Table napkins are on a surge as Americans eat out more, enjoy ‘fast casual’ dining, and turn to the pleasures of the homeland and the ‘staycation.’ TWM editor Helen Morris heads out towards the Adirondacks to SCA’s Hudson River mill.

The slow and steady train journey to Glens Falls from the heart of Manhattan gives a taste of the stunning natural beauty in the region that is home to SCA’s South Glens Falls tissue mill. Neighbouring tourist spots include the Adirondack mountain range, the Catskill Mountains, as well as rivers and valleys steeped in the history of the region’s indigenous Mohawk people.

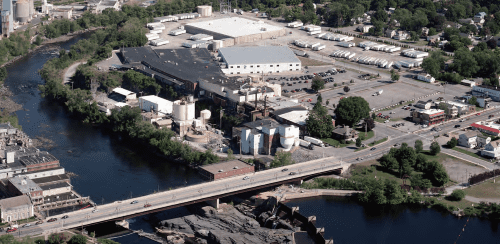

Located equidistant between New York City and Montreal, the plant sits alongside the magnificent Hudson River, which has always played a significant role for the area, not least as a major route for the Native American, British and Colonial forces during the Revolutionary War. For literary fans, the scenery and culture was also the inspiration for James Fenimore Cooper’s classic tale, The Last of the Mohicans. Cooper’s Cave – which offered protection to the characters in the story – is just around the corner.

During the industrial age, the vibrant timber industry used the river to float logs from the Adirondacks, enabling the local paper industry to flourish in the latter part of the 1800s. The construction of dams to generate hydropower from the river established an important economic base that still exists today.

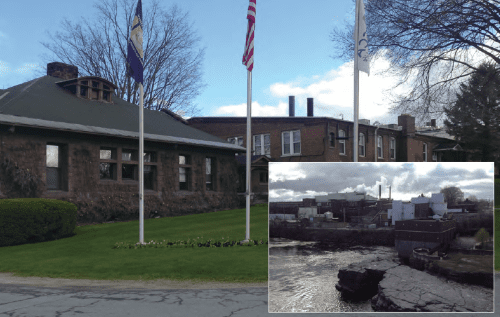

With a forecast of heavy snow looming, TWM meets Mike Mound, SCA Tissue North America site manager, northeast operations, and Amy Bellcourt, vice president communications SCA AfH Professional Hygiene at the historic site. Built in 1864, the Swedish tissue giant took it over in 2002 and the plant now has 270 staff and processes 110,000tpy of 100% recycled paper, producing 64,000 metric tpy on two paper machines. The local region provides ample demand for the site’s products, and the paper is converted into bath tissue, folded and hardwound towels and napkins that are sold into the regional AfH market including restaurants, offices and health care facilities across the northeast. Some 70% of production is for rolled product, jumbo rolls and hand towels while the remaining 30% is for napkins – a key growth market, according to Mound. Product innovation and diversification over the years has included universal products as well as premium products, dispensing systems for the food service, industrial, commercial and healthcare markets under the global Tork® brand of parent company SCA. There are also two deinking plants, and a second converting plant located 30 minutes away in Greenwich.

SCA was the driver of a significant step changer in the American tissue market last year when it acquired north American AfH company Wausau Paper – a move that increased its market share capacity by 6%. The move also boosted its geographical reach, adding two mills in Ohio and Kentucky to its North American portfolio as well as enhancing its premium tissue product portfolio – a PM with ATMOS technology that is less than three years old was included in the move.

SCA now claims the No 2 spot in America with 26% of the market, second only to Georgia-Pacific’s 30%.

The Wausau acquisition is one of a number of purchases America has seen over the last couple of years. According to Poyry, in just the fourth quarter of 2015 M&A activity saw $700m plus change hands with nearly all recent M&A activity focused on mill and converting assets for the AfH and private label retail tissue segments.

Home to the largest AfH sector in the world, this M&A activity has involved local and international tissue players as well as local graphic paper producers. They continue to be drawn to a market that offers stable growth and low private label concentration: Sofidel entered into the American market in 2012 with the acquisition of retail and AfH producer Cellynne Paper, boosting its presence further with the acquisition of Green Bay Converting in 2015; Hong Kong-based International Grand Investment – owner of Woodland Pulp in Maine – has recently started a new PM on site with another in the works; Georgia-Pacific increased its AfH offering with the purchase of SPG Holdings in 2014; Kruger Products boosted its AfH presence in 2014 after acquiring the converting assets of Metro Paper Industries; Orchids Paper spent $37m to enter a “strategic alliance” with Mexican producer Fabrica de Papel San Francisco; and NPS Corporation doubled in size in 2014 with the acquisition of National Tissue Company, expanding further in 2015 with the purchase of Celtic Paper.

Mike Mound, SCA Tissue North America site manager, northeast operations

Interestingly, two major graphic paper producers also joined the race: Resolute Forest Products comes from a print and paper background and announced its entrance into the tissue market in 2015, speeding up its entry with the acquisition of Atlas Paper in November 2015. In December 2015, Catalyst announced it will convert its uncoated mechanical PM11 at its Powell River mill to begin producing a towel product.

The activity isn’t surprising given the stable growth and also the potential of the region’s tissue market and density of its population. Mound says growth is steady at between 1-3% year-on-year, and that as the region’s demographics continue to evolve, new opportunities are presenting themselves to the tissue industry. “The growth trends we’re seeing aren’t slowing down and with the size of the population in America there’s always a lot of potential. We can also ship to a large part of the population, which expands the potential even further.”

He adds that the company is seeing a big increase in demand for napkins in the US: “People are eating out more and more, and we’re also seeing people holidaying more at home. There’s also a continual increase in “Fast Casual” dining and that’s where our product is very economical.” There’s also additional export potential into Canada, which “offers a lot of opportunity” and also has different product demands.

And in terms of European players such as Sofidel increasing its share in the US market, Bellcourt says that that “doesn’t affect us at all”.

Energy price increases are a continuing concern: “It’s a very regional issue, and it’s one that is a particular challenge for us” says Mound. “We’re continually focusing on our usage. We have a steam generator that re-uses energy so we’re very energy efficient. We also have a new Steel Yankee and we’re seeing a reduction of 3% year-on-year. We’ve also been upgrading our deinking processes so we can take more contaminates to make it white and bright. It’s a challenge.”

As for whether a third paper machine would be added at the site, Bellcourt was unable to comment on when and if an investment would be made: “We want to meet demand. We’re seeing very fast growth here in the northeast. And what the Wausau acquisition brings us is a strong No 2 position and a presence right in the middle of the country. The ATMOS production means we’re producing premium paper. And our Tork brand continues to remain strong and it has a sustainable image that is our primary focus here.”

“The goal is to be market leader,” she says. “We have a clear No 2 spot in America, we lead the market. We see lots of opportunities to grow, lots of synergies with Wausau Paper. For the immediate future we’ll be integrating our products, we expect that integration to continue to happen and springboard from there. We have many exciting innovations: restrooms are our targets with the launch of “Easy Cube”, etc. This is what we want to be doing to get to the No 1 spot in America.”