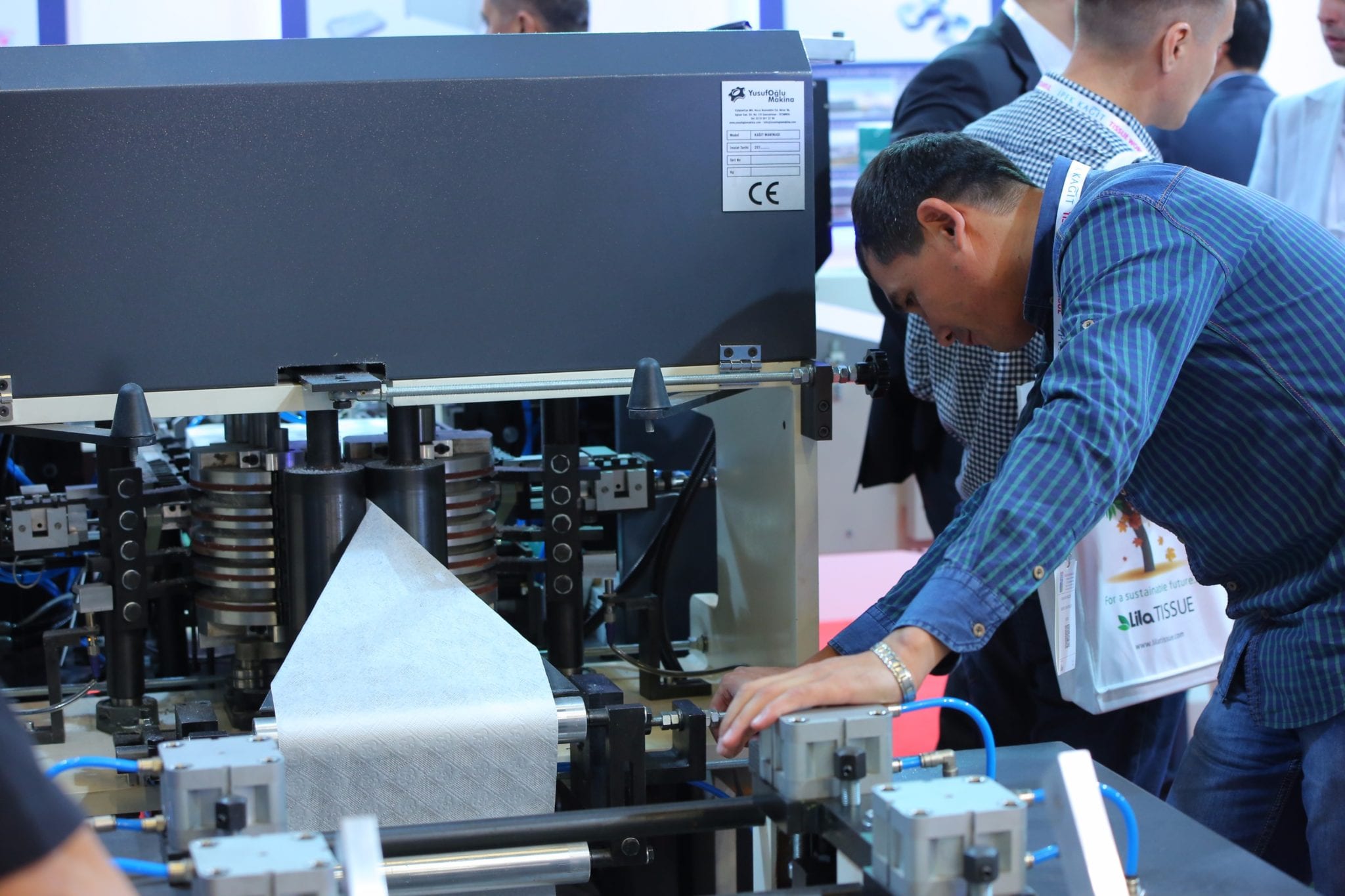

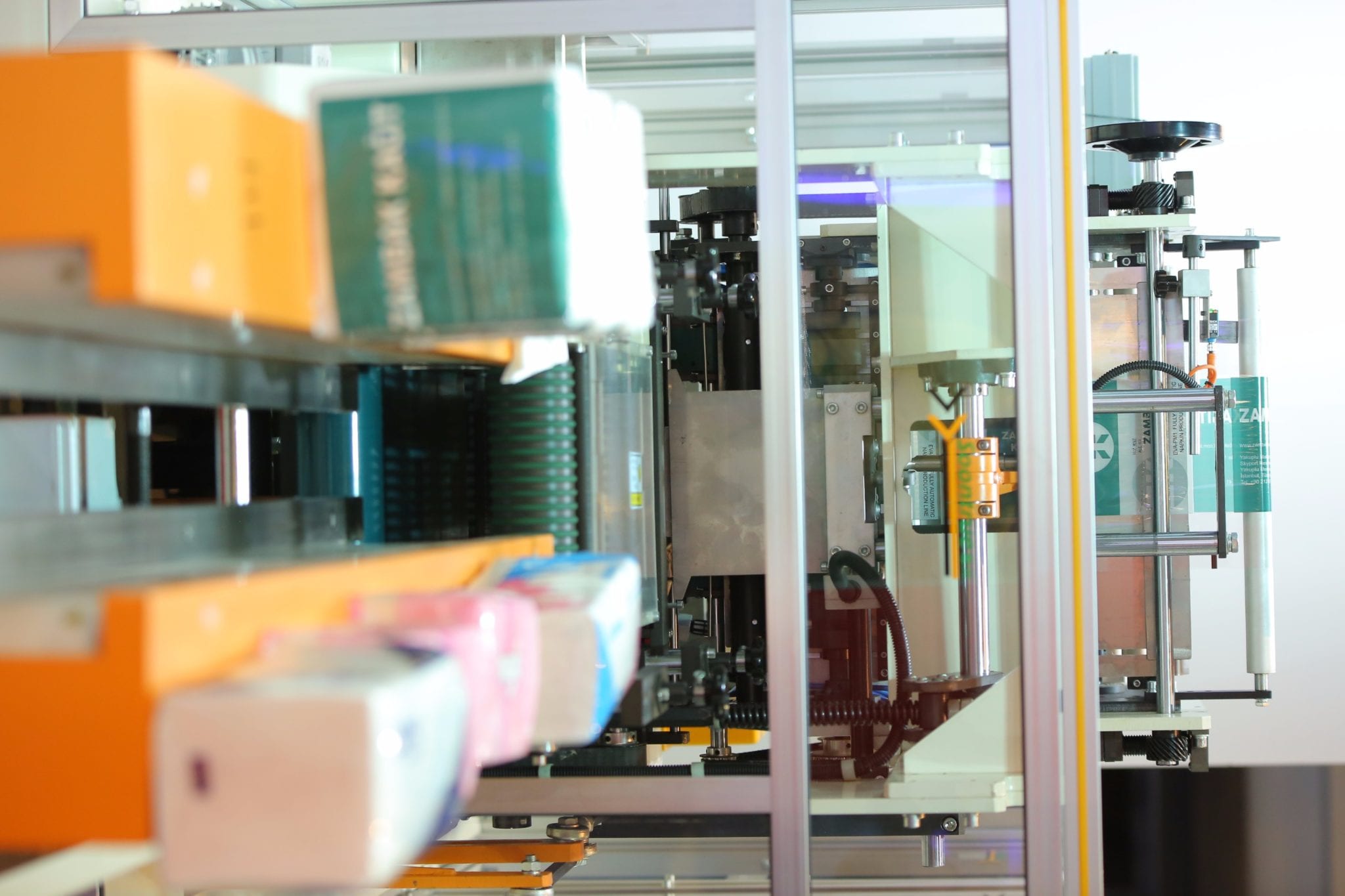

The show floor featured over 50 exhibiting companies such as Aktül Kağıt, Cellynne Converter, Lee & Man, Hayat Kimya, Ipek Kağıt, Kahramanmaraş Kağıt, Mediterranean Tissue Mill, Lila Kağıt and Parteks Kağıt.

A conference that discussed key issues impacting the region’s tissue market was also successfully held.

Tissue World Istanbul 2016 was backed by sponsorship from Hayat Kimya, İpek Kağıt, Aktül Kağıt, Lila Kağıt and Organik Kimya.

Conference Snapshot

Turkey: How can it maintain the pace of success? – provided an in-depth look into the key opportunities and challenges facing the dynamic Turkish tissue market, as well as the surrounding region’s. Here we review a handful of the key talks.

An outlook on the paper and board industry and the tissue paper sector in Turkey; Erdal Sükan, president, Turkish Pulp & Paper Industry Foundation

PAPER&BOARD PRODUCTION BY GRADE IN TURKEY (2015):

Corrugated Medium – 58%, Tissue Paper – 18%, Boards – 15%, Printing & writing paper – 6%, Wrapping paper – 2%, Cigarette and special paper – 1%

PAPER&BOARD CONSUMPTION BY GRADE IN TURKEY (2015)

Corrugated Medium – 42%, Printing & writing paper – 20%, Boards – 17%, Tissue Paper – 8%, Newsprint – 6%, Wrapping paper – 6%, Cigarette and special paper – 1%

With 74,7kg per capita consumption in 2014, Turkey was 47th in the world. Its population increased from 74.7 million to 78.7 million. All figures indicate that Turkish paper and board industry has a great growth potential. Currently about 50% of paper and board consumption is imported. Production capacity of tissue paper in Turkey increased steadily since 2011 to 2015 with a 41% increase. The production capacity amount

was 567,500 tonnes in 2011 which reached 801,000 tonnes in 2015.

Capacity utilisation was 82.5% in 2015 in tissue paper manufacturing sector. Tissue paper consumption also increased within the same period by 33%, from 370,500 tonnes to 494,500 tonnes. Ten countries have 92% of the all exportation of tissue paper; 84% to European countries: UK – 62.6%, Israel – 30.6%, Greece – 28.6%, Bulgaria – 5.6%, Iraq – 4.8%, Syria – 3.9%, Georgia – 2.8%, Kazakhstan – 2.6%, Angola – 2.5% and Azerbaijan – 2.2%.

Per capita consumption was 6.3 kg in 2015 and Turkey’s population is about 79 millions. Considering European average of 15 kg per capita consumption, investments in tissue papers in Turkey have great potential. In addition to that, Turkey’s neighbouring countries will have a potential for tissue paper exportation when the current wars end. Therefore, Turkey presents great opportunity to local as well as international investors. There is sufficient land existing in Turkey for forest plantation; investment in this area can also be considered because all pulp is being imported currently.

The Economic Outlook: Andrea Boltho, emeritus fellow, Magdalen College, University of Oxford

The economic outlook – fewer clouds on the horizon?

THE EUROPEAN ECONOMY

The European recovery has continued despite what happened in early 2016. The effects of Brexit, so far, seem to have been contained. Many of the past worries are no longer as worrying.

Increasing tensions in the Ukraine; a return to higher oil prices; deflation; Greece leaving the Eurozone; a Chinese hard landing; a US interest rate shock. But there are problems ahead: uncertainty over the US election; dealing with mountains of debt; lingering uncertainties over the Euro; further and greater Middle East turmoil.

EARLIER THIS YEAR EVERYTHING WAS FALLING:

Stock markets: confidence; oil prices; the Yuan; inflation; commodities; Brazil, Russia; investment; gold; birth rates, rain and snow.

BUT THINGS HAVE CALMED DOWN SINCE THEN:

Stock markets; confidence; oil prices; the Yuan; Brazil, Russia; rain and snow … are falling less. The days, however, are getting shorter.

THE LONGER-RUN EFFECTS OF BREXIT:

Economics: For the UK, most studies suggest relatively small negative effects. Oxford Economics, for instance, concludes, on the basis of nine different scenarios, that UK GDP could be from 0.1 to 3.9% lower in 2030 than it would otherwise have been. Even in the most extreme case, UK GDP growth between 2016 and 2030 would be cut by only 0.2/0.3 per cent per annum. For other countries the effects are also likely to be negative, but negligible (the only exception is Ireland, where GDP, by 2030, could be, in the most pessimistic scenario, 1.6 per cent lower than otherwise).

Politics: Brexit is a severe setback for European integration. As it is, two of the four big achievements of the EU (Schengen and monetary union) are at risk. Schengen may not be there next year; EMU may not be there in 10 years. The other two major achievements, the Single Market and the opening to Eastern Europe, are still in place (even if their biggest supporter, the UK, is now out of the EU), but both are threatened by the

rising wave of populism. The EU will not break down, but increasing integration is, at present at least, just not on the cards.

THE LINGERING WORRIES ABOUT THE EURO

Greece, despite the huge costs of its adjustment programme, has not gone for Grexit, but the temptation must still be there. Italy is subject to the same temptation (and two political parties, including the important 5 Star Movement, have openly talked about a referendum on EMU membership).

Grexit would, in all probability, have a serious negative effect on European growth. “Ixit” would, almost certainly, lead to EMU breakdown. This, in turn, would usher in a massive recession. The political will to stick to monetary union is very strong, but economic realities also matter.

TURKEY: HOW CAN IT MAINTAIN THE PACE OF SUCCESS?

A rapidly growing emerging economy, not that closely linked to Western Europe. Favourable features: huge scope for catchup; relatively good demographics; sensible fiscal policies; potential problems: large external deficit; relatively high inflation; threats to competitiveness; geography.

Outlook for the tissue business in the Near and Middle East region: Esko Uutela, principal – tissue, RISI

Tissue consumption in the MENA region by main country, 2015. The five largest countries account for 69% total consumption:

• Turkey: 28%

• Saudi Arabia: 16%

• Iran: 10%

• Israel: 8%

• Egypt: 7%

• UAE: 5%

• Morocco: 3%

• Lebanon: 3%

• Iraq: 3%

• Syria: 2%

• Algeria: 2%

• Jordan: 2% and all others: 9%

Political turbulences in the MENA region lowered the average growth in 2010- 2014, but in 2015 growth returned onto its former path. Average growth between 2003-2015: 8.8% per annum.

Growth rates of tissue consumption by main country 2005-2015; strong growth also in the main markets, well developed Israel an exception, Syria suffering from the civil war and exile:

• Turkey: 11%

• Saudi Arabia: 9%

• Iran: 13%

• Israel: 3%

• Egypt: 7%

• UAE: 5%

• Lebanon: 4.8%

• Morocco: 11.8%

• Iraq: 26%

• Kuwait: 5.2%

• Syria: – 1%

• Algeria: 11.4%

• Jordan: 8.8%

• all others: 11.8%

Estimated structure of tissue demand in the MENA region, 2015. Facial tissue/ hankies dominate in the Arab countries, toilet paper in Turkey and Israel (which account for 60% of MENA consumption):

• Facial/Hankies: 40%

• Toilet Paper: 34%

• Towelling: 15%

• Napkins: 10%

• Other: 1%

Volume growth of tissue consumption in the MENA region by main country, 2005- 2015. Turkey’s growth has been the largest by volume in the past 10 years:

• Turkey: 290,000 tonnes

• Saudi Arabia: 155,000 tonnes

• Iran: 120,000 tonnes

• Egypt: 60,000 tonnes

• Iraq: 45,000 tonnes

• Israel: 40,000 tonnes

• Morocco: 40,000 tonnes

• UAE: 35,000 tonnes

• Algeria: 20,000 tonnes

• Kuwait: 20,000 tonnes

• all others: 120,000 tonnes.

Turkey fourth largest net exporter worldwide, Egypt and Jordan the main exporters, Saudi Arabia, Iraq and Israel the main net importers.

Turkey exports tissue, mainly parent rolls, to very many destinations but the UK and Israel are the two largest buyers; major export growth in 2016.

Tissue market expansion will continue and regional consumption will grow by 1.3m tonnes and almost reach 3.0m tonnes by 2025.

During 2015-2025, Iran, Iraq and Syria are expected to have the highest relative growth rates, provided political turmoil will not worsen. Average

regional growth – 6.2%.

Expected volume growth of MENA tissue consumption by main grade, 2015-2025. Volume growth dominated by facial tissue/hankies, about two thirds of toilet paper volume growth in Turkey and Israel:

• Toilet Paper: 350,000 tonnes

• F/H: 610,000 tonnes

• Towelling: 260,000 tonnes

• Napkins: 80,000 tonnes

• Other: 20,000 tonnes.

Total expected regional growth 1.34 million tonnes.

Capacity shares of the main suppliers in the MENA region, 2016 (August). Relatively fragmented industry: top 10 players account for 60% of capacity:

• Hayat Kimya: 12.2%

• Ipek Kagit: 7.4%

• Nuqul-7%

• Aktül Kagit: 6.1%

• Lila Kagit: 6.1%

• Saudi Paper: 6.1%

• K-C: 4.5%

• ADNPM: 4.1%

• Indevco: 3.9%

• Tezol Tütün: 3.2%

• all others: 39.5%.

Total Capacity: 2.3m tonnes.

Average regional PM size – 25,600 tonnes. The leading Turkish companies operate the most modern tissue equipment contributing to their cost competitiveness. Average Tissue PM size 25,600 tonnes.

• Major tissue capacity changes (>10,000tpy) in the MENA region:

2014:

• Golboneh Pars Industrial, Tehran, Iran 21,000tpy

• Mediterranean Tissue Co., New Borg El Arab, Egypt 26,000tpy

• Parteks Paper, Kayseri, Turkey 25,000tpy

• Tunisie Ouate, Enfidha, Tunisia 25,000tpy

• Saudi Paper Manufacturing, Dammam, Saudi Arabia 15,000tpy

= 112,000tpy.

2015:

• Zarrin Barge Persia, Saveh, Markazi, Iran 70,000tpy

• Hayat Kimya Group, Mersin, Turkey 70,000tpy

• Essel Group, Caycuma, Zonguldak, Turkey 31,000tpy

• Faderco, Setif, Algeria 30,000tpy

• Abu Dhabi National Paper Mill, Abu Dhabi, UAE 30,000tpy

• Ipek Kagit Tissue/Eczacibasi Group, Manisa, Turkey 70,000tpy

• Azerbaijan Narmeh Paper Industries, Tabriz, Iran 29,000tpy

• Tezol Tütün ve Kagit San ve Tic, Mersin, Turkey 30,000tpy

= 360,000tpy.

2016:

• Aktül Kagit Üretim Pazarlama, Pamukova, Turkey 70,000tpy

• Arian Cellulose Sanat, Eshtehard, Karaj, Iran 35,000tpy

• Hayat Kimya Group, Ain Sokhna, Egypt 70,000tpy

= 175,000tpy.

2017-2018:

• Fine Hygienic Holding (Nuqul), Abu Dhabi, UAE 60,000tpy

• Al Faris, Khamis Mushayt, Saudi Arabia 25,000tpy

• Alex Converta, Alexandria, Egypt 25,000tpy

• Tezol Tütün, Izmir, Turkey 11,000tpy

• Paper Mill Investment, Algeria 32,000tpy

• CIDC, Baku, Azerbaijan 30,000tpy

= 173,000tpy.

Potential Projects:

• Eka Industrial Paper, Koseköy, Izmit, Turkey 38,000tpy

• Gulf Paper/Al Rajhi Group, Riyadh, Saudi Arabia 60,000tpy

= 98,000tpy.

New, partly export-oriented investments will likely increase tissue next exports further to more than 100,000 tonnes.

New investments during 2015-2017 will add substantial capacity and the average capacity utilisation will nosedive deeply below 80%.

CONCLUSIONS:

• The MENA region has been a major growth base for the global tissue industry expansion partly recovered from political turmoil and shows good growth again;

• The positive issue is that strong demand growth is expected to continue in the three largest markets Turkey, Saudi Arabia and Iran. Iran will benefit from the removal of the Western sanctions and tissue consumption will likely see very rapid growth.

• A major investment peak in occurring between 2015-2017 and there are limited possibilities to avoid regional overcapacity, some project delays have helped only marginally. Exports to other regions have limited chances to grow sufficiently to relieve the situation because of the existing tight international competition by Asian suppliers.

• The long-term outlook for the region is good as there is still a lot of growth potential, but based on the current outlook, suppliers need to think about timing of their new investments.

Turkish tissue players intend to score in Europe: Pirkko Petäjä, principal, Pöyry Management Consulting

OVERVIEW

• Rapid tissue capacity development in Turkey – CAGR 2005-2015, 13.4%.

• Turkish tissue industry is well equipped for success and to be competitive in the European export markets.

• Jumbo reels account for some 80% of Turkish exports and are targeted to developed markets.

• The leading tissue companies are all local. Typically they are part of large industrial groups and in a very solid and powerful ownership. The companies are not only dependent on the tissue market revenues.

• The Turkish tissue capacity has grown double digit and it has more than tripled in the last ten years; also demand has grown briskly. However, the

production exceeds the local demand making export very important.

• The Turkish industry has grown rapidly by the leading companies adding large 5.6m machines and it is as an average much more modern than the European.

LARGE STEPS AND MACHINES

Producers invested in large steps and mainly in large machines competitive also in Europe.

• Significant exporter of especially jumbo reels; the export volumes total some 170,000tpy while finished product exports are some 50,000tpy.

• Jumbo reels exported to developed markets such as the UK, Greece and Israel account for over 70% of the total. Finished goods exports are scattered

mainly to less developed markets in MENA and former CIS countries.

• Export volumes are sustainable and have shown steady growth with some minor exceptions including increased volumes to Greece due to difficulties of the local suppliers and decrease in Eastern Europe due to the conflict in Ukraine.

UK OFFERS THE BEST EXPORT OPPORTUNITY

The UK is clearly the best jumbo reel export opportunity in Europe. In Germany, for instance, the seemingly large trade volumes are mostly captive.

The UK market is characterised by the large share of independent converters, which explains the jumbo reel opportunity. That may diminish as large independent converters typically consider backward integration and are also interesting acquisition candidates for larger players seeking market share.

COMPARISON UK INDEPENDENT CONVERTERS

• Independent converters in Western Europe:

• Integrated – 90%

• Independent – 10%

• Independent converters in the UK

• Integrated – 75%

• Independent – 25%

• Some opportunities exist especially in former CIS and Balkan countries. Polish trade is mainly captive and opportunities in Hungary are partly fading away.

North African, Asian and new Iberian jumbo reel suppliers pose more threat for the Turks than the Central Europeans that export captive or special qualities. Turkey is too far to export significant volumes of finished products to the UK.

Jumbo Reel import to the UK in 2015:

• Turkey: 24%

• France: 23%

• Italy: 8%

• Other Europe: 21%

• Asia and Oceania: 11%

• Other MENA: 11%

• Americas: 3%

= 49% EU / 51% Non-EU.

Finished product import to the UK 2015:

• Germany: 26%,

• France: 12%,

• Italy: 12%

• Other Europe: 29%

• Asia and Oceania: 10%

• Turkey: 4%

• Other: 6%

= 79% – EU / 21% Non-EU.

Finished product exports from Turkey to developed markets, such as Western Europe, are negligible due to high transport costs, difficulties to be present in consumer markets and strong local competitors. Transportation cost from Turkey to, for instance, the UK:

• Jumbo reels 120 $/t

• Finished products 200 $/t.

LOOKING EASTWARDS

Beyond exporting, Turkish producers have successfully expanded presence outside Turkey in selected regions in the East. Tissue Market in Eastern Europe 2015:

• Russia: 27%

• Poland: 25%

• Romania: 8%

• Hungary: 7%

• Czech Republic – 7%

• Ukraine: 7%

• Other: 20%

Turkish type of organic growth with large steps is not applicable, especially with finished products, in developed European markets where competitors are locally established.

Entry to Europe through acquisition mitigates the risks related to organic growth. Various parts in Europe could benefit from stronger players and consolidation of the market.

INSTALLING CAPACITY TO EUROPE MAY BE CHALLENGING

Turkish type of organic growth with large steps is not applicable in developed markets in Europe where competitors are locally established.

Market requirements add complexity for market entry in Europe:

Powerful client universe less familiar to Turks – Lidl, Mercadona, Aldi, Sainbury’s

Strong existing (multinational) brands – Andrex, Lotus, Tork, Kleenex.

Strict environmental requirements.

ACQUISITION IS AN ALTERNATIVE

Entry to Europe through acquisition mitigates the risks in organic growth.

Various parts in Europe could benefit from stronger players and consolidation

Acquisition Example 1 – Navigator / AMS:

Portuguese pulp and paper producer, Navigator. Company (former Portucel), acquires tissue company. AMS to accelerate entry to tissue business. Shortly after the acquisition, Navigator announced a plan for major fibre integrated new tissue mill in Cacia, Portugal.

Acquisition Example 2 – SHP / Paloma:

The Slovak investment fund Eco-Invest, the owner of Slovak Hygienic Paper Group, signed a deal to acquire the traditional Slovenian tissue producer Paloma.

Acquisition Example 3 – Sofidel / Forest Papir:

The Italian tissue giant Sofidel acquires the consumer business of the large Hungarian independent converter Forest Papir to strengthen position in Eastern Europe.

Acquisition Example 4 – CEL / K-C Aranguren:

CEL Technologies & Systems acquired former Kimberly-Clark Aranguren and Artziniega sites with a deal to contract manufacture for K-C.

Trends, challenges and future opportunities in retail consumer tissue in the Middle East: Ahmed Bakr, research analyst, Euromonitor International, United Arab Emirates and Çağlar Altunel, country analyst, Euromonitor International, Turkey

WHAT IS THE GLOBAL UNMET MARKET POTENTIAL? INDUSTRY FORECAST MODEL

GDP growth and habit persistence will be among the key drivers of future growth; significant unmet retail volume potential globally – at estimated around 10 million tonnes – creates opportunities for further industry development. Positive growth globally, at 2% CAGR in constant value; Asia Pacific, led by China, records the fastest growth and by 2015 leads in absolute value.

UAE

Real GDP growth: 3.15% in 2015

Population: 9.16m

Only 11% of the total population are UAE nationals; population growth and influx of expatriates; rise in disposable income; rise in production and freight costs; average increase in unit prices.

Retail tissue split 2015 –

• Facial tissues: 70%

• Toilet paper: 20%

• Paper towels: 8%

• Paper tableware: 2%

Saudi Arabia

Accounts for around 90% of export earnings, 80% of budget revenues, and 45% of GDP. The expansion of modern grocery retailers. Increase of health and hygiene awareness. Retail tissue total value for 2015 – US$508 Million. Y-o-y growth – 9%

Two factory mills across the KSA – 160,000 tonnes.

• Retail tissue split – 2015

• Facial tissues: 71%

• Toilet paper: 10%

• Paper towels: 13%

• Paper tableware: 6%

Egypt

• Real GDP growth: 3.8% in 2015

• Egypt is the most populous country in the Middle East with 90m in 2015; per capita consumption of retail tissue stands at less than 1 kg.

• Egypt, retail tissue volume, tonnes, % Y-o-y growth:

• Facial tissues – 55%, toilet paper – 40%

• Price conscious, smaller packs. Among the top 10 tissue exporters in the world.

• Seven factory mills across Egypt – 250,000 tonnes.

Iran

Real GDP growth: 1.5% in 2015;

Second most populous country in the Middle East; second largest economy in the Middle East; per capita consumption for retail tissue is just at 1.7kg. Rapid urbanisation; convenience awareness.

Retail tissue total: Value for 2015; US$645m. Y-o-y growth – 14%

Price sensitive consumers; high income consumers and kitchen towels. Retail distribution development. Is the competitive landscape going to change?

Turkey

Retail tissue sales in Turkey – 2010-2015:

TRY current value 2015: 1.9bn.

The significant growth in TRY terms largely rely on the strong rise in the average unit prices; a marked decline is observed in retail tissue in 2015 when retail sales in current US$ is taken into consideration.

Growth in volume sales slows down in accordance with the stagnation in the overall consumer income level.

Although consumers’ income level stagnates, positive growth in volume sales of retail tissue continues. Rapid

urbanisation/modern grocery retailers. Urbanisation leads increasing per capita retail tissue consumption.

Rapid widespread of modern grocery retailers, in particular discounters, positively affected per capita consumption of retail tissue in Turkey.

Per capita consumption demonstrated healthy growth in Turkey, but still barely exceeds the half of Western Europe average. Which is why, retail tissue in Turkey harbours significant potential for further growth.

The gap between per capita retail tissue consumption in Turkey and per capita consumption in Western Europe will continue to become narrow. Expected per capita consumption in Western Europe in 2020: 8,90kg.