Country Update: France

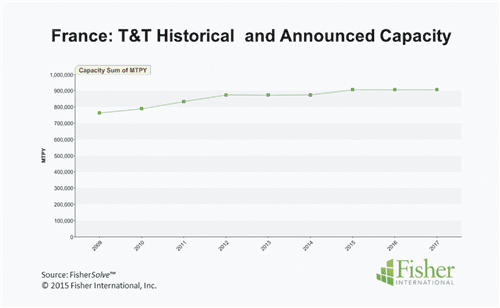

France is the fourth largest producer of Paper and Market Pulp in Western Europe making 10.1 million metric tonnes per year. Towel and Tissue (T&T) represents a little more than 8% of this paper and pulp production. France ranks third largest in the production of T&T products with nearly 900 thousand metric tons annually. Capacity trend for all grades in Western Europe has been flat over the last six years and announced increases/decreases also indicate flat growth for the next three years. T&T capacity growth in France has been on the incline for the six -year look back in time (Figure 1). This means France did not experience the dip in capacity that characterized its regional counterparts in 2012. Since then, the trend has continued upward. However, a lack of announced changes (upgrades, shutdowns, or new machines) over the near term makes it unclear that this trend will continue over the next three years.

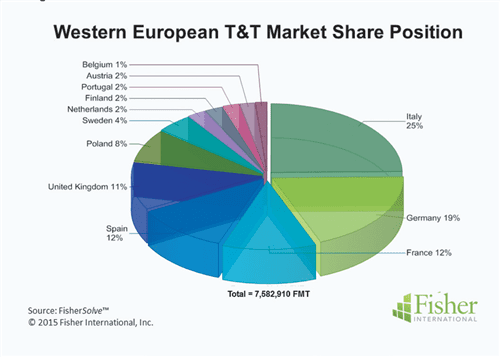

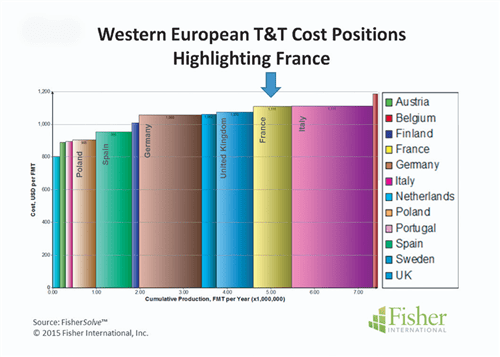

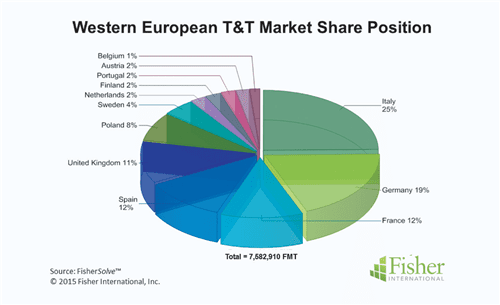

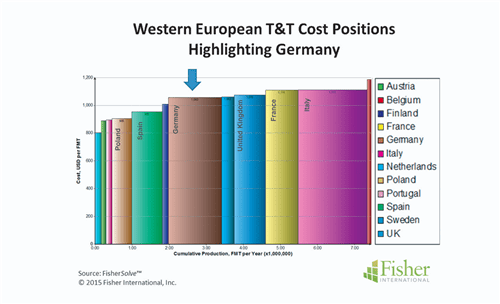

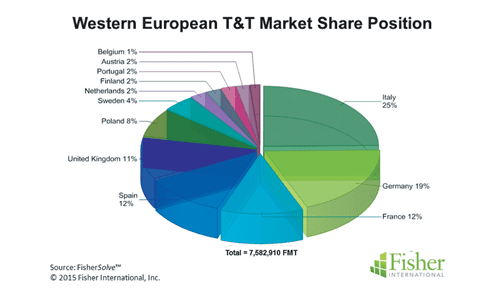

France’s T&T market position in Western Europe is moderately strong. At 12% market share, it ranks third largest T&T producer with just less than half the capacity of Italy and in relative parity with Spain (Figure 2). France’s solid position may not be totally defensible. Italy and Germany both have substantially larger market shares from which to compete and Germany has a cost advantage (Figure 3).

These two major competitors could represent a formidable challenge depending on mill-to-market proximity and factors like transportation cost from a specific mill might determine the market outlook. The cost disadvantage for France stems from lower fibre cost attributable to higher use of purchased fibre and somewhat higher labour cost.

Country Update: Germany

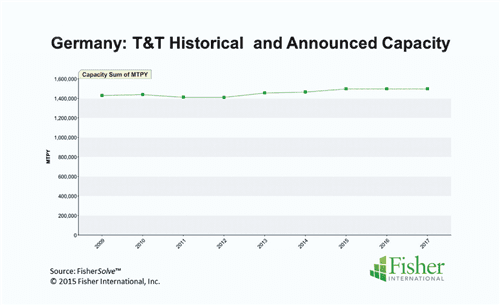

Germany is the largest producer of Paper and Market Pulp in Western Europe making nearly 25 million metric tonnes per year. Germany ranks second in Towel and Tissue (T&T) production with a little less than 1.5 million metric tons or about 6% of the pulp and paper. Capacity for all grades in Western Europe has been trending flat over the past six years and announced increases/decreases also indicate flat growth for the next three years. T&T products showed a slight decline until 2012. Since then the trend has been up but flattening for the projected years through 2017. Germany has been seeing a slow but gradually increasing trend for the past four years (Figure 1). A lack of announced changes (upgrades, shutdowns, or new machines) over the near term suggests steady capacity over the next three years. The nine-year window (2009 – 2017) has a cumulative average growth rate of 0.58%.

Germany’s T&T market position in Western Europe is strong. As the second largest T&T producer, it holds a 19% market share (Figure 2). Germany should be in a solid position compared to neighbouring countries, but that may not be a totally defensible stance. The larger producing countries of France and Italy have good market share positions from which to compete (Figure 3) but hold a higher cost position. Poland, on the other hand, could be very competitive with its low cost position and close proximity to German markets. There could be significant competition from mills shipping into specific markets across all four of these countries. Transportation cost could be a factor depending on mill and market location. Things like brand identity and product performance requirements versus delivered quality could also be significant hurdles. At equal performance and distribution cost the cost advantage for Polish mills may be significant.

Country Update: Italy

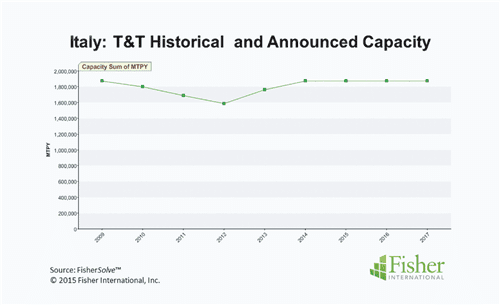

Italy is the fifth largest producer of Paper and Market Pulp in Western Europe making 10.1 million metric tons per year. Towel and Tissue (T&T) represents a little more than 17% of this production capacity. Italy ranks as the biggest producer of T&T products making in excess of 1.8+ million metric tonnes annually. Capacity trend for all grades in Western Europe shows flat growth over the past six years and announced increases/decreases also indicate flat growth for the next three years.

T&T products were in slight decline until 2012. Since then the trend has been up but flattening in the next three years. Italy also had a declining trend going into 2012 followed by a steady return to previous levels (Figure 1). A lack of announced changes (upgrades, shutdowns, or new machines) over the near term suggests steady capacity over the next three years.

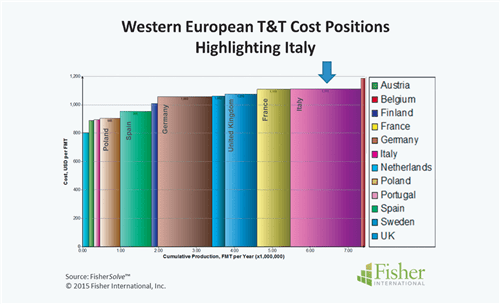

Italy’s T&T market position in Western Europe is very strong as the largest T&T producer commanding a 25% market share (Figure 2). Italy should be in a solid position compared to neighbouring countries, but that may not be a totally defensible position.

France and Germany also have good market share positions from which to compete. These two major competitors are also lower cost than Italy (Figure 3). There could be significant market competition from mills in these countries depending on the transportation cost from the specific mill to market combinations.

The cost disadvantage for Italy stems from an almost complete reliance on purchased pulp where the other two countries are integrating lower cost recycled fibre.

Country Update: Poland

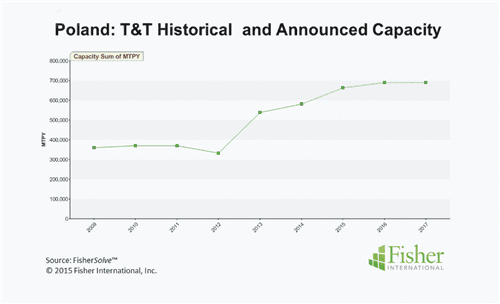

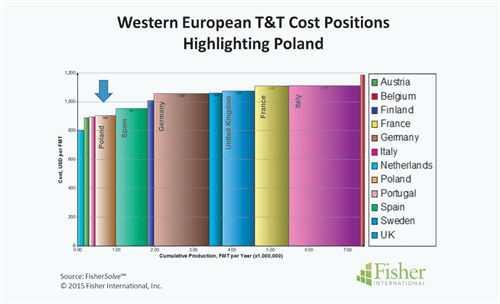

Poland is a relatively small player in the production of Paper and Market Pulp in Western Europe, making 4.2 million metric tonnes per year. Towel and Tissue (T&T) represents a healthy 14% of this paper and pulp total production capacity. Consequently, Poland currently ranks sixth in the production of T&T with approximately 600 thousand metric tons annually. Capacity trend for all grades in Western Europe shows flat over the past six years and announced increases/decreases also indicate flat growth for the next three years. In this region, T&T products declined slightly into 2012. Since then the trend has been up but flattening in the next three years. Poland was basically flat going into the 2012 inflection point. Since then, Poland has experienced solid steady growth almost doubling T&T Capacity (Figure 1). Announced expansions suggest the growth pattern will continue, albeit at a slower pace, over the next three years. Poland’s T&T market position in Western Europe is not commanding, being the sixth largest T&T producer with an acceptable but relatively weak 8% market share (Figure 2). Poland should be in a solid position in local markets where product recognition and preferences are strong purchase drivers. Outside of these markets there may be vulnerability against the larger producers in close geographic proximity.

Poland’s main defense and competitive advantage is a significantly lower cost profile versus nearby higher producing countries (Figure 3). These neighbouring major competitors could be formidable, but for the labour and energy advantages holding down cost in Poland. Significant market competition will likely depend on mill-to-market positions justified by feasible transportation costs from a specific mill to market.

Data for these reports are from FisherSolve™, the pulp and paper industry’s premier business intelligence resource. www.fisheri.com. Bill Burns can be contacted at [email protected].