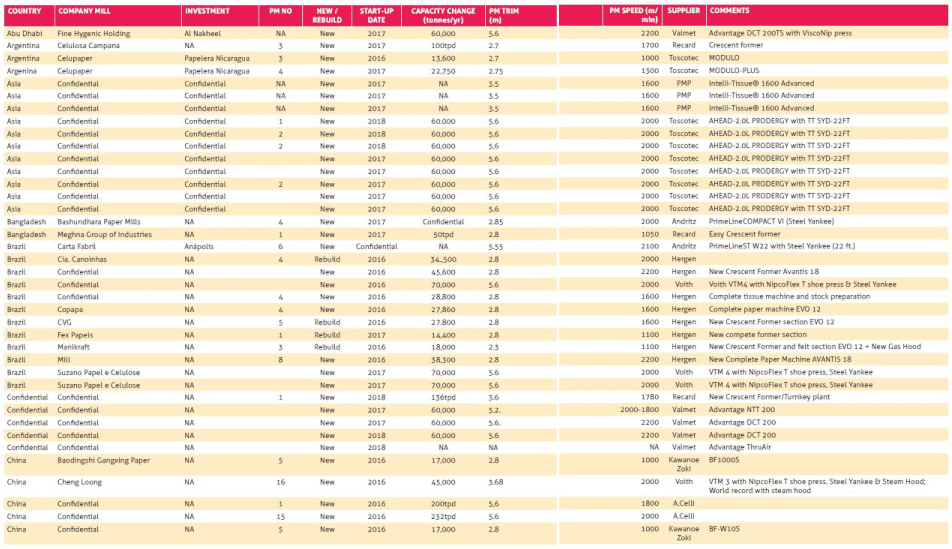

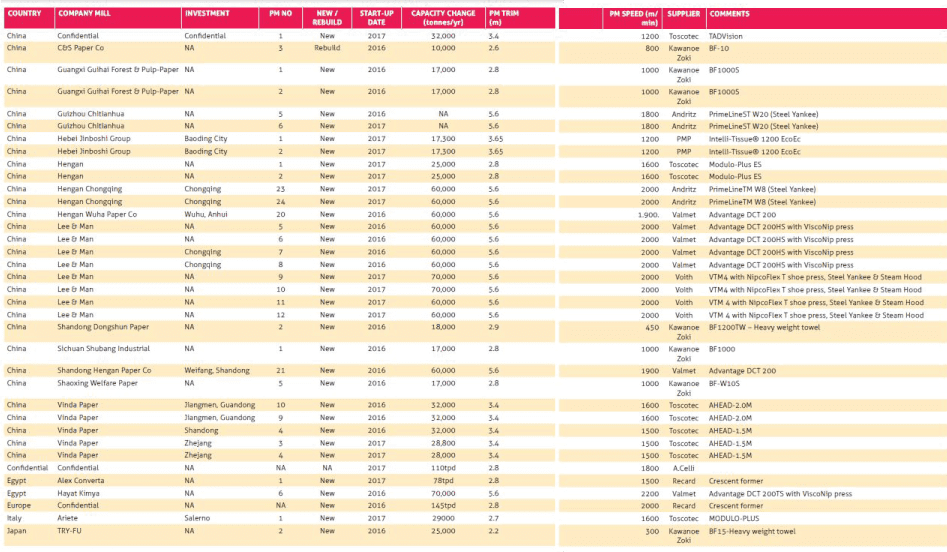

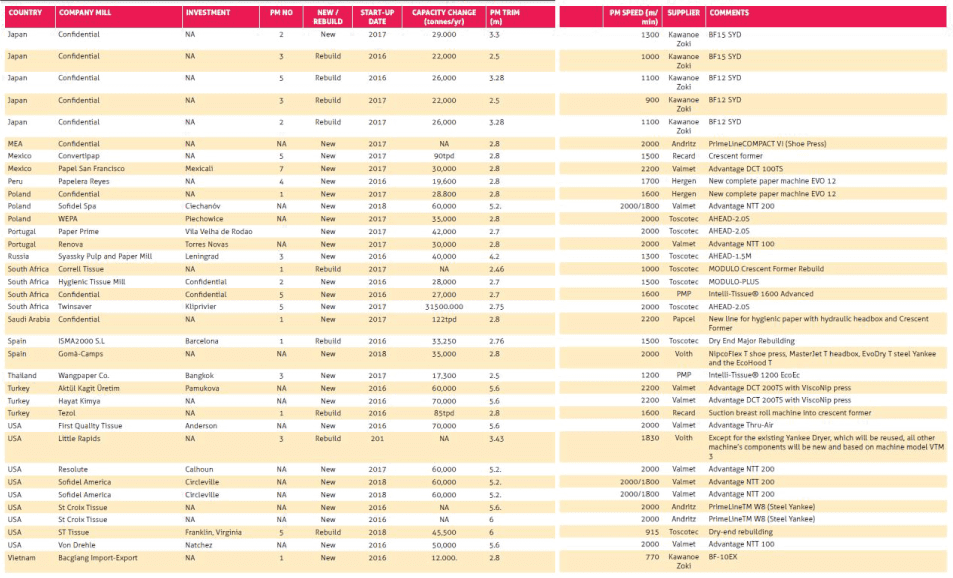

While 2016 has gone down in history for the many significant global events that took place, for the tissue industry it’s been a slightly more subdued period according to this year’s annual Projects Survey.

TWM’s annual survey charts all new capacity being added, ordered or in final planning stages during 2016-2017. The survey is interested in projects that will increase tissue capacity – the numerous smaller rebuilds around the world that won’t impact capacity have been excluded.

All the figures in the survey are based on the best information provided and this has included TWM’s own extensive research as well as relying on reliable responses from companies asked to detail their present and future developments.

It also includes first-hand knowledge gained from the many visits to tissue mills around the world for TWM’s bi-monthly Country Reports analysis, which during 2016 included visits to your peers and competitors in the American north-east, Egypt and Jordan, Vietnam, Colombia, Iran and India.

We aim to meet tissue mills that have news that relates to you – a new tissue machine start-up, a new products launch, new export target markets. The visits give TWM a unique in-sight into why that region and its tissue players are investing or not.

While this year’s figures may be a little more subdued when compared to that of 2015 and 2014’s, looking across the many financial and manufacturing sectors of the world’s economies and it’s evident that tissue and new tissue machinery start-ups are still fairing very well indeed.

For this year, as with last, many of the projects are subject to revision as, in many cases, information was not provided because it was deemed commercially sensitive or subject to financial uncertainty.

It’s also the case that a distinctive feature of this time in the cyclical development of tissue production is marked by the timely closure of old facilities to make way for the new.

Click to view

In some cases, delayed start-ups have meant projects have been repeated from last year’s survey; some of the ‘new’ capacity announced this year in fact includes some of last year’s estimate. It came apparent when compiling this year’s survey that many projects have been purposefully delayed, largely to deal with overcapacity or economic conditions. Additionally, a number of companies also issued projections for impressive tonnes per day figures, which will add, in the terms of the survey, unknown capacity.

With that in mind, in the past 12 months the global tissue industry has seen another substantial amount of new capacity announced or coming on stream, with 111 projects. This is compared to last year’s 126 projects, which was down from 146 in 2014.

Most of this year’s projects are once again set in China, which claims 35 projects – the same number as it claimed in 2015’s survey. Outside of China, growth is still focused on or from countries such as Brazil which claims 12 projects in this year’s survey and of course America, which claims nine. South Africa has four projects while Turkey – another star market – has three.

Overcapacity in many markets has evidently resulted in a slowdown of new project announcements.

As with last year, the scale of these machines is also significant – a large proportion of these new start-up machines have widths of 5.6m.

It should also be noted that 2015 was an above-average year for the global tissue business, with worldwide tissue consumption growing by 34.8 million tonnes and the global growth rate of tissue consumption at 4.0%.

According to figures from RISI, this compares to 3.2% growth in 2014 and 2013, 3.5% in 2012 and 3.6% in 2011.

The growth rates for 2016 have yet to be confirmed at the time of going to print and countries that had previously been picked as having star growth potential have faltered.

There was also significant slowing of growth in China – interesting 2016 was the year that saw tissue giant Asia Pulp & Paper announced that it was halting its expansion in the country in the face of oversupply, although it said it was to continue its expansion in Indonesia.

In 2017, TWM endeavours to bring you more in-depth analysis on tissue mills and their projects across the world with our Country Reports focused on countries as far ranging as Japan, Nigeria, Ireland, Canada, Brazil and Italy.

Click to view

Click to view

All aggregates taken from the survey should be treated with some caution. While all care has been taken to publish comprehensive data, it is inevitable that projects will be missing or details incomplete. Many projects have also been delayed so start-up data used in the 2015 Project Survey has had to be repeated. We welcome your help to ensure as comprehensive a survey as possible at the end of 2017.