In previous articles we have highlighted the driving forces behind retail tissue as a combination of factors centring on income, demography and availability. Thailand is no less subject to these forces than other markets, but some of the statistics linked to these drivers may be somewhat surprising.

Demography is destiny

Taking demography as an example, on average, fertility in Thailand is below that of most Western markets, with a rate of 1.5 compared to 1.65 in the UK for example. This puts the market at a very interesting juncture, one of a growing number of Asian markets that have managed to navigate the course of development while keeping a lid on population growth. Indeed, with fertility at such relatively low levels this put the country right in the middle of what is commonly referred to as the demographic ‘trilemma’, a development choice from competing forces, the economic, the family and social homogeneity. Preserving two is attainable but not three, meaning there is a compromise to make somewhere down the road and where this compromise lands will have implications for the fortunes of many markets, not least tissue products, as economy, demographics and homes are three core drivers.

The Thai demographic structure in 2022 is decidedly European in nature, ageing and with total population topping out at 79 million, and forecasts suggesting population will move into decline from around 2028. Although the Thai government has looked to make maternity benefits more generous, including 96 days of paid maternity leave, there is little sign that this will boost birth rates, all the evidence from comparable markets in the region is that falling birth rates are next to impossible to turn around through policy. For the tissue market, this is significant as it clearly points to a ceiling on consumption from a numbers perspective. Immigration and elongation of life expectancy are unlikely to make any significant contribution to total population numbers, this again points to the trilemma, low birth rates and a low (relative) average immigration rate mean that longer term, and like Japan, there will be significant economic questions to answer, not least to what extent automation can help solve the problem (more on this later).

Housing upgrades and time

One saving grace for the retail tissue industry will come from household growth, the current 25 million households will continue to grow on average by just under 1% CAGR over the coming five years, although this growth is decelerating long term in line with the underlying population trend. A further positive factor for retail tissue is the continued growth of flush toilet penetration, 90% reported in 2022 growing to 93% by 2030, as well as growth in the number of homes with a dedicated bathroom, from 83% to 87% over the same period. The expansion and modernisation of Thai housing stock will form a positive base for tissue expansion over the medium term, this will also be impacted by how quicky Covid-19 lifestyle change, more time spent at home for example. Google Mobility data for 1 July 2022, indicates a 21% decline in transit footfall and a 7% increase in time spent in residential locations compared to its May 2020 baseline.

Part of the development of housing stock is linked to disposable income levels, economic growth and growing income levels will remain a strong suit for the tissue industry which will continue to push volumes as well as being the key to broader format adoption beyond the core toilet paper category.

Tentative tissue forecasting

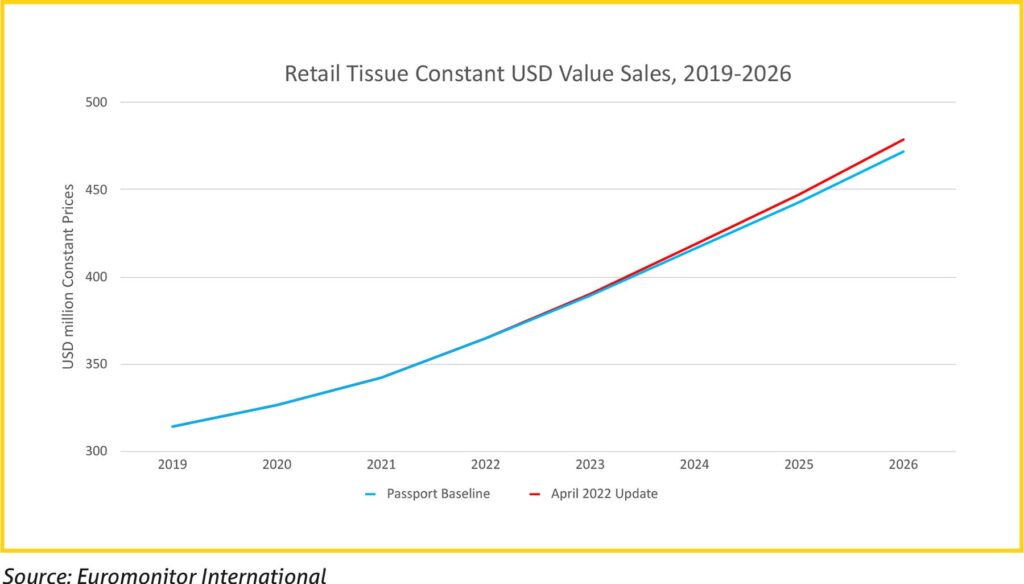

The surge in inflation over the last few months, although perhaps dampening the prospects for market growth, by April 2022 (our most recent data update, another is due in July 2022 but arrives too late for this article), was somewhat limited. Thailand tissue sales are still forecast rapid >6% value growth through to 2026, although this is a modest downgrade on expectations from the end of 2021. Needless to say, growth forecasts will inevitably be downgraded further as inflation bites into consumer expenditure, but this is more likely to be disruptive, than derail the course of market development.

Original Screen Shots

While discussions around pricing and availability are nonetheless important, the position of the Thai tissue market relative to others in the region is a strong basis to have confidence around continued long-term growth prospects. That is to say, against any measure, tissue consumption in Thailand remains far behind other markets in the region, the regional average and is dwarfed by expenditure in the world’s largest market in the US. Certainly, comparisons with the US are not particularly helpful for a multitude of good reasons, but if only to provide a sense of perspective these figures are presented in the ‘Retail tissue per household USD value sales’ chart.

The primacy of economic performance

Economic performance will be the critical factor for long-term market development, and this links irrevocably with disposable income levels. While inflation pressures will steal some of the prevailing momentum (more on this next) there is a lot of space to move into, what is euphemistically referred to as ‘low hanging fruit’. The link between disposable income growth and retail tissue sales is well established and sees Thailand tissue sales developing relatively well although some way behind the meteoric rise reported in neighbouring Vietnam.

The future growth opportunities for tissue (retail and AfH) are tightly bound to future economic performance and what this does for average household disposable income levels. This will be the critical factor in confirming Thailand’s growth trajectory over the medium term. That said, the country has not been immune to the march of inflation, and this has been particularly evident in summer 2022, annual inflation breaking the 7% barrier for the first time since 2008, this up by 2.5 percentage points over a month earlier.

As we have observed internationally, the current pandemic inflation surge has had a particularly invasive effect on household expenditure as it concentrated on food and beverage and transportation, which in the case of Thailand accounts for roughly half of household expenditure on average but an even greater proportion for lower-income homes. For context, already by May 2022, food inflation hit 8.2%, roughly doubling in a few short months, and transportation costs broke 13%, illustrating the country’s dependency on imported energy which also has implications for manufacturing, not least tissue production and conversion.

AfH Recovery

While there is much to be optimistic about the future of retail tissue growth in Thailand, this is still only half the story. AfH makes up a surprisingly large share of total tissue sales in the country, and like other markets each facet had a diametrically opposed pandemic experience, with lockdowns and tightening social control boosting domestic use while curtailing institutional sales.

The rebounding of international travel, with tourism making up a significant portion of AfH tissue sales in Thailand, will have an increasing positive impact on category sales. Forecasts for arrivals suggest that tourist numbers could return to pre-pandemic levels by 2025 meaning that this lucrative area for retail tissue will rebound strongly as a result. Taking the wider view, tourism represents 12% of GDP in Thailand, so a rebound of tourism and tourist expenditure not only boosts the AfH sector but has an important ‘trickle down’ effect for the broader economy, household incomes and ultimately available spend for retail tissue.