All-industry model assumes third pandemic wave in 2021 and up to 7.5% decline in global GDP before an anticipated recovery to set in in 2022.

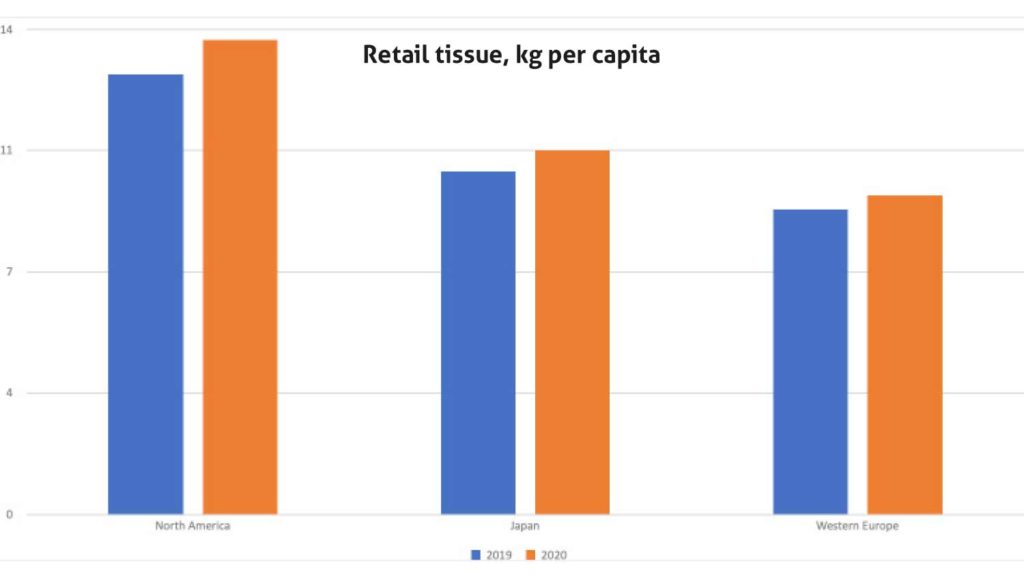

With nearly 10kg per capita in retail tissue in 2019, Japan has already had one of the highest per capita consumption levels in the world. Not surprisingly then, and in view of the declining population, opportunities for organic growth in Japan remained limited. Innovation has been among the drivers to support industry revenues.

Pre-Covid trends saw the evolution of products like compressed toilet paper, which also supported Japanese consumers’ increasing interest in convenience and time saving. Consumers appreciated compressed rolls as they require less frequent replacement and, therefore, reduce the time consumers need to spend shopping. This demand was bolstered by the increasing pressure on consumer time resulting from greater female participation in the paid workforce. Compressed rolls also proved popular amongst small and medium-sized businesses, which often purchase daily necessities such as toilet paper at nearby drugstores for convenience. The expansion of compressed toilet rolls illustrated manufacturers’ efforts to generate value and increase profitability in a category that has already achieved a deep level of penetration in the market with contracting population.

With the onset and spread of Covid-19, Japanese tissue demand spiked well beyond the originally projected growth for 2020, rising in both value and volume terms. In fact, while Euromonitor International pre-Covid projections set expected value growth in retail tissue at 1% (USD, 2019 fixed exchange rate), updated forecast puts growth at expected 6% in value terms. Volume growth is set to see over 5% increase in retail by the end of 2020, compared to previously expected nearly flat performance. As in many other markets affected by Covid, home seclusion is behind surge in demand for at-home use.

Earlier days of the pandemic and above-normal consumer demand led to pressure on supply chain, in store and e-commerce space. In fact, Euromonitor International e-commerce price and SKU tracking analytics VIA indicates that in April the proportion of Out of Stock SKUs had risen to over 40%. The pressure on supply chain eased up in the second half of 2020, as demand normalised.

Toilet paper, napkins and boxed facial tissues are amongst the categories to see the most positive impact from the home seclusion aimed at limiting the spread of Covid-19. In contrast, products designed for on-the-go consumption, such as pocket handkerchiefs, are seeing a slightly negative impact from the pandemic. The fact that such products are often purchased on impulse is a further constraint on their development as consumers have turned to less frequent, more planned shopping.

While home seclusions ease up, some of the adopted practices, such as working from home might linger. Indeed, Japan was already moving in this direction with its Work Style Reform policy, which is partly focused on making work more flexible. Although it will not compare with the levels of demand seen during the period of home seclusion, a trend towards more people working from home on a more regular basis might boost demand for products such as toilet paper for at-home use. At the same time, the negative economic impact of Covid-19 is likely to further intensify pricing competition in the already relatively commodified retail tissue category, as consumers might trade down in view of tighter budgets. Euromonitor International Industry Forecast Model provides a variety of scenarios that demonstrate the potential impact of Covid-19-driven macro shifts. The most likely one has a probability of 25-35%, assumes third global pandemic wave in 2021, and 2020 global GDP ranging between -7.5% and -5.5%. In this scenario, Japan retail tissue value growth might see value sales in 2021 lose additional 0.5% in retail value sales. Scenarios that assume further declines in GDP, beyond the most probable scenario, would lead to stronger losses in value of retail tissue sales as trading down and affordability will emerge as even stronger priorities for households. The model anticipates the recovery to set in in 2022.