Inside the broad assessment of the region’s 11 nations, the contrast between the two tissue powerhouses of Indonesia and Vietnam is the headline story… a tale of two countries, two economies and two Covid-19 responses.

The world market for retail tissue was particularly buoyant in 2020 following the Covid-19 pandemic, with consumers spending more time at home and looking to tissue as an agent of hygiene, and in some cases stockpiling.

That said, the tissue industry responded in broadly two tiers. Developed markets tended to see heightened growth, while developing and emerging markets saw overall growth slow but also, conversely, accelerate in some outlier examples, this was largely the result of specific local pandemic conditions and government intervention.

Southeast Asia in Focus

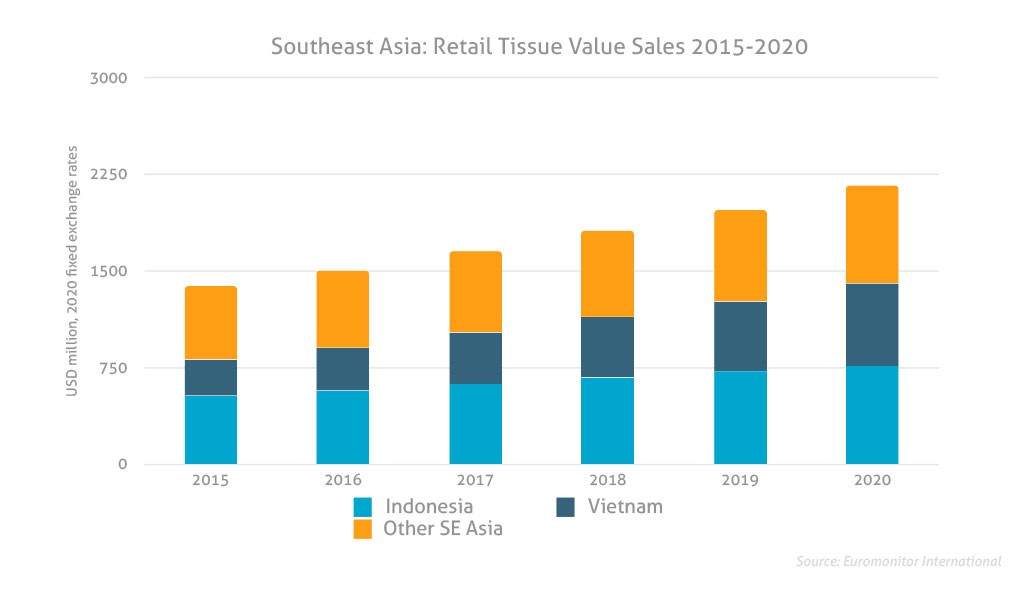

Southeast Asia (Brunei, Cambodia, Indonesia, Laos, Malaysia, East-Timor, Myanmar, the Philippines, Singapore, Thailand, and Vietnam) was emblematic of this mixed bag of growth in response to the pandemic. Value sales were $2.1bn in 2020 across the region but significantly, growth was half a percentage point up over 2019 levels at 9.5%. The big story in the region remains the contrasting performances of Indonesia and Vietnam, the regional tissue powerhouses, accounting for 65% of retail tissue expenditure in 2020.

Simply put, Indonesia’s Covid-19 experience saw the rate of value growth dip to 6.5% (down from an average CAGR of around 8%) while Vietnam was propelled in the opposite direction, as value growth surged to four percentage points to 19% in 2020. A tale of two countries, of two economies and two Covid-19 responses.

Indonesia

Indonesia accounts for 35% of value sales in the region and displayed a typical Covid-19 response, consumer changing lifestyles seeing an upturn in products like disposable wipes, an area in which consumers prioritised expenditure on products offering higher levels of hygiene/protection. The economic impact of Covid-19 is also a key consideration, meaning that consumers looked to cut expenditure and also consumption of non-essential items, to both cut overall outgoings and to free up expenditure for products offering hygienic protection, such as disposable wipes.

Indonesian consumers in this respect became more price-sensitive as an outcome of the pandemic, meaning that cut price brands overall performed better than the market average, but this – surprisingly – did not translate into a bonanza for private label products. The market share for private label remained stubbornly around the 5% mark, with local sources pointing to supply side issues as a factor in holding back sales.

As with other markets, the pandemic clearly boosted online sales. Southeast Asia was not alone in this respect, and it is interesting to observe that retailers around the world largely approached the pandemic from a similar standpoint. In one sense a major disruption, affecting operations, customers, and supply chain; on the other, an opportunity to drive scale (and therefore profitability) on home delivery options. In 2020, 5.5% of retail tissue value came through e-commerce channels, a four-fold increase over levels reported in 2015.

Looking at forecasts, although 2021 will likely see value sales recover and by 2022 the market start to return to pre-pandemic sales levels, habit persistence – the idea that usage itself drives further usage – supported by economics and incomes will be the cornerstone of a return to more predictable year-on-year value gains across categories.

Vietnam

Vietnam accounted for 30% of value sales in the region in 2020 and over the last decade has exhibited nothing short of a stellar retail tissue growth trajectory. In 2020 tissue growth was positively affected by the pandemic which was closely linked to government response early on. Strict lockdowns at the beginning of the pandemic, while keeping infection rates low also encouraged increased expenditure on tissue products, including stockpiling, as consumers tried to avoid running out while retail channels and supply chains faced severe disruption.

In terms of consumer buying behaviour, the onset of the pandemic created considerable financial stress for the economy and household budgets, with many people fearful of losing their jobs. As a result, there has been a marked increase in price sensitivity, with consumers carefully considering their spending, paying more attention to product value.

This also stimulated a change in distribution channel, with some switching to outlets that offered lower prices and better value for money. This change in behaviour also provided local brands with an opportunity to grow, given their generally more economical pricing and improving product quality.

Like other markets, Vietnam was by no means alone in reporting a significant upturn in e-commerce value sales, which doubled to 2% of total retail tissue in 2020. The biggest winners proved to be modern grocery retail channels, which strengthened their grip, dominating sales at the expense of health and beauty specialists and traditional retail outlets. Product availability and the impact of restrictions were clearly at work here.

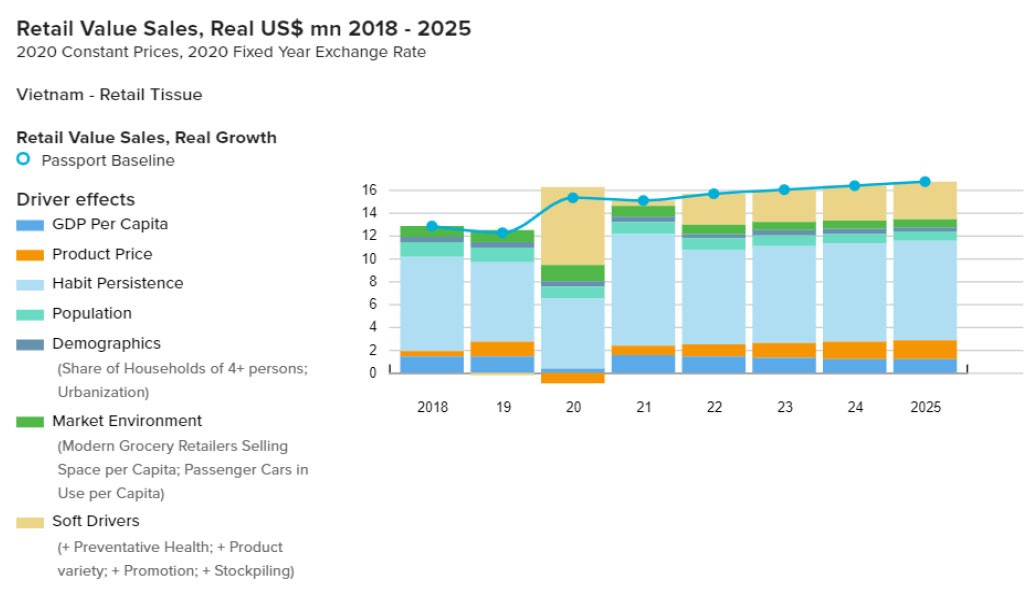

Looking at forecasts, although 2021 will likely see value sales tail off slightly as the dominant soft drivers of the core pandemic year dissipate, by 2022 the market looks set to be back on track and retuning to stable and high growth, again driven by habit persistence, economics, incomes and retail initiatives.

Forecast outlook

While the full extent of the economic fallout associated with the pandemic is still unknown, it is safe to say the region and world face some significant disruption over the coming years. Many observers see this as a five-year horizon, meaning that by 2025 we may well have navigated the worst of the impact.

Euromonitor’s tissue forecasts, which are produced through a combination of econometric modelling and local trade interview sources, suggest the outlook for tissue in the two leading Southeast Asian markets is more upbeat, with 2022 a likely year for something closer to normalisation.

For the retail tissue industry, the perspective remains extremely positive for the Southeast Asian region – there is still much to be hopeful about outside of economic disruption. Incomes will rise again and local populations continue to grow, as well as the number of households, and access to sanitation and modern retail. Taken together this is a heady combination to drive further rapid volume and value growth as we move out of pandemic, with more positive income profiles ultimately supporting habit persistence which remains the number one future growth metric across the region, particularly in the Indonesian and Vietnamese markets.

A question of retail tissue

One consideration for the tissue industry, and this observation is applicable globally: Given the fact that consumers around the world have had a significant shock, which has led to an unprecedented focusing of attention around hygiene, how can retail and commercial tissue products better align themselves with what looks set to be the prevailing trend of our time –

personal hygiene?

This leads to a broader question – industries as diverse as consumer appliances, home care and retail hygiene are asking themselves, “who does hygiene”?

All the evidence points to the fact that (in many cases) consumers will not easily forget the huge investment that has gone into education and changing lifestyles, with a clear focus on hygiene and disease prevention. While this has clearly benefited non-wovens and no-compromise sanitisation products, clearly the tissue industry has a part to play here, and this is more than likely a larger role in lower income markets.